Florida Paycheck Calculator Tool

Introduction to Paycheck Calculators

Paycheck calculators are essential tools for both employers and employees to determine the accurate amount of salary after deductions. These calculators consider various factors such as gross income, tax rates, and other deductions to provide a precise calculation of the net salary. In the state of Florida, paycheck calculators are particularly useful due to the state’s unique tax laws and regulations.

Understanding Florida’s Tax Laws

Florida is known for being one of the few states with no state income tax. This means that individuals living in Florida do not have to pay state taxes on their income, which can significantly impact the amount of money they take home. However, federal income taxes still apply, and other deductions such as social security taxes and Medicare taxes are also considered.

Using a Florida Paycheck Calculator Tool

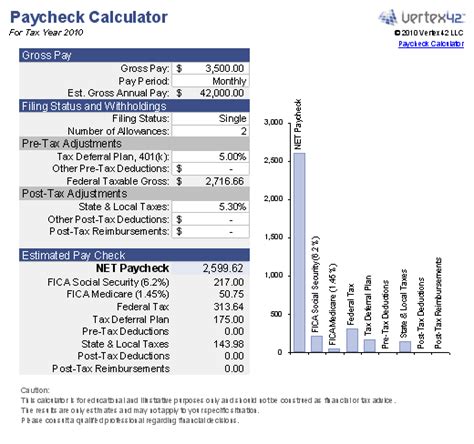

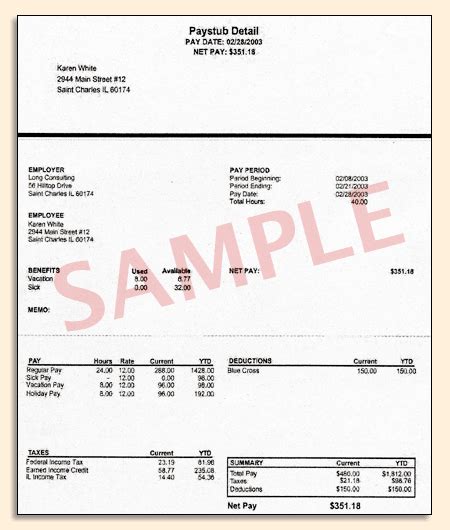

A Florida paycheck calculator tool is designed to simplify the process of calculating take-home pay. These tools typically require users to input their gross income, filing status, and the number of allowances they claim. The calculator then uses this information to estimate the federal income taxes withheld and other deductions, providing an accurate calculation of the net salary.

📝 Note: When using a paycheck calculator, it's essential to ensure that the tool is updated with the latest tax rates and regulations to get an accurate calculation.

Benefits of Using a Paycheck Calculator

There are several benefits of using a paycheck calculator, including: * Accurate Calculations: Paycheck calculators provide accurate calculations of take-home pay, helping individuals plan their finances effectively. * Time-Saving: These tools save time and effort by automating the calculation process, reducing the risk of human error. * Increased Transparency: Paycheck calculators provide a clear breakdown of deductions and taxes, helping individuals understand where their money is going.

Key Factors to Consider When Using a Paycheck Calculator

When using a paycheck calculator, there are several key factors to consider: * Gross Income: The total amount of money earned before deductions. * Filing Status: The individual’s marital status, which affects tax rates and deductions. * Number of Allowances: The number of exemptions claimed, which impacts the amount of taxes withheld. * Tax Rates: The rates at which federal, state, and local taxes are applied.

Common Deductions and Taxes

Some common deductions and taxes that are considered when using a paycheck calculator include: * Federal income taxes * Social security taxes * Medicare taxes * Health insurance premiums * Retirement plan contributions

| Deduction/Tax | Rate |

|---|---|

| Federal Income Tax | 10%-37% |

| Social Security Tax | 6.2% |

| Medicare Tax | 1.45% |

Real-World Applications of Paycheck Calculators

Paycheck calculators have various real-world applications, including: * Salary Negotiations: Individuals can use paycheck calculators to determine the actual value of a job offer, considering taxes and deductions. * Financial Planning: Paycheck calculators help individuals plan their finances effectively, making informed decisions about budgeting and saving. * Tax Planning: These tools can help individuals optimize their tax strategy, minimizing their tax liability and maximizing their take-home pay.

As individuals continue to navigate the complexities of taxation and payroll, paycheck calculators will remain essential tools for accurate calculations and financial planning. By understanding how to use these tools effectively, individuals can make informed decisions about their finances, ensuring a more stable and secure financial future.

What is the main purpose of a paycheck calculator?

+

The main purpose of a paycheck calculator is to provide an accurate calculation of take-home pay, considering various factors such as gross income, tax rates, and deductions.

Does Florida have a state income tax?

+

No, Florida is one of the few states with no state income tax.

What are some common deductions and taxes considered in a paycheck calculator?

+

Some common deductions and taxes include federal income taxes, social security taxes, Medicare taxes, health insurance premiums, and retirement plan contributions.