Maximize Your Savings with Firefighter Tax Deductions Worksheet

Firefighters play a crucial role in our communities, often putting their lives on the line to protect us. Given the demanding nature of the job, it's essential that firefighters understand how to maximize their savings through tax deductions. A well-prepared firefighter tax deductions worksheet can significantly reduce your taxable income, thereby increasing your take-home pay and providing more financial stability. This detailed guide will walk you through the process of creating and utilizing your firefighter tax deductions worksheet effectively.

Understanding Firefighter Tax Deductions

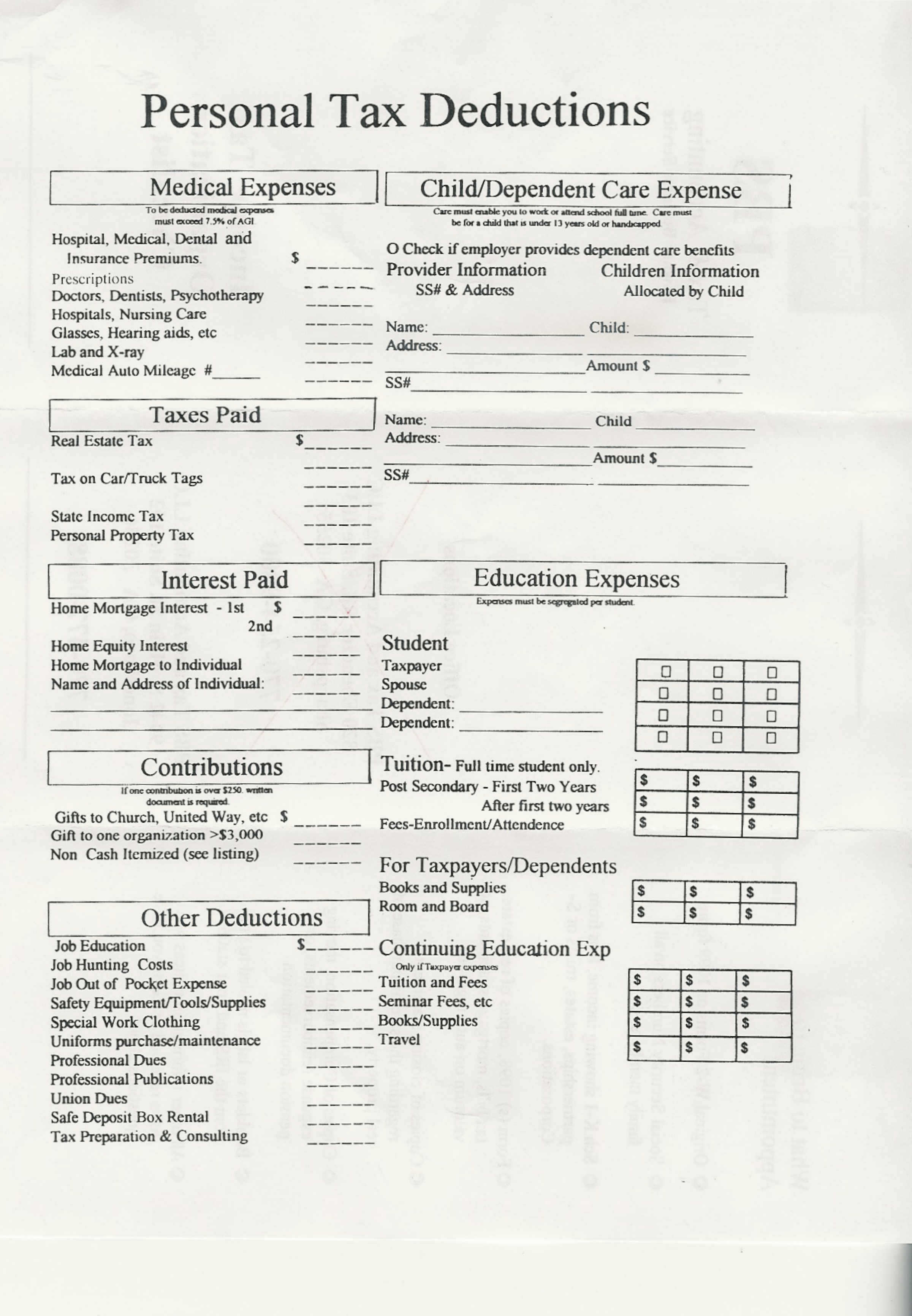

Tax deductions for firefighters can encompass a wide range of expenses. Before you can maximize your savings, you need to understand what qualifies:

- Uniforms and Protective Clothing: If your fire department requires you to provide your own uniforms or protective gear, you can deduct the cost of purchase, cleaning, repair, and replacement.

- Education and Training Costs: Expenses related to required certifications, classes, or advanced training can often be deductible.

- Professional Memberships: Costs associated with joining professional organizations related to firefighting.

- Travel Expenses: Travel for work-related activities, including conventions or seminars, can be deductible.

- Equipment: Special tools or equipment you purchase for firefighting or emergency medical services.

- Vehicle Deductions: If you use your personal vehicle for work, you might qualify for mileage deductions.

Creating Your Firefighter Tax Deductions Worksheet

Here’s how to effectively create your worksheet:

- Identify All Deductible Expenses: Begin by listing all possible expenses. This includes uniforms, equipment, travel, education, and any other costs incurred due to your job as a firefighter.

- Track Your Expenses: Use an app, a spreadsheet, or a physical notebook to log each expense as you incur it. Keeping receipts and notes will help in verifying these expenses.

- Categorize Expenses: Sort the expenses into categories like uniforms, education, travel, etc., to make filling out forms easier.

- Calculate Mileage: If you use your vehicle for work, calculate the mileage. Use the IRS’s standard mileage rate for the year.

- Include Documentation: Attach copies of receipts, invoices, or certifications that support your claims.

Completing Your Worksheet

When filling out your worksheet:

- Be as detailed as possible. Use descriptions like “firefighting boots” or “paramedic certification course.”

- Include the date of purchase or when the expense was incurred.

- Note the amount spent. This includes not only the purchase cost but also repair or cleaning costs for uniforms, for instance.

✅ Note: Ensure you retain all original documentation in case of an audit. Keeping electronic copies can also be beneficial for easy access and organization.

Optimizing Your Deductions

Here are some tips to optimize your deductions:

- Consider the Actual Expense vs. Standard Mileage Deduction: Depending on your situation, you might benefit more from actual vehicle expenses rather than the standard mileage rate. Analyze which method provides a larger deduction.

- Medical Expenses: If your employer does not provide health insurance or if you opt for private insurance, you might be able to deduct health-related costs.

- Educational Expenses: Not only direct course fees but also books, supplies, and travel costs for educational purposes can be deductible.

- Donations: Firefighters often engage in community service; donations made in this capacity might be deductible.

Example Tax Deductions Worksheet

| Category | Description | Date | Amount |

|---|---|---|---|

| Uniforms | Firefighting boots, pants, jackets | Jan 15, 2023 | 300</td> </tr> <tr> <td>Education</td> <td>EMT certification</td> <td>Mar 20, 2023</td> <td>750 |

| Vehicle Expenses | Mileage for work-related travel | Yearly total | 500</td> </tr> <tr> <td>Professional Memberships</td> <td>Annual IAFF membership fee</td> <td>Apr 10, 2023</td> <td>50 |

📌 Note: Ensure your deductions are in compliance with IRS regulations to avoid penalties or an audit.

By meticulously preparing your firefighter tax deductions worksheet, you can optimize your financial situation. Not only do you benefit from lower taxable income, but you also gain peace of mind knowing you've taken advantage of all available tax deductions. Remember, the key to maximizing these benefits is in the details - track, categorize, and document your expenses throughout the year.

After this thorough exercise in claiming your deserved deductions, you will find that not only do you reduce your tax liability, but you also understand better the value of your service. As a firefighter, you're already serving your community, and by managing your finances smartly, you're also taking care of your own future.

Can I deduct expenses even if my department provides equipment?

+

You can typically only deduct expenses you incur personally. If your department provides equipment and uniforms, you might not be able to claim those costs. However, if you purchase items not covered by your department or need to maintain, repair, or upgrade those items, you can potentially deduct those expenses.

What if I forget to keep receipts for my expenses?

+

Losing receipts can be problematic. While some deductions might still be possible through other forms of documentation (like credit card statements or bank records), having original receipts is preferable. Start tracking your expenses diligently to avoid this issue in the future.

Can I deduct home office expenses if I work from home occasionally?

+

Yes, you might be able to claim home office deductions if you use a dedicated space in your home for administrative tasks related to your firefighting job. However, ensure that the space is used exclusively for work purposes and check IRS guidelines regarding home office deductions.