Fannie Mae Rental Income Worksheet: Your Ultimate Guide

Filling out the Fannie Mae Rental Income Worksheet can often feel like navigating a labyrinth, but with the right guidance, it transforms into a manageable task that ensures your loan application process goes smoothly. In this comprehensive guide, we'll walk through every section of the worksheet, providing insights and tips to help you optimize your rental income for mortgage approval.

Understanding the Fannie Mae Rental Income Worksheet

Before diving into the specifics, it’s beneficial to have a holistic understanding of why this worksheet exists. Fannie Mae, one of the leading government-sponsored enterprises, facilitates homeownership by purchasing mortgages from lenders. This worksheet helps Fannie Mae assess the stability and reliability of rental income as part of the borrower’s overall financial health. Here’s what you need to know:

- Purpose: The worksheet enables lenders to calculate rental income accurately to determine the borrower’s ability to repay the mortgage.

- Applicability: It’s particularly relevant for investors looking to buy additional properties or use rental income from their current holdings to bolster their loan application.

🔍 Note: Always ensure that the rental income is reported consistently and accurately on your tax returns as this will affect how lenders view your income stability.

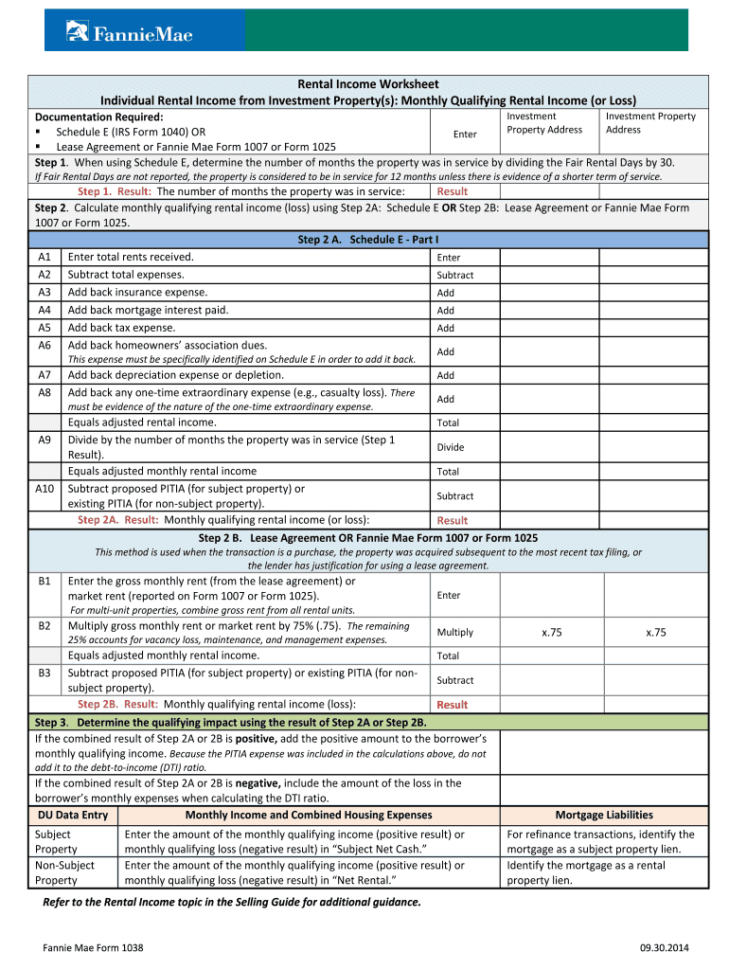

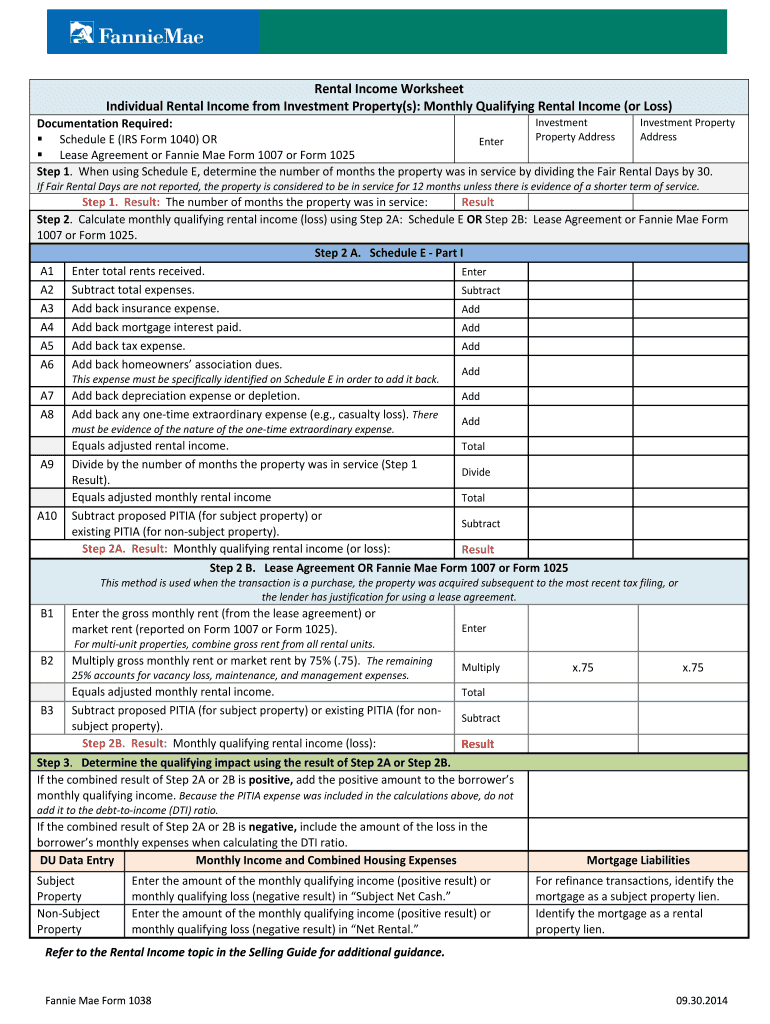

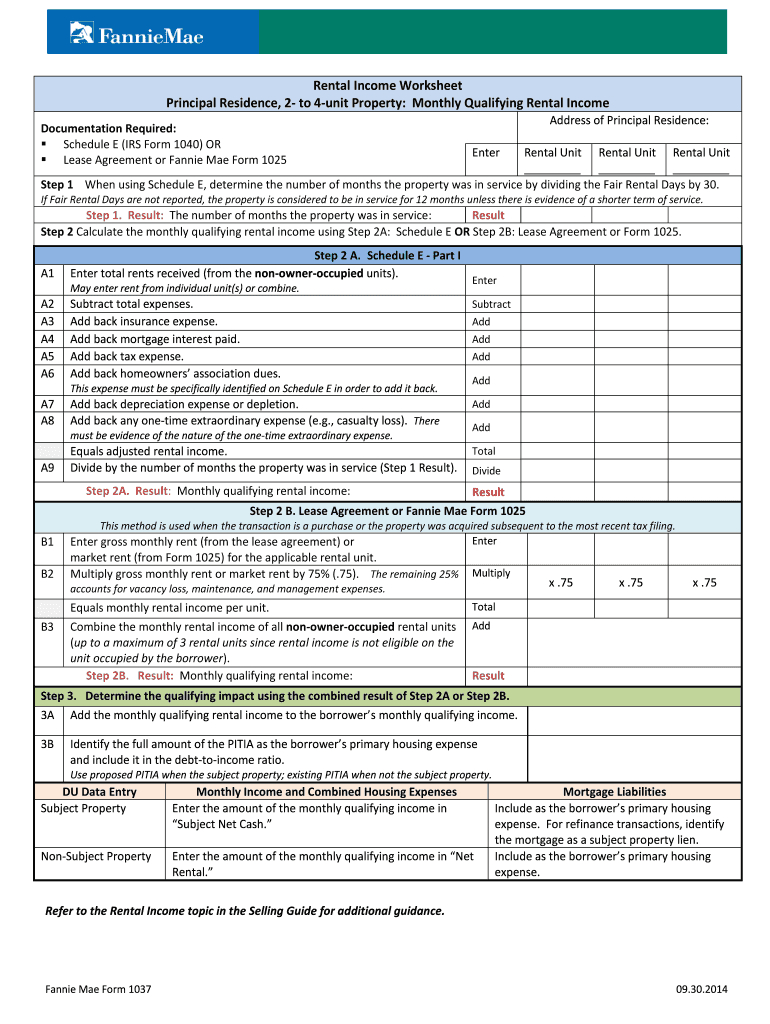

Breaking Down the Worksheet

The Fannie Mae Rental Income Worksheet is divided into various sections:

Section 1: Property Information

Here, you’ll provide:

- Address of the rental property

- Type of property (Single-family, Multi-family, etc.)

- Number of units

- Status of the property (Rented, Vacant, or Lease pending)

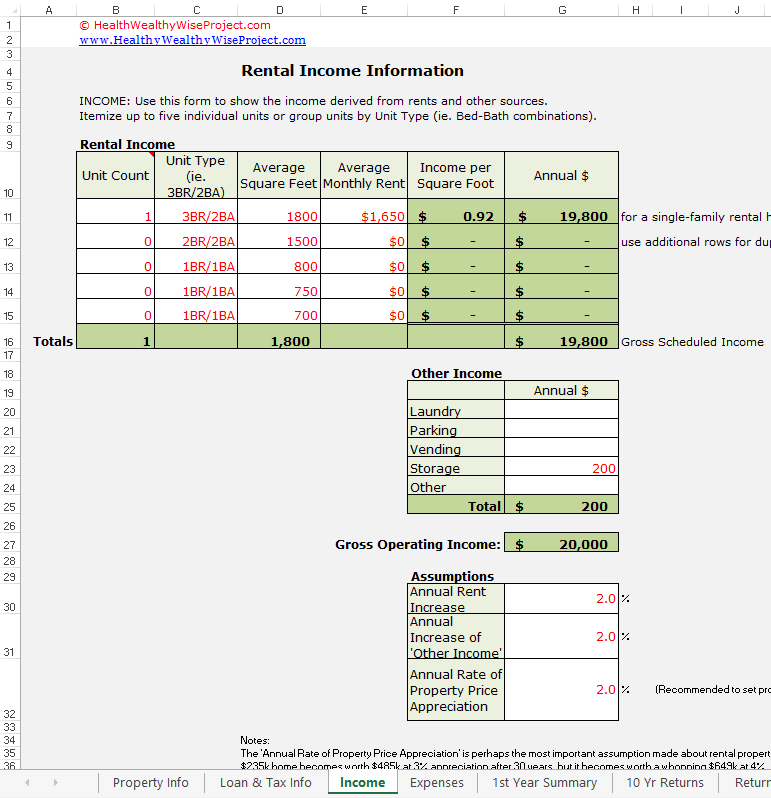

Section 2: Monthly Rental Income

This section requires you to:

- List the current rent for each unit

- Include future rent if known

- Calculate the total monthly rental income

Section 3: Expenses

To assess net rental income, you need to account for expenses:

| Expense Type | Description |

|---|---|

| Property Management | Fees if a management company is involved |

| Utilities | Water, electricity, gas if paid by the owner |

| Maintenance and Repairs | Regular upkeep and unforeseen repairs |

| Insurance | Homeowners or rental property insurance |

| Taxes | Property taxes |

| HOA Dues | Homeowners association fees if applicable |

| Other Expenses | Any other costs not listed above |

💡 Note: When calculating expenses, lenders might use a percentage of the gross rent to cover these costs if specific figures are not available. Ensure your estimates are realistic to avoid discrepancies in your loan application.

Section 4: Net Rental Income

Net rental income is derived by subtracting total expenses from total rental income:

- Total Monthly Rent: Sum of rents from all units

- Total Monthly Expenses: Sum of all listed expenses

- Net Income: Total rent minus total expenses

Key Considerations While Filling the Worksheet

- Consistency: Ensure the information matches your tax returns to avoid red flags during underwriting.

- Future Rent: If a property is currently vacant but rented pending, report the future rent.

- Expenses: Provide realistic estimates or document actual costs for accuracy.

- Vacancy Rates: Lenders might apply a vacancy factor to account for potential downtime. Be aware of this when calculating your net income.

Maximizing Your Rental Income on the Worksheet

- Optimize Property Usage: Consider if you can legally convert a basement or add a unit to increase rental income.

- Professional Management: While this incurs a cost, it could streamline operations and make the rental income more attractive to lenders.

- Rent Increases: Justify rent increases with market analysis if planning to do so.

- Tax Deductions: Understand which rental expenses are deductible to lower your taxable income, indirectly benefiting your net rental income calculations.

💸 Note: Consult with a real estate professional or tax advisor to ensure your rental income strategy aligns with both your financial goals and lending requirements.

In summary, filling out the Fannie Mae Rental Income Worksheet with precision and foresight can significantly impact your mortgage approval process. By understanding its purpose, breaking down each section, and considering key strategies to maximize your rental income, you pave the way for a smoother loan application journey. Remember, this worksheet isn’t just about numbers; it’s about presenting a compelling financial picture that supports your case for homeownership.

Why is the rental income worksheet important for my loan application?

+

The rental income worksheet helps lenders determine your income stability and capacity to service your mortgage. It’s crucial for accurately calculating your net rental income and assessing your overall financial health.

Can I include future rent for a currently vacant property?

+

Yes, if you have a signed lease or rental agreement in place, you can include the future rent in your calculations. This demonstrates potential income stability to the lender.

What should I do if I’m unsure about some expenses?

+

Estimate expenses realistically based on market data or historical costs for similar properties. Lenders might also apply industry-standard percentages to certain expenses if you’re unsure. It’s beneficial to consult with a property management expert for guidance.