5 Essential Tips for Completing the Federal Carryover Worksheet

Understanding how to navigate the Federal Carryover Worksheet can be daunting, especially for those unfamiliar with tax intricacies. This crucial document is instrumental in determining your taxable income by adjusting your excess net capital loss, unused charitable contributions, and other tax benefits carried over from one tax year to the next. Here are five essential tips to help you accurately complete the Federal Carryover Worksheet:

1. Identify Eligible Carryovers

Before diving into the worksheet, it’s important to recognize what qualifies as a carryover:

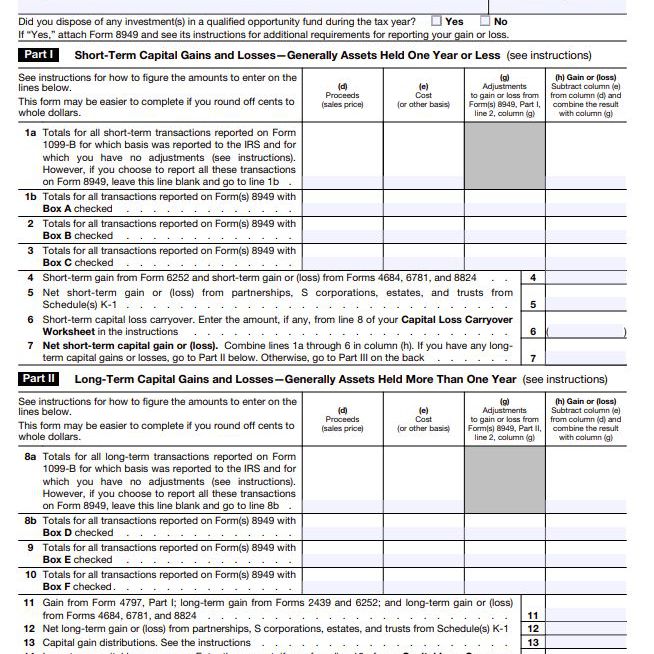

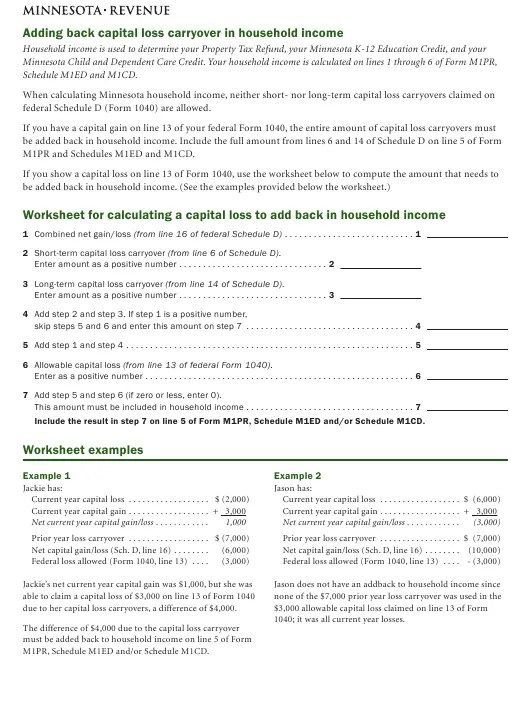

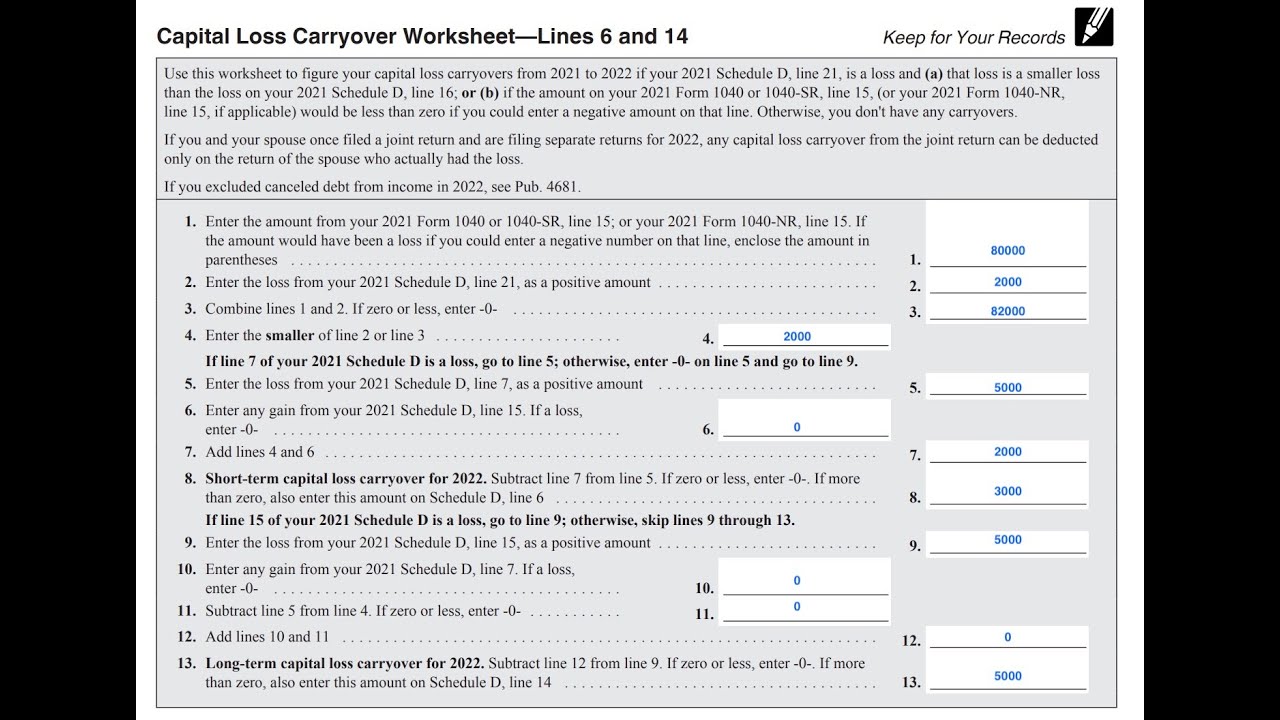

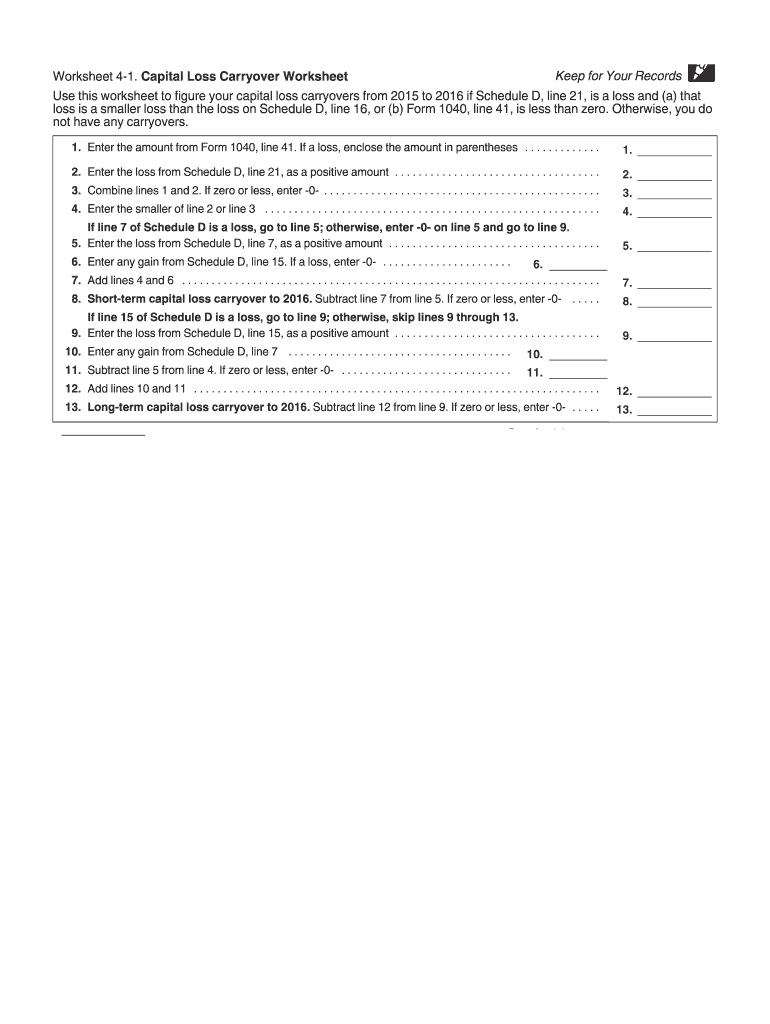

- Capital Losses: If your losses exceed your gains, you can carry forward the excess.

- Charitable Contributions: Deductions that exceed the cap can be carried over to the next year.

- Net Operating Loss: A situation where business expenses exceed income can be carried forward or back to offset other income.

- Unused Business Credits: Certain credits not fully used in the year they were generated can be carried over.

📝 Note: Different types of carryovers have distinct regulations regarding how and when they can be used.

2. Assemble Past Tax Returns

The Federal Carryover Worksheet relies heavily on information from your previous year’s tax return:

- Gather Prior Year Documents: Ensure you have copies of your previous year’s federal tax return, schedules, and any notices from the IRS.

- Keep Records: Organize your records to quickly locate losses, deductions, and credits from previous years.

3. Use IRS Publication 550

IRS Publication 550 is your go-to resource for understanding capital gains and losses, including how to carry them forward:

- Access the Publication: Download or view IRS Publication 550 for detailed instructions on carryover rules.

- Follow Examples: Use the step-by-step examples in the publication to guide you through the worksheet.

4. Utilize Software or a Tax Professional

Given the complexity of federal tax laws:

- Tax Software: Many reputable tax preparation software programs include tools for completing the Federal Carryover Worksheet.

- Consult Professionals: For personalized advice and to ensure compliance, consider hiring a tax professional.

📝 Note: Ensure you understand the limitations and charges associated with tax software or professional services.

5. Review Your Calculations and Carryovers

Before submitting your return, double-check your carryover calculations:

- Verify Calculations: Use a calculator or software to confirm your numbers are correct.

- Check IRS Limits: Ensure that your carryover amounts do not exceed the allowable limits or duration as per IRS rules.

📝 Note: Mistakes in carryover amounts can lead to a deficiency in your tax calculations, causing potential audit risks.

In sum, correctly completing the Federal Carryover Worksheet is vital for accurate tax reporting. By identifying eligible carryovers, gathering past returns, utilizing resources like IRS Publication 550, seeking professional or software help, and reviewing your calculations, you can streamline this process and ensure that your tax calculations are accurate, thus reducing the likelihood of issues with the IRS.

What should I do if my carryover exceeds the IRS limits?

+

Excess carryover amounts beyond IRS limits cannot be claimed. Instead, they need to be carried over to subsequent years until they are fully utilized or the carryover period expires.

Can I carryover losses indefinitely?

+

The duration for which you can carry over losses varies. Capital losses can be carried forward indefinitely, whereas net operating losses must typically be carried back or forward within a specific number of years, as per current IRS regulations.

How do I know if I am carrying over the correct amount?

+

Use IRS worksheets, consult with tax professionals, or utilize tax software that ensures you follow the latest tax laws and guidelines for carryover amounts.