House Hunting After Leaving the Navy Made Easy

Transitioning from Navy Life to Civilian Housing

Congratulations on your decision to leave the Navy and start a new chapter in your life! As a former Navy personnel, you’re likely no stranger to change and adaptability. However, navigating the civilian housing market can be overwhelming, especially when it comes to finding the perfect home. In this article, we’ll provide you with a comprehensive guide to house hunting after leaving the Navy, making your transition as smooth as possible.

Understanding Your Housing Needs

Before starting your house hunt, it’s essential to understand your housing needs. Consider the following factors:

- Location: Where do you want to live? Do you have a specific city or state in mind? Are you looking for a rural or urban area?

- Space: How many bedrooms and bathrooms do you need? Do you require a backyard or a specific type of flooring?

- Budget: What is your budget for housing? Consider your income, expenses, and savings.

- Amenities: What amenities are you looking for in a home? Do you need a pool, gym, or community garden?

Exploring Housing Options

As a former Navy personnel, you may be eligible for various housing benefits and programs. Here are a few options to consider:

- VA Loans: The Department of Veterans Affairs (VA) offers zero-down mortgages with competitive interest rates and lower fees.

- USDA Loans: The United States Department of Agriculture (USDA) provides zero-down mortgages for rural areas.

- FHA Loans: The Federal Housing Administration (FHA) offers mortgages with lower down payments and more lenient credit score requirements.

- Renting: Renting can be a great option if you’re not ready to buy or need time to explore different areas.

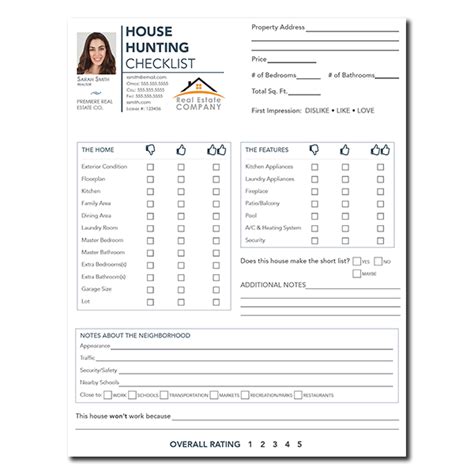

House Hunting Strategies

Now that you’ve determined your housing needs and explored your options, it’s time to start house hunting. Here are some strategies to keep in mind:

- Research: Research different neighborhoods, schools, and local amenities.

- Online Search: Use online real estate platforms to browse homes and filter by your criteria.

- Work with a Realtor: A reputable realtor can guide you through the home-buying process and provide valuable insights.

- Visit Open Houses: Attend open houses to get a feel for different homes and neighborhoods.

- Drive-By Viewing: Drive by potential homes to get a sense of the area and exterior condition.

Inspections and Due Diligence

Once you’ve found a potential home, it’s essential to conduct inspections and due diligence. Here are some steps to take:

- Home Inspection: Hire a professional home inspector to identify potential issues with the property.

- Termite Inspection: Check for termite damage and activity.

- Appraisal: An appraiser will determine the value of the property to ensure it matches the sale price.

- Review Homeowner Association (HOA) Documents: If the property has an HOA, review the documents to understand the rules and fees.

🚨 Note: Always prioritize inspections and due diligence to avoid costly surprises down the road.

Closing the Deal

Once you’ve completed inspections and due diligence, it’s time to close the deal. Here are the final steps:

- Negotiate Repairs: If inspections reveal issues, negotiate with the seller to repair or credit you for the repairs.

- Finalize Financing: Complete your mortgage application and finalize your financing.

- Review and Sign Documents: Carefully review and sign the sale documents.

- Close the Sale: Meet with the seller, realtor, and other parties to transfer ownership and complete the sale.

Additional Tips for Navy Veterans

As a Navy veteran, you may be eligible for additional benefits and programs. Here are a few tips to keep in mind:

- VA Benefits: Take advantage of VA benefits, such as the VA home loan guarantee and vocational rehabilitation.

- Transition Assistance: Utilize transition assistance programs, such as the Transition Assistance Program (TAP), to help with your transition to civilian life.

- Veteran-Friendly Real Estate Agents: Work with real estate agents who have experience working with veterans and understand your unique needs.

What are the benefits of using a VA loan?

+

VA loans offer zero-down mortgages, competitive interest rates, and lower fees. They also provide more lenient credit score requirements and no mortgage insurance premiums.

How do I find a veteran-friendly real estate agent?

+

Look for real estate agents who have experience working with veterans and understand your unique needs. You can also ask for referrals from fellow veterans or check with the VA for recommendations.

What is the Transition Assistance Program (TAP)?

+

TAP is a transition assistance program designed to help service members transition to civilian life. The program provides career counseling, resume building, and job placement assistance.

In conclusion, house hunting after leaving the Navy can be a daunting task, but with the right guidance and resources, you can find your perfect home. Remember to understand your housing needs, explore your options, and prioritize inspections and due diligence. Don’t forget to take advantage of VA benefits and programs, and work with veteran-friendly real estate agents. With patience and persistence, you’ll be enjoying your new home in no time.