Create Balance Sheet In Excel

Creating a Balance Sheet in Excel

A balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It lists the company’s assets, liabilities, and equity, and is a useful tool for investors, lenders, and other stakeholders. In this article, we will walk through the steps to create a balance sheet in Excel.

Understanding the Components of a Balance Sheet

Before we start creating a balance sheet in Excel, let’s take a look at the three main components: * Assets: These are the resources owned or controlled by the company, such as cash, accounts receivable, inventory, and property, plant, and equipment. * Liabilities: These are the debts or obligations of the company, such as accounts payable, loans, and taxes owed. * Equity: This represents the ownership interest in the company, including common stock, preferred stock, and retained earnings.

Setting Up the Balance Sheet Template in Excel

To create a balance sheet in Excel, follow these steps: 1. Open a new Excel spreadsheet and give it a title, such as “Balance Sheet”. 2. Set up the column headers: Create columns for the account name, account number, and debit or credit balance. 3. Set up the row headers: Create rows for the different categories of assets, liabilities, and equity. 4. Format the cells: Use a consistent font, such as Arial or Calibri, and adjust the column widths and row heights as needed.

Entering Assets into the Balance Sheet

The assets section of the balance sheet includes the company’s current and non-current assets. Current assets are those that can be converted into cash within one year, while non-current assets are those that cannot be converted into cash within one year. Some common examples of assets include: * Cash and cash equivalents: This includes cash, bank accounts, and short-term investments. * Accounts receivable: This includes amounts owed to the company by its customers. * Inventory: This includes the company’s stock of goods, materials, and supplies. * Property, plant, and equipment: This includes the company’s land, buildings, machinery, and equipment.

To enter assets into the balance sheet, follow these steps: 1. Create a new row for each asset account. 2. Enter the account name and number in the respective columns. 3. Enter the debit or credit balance for each asset account.

Entering Liabilities into the Balance Sheet

The liabilities section of the balance sheet includes the company’s current and non-current liabilities. Current liabilities are those that must be paid within one year, while non-current liabilities are those that do not have to be paid within one year. Some common examples of liabilities include: * Accounts payable: This includes amounts owed by the company to its suppliers. * Loans: This includes amounts borrowed by the company from banks or other lenders. * Taxes owed: This includes amounts owed by the company to the government for taxes.

To enter liabilities into the balance sheet, follow these steps: 1. Create a new row for each liability account. 2. Enter the account name and number in the respective columns. 3. Enter the debit or credit balance for each liability account.

Entering Equity into the Balance Sheet

The equity section of the balance sheet represents the ownership interest in the company. Some common examples of equity include: * Common stock: This represents the amount of money invested in the company by its shareholders. * Preferred stock: This represents a type of stock that has a higher claim on assets and dividends than common stock. * Retained earnings: This represents the amount of profit that the company has retained over time.

To enter equity into the balance sheet, follow these steps: 1. Create a new row for each equity account. 2. Enter the account name and number in the respective columns. 3. Enter the debit or credit balance for each equity account.

Formatting the Balance Sheet

Once you have entered all of the accounts into the balance sheet, you can format it to make it easier to read. Some tips for formatting the balance sheet include: * Using bold font: Use bold font to highlight the headings and subheadings. * Using italic font: Use italic font to highlight the account names. * Using colors: Use colors to highlight the different sections of the balance sheet. * Using borders: Use borders to separate the different sections of the balance sheet.

📝 Note: It's essential to ensure that the balance sheet is properly formatted and easy to read, as it will be used by investors, lenders, and other stakeholders to make important decisions about the company.

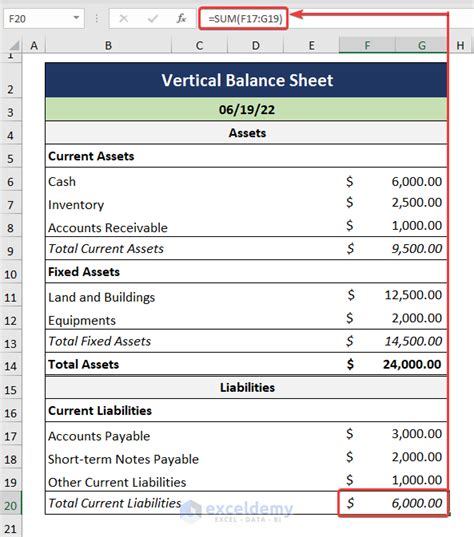

Example of a Balance Sheet in Excel

Here is an example of what a balance sheet might look like in Excel:

| Account Name | Account Number | Debit/Credit Balance |

|---|---|---|

| Cash and Cash Equivalents | 1000 | 100,000</td> </tr> <tr> <td>Accounts Receivable</td> <td>1100</td> <td>50,000 |

| Inventory | 1200 | 200,000</td> </tr> <tr> <td>Property, Plant, and Equipment</td> <td>1300</td> <td>500,000 |

| Accounts Payable | 2000 | 50,000</td> </tr> <tr> <td>Loans</td> <td>2100</td> <td>200,000 |

| Taxes Owed | 2200 | 20,000</td> </tr> <tr> <td>Common Stock</td> <td>3000</td> <td>100,000 |

| Retained Earnings | 3100 | $500,000 |

In summary, creating a balance sheet in Excel is a straightforward process that involves setting up a template, entering the company’s assets, liabilities, and equity, and formatting the sheet to make it easy to read. By following these steps, you can create a balance sheet that provides a clear picture of the company’s financial position and helps investors, lenders, and other stakeholders make informed decisions.

What is the purpose of a balance sheet?

+

The purpose of a balance sheet is to provide a snapshot of a company’s financial position at a specific point in time, including its assets, liabilities, and equity.

What are the three main components of a balance sheet?

+

The three main components of a balance sheet are assets, liabilities, and equity.

How do I format a balance sheet in Excel?

+

To format a balance sheet in Excel, use bold font to highlight the headings and subheadings, italic font to highlight the account names, and colors and borders to separate the different sections of the balance sheet.