Unlock Your Housing Allowance: Guidestone Worksheet Guide

In the journey towards homeownership, understanding and making use of available resources can significantly ease the financial burden. One such resource for those in service or working for specific organizations might be the housing allowance provided by Guidestone Financial Resources. This comprehensive guide is crafted to help you unlock and maximize your housing allowance, detailing step-by-step how to navigate through the intricacies of the Guidestone Housing Allowance Worksheet. Whether you're already familiar with the concept or just starting to explore, this post aims to clarify, educate, and assist in optimizing this unique financial opportunity.

Understanding the Housing Allowance

The housing allowance is not just an additional income but a tax-exempt benefit designed to assist eligible individuals in covering housing-related expenses. Here's what you need to know:

- Tax Exemption: Funds received as part of the housing allowance are not subject to federal income tax, which can result in significant savings.

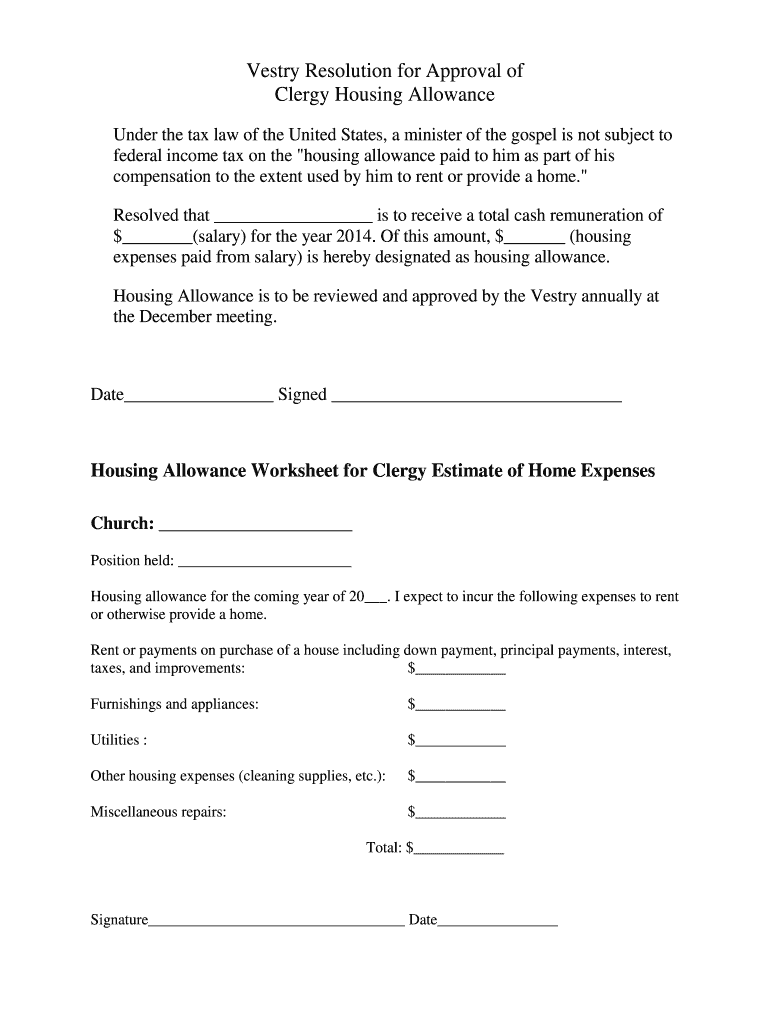

- Qualifications: Typically, this allowance is available for ministers, chaplains, or employees of religious organizations or non-profits affiliated with Guidestone.

- Flexible Use: The money can be used for mortgage payments, rent, utilities, furnishings, and home improvements or repairs.

Steps to Utilize the Guidestone Worksheet

Navigating the Guidestone Housing Allowance Worksheet might seem daunting at first, but with these steps, you'll find it straightforward:

1. Determine Your Eligibility

First, confirm your eligibility for the housing allowance:

- Are you employed by or in ministry with an organization affiliated with Guidestone?

- Is your organization or church aware of and in agreement with your intent to use this benefit?

Documentation of your employment status and intent to claim the housing allowance may be required.

2. Access the Worksheet

The Guidestone worksheet can be found on their official resources or provided by your employer:

- Visit the Guidestone website or check with HR for downloadable forms.

- Ensure you have the latest version to comply with current regulations and guidelines.

3. Fill Out the Worksheet

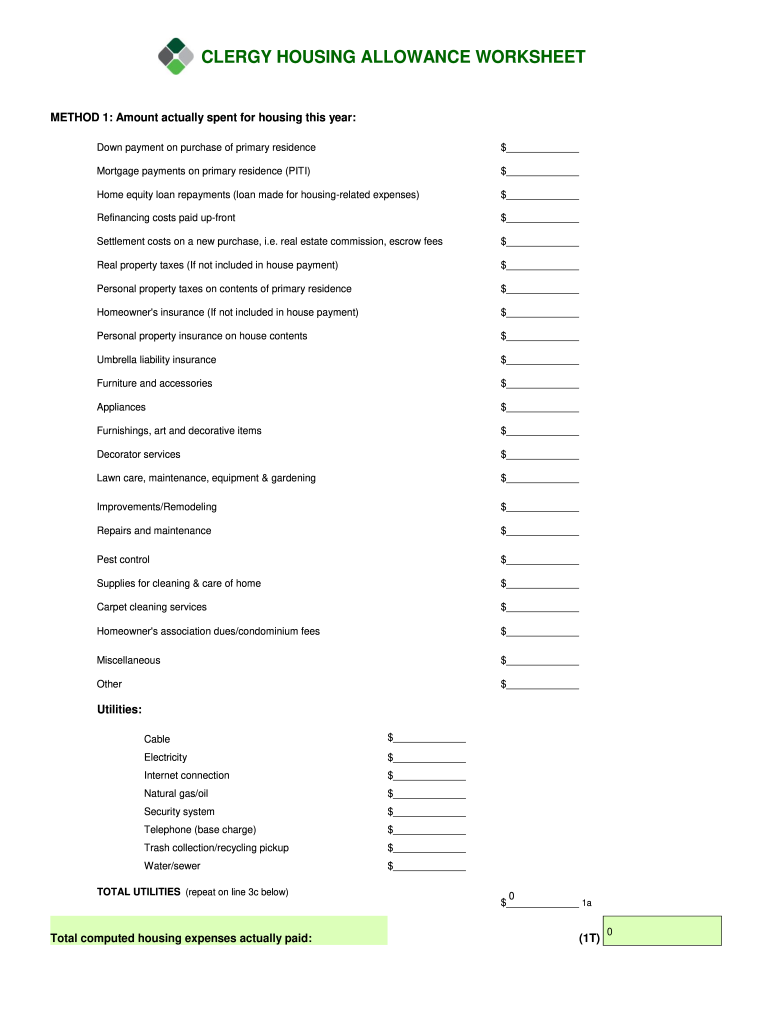

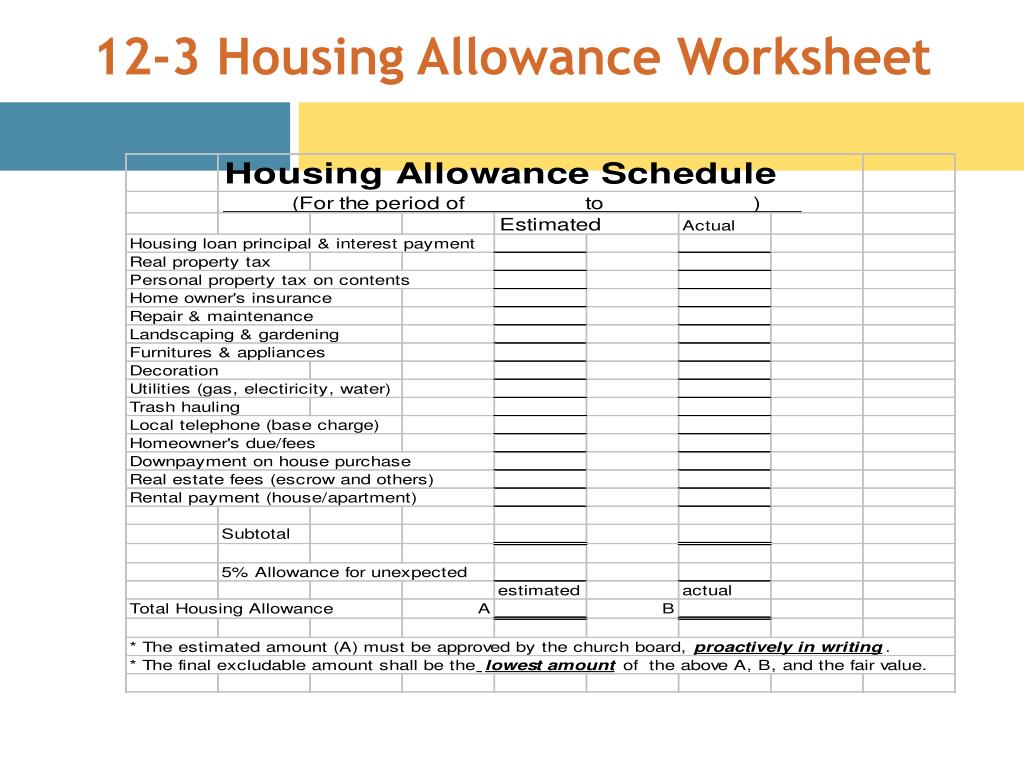

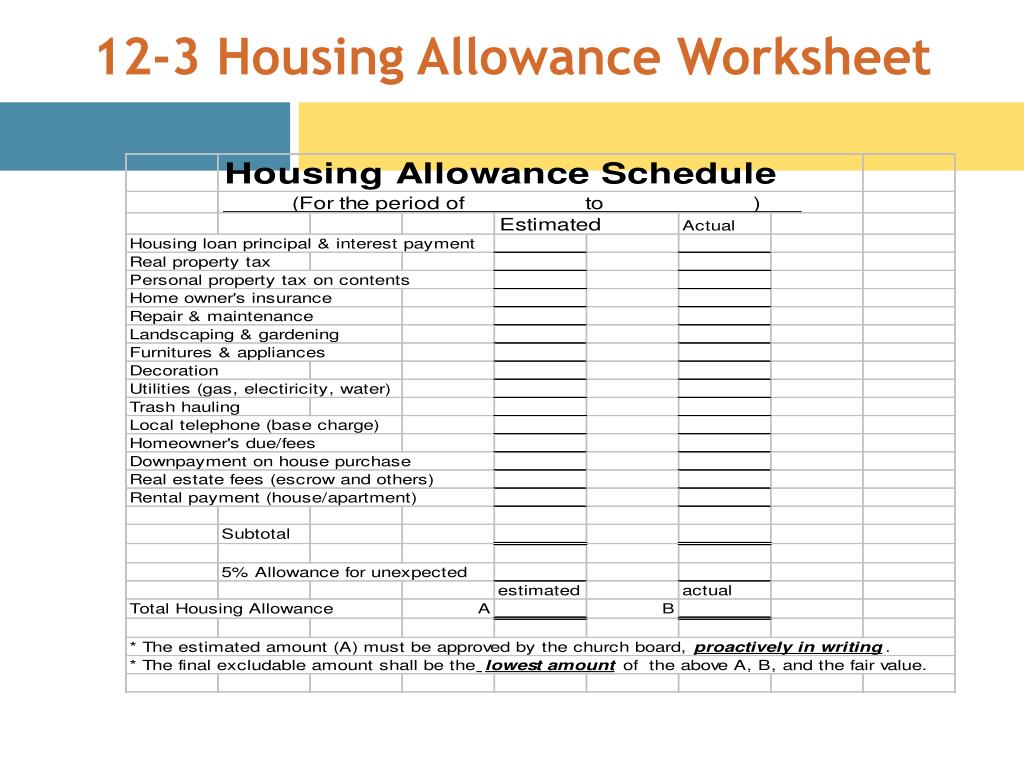

The worksheet breaks down into several key sections:

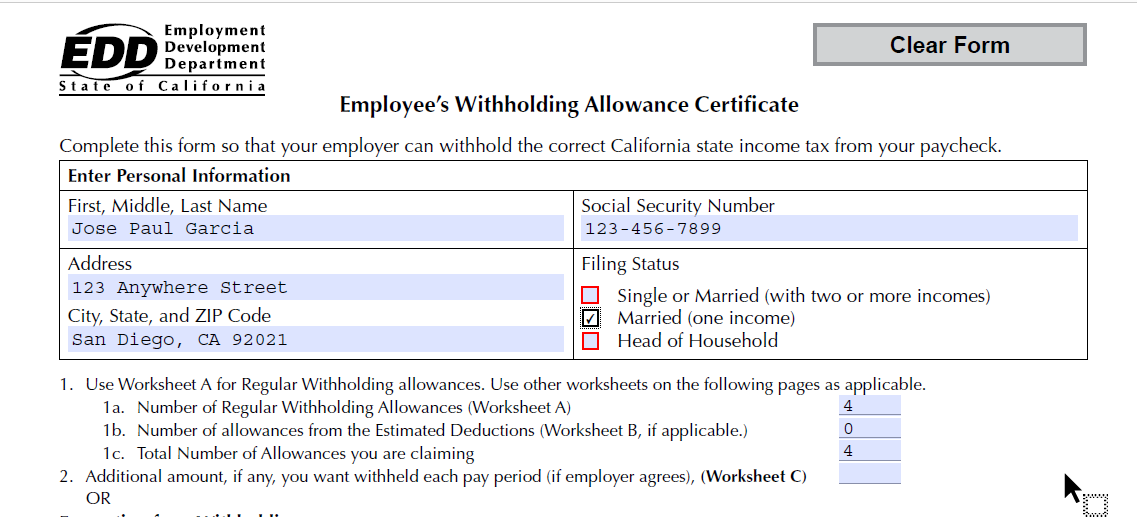

- Personal Information: Fill in your name, SSN, address, and employment details.

- Current Housing Costs: Calculate your monthly or annual housing expenses, including utilities, rent, or mortgage payments, insurance, and more.

- Projected Expenses: Estimate future housing costs if applicable, such as repairs or renovations.

- Housing Allowance Calculation: This section allows you to compute your eligible housing allowance based on your current and projected expenses.

- Authorization and Agreements: Ensure all necessary signatures and acknowledgments are completed.

| Section | Description |

|---|---|

| Personal Info | Name, SSN, Address, Employment Status |

| Current Costs | Rent/Mortgage, Utilities, Home Insurance, etc. |

| Projected Costs | Repairs, Renovations, Furnishings |

| Calculation | Total allowable housing allowance based on expenses |

⚠️ Note: Always verify the numbers with your financial advisor to ensure accuracy and compliance with IRS regulations.

4. Submit Your Worksheet

Submission procedures will vary:

- Some organizations might require an electronic submission through their internal systems.

- Others might prefer physical copies, ensuring all signatures are in place.

5. Track and Document Expenses

Keep meticulous records:

- Receipts, invoices, and bank statements that reflect your housing expenses.

- Maintain a ledger or use software to track spending against the allowance.

6. Review and Adjust Annually

The housing allowance might need adjustments:

- Changes in your living situation or employment status.

- Annual cost of living adjustments or major home improvements.

The landscape of the housing allowance benefits requires adaptability and continuous learning. Unlocking and utilizing your Guidestone housing allowance effectively can transform your approach to managing housing expenses. Whether you're planning to buy a home, move into a new rental, or simply aiming to reduce your taxable income, understanding and maximizing this benefit is crucial. By following this guide, you not only navigate through the paperwork but also unlock a pathway towards financial security and peace of mind in your living arrangements. Remember, these allowances are not just perks but strategic financial tools if used wisely.

How do I know if I am eligible for the housing allowance?

+

Eligibility is often tied to employment status with organizations affiliated with Guidestone. Confirm your eligibility by reviewing your employment contract or speaking directly with HR or your church administration.

Can I use the housing allowance for any housing expense?

+

Yes, as long as the expense is related to your primary residence. This includes rent, mortgage payments, utilities, home repairs, and furnishings. Always check IRS guidelines to ensure your expenditures qualify.

What if my housing expenses exceed the allowance?

+

If your housing costs are higher than the allowance, you’ll need to cover the excess from other income sources. The housing allowance aims to reduce your tax burden, not cover all housing costs.