Georgia Wage Calculator Tool

Introduction to Georgia Wage Calculator Tool

The Georgia Wage Calculator Tool is an innovative online resource designed to help employees and employers in Georgia accurately calculate wages, taking into account various factors such as regular pay, overtime, and deductions. This tool is particularly useful in ensuring compliance with the Fair Labor Standards Act (FLSA) and Georgia state labor laws. With the increasing complexity of wage calculations, this tool simplifies the process, providing a straightforward and efficient way to determine wages.

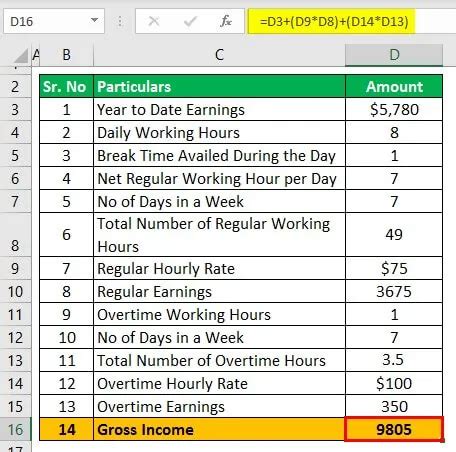

How the Georgia Wage Calculator Tool Works

The Georgia Wage Calculator Tool operates by gathering specific information from the user, such as the employee’s regular pay rate, the number of hours worked, including overtime, and any applicable deductions. The tool then processes this information according to the relevant labor laws and regulations, including those related to minimum wage, overtime pay, and permissible deductions. The result is an accurate calculation of the employee’s wages, ensuring that both employers and employees understand their obligations and rights regarding compensation.

Benefits of Using the Georgia Wage Calculator Tool

There are several benefits to using the Georgia Wage Calculator Tool: - Accuracy: It ensures accurate wage calculations, reducing the risk of errors that could lead to legal issues or disputes. - Compliance: The tool helps employers comply with federal and state labor laws, minimizing the risk of fines and penalties. - Efficiency: It streamlines the wage calculation process, saving time and resources that would be spent on manual calculations or consulting with legal experts. - Transparency: Both employers and employees can use the tool to understand how wages are calculated, promoting transparency and trust in the employment relationship.

Features of the Georgia Wage Calculator Tool

The Georgia Wage Calculator Tool includes several key features: - Regular Pay Calculator: Calculates the regular pay based on the pay rate and hours worked. - Overtime Pay Calculator: Determines the overtime pay according to the FLSA and Georgia state laws. - Deductions Calculator: Allows for the calculation of permissible deductions, ensuring they are in compliance with labor laws. - Tax Calculator: Estimates the taxes withheld from the employee’s wages, providing a comprehensive view of the take-home pay.

Using the Georgia Wage Calculator Tool Effectively

To get the most out of the Georgia Wage Calculator Tool, follow these steps: - Gather all necessary information, including pay rates, hours worked, and any deductions. - Input the information accurately into the tool. - Review the calculations to ensure they align with your expectations and labor laws. - Use the tool regularly to stay up-to-date with any changes in labor laws or employee information.

💡 Note: It's essential to regularly update the information used in the Georgia Wage Calculator Tool to reflect any changes in labor laws, employee pay rates, or working hours.

Understanding Labor Laws in Georgia

To fully utilize the Georgia Wage Calculator Tool, it’s crucial to have a basic understanding of labor laws in Georgia, including: - Minimum Wage: The minimum wage rate in Georgia, which may be higher than the federal minimum wage. - Overtime Pay: The requirements for paying overtime, including the rate and the conditions under which overtime pay is mandatory. - Permissible Deductions: The types of deductions that can be made from an employee’s wages, such as taxes, and the limits on these deductions.

| Category | Description |

|---|---|

| Minimum Wage | The lowest wage per hour that an employer can pay an employee. |

| Overtime Pay | Pay for hours worked beyond the standard 40 hours per week, typically at a rate of 1.5 times the regular pay rate. |

| Permissible Deductions | Deductions allowed by law, such as taxes, that can be subtracted from an employee's wages. |

Best Practices for Employers and Employees

For employers and employees to make the most of the Georgia Wage Calculator Tool and to maintain a positive and compliant employment relationship: - Stay Informed: Keep up-to-date with the latest labor laws and regulations. - Communicate: Ensure open communication about wages, deductions, and any changes. - Use the Tool Regularly: Regularly use the Georgia Wage Calculator Tool to ensure accuracy and compliance.

As the employment landscape continues to evolve, tools like the Georgia Wage Calculator Tool play a vital role in maintaining fairness, transparency, and compliance with labor laws. By understanding and utilizing this tool effectively, both employers and employees can navigate the complexities of wage calculations with confidence.

In wrapping up, the key points to remember include the importance of accuracy, compliance, and efficiency in wage calculations, as well as the benefits and features of the Georgia Wage Calculator Tool. By embracing this tool and staying informed about labor laws, employers and employees can foster a more positive and productive work environment.

What is the primary purpose of the Georgia Wage Calculator Tool?

+

The primary purpose of the Georgia Wage Calculator Tool is to help employers and employees accurately calculate wages, ensuring compliance with federal and state labor laws.

How does the tool handle overtime pay calculations?

+

The tool calculates overtime pay based on the FLSA and Georgia state laws, ensuring that overtime is correctly compensated at 1.5 times the regular pay rate for hours worked beyond 40 in a workweek.

Can the Georgia Wage Calculator Tool be used for all types of employment?

+

While the tool is versatile, it’s primarily designed for standard employment arrangements. For more complex situations, such as contract workers or those with unique compensation packages, additional consultation with labor law experts may be necessary.

Related Terms:

- georgia wage calculator

- Hourly paycheck calculator Georgia

- Georgia income tax calculator

- Georgia wage calculator hourly

- Florida paycheck calculator

- Take home pay calculator