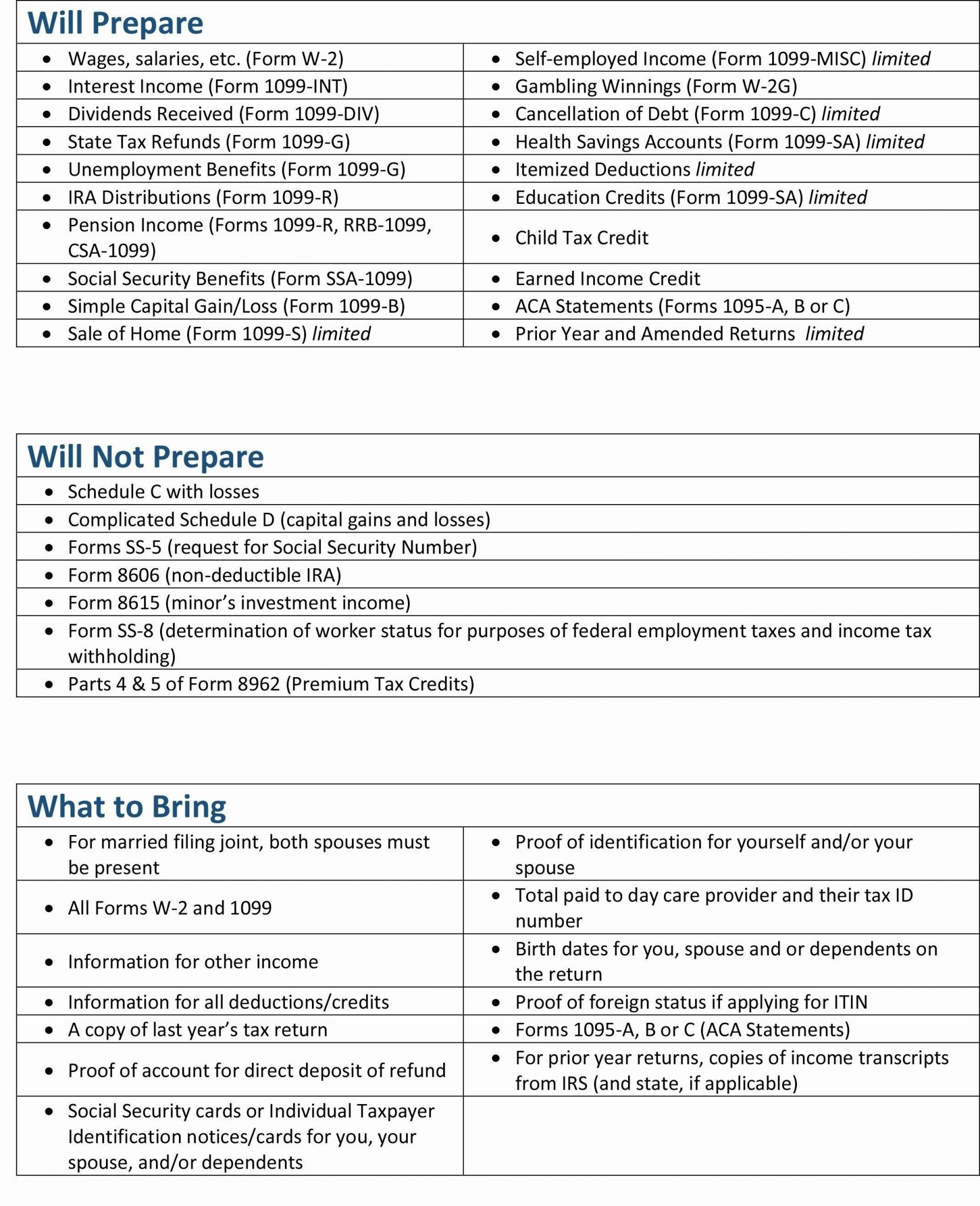

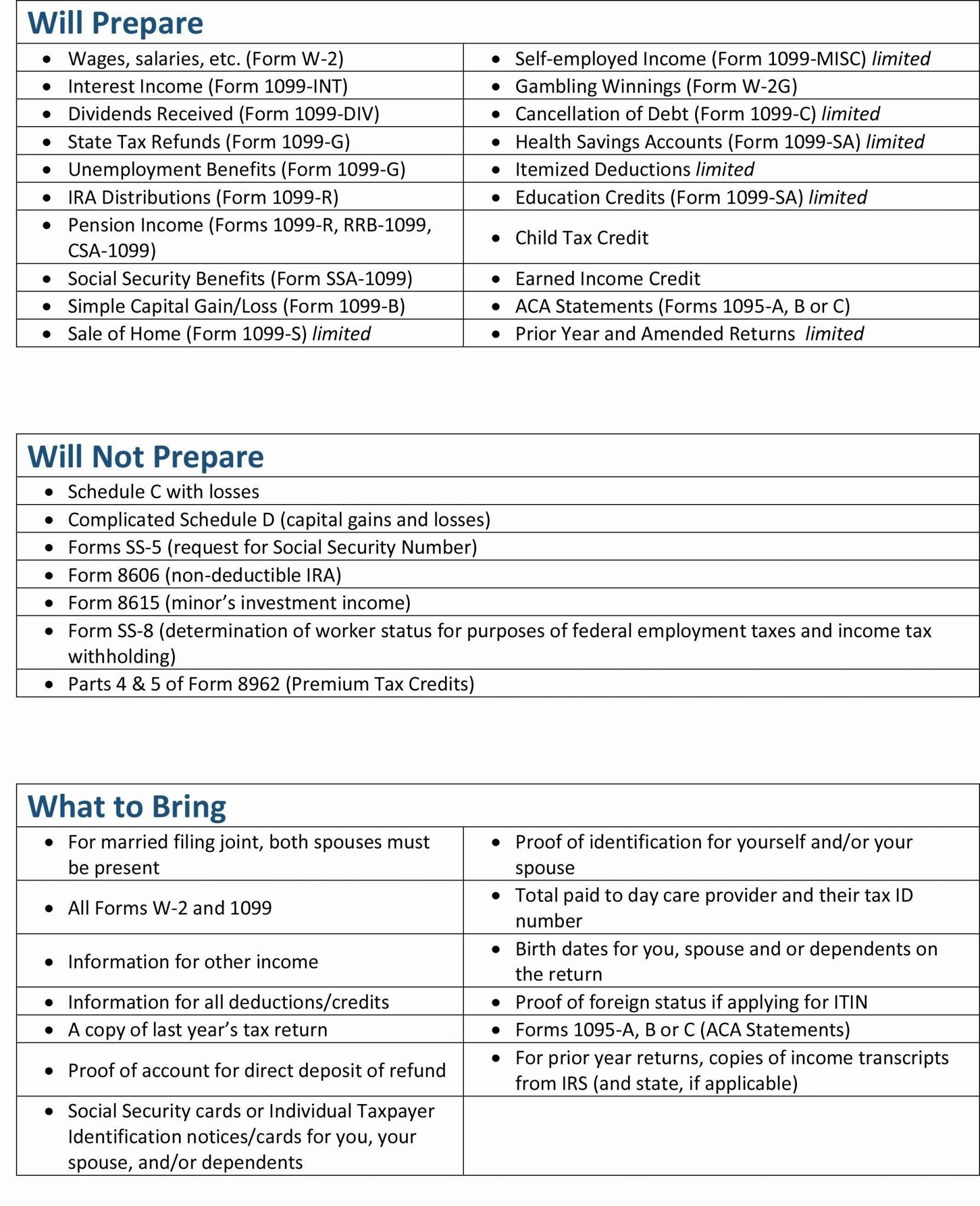

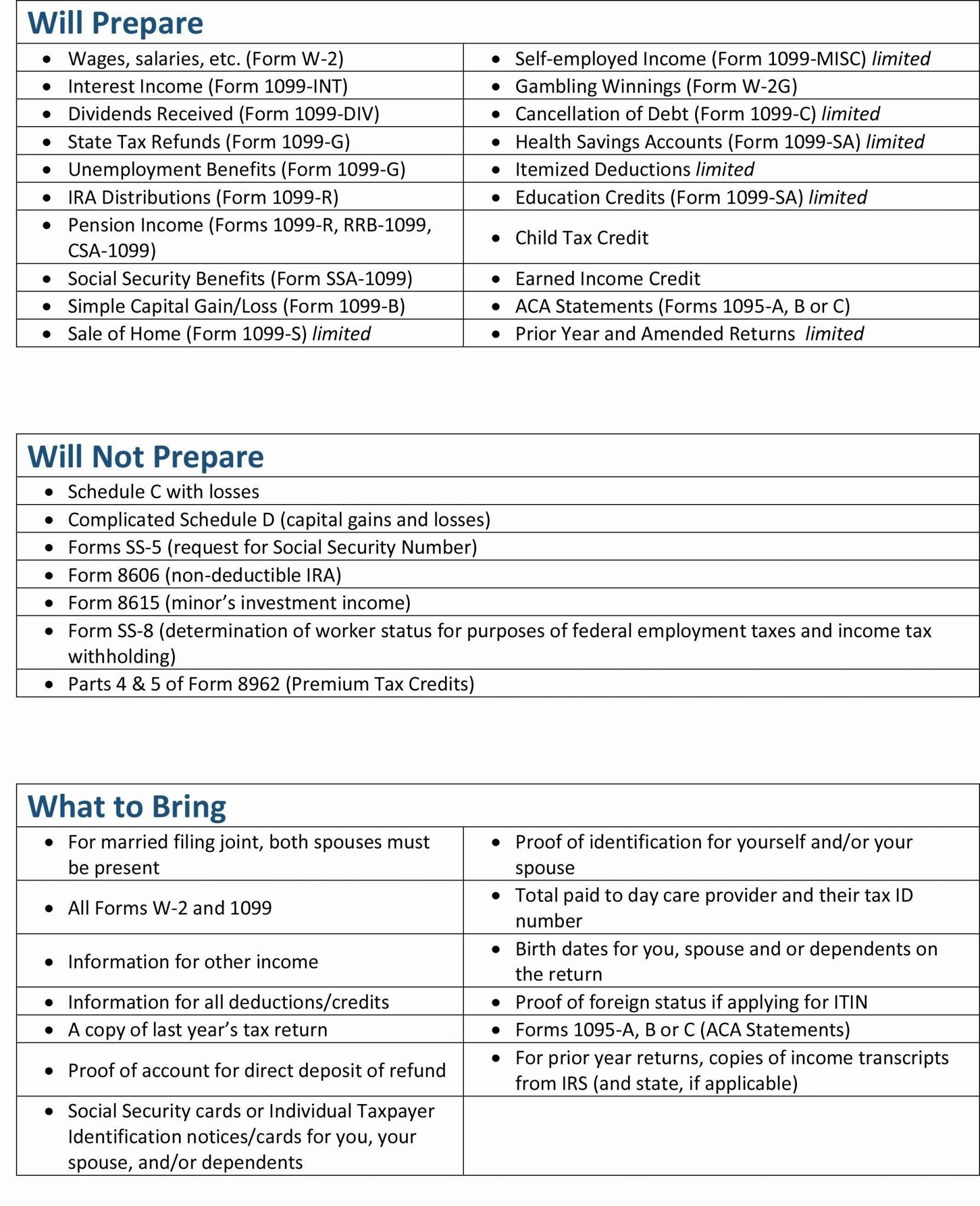

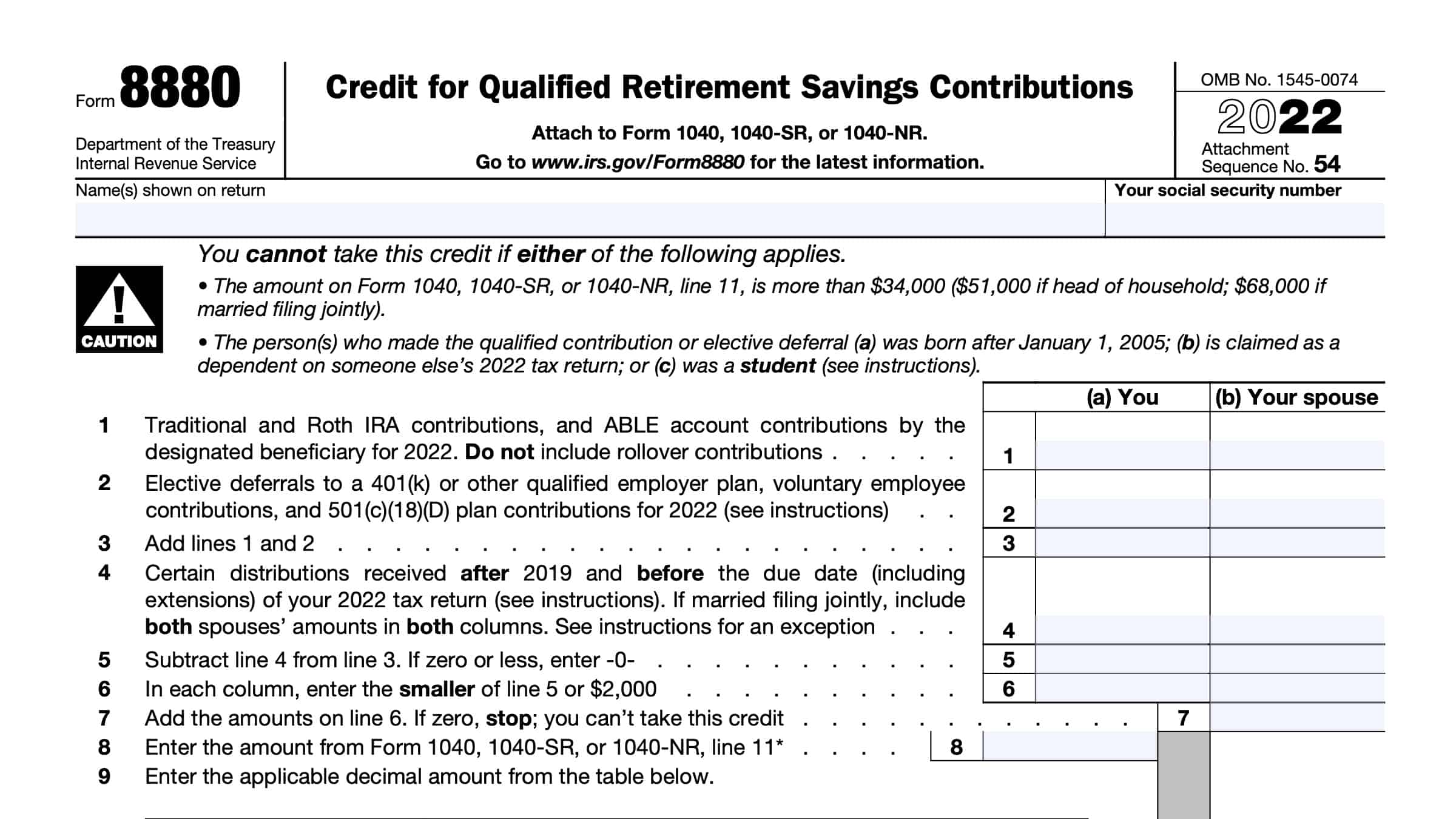

Maximize Your Credit with Form 8880 Limit Worksheet

When it comes time to file your federal taxes, if you're interested in claiming the Saver's Credit, also known as the Retirement Savings Contributions Credit, Form 8880 plays a critical role. This form can help maximize your credit by allowing you to calculate how much you might qualify for based on your contributions to retirement accounts. Here's how you can make the most of Form 8880 using the Limit Worksheet.

Understanding the Saver’s Credit

The Saver’s Credit is designed to encourage low- to middle-income workers to save for retirement by giving them a tax credit for their contributions. Unlike tax deductions, credits reduce the amount of tax you owe dollar for dollar.

Eligibility Criteria

- You must be 18 or older

- You must not be a full-time student

- You cannot be claimed as a dependent on someone else’s tax return

- You must contribute to a qualified retirement plan like an IRA, 401(k), or similar retirement accounts

How to Use Form 8880

Here’s a step-by-step guide to filling out Form 8880:

1. Determine Your Contribution

First, you need to know how much you’ve contributed to your retirement accounts in the tax year. This includes both employee contributions and any employer matches.

2. Check Your Adjusted Gross Income (AGI)

The credit amount is determined based on your AGI. The credit percentage decreases as your income increases:

| AGI Status | Married Filing Jointly | Head of Household | Other Filers |

|---|---|---|---|

| 50% of Credit | 41,500 or less</td> <td>31,125 or less | 20,750 or less</td> </tr> <tr> <td>20% of Credit</td> <td>41,501 - 44,000</td> <td>31,126 - 33,000</td> <td>20,751 - 22,000</td> </tr> <tr> <td>10% of Credit</td> <td>44,001 - 68,000</td> <td>33,001 - 51,000</td> <td>22,001 - $34,000 |

3. Use the Limit Worksheet

The Limit Worksheet is found on the back of Form 8880, and it helps you determine the maximum amount of your contributions you can use to calculate your credit:

- Line 1: Enter your total contributions to all retirement plans.

- Line 2: Look up your AGI and enter the applicable limit based on your filing status.

- Line 3: Enter the smaller of line 1 or line 2.

- Line 4: Enter the total amount of distributions received from retirement plans (IRAs, 401(k)s, etc.).

- Line 5: Subtract line 4 from line 3.

📝 Note: If the amount on Line 5 is negative, you are not eligible for the Saver's Credit for that tax year.

4. Calculate Your Credit

Now, you can determine your credit amount by multiplying the figure from line 5 by the applicable credit rate from the table above.

Important Points to Consider

- The maximum credit amount is 1,000 for single filers and 2,000 for those married filing jointly.

- The credit is nonrefundable; it can reduce your tax liability to zero but will not result in a refund if your credit is greater than your tax liability.

- Contributions for retirement plans made by April 15th of the following year can be considered for the credit if you file your tax return by then.

Strategies to Maximize Your Credit

To make the most out of your Saver’s Credit:

- Contribute the maximum amount allowed by the law to your retirement accounts, considering the tax benefits like deductions and credits.

- Understand the phase-out limits for your income to plan your contributions effectively.

- If you receive a distribution from a retirement plan, reinvest it quickly to reduce the negative impact on your credit calculation.

- If you’re married, file jointly if possible, as this doubles the maximum credit potential.

By understanding and correctly utilizing Form 8880 and the associated Limit Worksheet, you can significantly enhance your tax savings through the Saver's Credit. Remember, each dollar of credit reduces the tax you owe, making it a powerful tool in your tax planning arsenal.

Can I claim the Saver’s Credit if I contribute to my employer’s retirement plan?

+

Yes, you can claim the Saver’s Credit if you contribute to a qualified employer-sponsored retirement plan, such as a 401(k) or 403(b).

What happens if I contributed to a retirement plan but then took money out of it?

+

Any distributions from retirement plans in the same tax year can reduce or negate your Saver’s Credit. You can, however, roll over or reinvest your distributions to avoid this situation.

Do I have to claim the Saver’s Credit if I’m eligible?

+

No, claiming the Saver’s Credit is optional. You can choose to contribute to a retirement plan without claiming the credit.