7 Dollar Up Worksheets for Budgeting Success

In today's fast-paced and financially demanding world, managing personal finances can often feel like navigating through a complex maze. However, the concept of budgeting, although simple at its core, can be daunting without the right tools and strategies. Enter 7 Dollar Up Worksheets, an innovative approach designed to simplify budgeting and empower individuals to take control of their financial futures. These worksheets aren't just about tracking expenses; they are crafted to foster a deeper understanding of personal finance, encourage saving, and guide users toward financial freedom.

What Are 7 Dollar Up Worksheets?

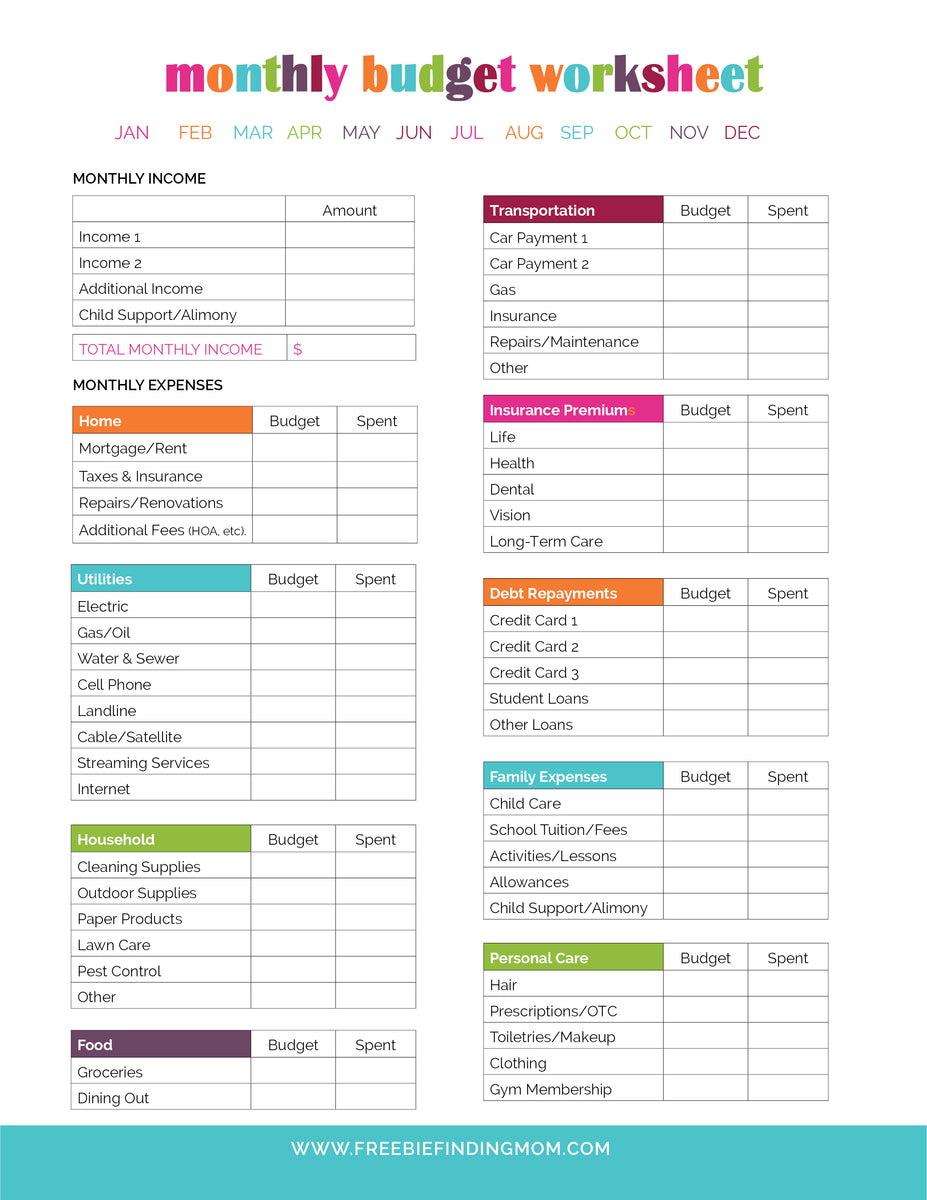

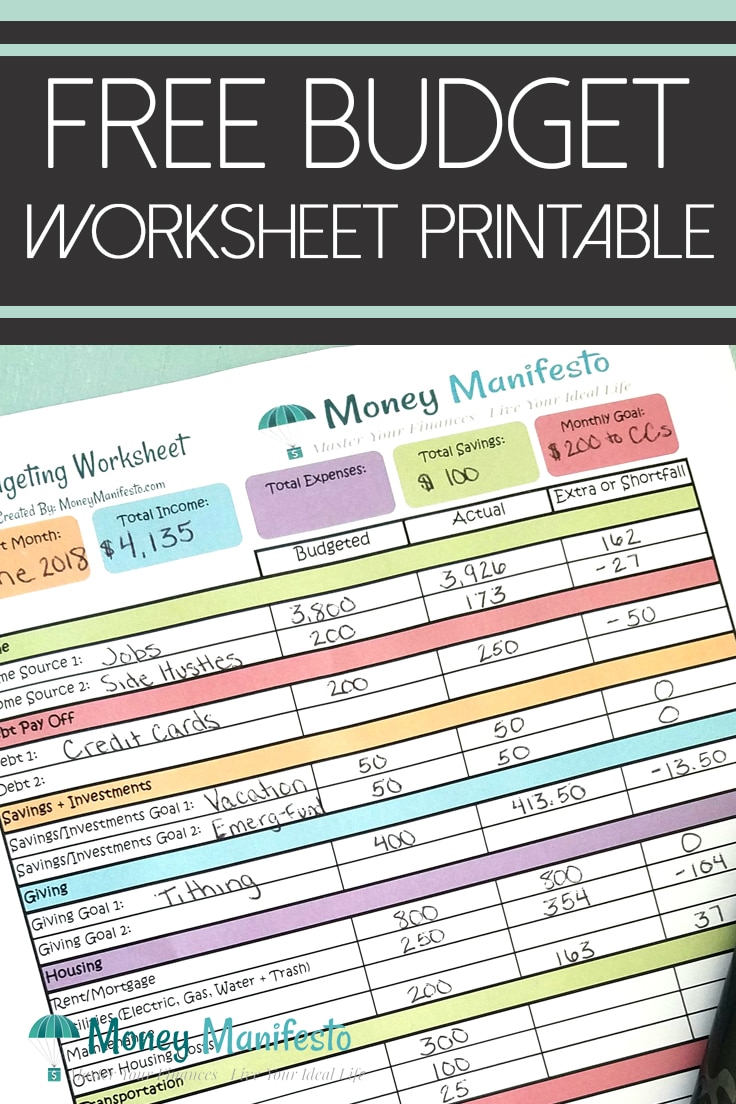

7 Dollar Up Worksheets represent a novel budgeting system where you divide your income into seven categories, each symbolizing a step towards financial stability. Here’s how it works:

- Income: Start by documenting your total income.

- Emergency Fund: Allocate funds to cover unexpected expenses.

- Regular Bills: Utilities, rent/mortgage, and other monthly obligations.

- Transportation: Costs associated with commuting, fuel, or public transit.

- Groceries: Food and household items.

- Discretionary: Entertainment, dining out, and non-essential purchases.

- Savings/Goals: Investments, retirement, or saving for future goals.

How They Help

By breaking down your financial life into these clear segments, 7 Dollar Up Worksheets not only help in tracking where your money goes but also in:

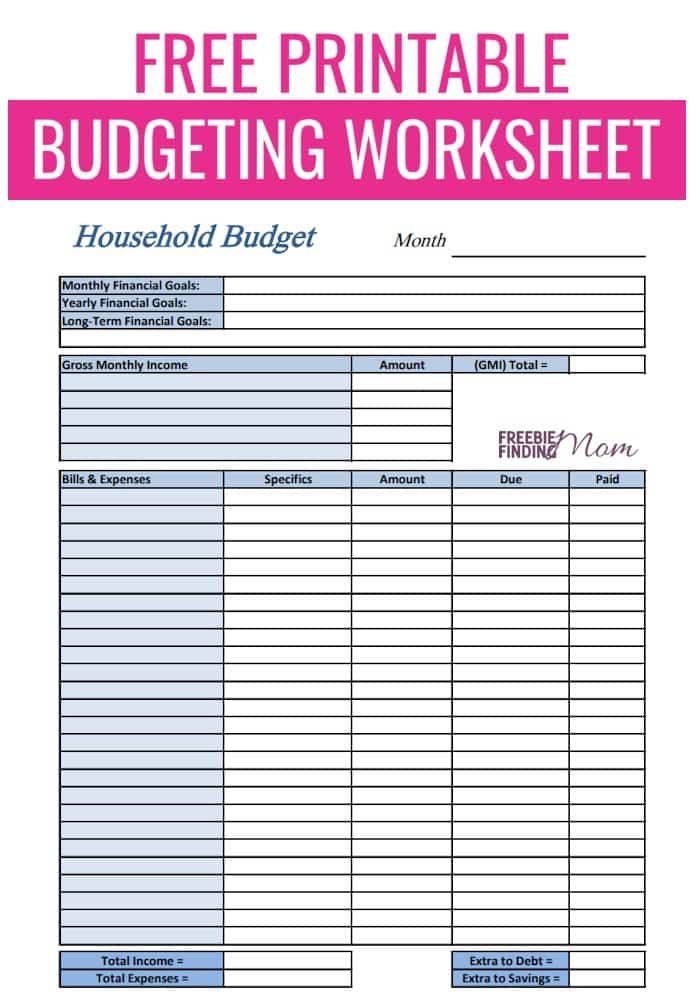

- Setting financial goals.

- Preventing overspending in certain categories.

- Building an emergency cushion.

- Encouraging long-term saving.

Setting Up Your 7 Dollar Up Worksheets

Here’s a step-by-step guide to setting up your own 7 Dollar Up Worksheets:

- Assess Your Income: Write down your after-tax income. This is your starting point for budgeting.

- Determine Your Expenses:

- Emergency Fund: A common rule is to allocate 5-10% for emergencies.

- Regular Bills: This might be around 30-35% of your income, depending on your living situation.

- Transportation: 10-15% if you commute frequently.

- Groceries: Aim for about 10-15% of your income.

- Discretionary: Set limits here to avoid lifestyle creep.

- Savings/Goals: Ideally, 20% should go towards savings or long-term investments.

- Create Your Worksheet:

Category Percentage of Income Monthly Amount Income 100% [Your Income]</td> </tr> <tr> <td>Emergency Fund</td> <td>5-10%</td> <td>[Your Calculation] Regular Bills 30-35% [Your Calculation]</td> </tr> <tr> <td>Transportation</td> <td>10-15%</td> <td>[Your Calculation] Groceries 10-15% [Your Calculation]</td> </tr> <tr> <td>Discretionary</td> <td>5-15%</td> <td>[Your Calculation] Savings/Goals 20% $[Your Calculation]

- Track and Adjust: Regularly review and adjust allocations based on your spending habits and changes in income or expenses.

🚨 Note: Regular review of your 7 Dollar Up Worksheets is crucial. As your financial situation evolves, your budget should too.

Benefits of Using 7 Dollar Up Worksheets

Here are some of the key advantages:

- Visualizes Financial Health: At a glance, you can see how well you’re managing your money.

- Encourages Fiscal Responsibility: Knowing your spending limits for each category promotes mindful spending.

- Promotes Financial Goals: The dedicated ‘Savings/Goals’ section keeps your long-term objectives in sight.

- Reduces Financial Stress: By providing a clear roadmap, these worksheets alleviate the anxiety associated with money management.

Practical Tips for Effective Use

- Automate Savings: Set up automatic transfers to your savings account to ensure you’re saving before spending.

- Review Monthly: Spend time reviewing your worksheet to adapt to changes in income or expenses.

- Include Irregular Expenses: Don’t forget to budget for less frequent expenses like annual subscriptions or quarterly taxes.

- Use Budgeting Software: Apps can help you track expenses in real-time and alert you when you’re nearing your limits.

💡 Note: Pairing your 7 Dollar Up Worksheets with financial education can enhance your budgeting skills.

Overcoming Common Budgeting Challenges

Even with a straightforward system like 7 Dollar Up Worksheets, budgeting can present challenges:

- Overspending: If you find yourself exceeding your discretionary spending, review your habits and consider what adjustments you can make.

- Unforeseen Expenses: Building and regularly contributing to an emergency fund helps manage these.

- Variable Income: For those with irregular incomes, a proactive approach is necessary, estimating the lowest monthly income to ensure all expenses are covered.

👀 Note: Adjusting percentages might be necessary if your financial situation is particularly volatile or unique.

In summary, the 7 Dollar Up Worksheets provide a structured yet flexible approach to budgeting. This method not only helps you understand where your money goes but also encourages financial discipline, promotes saving, and sets a foundation for financial independence. By categorizing your finances into seven manageable areas, you can make informed decisions, leading to a more secure and stress-free financial life. Remember, the key to successful budgeting with these worksheets is regular review, adjustment, and the commitment to your financial goals.

How often should I update my 7 Dollar Up Worksheets?

+

It’s recommended to update your worksheets at least once a month. However, for better control and adaptability, weekly reviews can be beneficial.

Can I adjust the percentages in the 7 Dollar Up Worksheets?

+

Absolutely! The percentages provided are general guidelines. You should tailor them to your income, expenses, and financial goals.

What should I do if my income is variable?

+

Use your lowest expected monthly income to set your budget. When you earn more, you can increase your savings or allocate the extra to other areas.