5 Ways Calculate Payback

Introduction to Payback Period Calculation

When evaluating investment opportunities, one crucial factor to consider is the payback period. The payback period is the time it takes for an investment to generate returns equal to its initial cost. It’s a key metric for assessing the risk and potential of an investment. In this article, we will explore five ways to calculate the payback period, each with its own set of considerations and applications.

Understanding the Payback Period

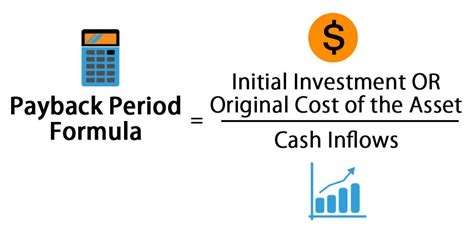

The payback period is essentially about how long it takes for an investment to pay for itself. It’s a simple yet effective way to compare different investment opportunities. A shorter payback period generally indicates a lower-risk investment with quicker returns, while a longer payback period may signify higher risk and slower returns. The formula for the payback period is straightforward: it’s the initial investment divided by the annual cash inflow.

1. Basic Payback Period Calculation

The basic payback period calculation involves dividing the total investment by the expected annual cash flow. For example, if an investment costs 100,000 and is expected to generate 20,000 in cash flow each year, the payback period would be 5 years (100,000 / 20,000 = 5). This method provides a quick and simple way to evaluate investments but doesn’t account for factors like time value of money or potential variations in annual cash flow.

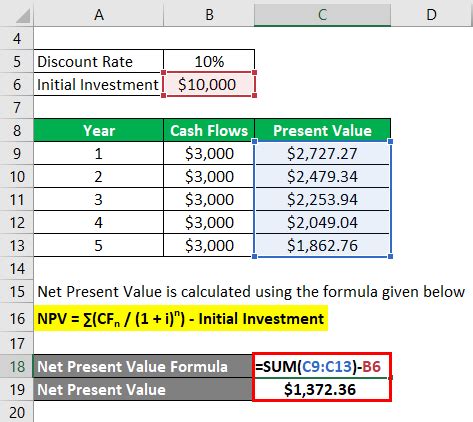

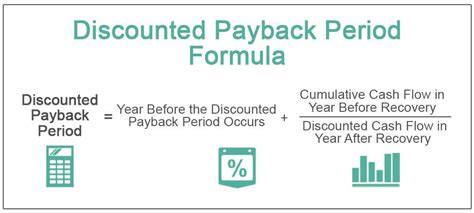

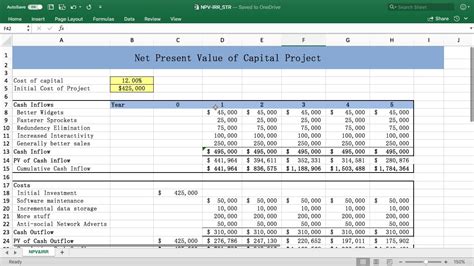

2. Discounted Payback Period Calculation

The discounted payback period is a more sophisticated calculation that takes into account the time value of money. It calculates the payback period based on the present value of future cash flows, using a discount rate to reflect the risk associated with the investment. This method provides a more accurate picture of an investment’s potential, especially for projects with long payback periods or high-risk profiles.

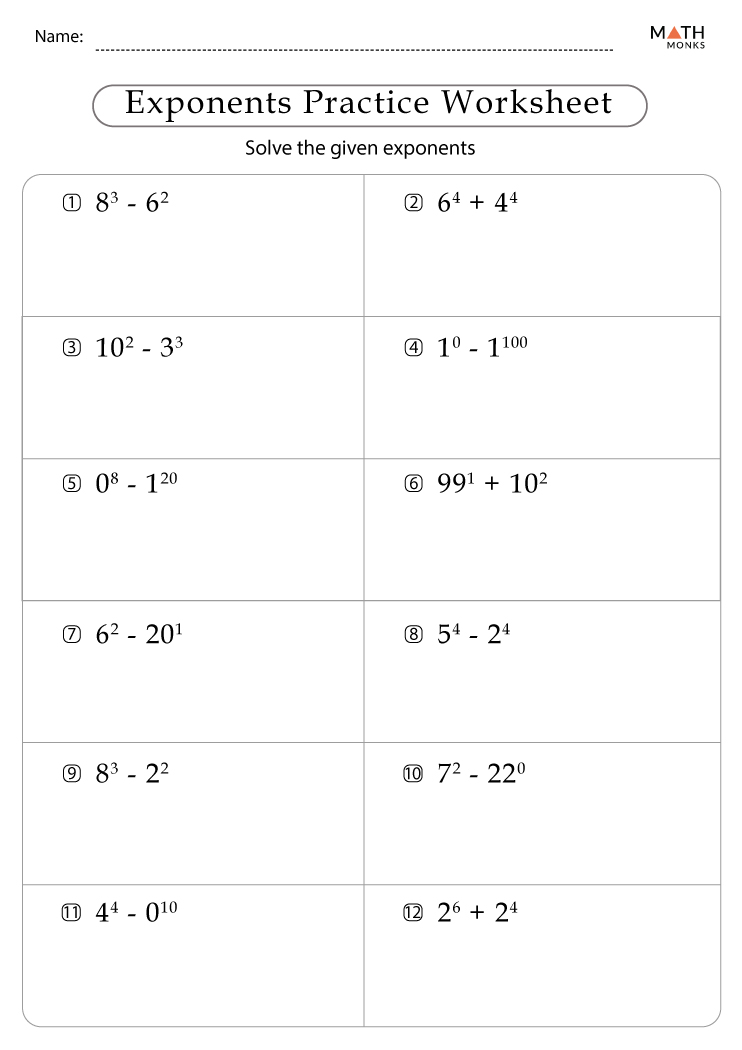

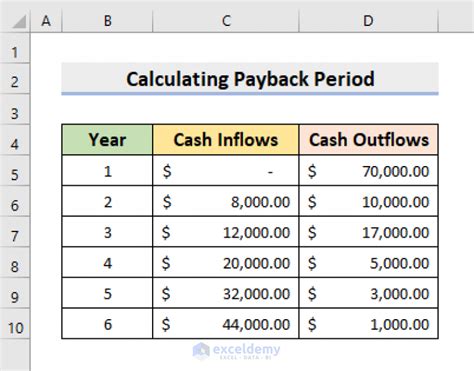

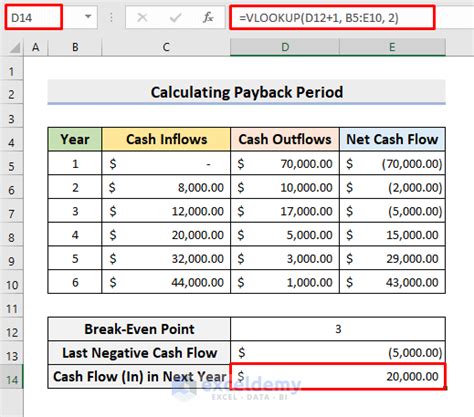

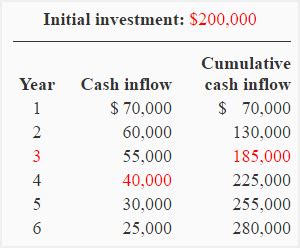

3. Payback Period with Uneven Cash Flows

Not all investments generate even cash flows each year. Some may have higher returns in the initial years and lower returns later on, or vice versa. Calculating the payback period for such investments involves cumulative cash flows. You add up the cash flows year by year until the cumulative cash flow equals or exceeds the initial investment. This method is particularly useful for investments with fluctuating returns.

4. Payback Period Considering Inflation

Inflation can significantly impact the value of money over time, making future cash flows worth less in real terms. To calculate the payback period considering inflation, you need to adjust the cash flows for inflation before calculating the payback period. This involves using the nominal cash flows and applying an inflation rate to find the real cash flows, then proceeding with the payback period calculation as usual.

5. Payback Period with Tax Effects

Taxes can also affect the cash flows from an investment. Calculating the payback period with tax effects involves adjusting the cash flows to reflect tax savings or expenses associated with the investment. For instance, depreciation can reduce taxable income, thus reducing tax liability and increasing cash flow. This method provides a more realistic view of an investment’s potential by considering the impact of taxation.

📝 Note: When calculating payback periods, especially with complex scenarios involving inflation, taxes, or uneven cash flows, it's crucial to have a clear understanding of the investment's specifics and to apply the correct formulas and considerations to ensure accurate results.

In the realm of investment analysis, understanding and calculating the payback period is fundamental. Whether using the basic method or more advanced calculations that account for the time value of money, inflation, taxes, or uneven cash flows, the goal remains the same: to make informed decisions about where and how to invest. Each of the five methods outlined has its place and application, depending on the specifics of the investment in question.

The decision to invest should always be based on a thorough analysis, considering not just the payback period but other critical factors such as risk, potential for growth, and alignment with investment goals. In a world where investment opportunities are diverse and complex, having the right tools and knowledge to evaluate them is key to success.

What is the primary purpose of calculating the payback period?

+

The primary purpose of calculating the payback period is to determine how long it will take for an investment to generate returns equal to its initial cost, thus helping in assessing the risk and potential of the investment.

How does inflation affect the payback period calculation?

+

Inflation affects the payback period calculation by reducing the value of future cash flows. To account for inflation, cash flows need to be adjusted to their real value, which can lead to a longer payback period in inflationary conditions.

What is the difference between the basic payback period and the discounted payback period?

+

The basic payback period does not account for the time value of money, whereas the discounted payback period takes into consideration the present value of future cash flows, making it a more accurate measure of an investment’s potential, especially for high-risk or long-term investments.