5 Ways To Calculate Wacc

Introduction to WACC

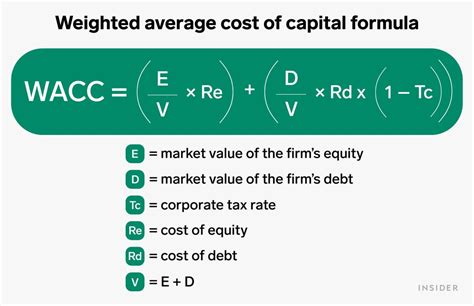

The Weighted Average Cost of Capital (WACC) is a crucial concept in finance that represents the average cost of capital for a company, taking into account the costs of different capital components, such as debt and equity. It is used to evaluate investment opportunities, determine the feasibility of projects, and make informed decisions about capital structure. In this article, we will explore five ways to calculate WACC, highlighting the importance of accurate calculation and its impact on business decisions.

Understanding WACC Components

Before diving into the calculation methods, it is essential to understand the components of WACC. The two primary components are: * Cost of Debt: The cost of borrowing funds, typically represented by the interest rate on debt. * Cost of Equity: The cost of equity capital, which can be calculated using various methods, such as the Capital Asset Pricing Model (CAPM).

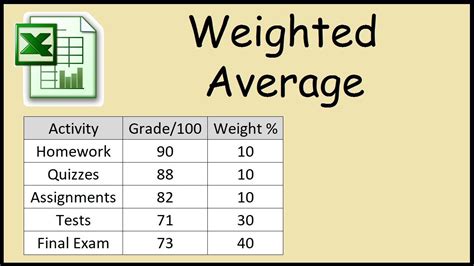

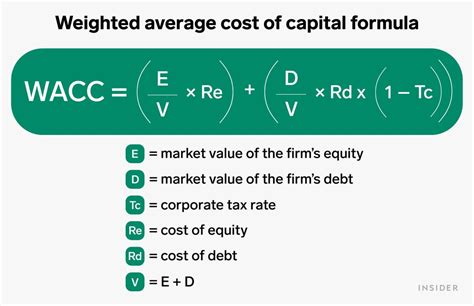

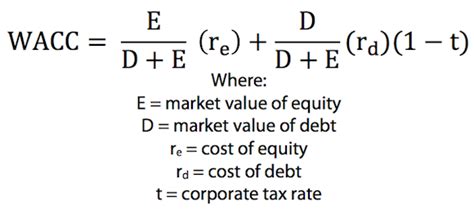

Method 1: Basic WACC Calculation

The basic WACC calculation involves weighing the costs of debt and equity by their respective proportions in the capital structure. The formula is: WACC = (Cost of Debt x Debt Proportion) + (Cost of Equity x Equity Proportion) For example, if a company has a debt proportion of 30% and an equity proportion of 70%, with a cost of debt of 5% and a cost of equity of 10%, the WACC would be: WACC = (0.05 x 0.3) + (0.1 x 0.7) = 0.015 + 0.07 = 0.085 or 8.5%

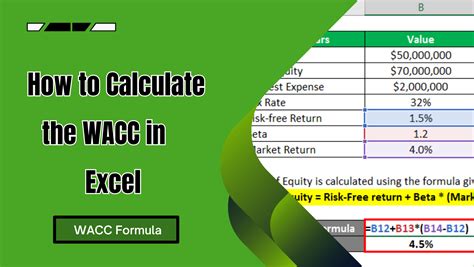

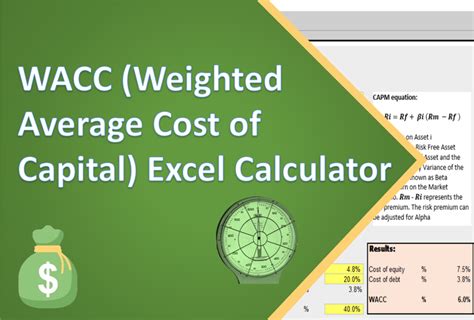

Method 2: Using the Capital Asset Pricing Model (CAPM)

The CAPM is a widely used method to estimate the cost of equity. It takes into account the risk-free rate, the market risk premium, and the company’s beta. The formula is: Cost of Equity = Risk-Free Rate + (Market Risk Premium x Beta) Using the CAPM, we can calculate the cost of equity and then use it to calculate the WACC.

Method 3: Adjusting for Tax Effects

When calculating WACC, it is essential to consider the tax effects of debt financing. The formula is: WACC = (Cost of Debt x (1 - Tax Rate) x Debt Proportion) + (Cost of Equity x Equity Proportion) For example, if a company has a debt proportion of 30% and an equity proportion of 70%, with a cost of debt of 5% and a tax rate of 20%, the WACC would be: WACC = (0.05 x (1 - 0.2) x 0.3) + (0.1 x 0.7) = 0.012 + 0.07 = 0.082 or 8.2%

Method 4: Using the Discounted Cash Flow (DCF) Method

The DCF method involves estimating the present value of future cash flows using the cost of capital as a discount rate. The formula is: Present Value = Future Cash Flow / (1 + WACC)^n By rearranging the formula, we can solve for WACC.

Method 5: Using the Miles-Ezzell Formula

The Miles-Ezzell formula is an alternative method to calculate WACC, which takes into account the company’s debt and equity proportions, as well as the cost of debt and equity. The formula is: WACC = (Cost of Debt x Debt Proportion) + (Cost of Equity x Equity Proportion) - (Cost of Debt x Debt Proportion x Tax Rate) This method provides a more accurate estimate of WACC, especially when the company has a significant amount of debt.

📝 Note: It is essential to use the correct input values and formulas when calculating WACC, as small errors can lead to significant differences in the calculated WACC.

| Method | Formula | Description |

|---|---|---|

| Basic WACC Calculation | WACC = (Cost of Debt x Debt Proportion) + (Cost of Equity x Equity Proportion) | Weights the costs of debt and equity by their respective proportions |

| CAPM | Cost of Equity = Risk-Free Rate + (Market Risk Premium x Beta) | Estimates the cost of equity using the CAPM |

| Adjusting for Tax Effects | WACC = (Cost of Debt x (1 - Tax Rate) x Debt Proportion) + (Cost of Equity x Equity Proportion) | Considers the tax effects of debt financing |

| DCF Method | Present Value = Future Cash Flow / (1 + WACC)^n | Estimates the present value of future cash flows using the cost of capital as a discount rate |

| Miles-Ezzell Formula | WACC = (Cost of Debt x Debt Proportion) + (Cost of Equity x Equity Proportion) - (Cost of Debt x Debt Proportion x Tax Rate) | Provides an alternative method to calculate WACC, considering debt and equity proportions, as well as the cost of debt and equity |

In summary, calculating WACC is a critical step in evaluating investment opportunities and making informed decisions about capital structure. The five methods presented in this article provide a range of approaches to calculate WACC, each with its strengths and limitations. By understanding the components of WACC and using the correct formulas and input values, businesses can make more accurate decisions and drive growth.

What is the purpose of calculating WACC?

+

The purpose of calculating WACC is to determine the average cost of capital for a company, which can be used to evaluate investment opportunities, determine the feasibility of projects, and make informed decisions about capital structure.

What are the components of WACC?

+

The two primary components of WACC are the cost of debt and the cost of equity.

How do I choose the correct method to calculate WACC?

+

The choice of method depends on the company’s specific circumstances, such as the availability of data and the complexity of the capital structure. It is essential to understand the strengths and limitations of each method and choose the one that best suits the company’s needs.