5 Education Loan Options for Veterans

Education Benefits for Veterans: Exploring Loan Options

As a veteran, you’ve made significant sacrifices to serve your country. Now, it’s time to focus on your future, and education can play a vital role in achieving your goals. The good news is that there are various education loan options available specifically for veterans, offering favorable terms and benefits. In this article, we’ll delve into five education loan options designed to support veterans in pursuing their educational aspirations.

Option 1: GI Bill Benefits

The GI Bill is one of the most well-known education benefits for veterans. Administered by the U.S. Department of Veterans Affairs (VA), the GI Bill provides financial assistance for education and training. There are two main types of GI Bill benefits:

- Post-9⁄11 GI Bill (Chapter 33): Covers up to 100% of in-state tuition and fees for public colleges and universities, as well as a monthly stipend for living expenses and books.

- Montgomery GI Bill Active Duty (MGIB-AD, Chapter 30): Offers a monthly stipend for education and training, which can be used to cover tuition, fees, and living expenses.

To be eligible for GI Bill benefits, you must have served at least 90 days of active duty since September 10, 2001. It’s essential to note that the GI Bill is not a loan, and you won’t need to repay the benefits.

Option 2: Military Tuition Assistance (TA)

Military Tuition Assistance (TA) is a benefit provided by the military services to help active-duty, reserve, and National Guard personnel pursue higher education. TA can cover up to 100% of tuition costs, with a maximum annual limit of $4,500. The benefit is available for both undergraduate and graduate degree programs.

To be eligible for TA, you must:

- Be an active-duty, reserve, or National Guard member

- Be in good standing with your military service

- Enroll in a degree-granting program at an accredited institution

- Not have exceeded the annual TA limit

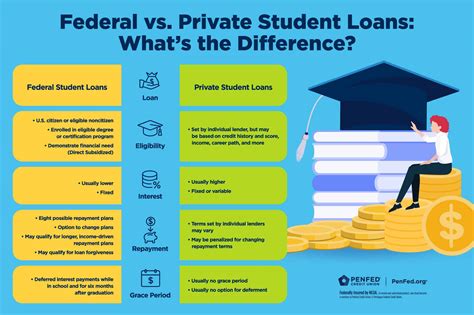

Option 3: Federal Student Loans

Federal student loans are available to veterans and their dependents, offering favorable terms and benefits. Some popular options include:

- Direct Subsidized and Unsubsidized Loans: Offered to undergraduate and graduate students, these loans have a fixed interest rate and flexible repayment terms.

- Direct PLUS Loans: Available to graduate and professional students, as well as parents of undergraduate students, these loans have a fixed interest rate and can be used to cover additional education expenses.

To apply for federal student loans, you’ll need to complete the Free Application for Federal Student Aid (FAFSA).

Option 4: Veteran-Specific Scholarships

There are numerous scholarships available specifically for veterans, offering financial assistance for education and training. Some popular options include:

- Tillman Military Scholarship: Provides scholarships to veterans and their spouses, covering tuition, fees, and living expenses.

- Wounded Warrior Project Scholarship: Offers scholarships to wounded veterans, supporting their pursuit of higher education.

- Veterans United Foundation Scholarship: Provides scholarships to veterans and their dependents, covering tuition, fees, and living expenses.

These scholarships often have specific eligibility requirements, so be sure to review the criteria carefully.

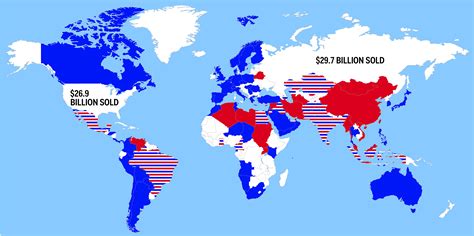

Option 5: State-Specific Education Benefits

Many states offer education benefits specifically for veterans, providing financial assistance for tuition, fees, and living expenses. Some examples include:

- California’s CalVet College Tuition Waiver: Offers tuition waivers to eligible veterans and their dependents, covering tuition and fees at public colleges and universities.

- Texas’s Hazlewood Act: Provides tuition exemptions to eligible veterans and their dependents, covering tuition and fees at public colleges and universities.

It’s essential to research the education benefits available in your state to determine which options you may be eligible for.

📝 Note: Be sure to review the eligibility requirements and application processes for each education loan option carefully, as they may vary. It's also essential to consult with a financial aid advisor to determine the best options for your specific situation.

By exploring these education loan options, you can take the first step towards achieving your educational goals and securing a brighter future.

What are the eligibility requirements for GI Bill benefits?

+

To be eligible for GI Bill benefits, you must have served at least 90 days of active duty since September 10, 2001.

Can I use Military Tuition Assistance (TA) and GI Bill benefits simultaneously?

+

No, you cannot use TA and GI Bill benefits simultaneously. However, you can use TA to cover tuition costs and then apply for GI Bill benefits to cover living expenses and other education-related costs.

What are the interest rates for federal student loans?

+

The interest rates for federal student loans vary depending on the type of loan and the borrower’s credit score. For the 2022-2023 academic year, the interest rates range from 4.53% to 7.08%.

Related Terms:

- Veteran student loan forgiveness

- USAA student loans

- FAFSA for veterans

- FAFSA military Grant

- VA education benefits for dependents

- Federal student loans