Genworth Income Calculator: Maximize Your Financial Planning

When it comes to financial planning, using tools like the Genworth Income Calculator can be a game-changer. This intuitive tool offers a seamless way to estimate your income requirements in retirement, understand your current financial situation, and plan for the future with precision. Let's delve into how you can leverage this tool to craft a robust financial strategy for your golden years.

Understanding the Basics of Genworth Income Calculator

The Genworth Income Calculator isn’t just another financial tool; it’s a comprehensive platform designed to assist individuals in plotting their financial futures:

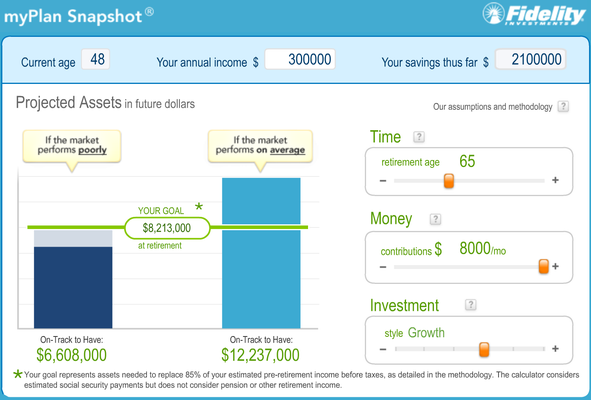

- Income Estimation: It allows users to calculate potential retirement income based on their savings, investments, and future income sources.

- Scenario Analysis: You can evaluate different financial scenarios to see how changes in saving habits, investment returns, or inflation might affect your income in retirement.

- Expense Prediction: The calculator helps predict your expenses in retirement, taking into account inflation and lifestyle changes.

- Life Expectancy: It considers varying life expectancies to ensure you don’t outlive your resources.

Steps to Use Genworth Income Calculator

Here’s a step-by-step guide on how to effectively use this calculator to maximize your financial planning:

-

Log in or Register:

Visit the Genworth website and access the Income Calculator. If you’re not yet a user, register for an account, ensuring you provide accurate personal information for tailored results.

-

Enter Personal Information:

Input your details like age, retirement age, and life expectancy. This step is crucial as it sets the baseline for all future calculations.

-

Input Financial Data:

- Current Savings

- Monthly Contributions

- Investment Portfolio Details

- Expected Social Security Benefits

- Additional Income Sources

-

Define Retirement Expenses:

Estimate your monthly expenses in retirement. The tool can help you project these costs over time, considering inflation and potential lifestyle changes.

-

Run Calculations:

Now, hit ‘Calculate’. The tool will simulate various scenarios, showing you how long your money might last under different circumstances.

💡 Note: Ensure you review different scenarios to understand the impact of various assumptions on your retirement income.

Maximizing Financial Planning with Genworth Income Calculator

To make the most out of this tool:

- Regular Updates: Regularly update your financial data. Life changes, and so should your financial plan.

- Scenario Testing: Test various investment return rates, retirement ages, and inflation rates to understand potential outcomes.

- Review and Adjust: Use the calculator to review and adjust your savings and investment strategies as needed.

- Professional Advice: While the calculator provides estimates, consulting with a financial advisor can help refine your plan further.

Important Notes for Effective Use

🚨 Note: Remember that projections from the calculator are estimates. Life events, market fluctuations, and policy changes can impact your actual financial situation.

Planning for retirement is a critical aspect of financial management, and tools like the Genworth Income Calculator provide a sophisticated yet user-friendly platform to assist in this journey. By understanding how to utilize this calculator, you empower yourself to make informed decisions that align with your retirement goals. Whether it's adjusting savings rates, planning for potential income sources, or simply understanding how long your funds might last, this tool is invaluable in crafting a financially secure future.

What is the Genworth Income Calculator?

+

The Genworth Income Calculator is an online tool designed to help you estimate your income needs in retirement, based on various financial inputs and future scenarios.

How accurate is the Genworth Income Calculator?

+

While the calculator uses sophisticated algorithms and up-to-date financial data, its accuracy depends on the accuracy of the inputs you provide and the unpredictable nature of future economic conditions.

Can I trust the results from this calculator for planning my retirement?

+

The calculator provides valuable insights and should be used as part of a broader financial planning strategy, ideally in conjunction with advice from a financial advisor.