5 GA Paycheck Tips

Introduction to GA Paycheck Tips

When it comes to managing finances, having a steady paycheck is just the beginning. For those receiving a GA paycheck, it’s essential to understand how to make the most of it. In this article, we will delve into the world of GA paychecks, exploring what they are, their benefits, and most importantly, providing 5 valuable tips on how to manage them effectively. Whether you’re a newcomer to the GA paycheck system or a seasoned recipient, these tips are designed to help you navigate the complexities of financial management with ease.

Understanding GA Paychecks

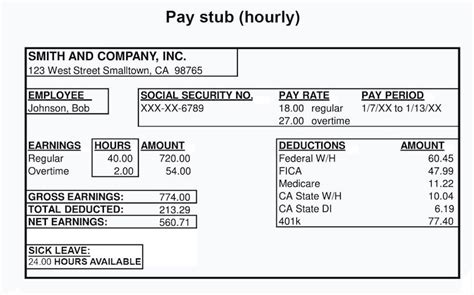

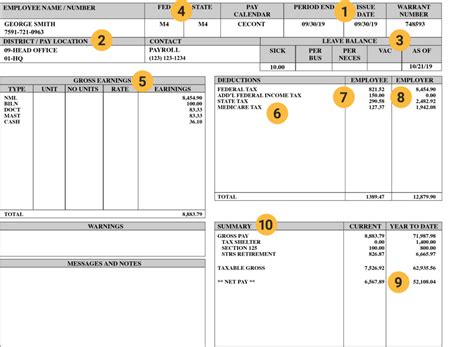

Before we dive into the tips, let’s first understand what GA paychecks are. GA, or General Assistance, paychecks are provided to individuals who require financial assistance due to various reasons such as unemployment, disability, or other hardships. These paychecks are a form of support to help individuals meet their basic needs until they can become self-sufficient again. Understanding the purpose and the amount one receives is crucial for effective financial planning.

Benefits of GA Paychecks

GA paychecks offer several benefits, including: - Financial Stability: They provide a steady income, which can be a lifesaver during difficult times. - Opportunity for Recovery: The financial support allows individuals to focus on recovering from their current situation, whether it’s finding new employment or dealing with health issues. - Access to Essential Services: With a GA paycheck, individuals can afford basic necessities like food, housing, and healthcare.

5 GA Paycheck Tips for Effective Management

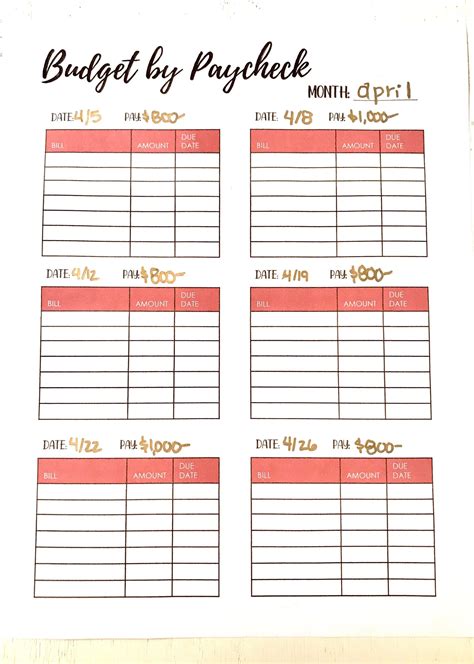

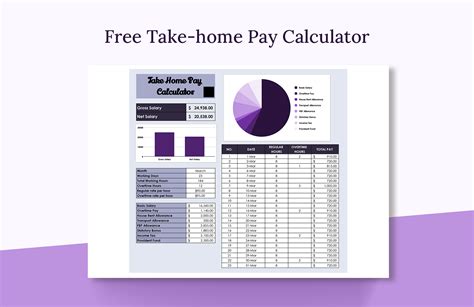

Now, let’s move on to the 5 tips that can help you manage your GA paycheck more efficiently: 1. Budgeting: The first step to managing your GA paycheck is to create a budget. List all your expenses, from rent and utilities to food and transportation. Then, allocate your paycheck accordingly, ensuring you cover all necessary expenses. 2. Prioritization: Prioritize your expenses. Essential expenses like rent/mortgage, utilities, and food should come first. Non-essential expenses, such as entertainment, should be considered last. 3. Savings: Even on a limited income, it’s crucial to save. Try to set aside a small portion of your paycheck each month. This fund can be used for emergencies, avoiding debt, and working towards long-term financial goals. 4. Debt Management: If you have debts, such as credit card balances or loans, managing them effectively is key. Consider debt consolidation or reaching out to a financial advisor for personalized advice. 5. Financial Education: Lastly, educate yourself on personal finance. Understanding concepts like compound interest, credit scores, and investment can empower you to make informed financial decisions, potentially leading to a more stable financial future.

Implementing the Tips

Implementing these tips requires discipline and patience but can significantly improve your financial situation. Start by applying one tip at a time, gradually incorporating all into your financial routine. Remember, the goal is not just to manage your GA paycheck but to work towards a point where you may not need it, achieving financial independence.

📝 Note: Always review and understand the terms and conditions of your GA paycheck, including any requirements for recipients and potential impacts on other benefits you might be receiving.

As we reflect on the journey of managing GA paychecks, it’s clear that with the right strategies, individuals can not only survive but thrive. By applying these tips and maintaining a proactive approach to financial management, the path to stability and independence becomes clearer. The key is persistence, patience, and a willingness to learn and adapt to new financial situations. In the end, effective management of a GA paycheck is not just about making ends meet; it’s about building a foundation for a brighter, more secure financial future.

What is a GA paycheck?

+

A GA paycheck refers to the financial assistance provided by the government to individuals in need, helping them meet basic living expenses until they can regain stability.

How do I manage my GA paycheck effectively?

+

Effective management involves creating a budget, prioritizing expenses, saving, managing debt, and educating yourself on personal finance. Applying these strategies can help you make the most of your GA paycheck.

Can I save money while receiving a GA paycheck?

+

Yes, saving is possible and recommended, even on a limited income. Try to allocate a small portion of your paycheck each month towards savings, which can be used for emergencies or long-term goals.