Military

2025 FSA Contribution Limits

Understanding the 2025 FSA Contribution Limits

The Flexible Spending Account (FSA) is a valuable benefit that allows employees to set aside pre-tax dollars for healthcare and dependent care expenses. As we approach the new year, it’s essential to understand the 2025 FSA contribution limits and how they may impact your benefits. In this article, we’ll delve into the details of the 2025 FSA contribution limits, explore the benefits of FSAs, and provide tips on how to maximize your contributions.

What are FSAs, and How Do They Work?

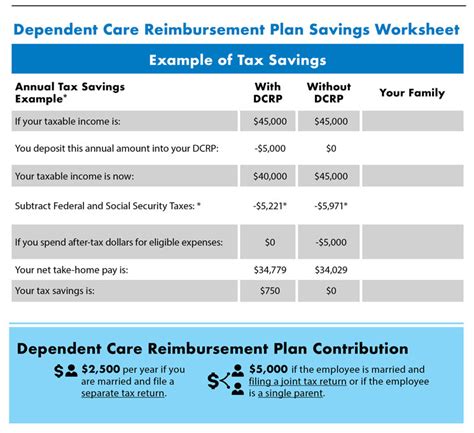

FSAs are employer-sponsored benefit plans that allow employees to contribute pre-tax dollars to a dedicated account. The funds in this account can be used to pay for eligible healthcare and dependent care expenses, such as medical bills, prescriptions, childcare costs, and elder care expenses. The primary advantage of FSAs is that they reduce your taxable income, resulting in lower federal income taxes and potentially lower state and local taxes.

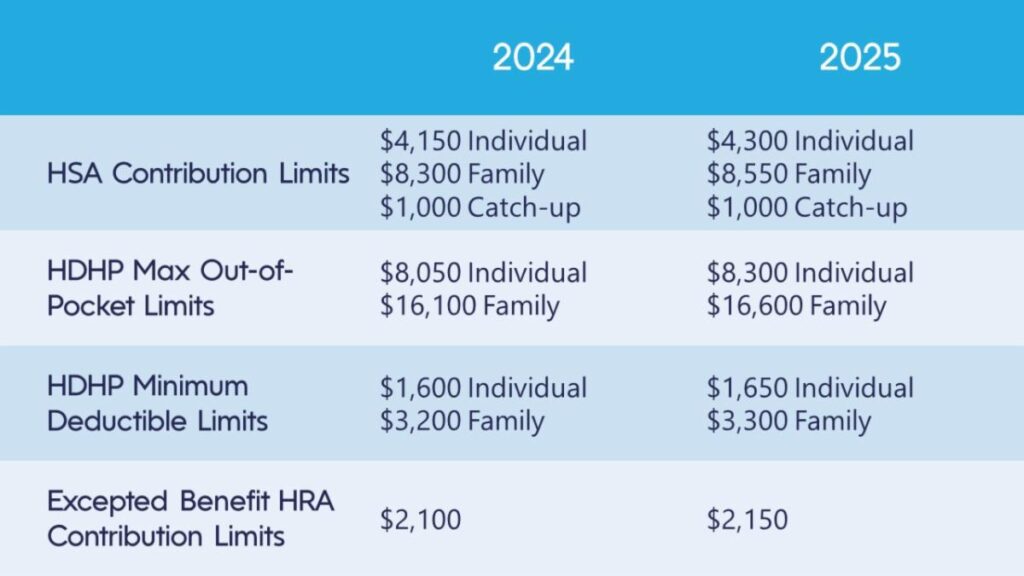

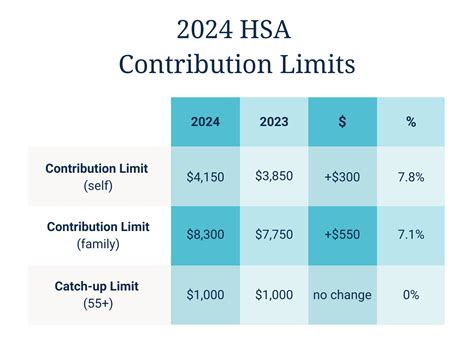

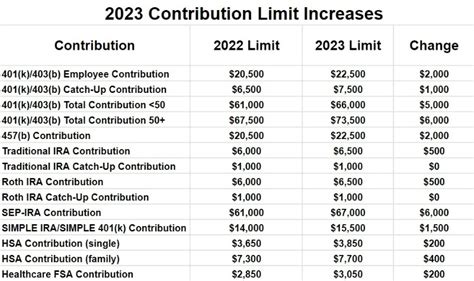

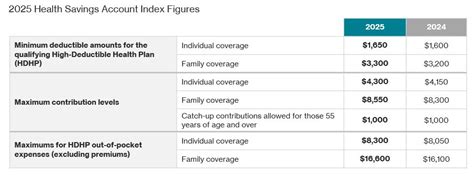

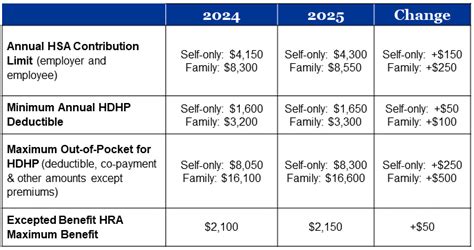

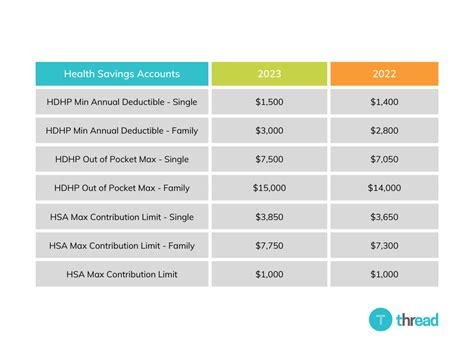

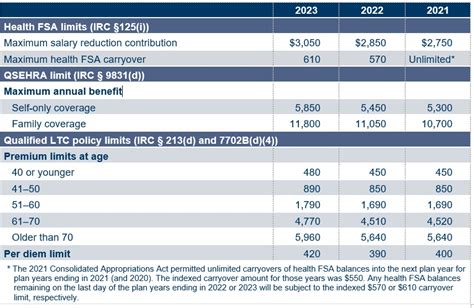

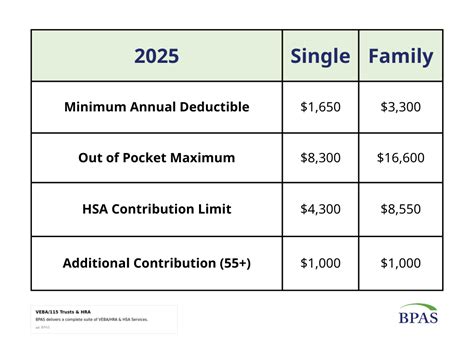

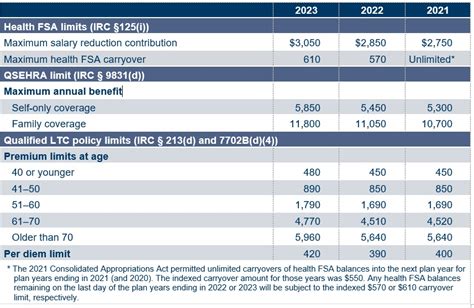

2025 FSA Contribution Limits

The Internal Revenue Service (IRS) sets the annual contribution limits for FSAs. For 2025, the FSA contribution limits are as follows: - Healthcare FSA: The maximum annual contribution limit is 3,200. - Dependent Care FSA: The maximum annual contribution limit is 5,000 for single filers and 10,000 for joint filers. - Limited Expense Health Flexible Spending Arrangement (LEX HCFSA): The maximum annual contribution limit is 3,200. It’s essential to note that these limits may be subject to change, and your employer may have additional rules or restrictions on FSA contributions.

Benefits of FSAs

FSAs offer several benefits to employees, including: * Tax savings: Contributions to an FSA are made with pre-tax dollars, reducing your taxable income and lowering your federal income taxes. * Increased take-home pay: By reducing your taxable income, you may be able to increase your take-home pay. * Convenience: FSAs provide a convenient way to pay for eligible expenses, as the funds are typically accessed using a debit card or reimbursement process. * Flexibility: FSAs can be used to pay for a wide range of eligible expenses, from medical bills to childcare costs.

Types of FSAs

There are several types of FSAs, each with its own unique characteristics and benefits: * Healthcare FSA: Used to pay for eligible medical expenses, such as doctor visits, prescriptions, and medical equipment. * Dependent Care FSA: Used to pay for eligible dependent care expenses, such as childcare costs, elder care expenses, and summer camp fees. * Limited Expense Health Flexible Spending Arrangement (LEX HCFSA): A type of healthcare FSA that is limited to dental and vision expenses.

How to Maximize Your FSA Contributions

To get the most out of your FSA, follow these tips: * Contribute the maximum amount: Take advantage of the annual contribution limits to maximize your tax savings. * Plan your expenses: Estimate your eligible expenses for the year and contribute accordingly. * Use the FSA calculator: Many employers offer FSA calculators to help you determine the optimal contribution amount. * Keep receipts: Keep track of your receipts and documentation to ensure you can reimburse yourself for eligible expenses.

Eligible Expenses

FSAs can be used to pay for a wide range of eligible expenses, including: * Medical expenses: Doctor visits, prescriptions, medical equipment, and hospital stays. * Dental and vision expenses: Dental cleanings, eyeglasses, contact lenses, and vision exams. * Dependent care expenses: Childcare costs, elder care expenses, summer camp fees, and before- and after-school programs. * Over-the-counter (OTC) medications: OTC medications and supplies, such as band-aids, antacids, and pain relievers.

FSA Administration

FSAs are typically administered by a third-party administrator (TPA) or the employer’s human resources department. The administrator is responsible for: * Managing contributions: Handling employee contributions and ensuring compliance with IRS regulations. * Processing reimbursements: Reviewing and processing reimbursement requests for eligible expenses. * Providing customer support: Assisting employees with FSA-related questions and issues.

💡 Note: It's essential to review your employer's FSA plan documents and summary plan description to understand the specific rules and regulations governing your FSA.

Conclusion and Final Thoughts

In conclusion, understanding the 2025 FSA contribution limits and how to maximize your contributions can help you make the most of this valuable employee benefit. By taking advantage of the tax savings and convenience offered by FSAs, you can reduce your taxable income, increase your take-home pay, and better manage your healthcare and dependent care expenses. Remember to review your employer’s FSA plan documents, plan your expenses carefully, and keep track of your receipts to ensure you can reimburse yourself for eligible expenses.

What is the maximum annual contribution limit for a healthcare FSA in 2025?

+

The maximum annual contribution limit for a healthcare FSA in 2025 is $3,200.

Can I use my FSA to pay for over-the-counter (OTC) medications?

+

Yes, you can use your FSA to pay for OTC medications and supplies, such as band-aids, antacids, and pain relievers.

How do I reimburse myself for eligible expenses using my FSA?

+

You can reimburse yourself for eligible expenses using your FSA by submitting a claim form and providing documentation, such as receipts, to your FSA administrator.