Duval Homestead Exemption for Military

Introduction to Duval Homestead Exemption for Military

The Duval Homestead Exemption is a valuable benefit for homeowners in Duval County, Florida, particularly for military personnel and veterans. This exemption can significantly reduce the amount of property taxes owed on a primary residence. In this article, we will delve into the details of the Duval Homestead Exemption, its eligibility criteria, and the application process, with a focus on how it applies to military personnel.

What is the Duval Homestead Exemption?

The Duval Homestead Exemption is a tax exemption provided by the state of Florida to eligible homeowners. It allows for a reduction of up to $50,000 in the assessed value of a primary residence, which in turn reduces the property taxes owed. This exemption is available to all eligible Florida residents, including military personnel and veterans, who own and occupy a property as their primary residence.

Eligibility Criteria for Military Personnel

To be eligible for the Duval Homestead Exemption, military personnel must meet certain criteria: * The property must be the primary residence of the applicant. * The applicant must be a Florida resident. * The applicant must have legal or beneficial title to the property. * The property must be located in Duval County, Florida. * The applicant must occupy the property as their primary residence on January 1 of the tax year.

Military personnel who are deployed or stationed outside of Florida may still be eligible for the exemption if they can demonstrate that they intend to return to the property as their primary residence.

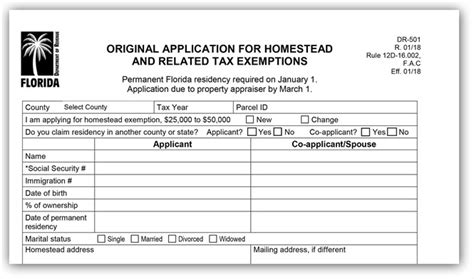

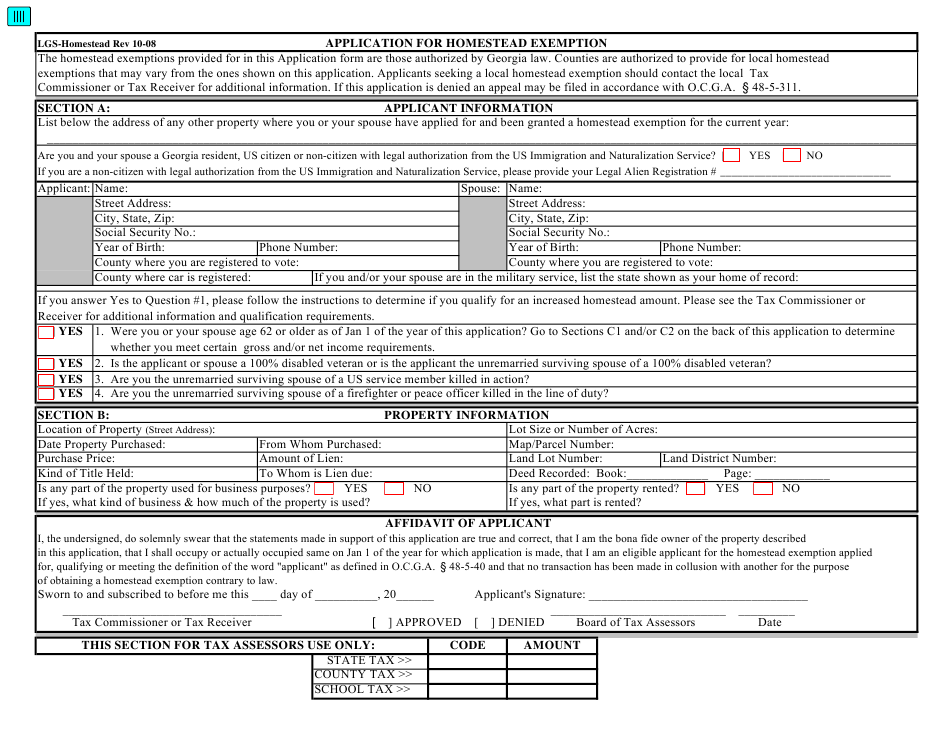

Application Process

To apply for the Duval Homestead Exemption, military personnel must submit an application to the Duval County Property Appraiser’s office by March 1 of the tax year. The application can be submitted online, by mail, or in person. Required documentation includes: * Proof of residency (e.g., Florida driver’s license, voter registration card) * Proof of property ownership (e.g., deed, title) * Proof of military status (e.g., military ID, DD Form 214)

📝 Note: The application process and required documentation may vary depending on individual circumstances. It is recommended that applicants consult with the Duval County Property Appraiser's office for specific guidance.

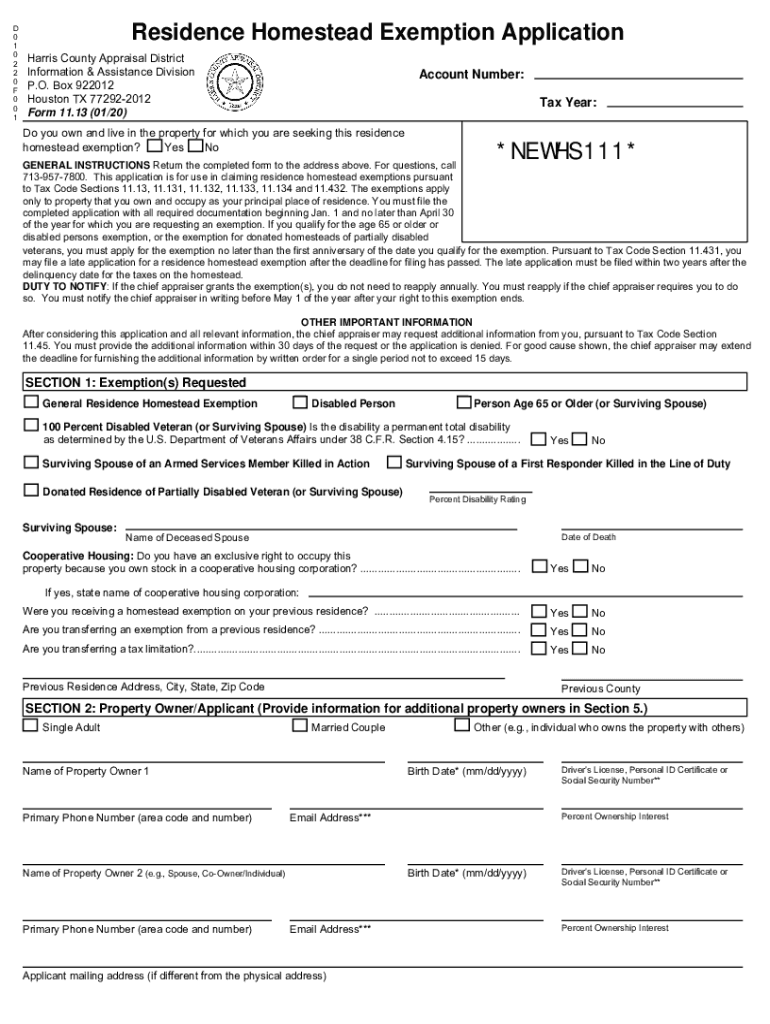

Additional Benefits for Military Personnel

In addition to the Duval Homestead Exemption, military personnel may be eligible for other property tax benefits in Florida. These include: * Deployment-related exemptions: Military personnel who are deployed outside of Florida may be eligible for additional exemptions or reductions in property taxes. * Veterans’ exemptions: Eligible veterans may be eligible for additional exemptions or reductions in property taxes. * Disabled veterans’ exemptions: Disabled veterans may be eligible for a complete exemption from property taxes.

Table of Exemptions

The following table summarizes the exemptions available to military personnel in Duval County, Florida:

| Exemption | Amount | Eligibility |

|---|---|---|

| Duval Homestead Exemption | Up to $50,000 | Primary residence, Florida resident, legal or beneficial title |

| Deployment-related exemptions | Varying amounts | Deployed outside of Florida, primary residence |

| Veterans' exemptions | Varying amounts | Eligible veterans, primary residence |

| Disabled veterans' exemptions | Complete exemption | Disabled veterans, primary residence |

Conclusion

The Duval Homestead Exemption is a valuable benefit for military personnel and veterans who own and occupy a primary residence in Duval County, Florida. By understanding the eligibility criteria and application process, military personnel can take advantage of this exemption and reduce their property taxes. Additionally, military personnel may be eligible for other property tax benefits, such as deployment-related exemptions, veterans’ exemptions, and disabled veterans’ exemptions. It is essential for military personnel to consult with the Duval County Property Appraiser’s office to determine their eligibility for these benefits and to ensure they receive the maximum amount of exemptions available to them.

What is the deadline to apply for the Duval Homestead Exemption?

+

The deadline to apply for the Duval Homestead Exemption is March 1 of the tax year.

Can military personnel who are deployed outside of Florida still apply for the Duval Homestead Exemption?

+

Yes, military personnel who are deployed outside of Florida may still be eligible for the Duval Homestead Exemption if they can demonstrate that they intend to return to the property as their primary residence.

What documentation is required to apply for the Duval Homestead Exemption?

+

Required documentation includes proof of residency, proof of property ownership, and proof of military status.