5 Essential Tips for Completing Genworth's Rental Income Worksheet

When applying for a mortgage or refinancing your home, understanding how lenders calculate your income is crucial. For those who own rental properties, rental income plays a significant role in this equation. Genworth Financial, a major player in mortgage insurance, provides a Rental Income Worksheet to help both lenders and borrowers accurately document and verify rental income. Here are five essential tips to help you navigate and complete this worksheet effectively:

1. Review Prior Year Taxes

The foundation of the Rental Income Worksheet is often last year’s tax returns. Here’s what to focus on:

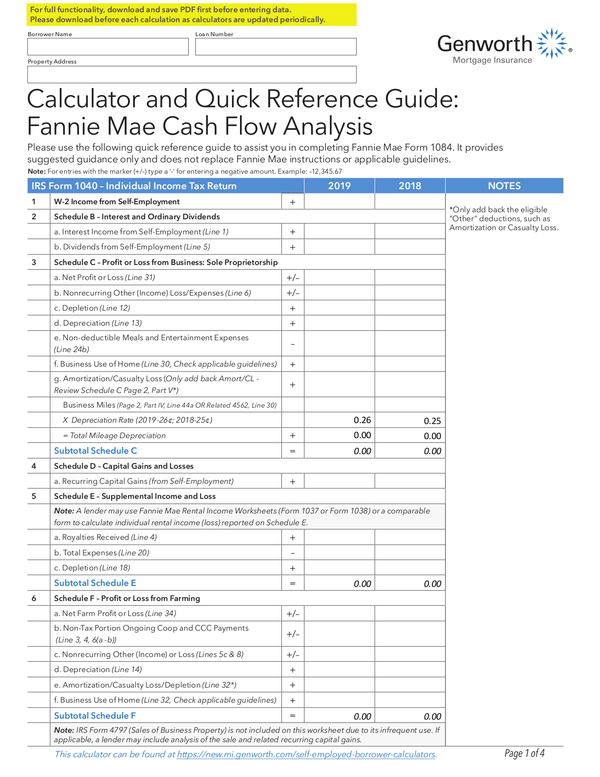

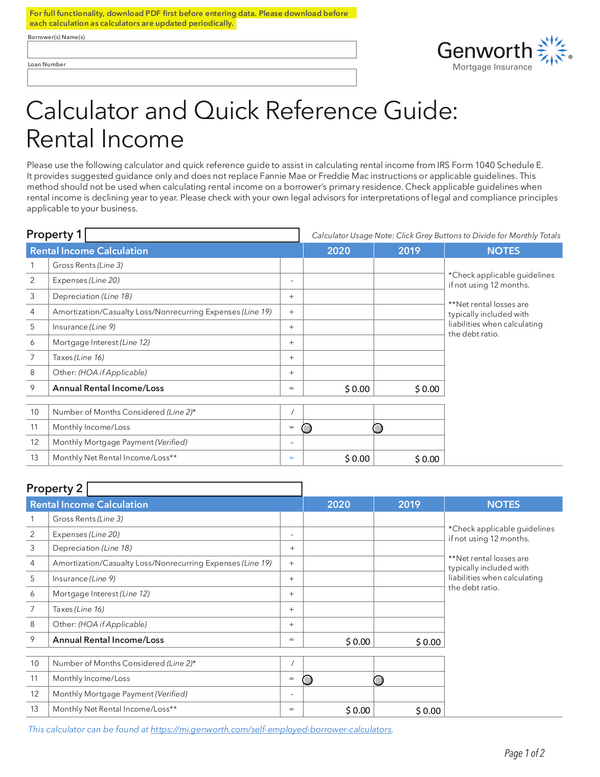

- Schedule E: This is where you’ll find your rental property income and expenses detailed. Look at:

- Income from rents

- Expenses including mortgage interest, taxes, insurance, repairs, and management fees

- Net profit or loss

- Depreciation and Amortization: Since these are not cash outflows, you’ll need to add them back to your net profit to determine the actual cash flow from the property.

2. Understand Annualization

If you recently started renting out your property or acquired a new rental property during the year, the income might not reflect a full year’s data:

- Annualize Income: If your property has less than a year of income history, you might need to project the income as if it were for a full year. Here’s how you can do that:

- Calculate the average monthly rental income and multiply it by 12 to get an annualized figure.

- Consider vacancy rates, seasonal fluctuations, and other factors that might affect income.

3. Document Current Rental Agreements

Having current rental agreements at your fingertips can provide:

- Verification of Income: Lenders will want to see lease agreements to confirm the rental income claimed in the worksheet.

- Security Deposit Receipts: These can sometimes be used as additional proof of tenancy and potential future income.

4. Calculate Your Rental Income

Here are the steps to calculate your rental income:

- Gross Rent: Summarize all the rental income received, including any additional payments like utilities or pet fees.

- Subtract Vacancy Allowance: Typically, lenders allow for a vacancy rate of 5-10%. Use this figure to estimate potential periods without rental income.

- Operating Expenses: Deduct:

- Property management fees

- Maintenance and repair costs

- Insurance

- Utilities (if not paid by tenant)

- HOA or condo association fees (if applicable)

- Net Rental Income: Subtract your total operating expenses from the adjusted gross rent to arrive at your net rental income.

| Description | Amount |

|---|---|

| Gross Rent | $X |

| Less Vacancy Allowance (e.g., 5% of Gross Rent) | -$X |

| Less Operating Expenses | -$X |

| Net Rental Income | $X |

📌 Note: When calculating your net rental income, be sure to include all forms of income from your rental property, including laundry fees, pet fees, and any other tenant payments.

5. Consider the Impact of Depreciation

Depreciation is a non-cash expense that reduces your taxable income:

- Add Back Depreciation: To accurately portray your cash flow, add back depreciation to your net income from Schedule E.

- Amortization of Loans: If you’ve capitalized loan origination fees or other mortgage acquisition costs, their amortization can also be added back.

📌 Note: By adding back depreciation, you're essentially calculating the cash flow from your rental property rather than the tax-loss scenario often portrayed on Schedule E.

The process of completing Genworth's Rental Income Worksheet can seem daunting, but with a clear understanding of your rental finances and the tips outlined above, you can ensure accuracy and maximize your rental income's impact on your loan application.

The significance of rental income can't be overstated in mortgage applications, especially when it comes to qualifying for the loan amount you need. By meticulously documenting and calculating your rental income, you provide lenders with the assurance that your rental property can support the additional debt you wish to take on. Remember, the worksheet is not just about numbers; it's a reflection of your rental investment's viability and stability, which ultimately influences your borrowing power.

What if I have a rental property with no income?

+

If you have a rental property that has not produced income for the full year or has been vacant, lenders may still consider it as potential income, but they might reduce the expected income to account for periods without tenants or apply a vacancy rate to the calculation.

Can I use a projected rental income?

+

Yes, if your property has recently been rented or you have a lease in place but haven’t received income for a full year, you can project the income for a full year. However, lenders often apply a vacancy allowance to this figure to account for potential downtime.

What documentation do I need for rental income?

+

You will generally need tax returns (Schedule E), current lease agreements, rent receipts, and any documentation showing the terms of tenancy including security deposit receipts.