5 Essential Steps to Enact Rental Income Worksheet

Understanding Rental Income: A Comprehensive Guide

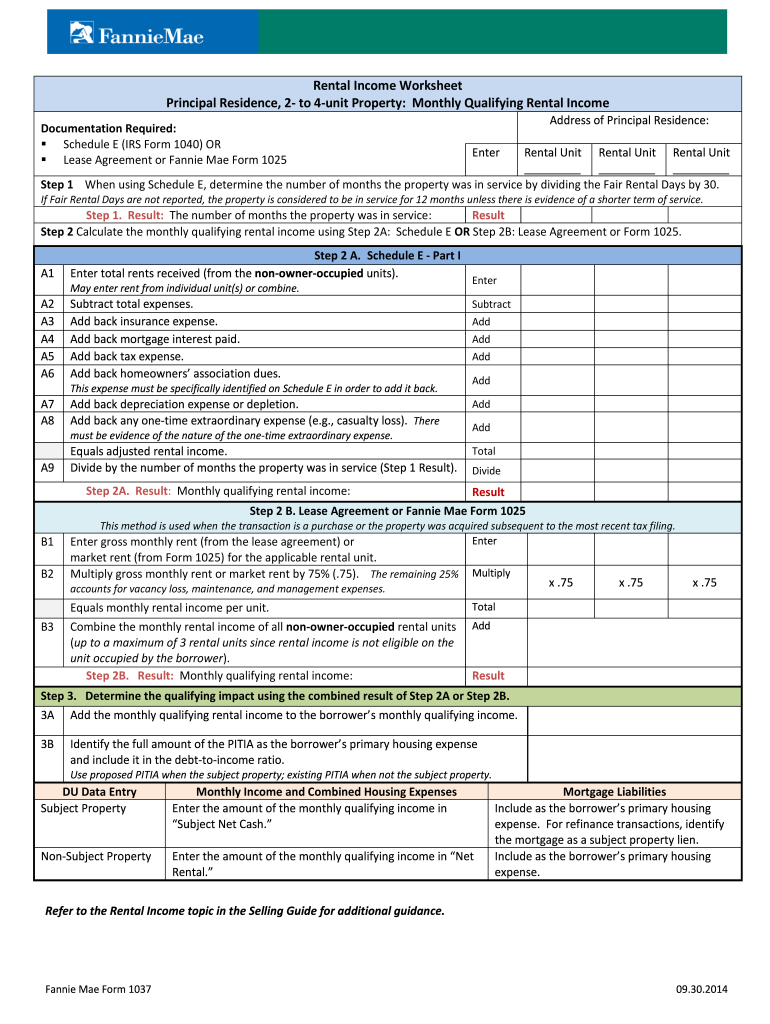

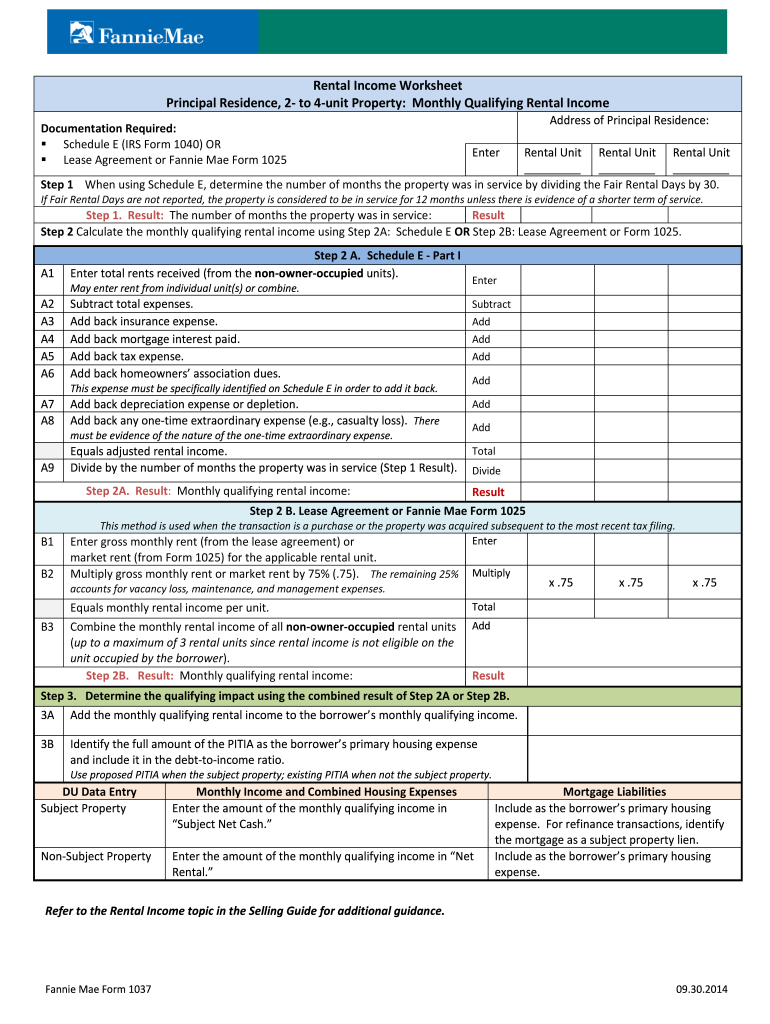

Rental income is a significant source of revenue for many property owners. It’s essential to accurately track and report rental income to ensure compliance with tax laws and to make informed financial decisions. A rental income worksheet is a valuable tool that helps property owners organize and calculate their rental income. In this article, we will outline the 5 essential steps to enact a rental income worksheet.

Step 1: Gather Necessary Documents and Information

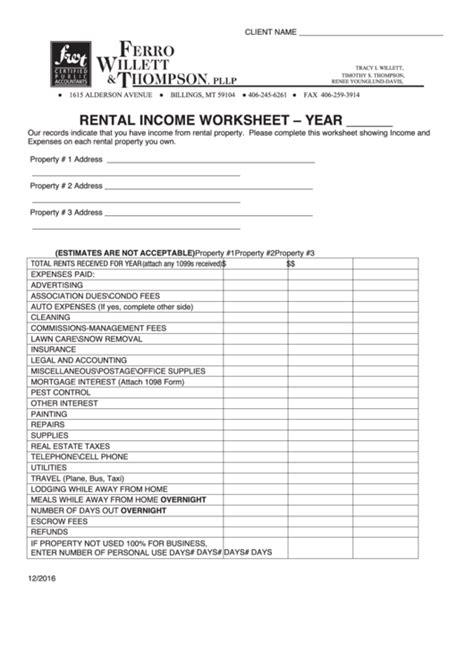

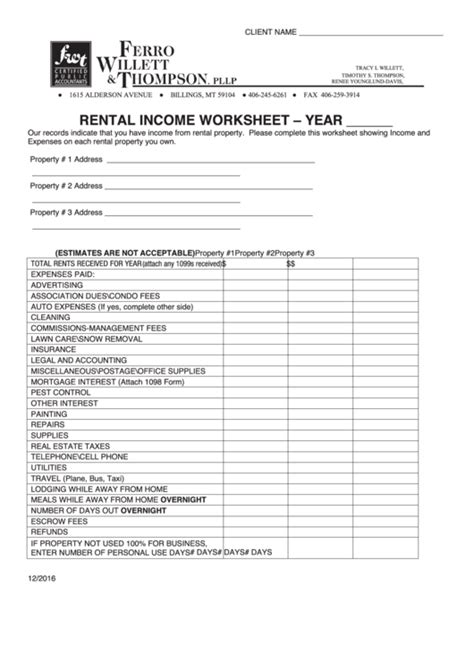

To create an accurate rental income worksheet, you need to gather all relevant documents and information related to your rental property. This includes:

- Rental agreements: Collect all signed rental agreements, including the start and end dates, rent amount, and any additional fees.

- Rent payments: Record all rent payments received, including the date, amount, and payment method.

- Expenses: Gather receipts and invoices for all expenses related to the rental property, such as maintenance, repairs, and utilities.

- Tax documents: Collect all tax-related documents, including property tax bills and mortgage interest statements.

Step 2: Calculate Gross Rental Income

Gross rental income is the total amount of rent received from tenants before deducting any expenses. To calculate gross rental income, follow these steps:

- Add up all rent payments: Total the amount of rent received from all tenants for the reporting period.

- Include additional income: Add any additional income from the rental property, such as laundry or parking fees.

Step 3: Calculate Operating Expenses

Operating expenses are the costs associated with running the rental property. To calculate operating expenses, follow these steps:

- Categorize expenses: Group expenses into categories, such as maintenance, repairs, utilities, and property taxes.

- Total expenses: Calculate the total amount of expenses for each category.

- Subtract expenses from gross income: Subtract the total operating expenses from the gross rental income to calculate the net operating income.

Step 4: Calculate Net Rental Income

Net rental income is the profit earned from the rental property after deducting all expenses. To calculate net rental income, follow these steps:

- Subtract operating expenses from gross income: Subtract the total operating expenses from the gross rental income.

- Subtract mortgage interest and property taxes: Subtract mortgage interest and property taxes from the net operating income.

Step 5: Review and Update the Worksheet

Regularly review and update the rental income worksheet to ensure accuracy and compliance with tax laws. Follow these steps:

- Review rental agreements: Review rental agreements to ensure they are up-to-date and accurate.

- Update expense records: Update expense records to reflect any changes in operating expenses.

- Verify tax documents: Verify tax documents to ensure compliance with tax laws.

Notes

📝 Note: Keep accurate and detailed records of all rental income and expenses to ensure compliance with tax laws and to make informed financial decisions.

📝 Note: Review and update the rental income worksheet regularly to reflect any changes in rental income or expenses.

Conclusion

Creating a rental income worksheet is an essential step in managing rental properties. By following these 5 essential steps, property owners can accurately track and report rental income, ensuring compliance with tax laws and informed financial decisions. Remember to regularly review and update the worksheet to reflect any changes in rental income or expenses.

FAQ Section

What is a rental income worksheet?

+

A rental income worksheet is a document used to track and calculate rental income and expenses for a rental property.

Why is it essential to create a rental income worksheet?

+

Creating a rental income worksheet is essential to ensure compliance with tax laws and to make informed financial decisions.

What information is required to create a rental income worksheet?

+

To create a rental income worksheet, you need to gather rental agreements, rent payments, expenses, and tax documents related to the rental property.

Related Terms:

- Enact Rental Income Worksheet

- Enact rental income worksheet pdf

- Enact rental income worksheet 2022

- Enact rental Income Worksheet 2024

- MGIC rental income Worksheet

- Enact rental income worksheet excel