5 Tips Form 1020 Food Stamps

Introduction to Form 1020 and Food Stamps

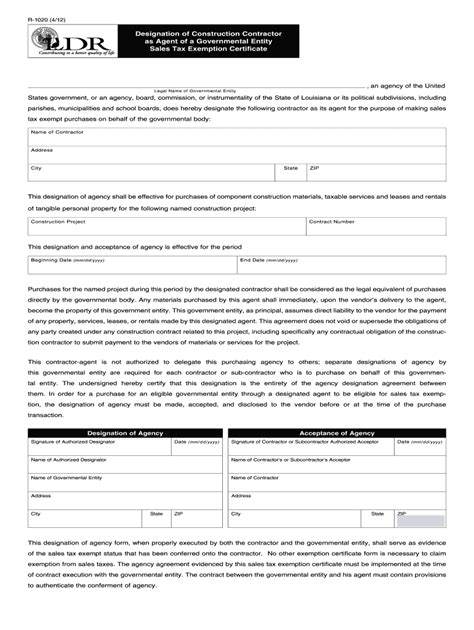

Form 1020 is not directly related to food stamps, but rather it’s an IRS form used for estates and trusts. However, for individuals receiving food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), understanding the tax implications and the forms involved can be crucial. The actual form related to food stamps and tax returns is more aligned with the application process for SNAP benefits, which doesn’t directly involve Form 1020. To clarify, we’ll focus on general tips that could be beneficial for individuals applying for or receiving food stamps, emphasizing the importance of accurate information and compliance with tax laws.

Understanding Eligibility for Food Stamps

To be eligible for food stamps, applicants must meet specific income and resource requirements. These requirements can vary by state, so it’s essential to check the local guidelines. Generally, the eligibility is based on: - Income: Both gross and net income are considered. The income limits are typically based on the federal poverty guidelines. - Resources: This includes cash, savings, and other assets. Some resources, like a primary home, are usually exempt. - Household Size: The number of people living together and purchasing food as a unit affects the eligibility and benefit amount.

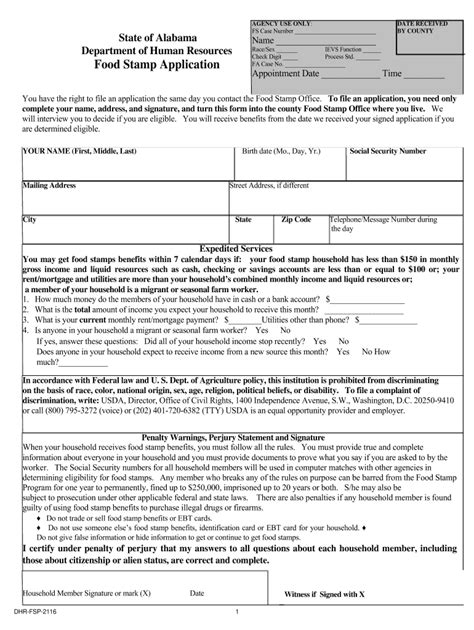

Applying for Food Stamps

The application process for food stamps involves several steps: - Gathering Required Documents: This includes identification, proof of income, and proof of residency. - Filling Out the Application: This can usually be done online, by mail, or in person at a local social services office. - Interview: Many states require an interview, which can be conducted over the phone or in person, to review the application and ask additional questions. - Determination of Eligibility: After submitting the application and completing the interview, the caseworker will determine eligibility and the benefit amount.

Tax Implications for Food Stamp Recipients

Food stamps themselves are not taxable. However, the income used to determine eligibility for food stamps is subject to taxation. It’s crucial for recipients to understand their tax obligations and how receiving food stamps might affect their tax situation. For instance: - Reporting Income: All income, including earnings from jobs and other sources, must be reported accurately on tax returns. - Claiming Deductions and Credits: Recipients may be eligible for certain tax deductions and credits, such as the Earned Income Tax Credit (EITC), which can reduce their tax liability.

5 Tips for Managing Finances While Receiving Food Stamps

Here are five tips that can help individuals manage their finances effectively while receiving food stamps: - Create a Budget: Tracking income and expenses is crucial. Make a budget that accounts for all necessary expenditures, including rent/mortgage, utilities, and food. - Utilize Local Resources: Many communities offer financial counseling and assistance programs that can provide valuable advice and support. - Save When Possible: Even small amounts saved regularly can add up over time. Consider opening a savings account specifically for emergencies. - Look for Job Training Opportunities: Improving job skills can lead to better employment opportunities and higher income, which may eventually phase out the need for food stamps. - Stay Informed About Eligibility: Laws and regulations regarding food stamps can change. Stay updated on any changes that might affect eligibility or benefit amounts.

📝 Note: It's essential to consult with a financial advisor or tax professional for personalized advice on managing finances and understanding tax implications while receiving food stamps.

In summary, managing finances while receiving food stamps requires careful planning, adherence to eligibility requirements, and an understanding of the tax implications involved. By following these tips and staying informed, individuals can make the most of the assistance provided by food stamps and work towards financial stability.

What is the primary purpose of the Supplemental Nutrition Assistance Program (SNAP)?

+

The primary purpose of SNAP, also known as food stamps, is to provide nutritional assistance to eligible low-income individuals and families.

How do I apply for food stamps?

+

You can apply for food stamps by submitting an application through your local social services office, online, or by mail, depending on the options available in your state.

Are food stamps considered taxable income?

+

No, food stamps themselves are not considered taxable income. However, the income used to determine eligibility for food stamps is subject to taxation.