USMC Financial Worksheet Guide: Maximize Your Benefits

Understanding the intricacies of military finance can be overwhelming, especially for members of the United States Marine Corps (USMC). This guide aims to demystify the process by exploring how to effectively utilize the USMC Financial Worksheet to maximize your benefits. Whether you're a seasoned Marine or someone new to the Corps, the knowledge contained within this worksheet can significantly impact your financial future.

What is the USMC Financial Worksheet?

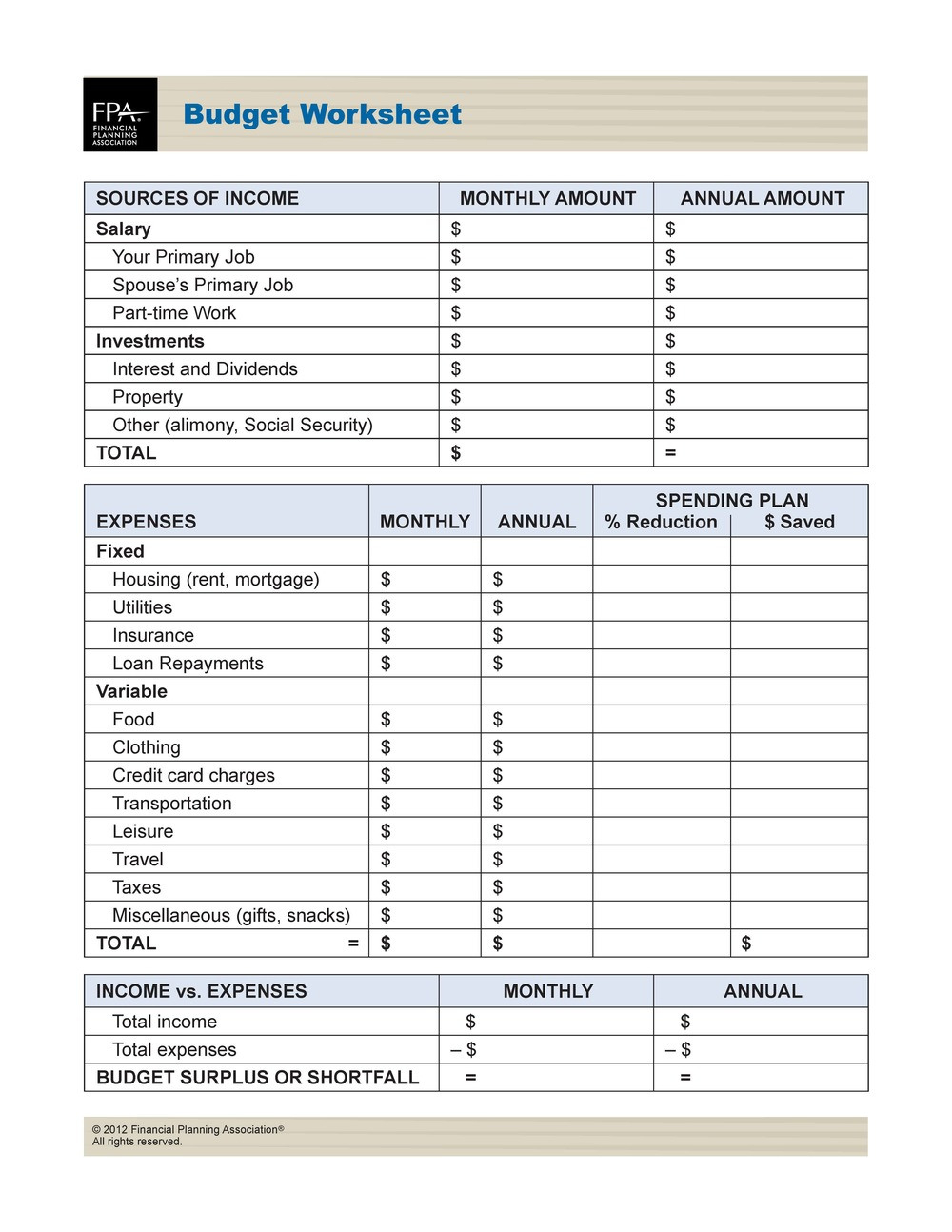

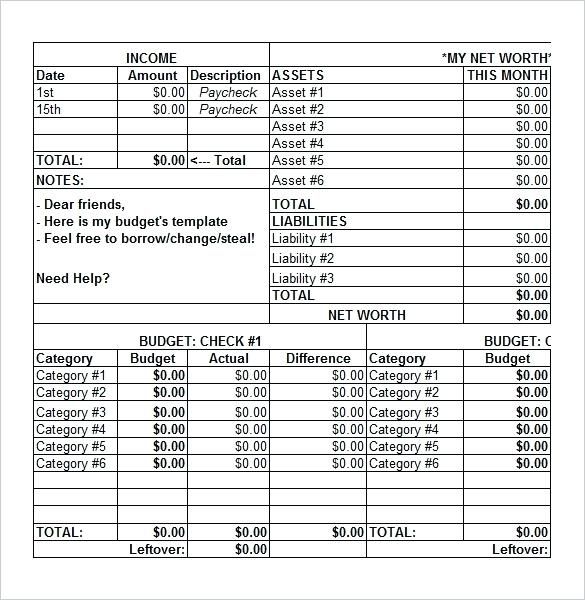

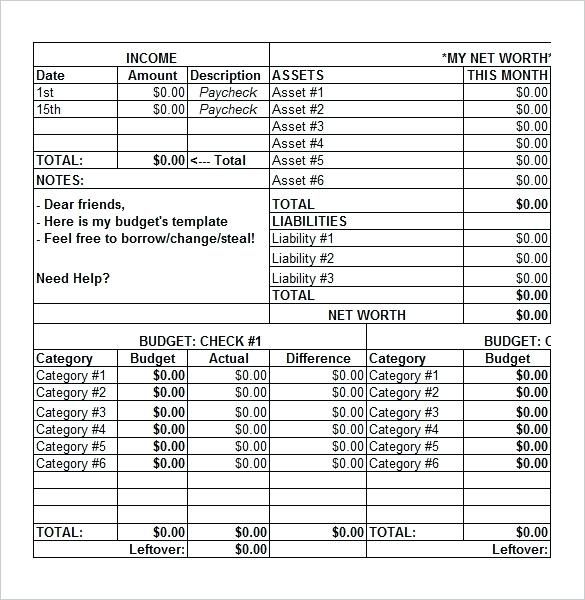

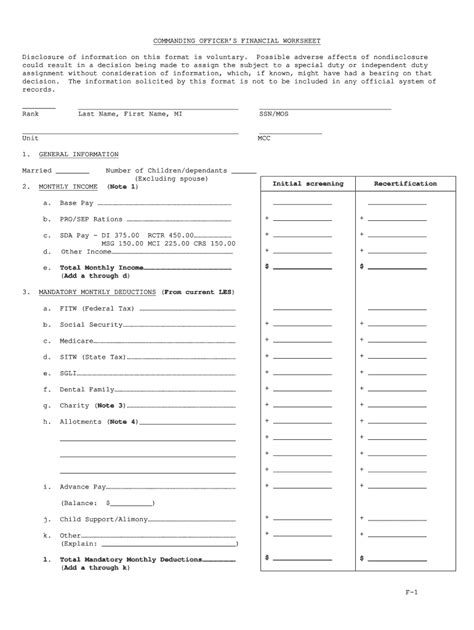

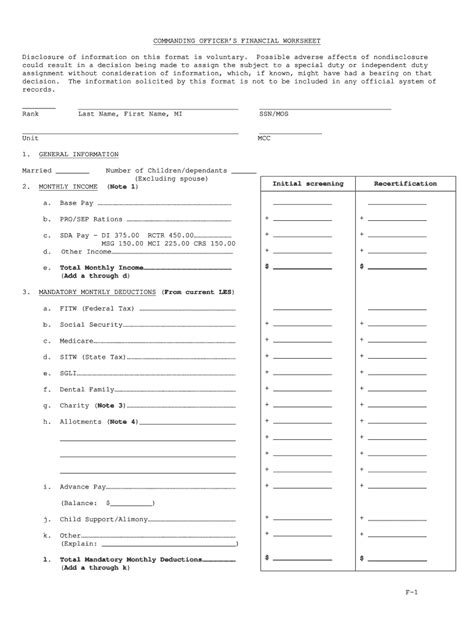

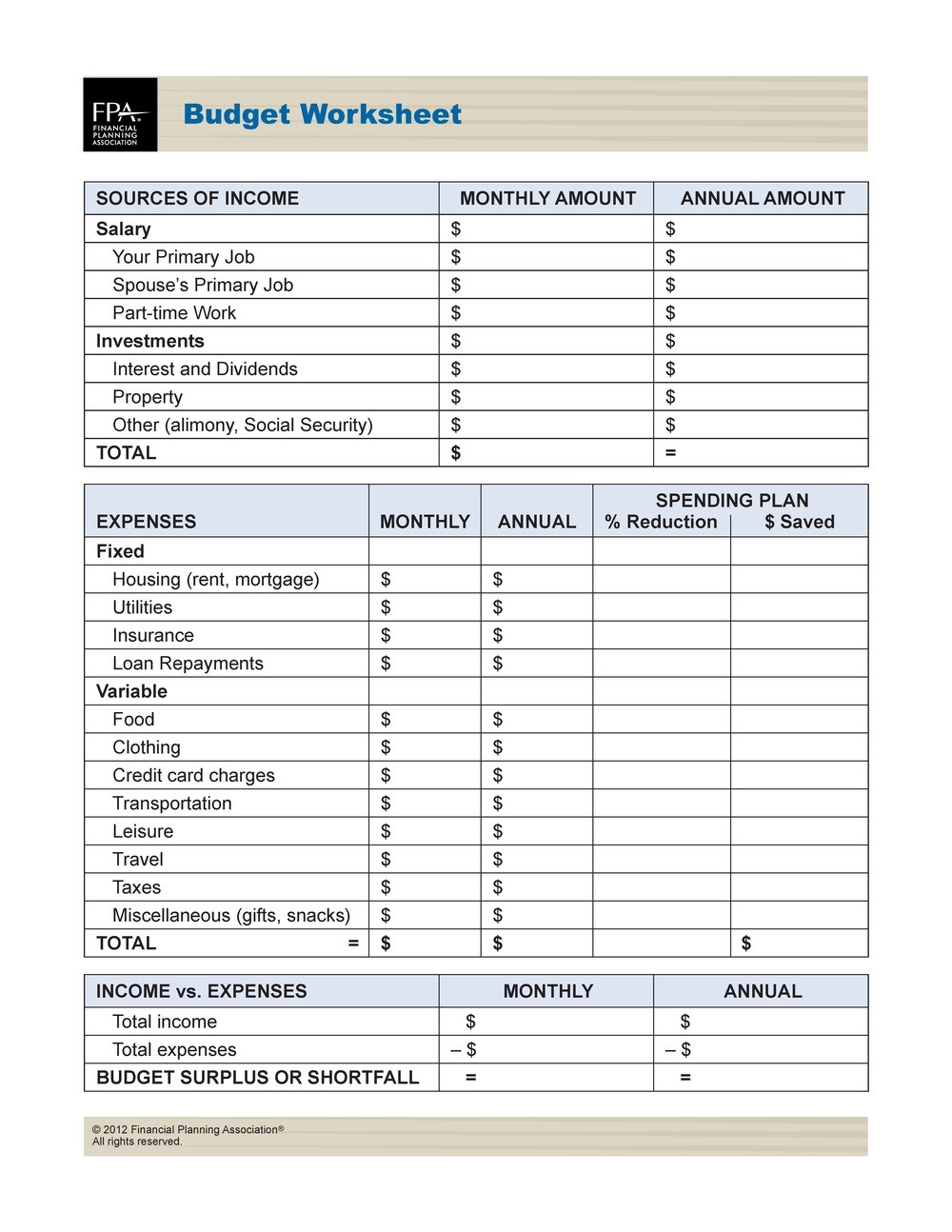

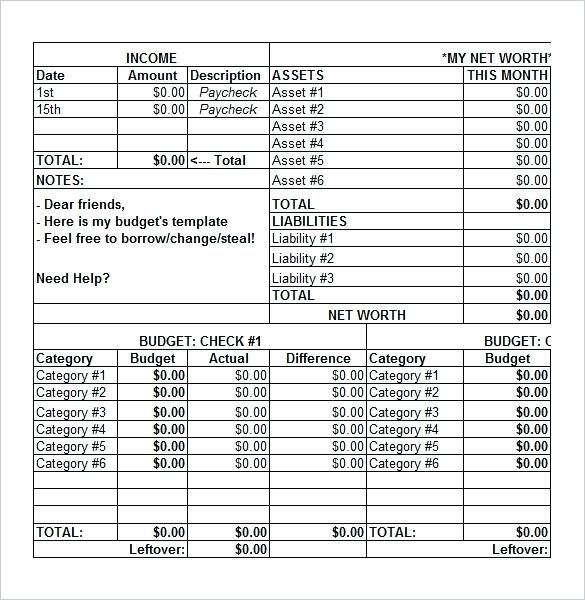

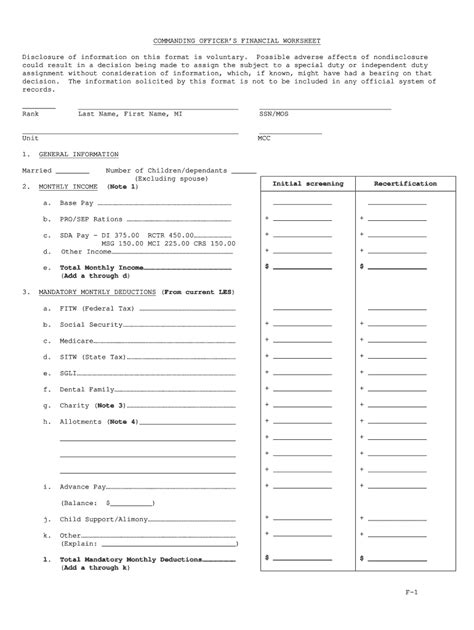

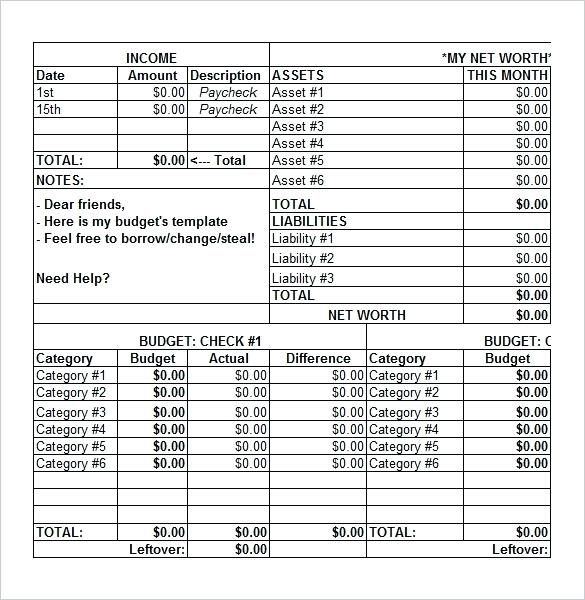

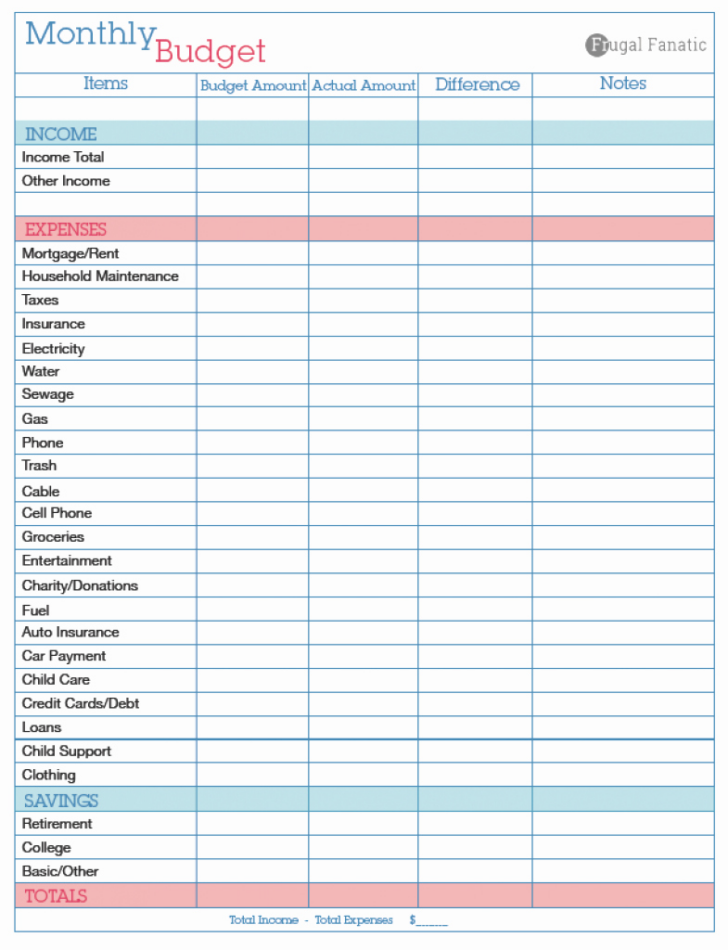

The USMC Financial Worksheet is a comprehensive tool designed to help Marines and their families manage their finances while serving in the Corps. It provides a structured approach to tracking income, expenses, savings, and investments, ensuring that every Marine can plan for both the short and long term.

- Tracks Regular and Variable Income: From base pay, allowances, and bonuses to less frequent income like tax refunds.

- Budgets Expenses: It helps in categorizing and managing both necessary (food, housing) and discretionary (entertainment, travel) expenses.

- Plans for Savings and Investment: It guides how to allocate funds towards savings for future goals or investments.

How to Fill Out the USMC Financial Worksheet

Income Section

Start by listing all sources of income:

| Income Source | Amount |

| Basic Pay | $X |

| Basic Allowance for Subsistence (BAS) | $X |

| Basic Allowance for Housing (BAH) | $X |

| Special Duty Assignment Pay (SDAP) | $X |

| Other Allowances or Bonuses | $X |

Include any supplemental income from investments, side gigs, or part-time work if applicable.

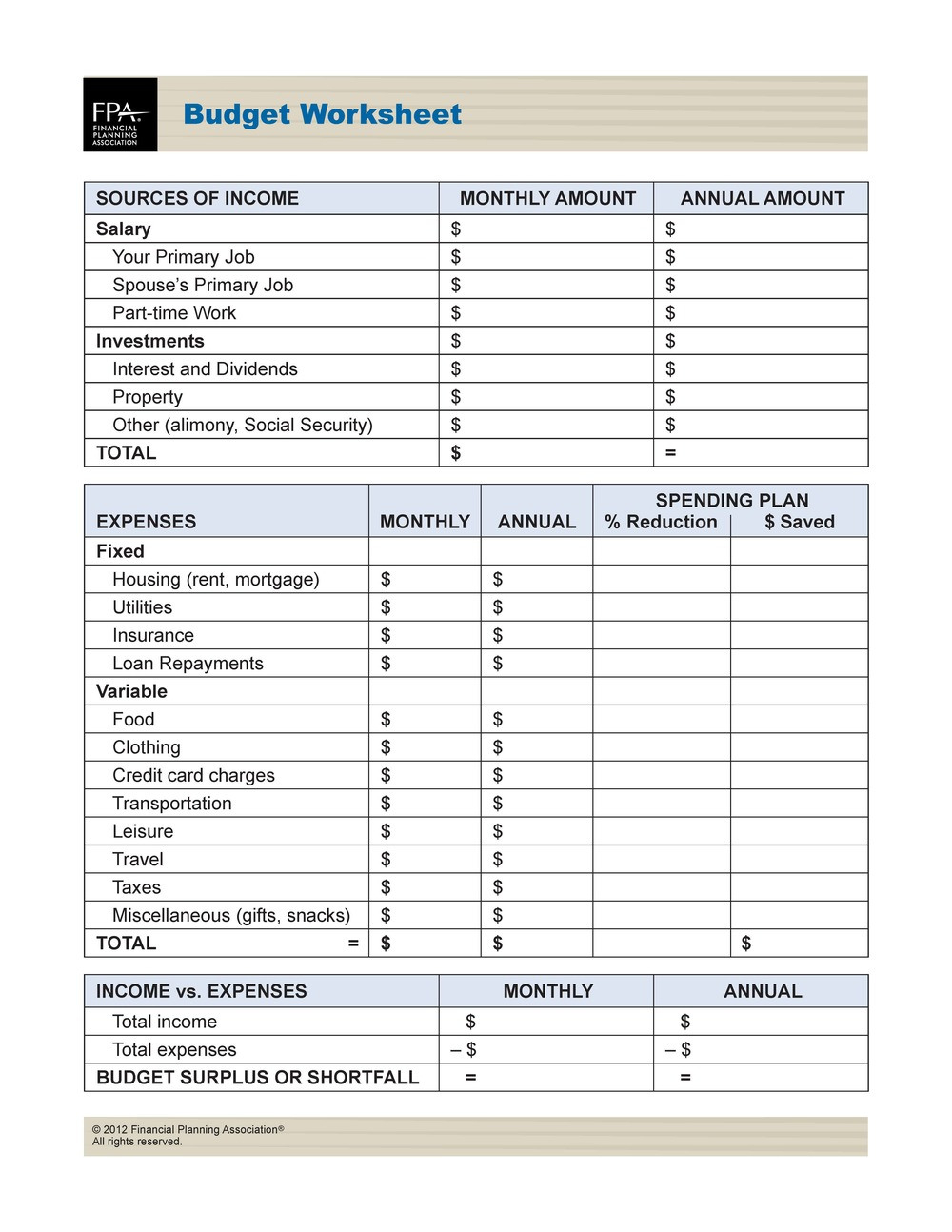

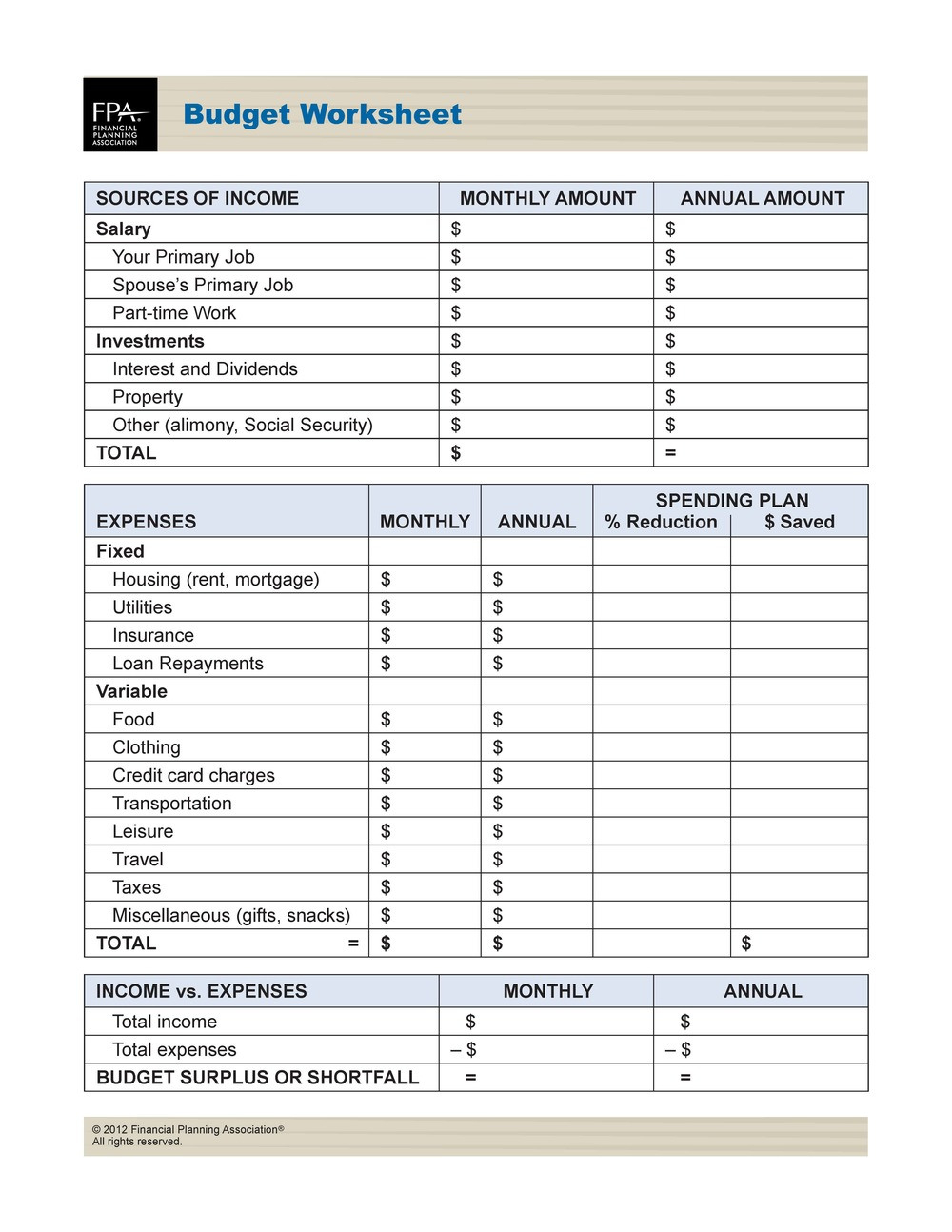

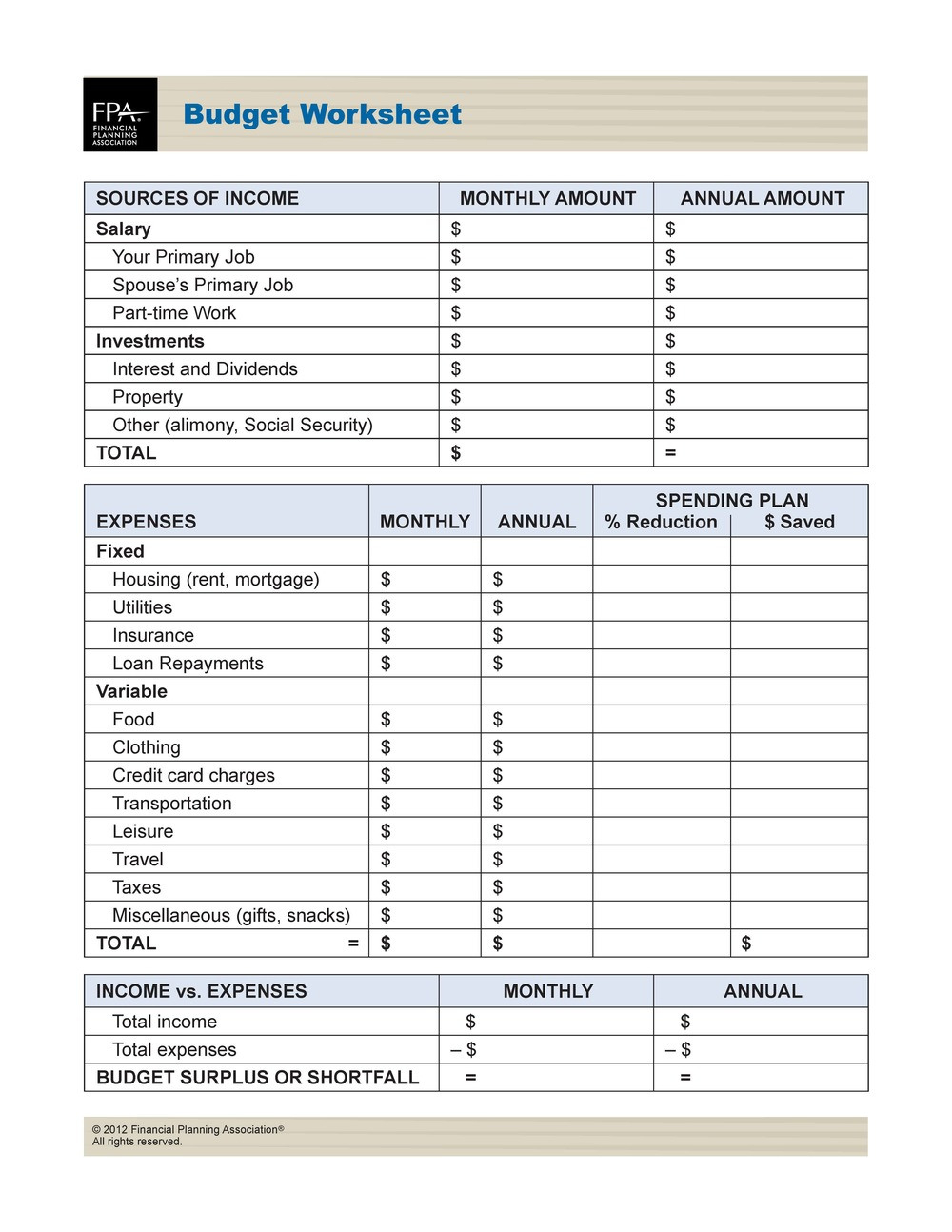

Expenses Section

Your expenses can be divided into fixed and variable:

- Fixed Expenses: Rent/mortgage, car payments, insurance, utilities.

- Variable Expenses: Groceries, clothing, hobbies, entertainment.

Be meticulous in tracking these to understand where your money goes.

Savings and Investments

Here, you should:

- Set savings goals for emergencies, retirement, education, etc.

- Outline current investments or potential investments like Thrift Savings Plan (TSP), stocks, bonds, or real estate.

Maximizing Your Benefits

Education Benefits

Marines can take advantage of various educational benefits including the GI Bill:

- The Montgomery GI Bill (MGIB) - Active Duty.

- Post-9/11 GI Bill.

- Tuition Assistance (TA) - which pays up to 100% of tuition costs for approved courses.

💡 Note: Check eligibility and how to apply for these benefits as they can significantly reduce out-of-pocket educational expenses.

Healthcare Benefits

The USMC provides comprehensive healthcare through TRICARE, but understanding your options can save money:

- TRICARE Prime: Free or low-cost, but requires a Primary Care Manager (PCM).

- TRICARE Select: More flexibility, but with higher out-of-pocket costs.

Family members also qualify for care, but ensure they are properly enrolled.

Retirement Benefits

Planning for retirement is crucial:

- Blended Retirement System (BRS) which includes:

- Defined Benefit (pension).

- Thrift Savings Plan with matching contributions.

- Mid-career bonus.

Other Benefits

Don't forget about:

- Housing Allowance: Depending on location and rank, you might receive BAH or live in military housing.

- Commissary and Exchange Privileges: Saving on groceries and goods.

- Travel and Vacation: Discounts through Space-A Travel or through American Forces Travel.

Optimization Tips

- Regularly update your worksheet to reflect changes in income or expenses.

- Automate savings to ensure funds are set aside before you can spend them.

- Consider pre-tax contributions to TSP for tax benefits.

Long-Term Financial Planning

Use the USMC Financial Worksheet not just for day-to-day budgeting, but for long-term goals:

- Set up a savings plan for buying a home, starting a business, or retirement.

- Plan for life events like marriage, children, or extended deployments.

In summary, the USMC Financial Worksheet is more than a tool; it's a strategic guide to financial success. By understanding how to fill it out correctly and leveraging the various benefits available, Marines can secure their financial well-being. From education to healthcare, retirement, and beyond, the opportunities to save and invest are vast. Regularly revisiting and adjusting your financial plan, coupled with disciplined savings and informed decision-making, ensures you can truly maximize your benefits.

What are the differences between the MGIB and the Post-9⁄11 GI Bill?

+

The MGIB provides a monthly stipend for education, whereas the Post-9⁄11 GI Bill offers tuition and fee payments directly to educational institutions, a housing allowance, and a book stipend. The latter is generally considered more generous for eligible Marines.

Can family members use my TRICARE benefits?

+

Yes, with proper enrollment, family members can use your TRICARE benefits. However, the specifics of coverage and costs depend on the TRICARE plan you are enrolled in.

What is the Space-A Travel program, and how can I use it?

+Space-A Travel allows military members, retirees, and their families to travel on military aircraft for a nominal fee. Flights are not guaranteed, but if seats are available after all service needs are met, you can potentially travel internationally or domestically.