Military

5 Georgia Payroll Tips

Introduction to Georgia Payroll

Managing payroll in Georgia requires attention to detail and adherence to both federal and state regulations. As an employer, understanding these regulations is crucial to avoid any legal or financial issues. Georgia payroll management involves calculating employee wages, deducting taxes, and ensuring compliance with labor laws. In this article, we will delve into key aspects of Georgia payroll, providing insights and tips for effective management.

Understanding Georgia Payroll Laws

Georgia payroll laws are designed to protect both employees and employers. These laws cover minimum wage, overtime pay, and the handling of payroll taxes. Minimum wage in Georgia is 5.15 per hour for employers with six or more employees, although the federal minimum wage of 7.25 per hour supersedes this if it is higher. Employers must also comply with overtime regulations, paying employees 1.5 times their regular rate for hours worked beyond 40 in a workweek. Understanding these laws is essential for maintaining a compliant and fair work environment.

Georgia Payroll Taxes

Payroll taxes in Georgia include federal income taxes, Social Security taxes, and Medicare taxes. Employers must withhold these taxes from employee wages and contribute their portion as well. Georgia does not have a state income tax, which simplifies payroll processing but does not exempt employers from federal tax obligations. Employers must file these taxes quarterly and annually, using forms such as the 941 for quarterly filings and W-2 and W-3 forms for annual reporting. It’s also crucial to stay updated on any changes to tax rates or filing requirements.

5 Key Georgia Payroll Tips

Here are five essential tips for managing payroll in Georgia effectively: - Stay Compliant with Labor Laws: Ensure you are up to date with the latest labor laws, including minimum wage, overtime, and workers’ compensation requirements. - Accurate Record Keeping: Maintain precise records of employee hours, wages, and deductions. This is vital for tax filings and in case of audits. - Timely Tax Filings: Submit payroll taxes on time to avoid penalties and fines. Utilize online filing systems for efficiency and accuracy. - Employee Classification: Correctly classify employees as exempt or non-exempt to ensure proper overtime pay and benefits administration. - Regular Audits: Conduct regular internal audits to identify and correct any discrepancies in payroll before they become significant issues.

Benefits of Outsourcing Payroll

Outsourcing payroll can be beneficial for businesses, especially small to medium-sized enterprises that may not have the resources or expertise to handle payroll in-house. Payroll service providers can manage payroll taxes, ensure compliance with labor laws, and provide employee payroll services, reducing the administrative burden on the business. This can also reduce the risk of errors and penalties associated with non-compliance.

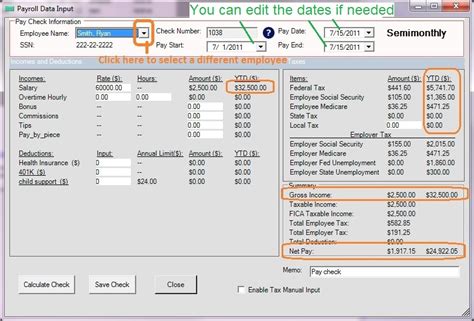

Implementing Payroll Software

Implementing payroll software can significantly streamline payroll processing. This software can automate calculations, generate reports, and facilitate tax filings. When selecting payroll software, consider factors such as ease of use, scalability, integration with existing HR systems, and customer support. Cloud-based payroll solutions offer flexibility and accessibility, allowing for payroll management from anywhere.

Training for Payroll Professionals

Continuous training is essential for payroll professionals to stay updated on changes in laws, regulations, and best practices. This training can be through workshops, webinars, or certification programs like the Certified Payroll Professional (CPP) designation. Staying informed helps in maintaining compliance and efficiently managing payroll processes.

📝 Note: Regularly reviewing and updating payroll policies and procedures is crucial to ensure they align with the latest regulations and laws.

To summarize, managing payroll in Georgia involves understanding and complying with federal and state regulations, accurately processing payroll taxes, and maintaining detailed records. By following the provided tips and considering outsourcing or payroll software, businesses can ensure a smooth and compliant payroll process. Effective payroll management is not just about legal compliance but also about ensuring fair treatment and compensation for employees, which can boost morale and productivity.