Mastering Genworth Income Calculation: Your Essential Worksheet Guide

When embarking on the journey of homeownership or refinancing, it's not uncommon to hear the term "genworth income calculation worksheet." Whether you are a seasoned real estate professional, a financial advisor, or a prospective borrower, understanding how lenders calculate income is crucial for both accuracy and success in loan applications. This comprehensive guide dives into the intricacies of using the Genworth Income Calculation Worksheet, a tool often employed to determine mortgage eligibility by ensuring that income verification is done with precision and in compliance with Genworth Financial's guidelines.

Understanding the Importance of Income Calculation

At the heart of any mortgage application lies the assessment of the applicant's ability to repay the loan. The Genworth Income Calculation Worksheet helps to:

- Verify the stability and continuity of income sources.

- Assess the consistency of earnings to meet monthly mortgage obligations.

- Calculate the qualifying income that will be used for determining the loan amount.

- Ensure compliance with investor guidelines and lending policies.

The Components of the Worksheet

The Genworth Income Calculation Worksheet comprises several key sections designed to capture and analyze different types of income:

Borrower Information

- Name, SSN, Address, and other personal details for all borrowers are collected here.

Income Types

- Salaried Income – includes base pay, bonuses, commissions, etc.

- Self-Employed Income – involves analyzing business income and expenses.

- Part-Time Income – potential income sources outside the primary occupation.

- Retirement/Investment Income – pensions, annuities, dividends, and interest income.

- Alimony/Child Support – if applicable and verified.

- Public Assistance and Social Security – for individuals receiving government benefits.

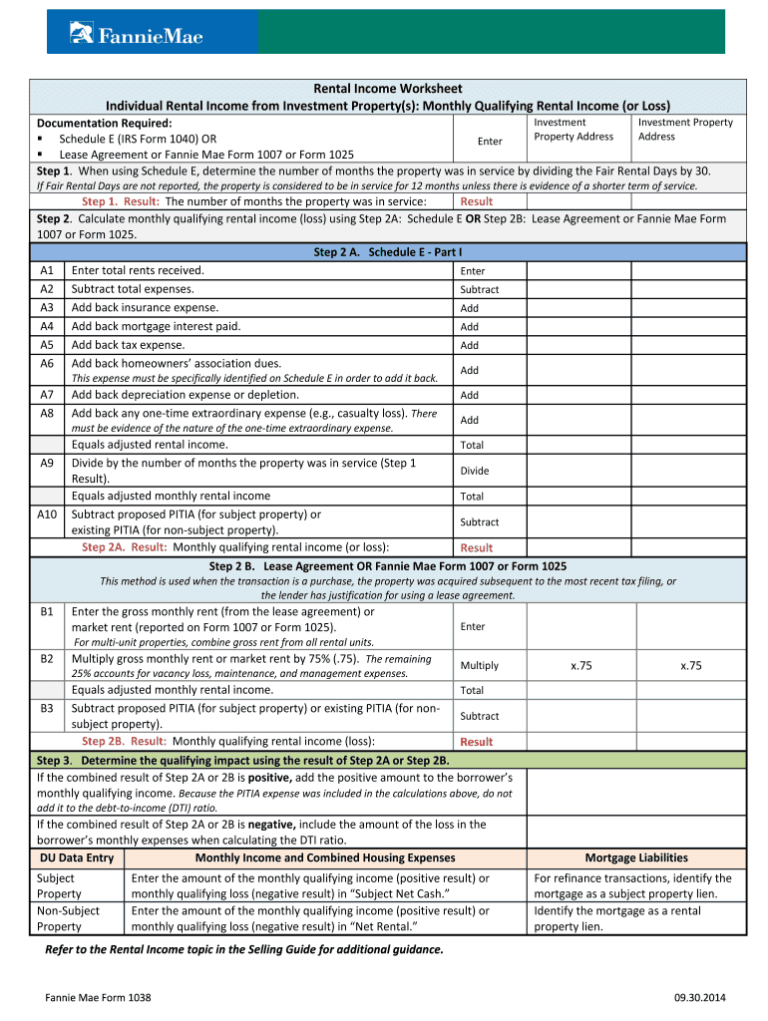

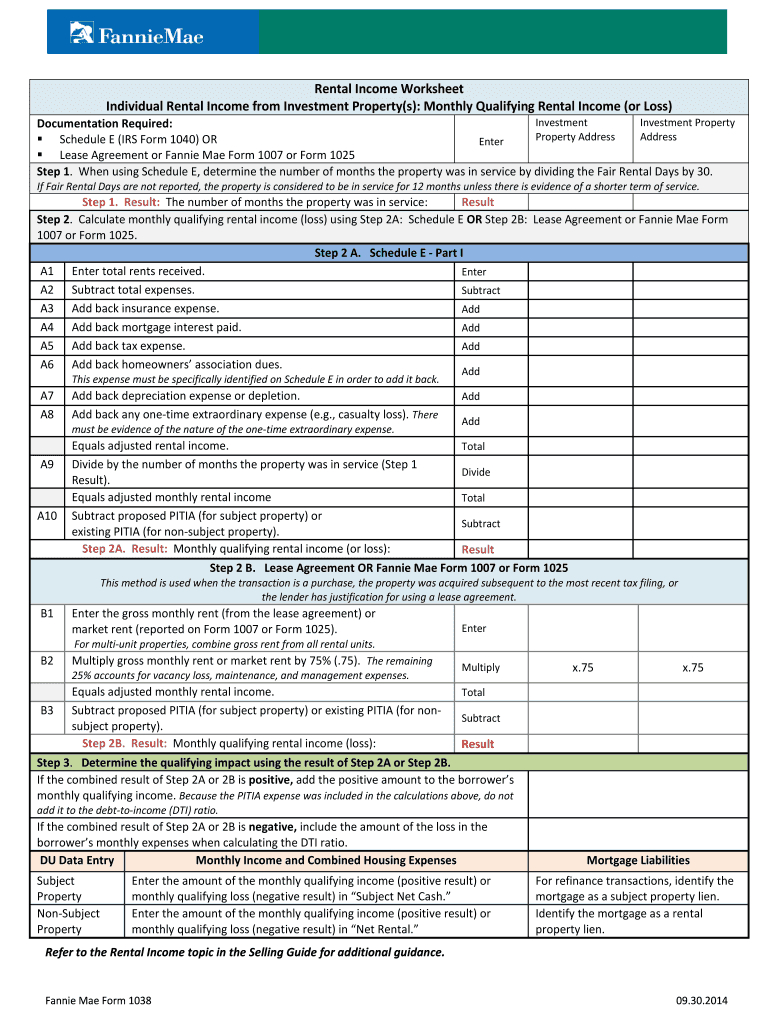

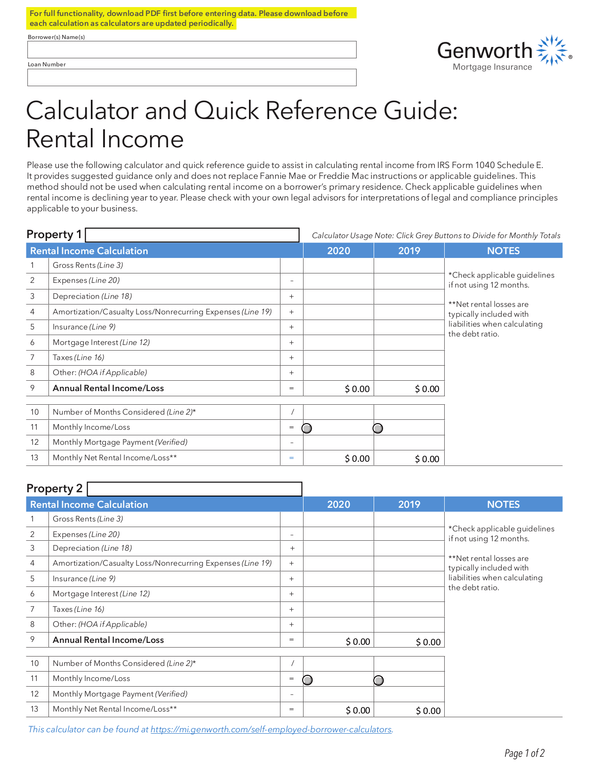

- Rental and Other Miscellaneous Income – rental properties, trust income, or other consistent income sources.

Documentation Requirements

- Recent pay stubs, W-2s, tax returns, and other proof of income documents are needed for verification.

Calculations

- The worksheet has formulas or sections to average and annualize income, calculate depreciation, and apply adjustments to arrive at the qualifying income figure.

📝 Note: Different lenders may have variations in how they apply these calculations, so be sure to refer to the specific guidelines provided by Genworth.

How to Use the Genworth Income Calculation Worksheet

Using the worksheet effectively involves the following steps:

1. Collect Necessary Documents

Gather all relevant income documentation as listed in the worksheet instructions. These documents serve as the foundation for the income calculations.

2. Fill in Borrower Information

Enter each borrower’s information accurately to avoid discrepancies during the underwriting process.

3. Assess Income Types

Identify and document all sources of income, noting any changes or anomalies in the income stream. Here’s an example:

| Income Type | How to Calculate |

|---|---|

| Salaried | Base Salary + Average Bonus/Commission (over the past 2 years) |

| Self-Employed | Business Income - Expenses = Net Income, then apply Genworth guidelines for adjustments |

| Part-Time | Two-Year Average of After-Tax Part-Time Income |

| Investment/Retirement | Annualized Value of Investment Income |

4. Apply Adjustments

Adjust for one-time events, non-recurring income, or known future decreases in income to create a more realistic picture of qualifying income.

5. Verification and Calculations

Use the provided formulas to calculate the qualifying income, ensuring all income is verified and appropriately adjusted.

6. Review and Accuracy Check

Double-check all entered data, calculations, and verify the results align with Genworth’s guidelines. Mistakes here can lead to loan denials or underwriting issues.

🛠️ Note: Do not rely solely on the worksheet output; always cross-reference with tax documents and actual income statements.

Challenges and Tips

Income calculation can be fraught with challenges, especially for:

- Borrowers with fluctuating income.

- Self-employed individuals where business expenses can significantly impact net income.

- Those with multiple or complex income streams.

Here are some tips:

- Keep meticulous records and ensure documentation matches the income figures entered.

- Explain any unusual income fluctuations in a cover letter or narrative form.

- Engage with a knowledgeable loan officer who can guide you through nuances of the Genworth worksheet.

- Understand that some adjustments can be made for seasonal workers or those with commission-based earnings, but these adjustments must be reasonable.

Wrapping Up the Calculation

In the final stages of your loan application process, the Genworth Income Calculation Worksheet ensures that your income meets the necessary criteria for loan approval. By following this guide, you can effectively present your financial profile to lenders, increasing the chances of a favorable outcome.

Remember, while the worksheet streamlines the process, understanding the underlying principles and regulations is key to using it correctly. Here, we've explored how to complete the worksheet, the different income types it accounts for, and some common challenges borrowers might encounter. The ultimate goal is to provide lenders with a clear and accurate snapshot of your income, facilitating a smoother mortgage underwriting experience.

Can I use the Genworth Income Calculation Worksheet if I have multiple jobs?

+Yes, you can. The worksheet has sections for different income types, including part-time jobs. Make sure to document each job with the appropriate verification documents, like pay stubs or 1099s, and calculate the average income from each source over the past two years.

What should I do if my income has recently decreased?

+Any recent decreases in income should be noted on the worksheet. You may need to provide an explanation for the decrease, provide evidence of the new income level, and the lender may apply adjustments to account for the change in your financial situation.

How does the worksheet handle self-employment income?

+The worksheet analyzes business income by subtracting expenses to arrive at net income. Adjustments may be applied for depreciation, non-recurring items, and other allowable business deductions per Genworth’s guidelines.