5 Tips Fraud

Introduction to Fraud Prevention

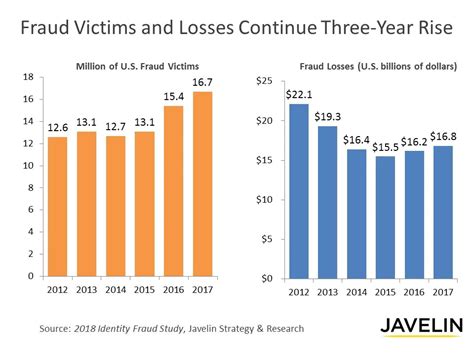

Fraud is a serious issue that affects individuals, businesses, and organizations worldwide. It can take many forms, including identity theft, phishing scams, and financial fraud. To protect yourself and your assets, it’s essential to be aware of the common types of fraud and take steps to prevent them. In this article, we’ll discuss five tips to help you avoid falling victim to fraud.

Tip 1: Be Cautious with Personal Information

Your personal information is valuable, and identity thieves will stop at nothing to get their hands on it. To protect yourself, be cautious when sharing personal information, such as your social security number, address, and financial information. Only share this information with trusted individuals and organizations, and make sure you’re using secure websites and platforms. Here are some additional tips to keep in mind: * Use strong, unique passwords for all accounts * Enable two-factor authentication whenever possible * Monitor your credit report regularly for suspicious activity

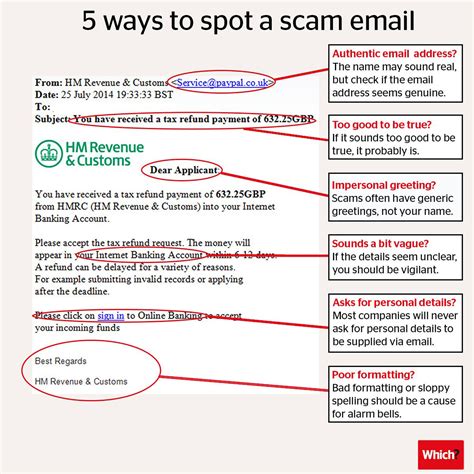

Tip 2: Verify the Authenticity of Requests

Phishing scams often involve fake emails, phone calls, or messages that appear to be from legitimate sources. To avoid falling victim to these scams, verify the authenticity of requests before responding or taking action. Here are some red flags to watch out for: * Unsolicited requests for personal or financial information * Spelling and grammar mistakes in emails or messages * Urgent or threatening language * Requests to click on suspicious links or download attachments

Tip 3: Use Secure Payment Methods

When making online purchases or paying bills, use secure payment methods to protect your financial information. Here are some tips to keep in mind: * Use credit cards or payment services like PayPal, which offer built-in protection and dispute resolution * Avoid using debit cards or wire transfers, which can be riskier * Make sure the website or platform you’re using is secure and trustworthy

Tip 4: Monitor Your Accounts Regularly

Regularly monitoring your accounts can help you detect suspicious activity and prevent fraud. Here are some tips to keep in mind: * Check your bank statements and credit card statements regularly for unfamiliar transactions * Set up account alerts to notify you of suspicious activity * Use account monitoring services to track your credit report and detect potential fraud

Tip 5: Educate Yourself and Others

Finally, educating yourself and others about fraud prevention is crucial to staying safe. Here are some tips to keep in mind: * Stay up-to-date with the latest fraud trends and scams * Share your knowledge with friends and family to help them stay safe * Use online resources and workshops to learn more about fraud prevention

🚨 Note: Fraud can happen to anyone, so it's essential to be vigilant and take steps to protect yourself and your assets.

In summary, protecting yourself from fraud requires a combination of caution, vigilance, and education. By following these five tips, you can significantly reduce your risk of falling victim to fraud and keep your personal and financial information safe.

What is the most common type of fraud?

+

Identity theft is one of the most common types of fraud, where an individual’s personal information is stolen and used for malicious purposes.

How can I protect myself from phishing scams?

+

To protect yourself from phishing scams, be cautious when clicking on links or downloading attachments from unknown sources, and verify the authenticity of requests before responding or taking action.

What should I do if I suspect I’ve been a victim of fraud?

+

If you suspect you’ve been a victim of fraud, contact your bank or financial institution immediately, and report the incident to the relevant authorities, such as the Federal Trade Commission (FTC) or your local police department.