Food Stamps

Workers Comp and Food Stamps Income

Introduction to Workers Comp and Food Stamps Income

When individuals are injured on the job, they may be eligible for workers’ compensation benefits to help replace their lost income. However, for those who rely on government assistance programs like food stamps, also known as the Supplemental Nutrition Assistance Program (SNAP), the interaction between these benefits can be complex. In this article, we will delve into how workers’ compensation affects food stamps income, exploring the rules, regulations, and potential impacts on eligibility and benefit amounts.

Understanding Workers’ Compensation

Workers’ compensation is a state-mandated insurance program that provides benefits to employees who suffer work-related injuries or illnesses. The primary goal of workers’ compensation is to ensure that injured workers receive necessary medical care and partial wage replacement during their recovery period. The benefits are usually administered by the state and funded by employers through insurance premiums. The amount of workers’ compensation benefits varies by state but typically includes coverage for medical expenses, temporary disability benefits, permanent disability benefits, and death benefits.

Understanding Food Stamps (SNAP)

The Supplemental Nutrition Assistance Program (SNAP), commonly referred to as food stamps, is a federal program designed to help low-income individuals and families purchase food. SNAP benefits are provided through an Electronic Benefits Transfer (EBT) card, which can be used like a debit card to buy eligible food items. Eligibility for SNAP is based on income, resources, and other factors such as household size and composition. The program aims to improve nutrition and health by providing access to nutritious food for those who might otherwise struggle to afford it.

Impact of Workers’ Compensation on Food Stamps Eligibility

The impact of workers’ compensation on food stamps eligibility can vary depending on the specific circumstances of the individual and the rules of their state. Generally, workers’ compensation benefits are considered income for SNAP purposes, which means they can affect eligibility and benefit amounts. However, the treatment of workers’ compensation as income may differ in how it is counted towards the income eligibility limits for SNAP.

- Countable Income: For SNAP, some types of income are not counted when determining eligibility, such as income tax refunds, educational grants, and certain types of government benefits. Workers’ compensation benefits are typically considered countable income, meaning they will be included in the calculation of the household’s gross income.

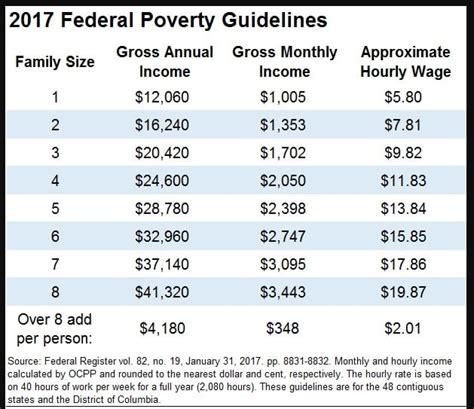

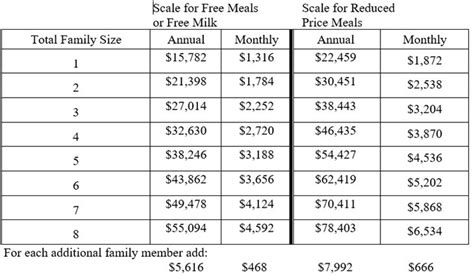

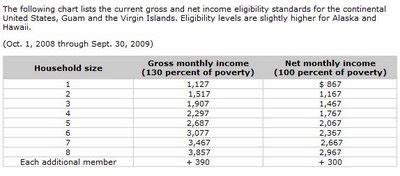

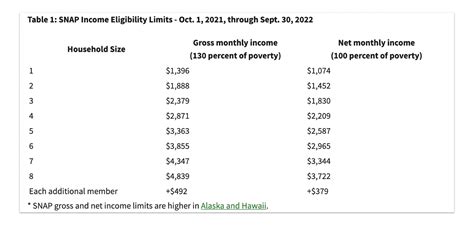

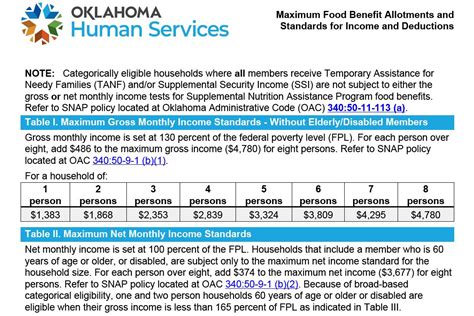

- Gross Income Limits: SNAP eligibility is partly determined by whether the household’s gross income is at or below 130% of the federal poverty guidelines. If workers’ compensation benefits push a household’s gross income above this threshold, the household may not be eligible for SNAP.

- Deductions and Exemptions: There are deductions and exemptions that can reduce the countable income for SNAP eligibility purposes. For example, certain expenses like rent/mortgage, utilities, and child care costs can be deducted from the gross income. Understanding what deductions are available can help households with workers’ compensation income to potentially qualify for SNAP.

Calculating SNAP Benefits with Workers’ Compensation Income

If a household with workers’ compensation income is eligible for SNAP, the next step is to calculate the benefit amount. The calculation involves determining the household’s net income after applying the appropriate deductions and then comparing it to the maximum monthly allotment for the household size.

| Household Size | Maximum Monthly Gross Income | Maximum Monthly Allotment |

|---|---|---|

| 1 | $1,313 | $194 |

| 2 | $1,784 | $357 |

| 3 | $2,255 | $509 |

📝 Note: These figures are examples and may vary based on the federal poverty guidelines and state-specific rules.

Reporting Changes and Maintaining Eligibility

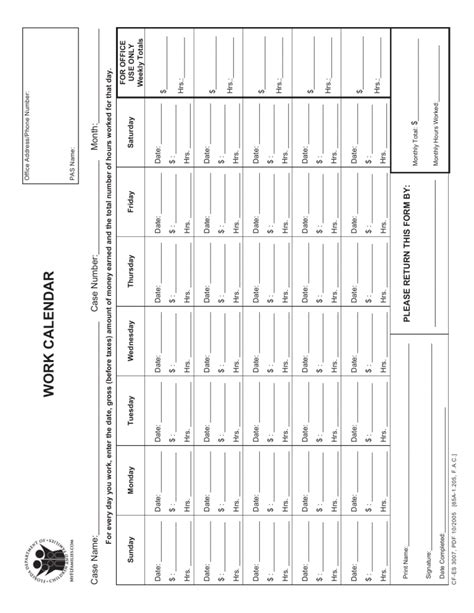

It’s crucial for SNAP recipients to report any changes in their income, including the start or stop of workers’ compensation benefits, to their local SNAP office. Failing to report changes can lead to incorrect benefit amounts, potential overpayment, and even disqualification from the program. Recipients should understand the reporting requirements and timelines in their state to ensure they comply with SNAP regulations.

Conclusion and Key Points

The interaction between workers’ compensation and food stamps income is intricate, with workers’ compensation benefits generally considered as countable income for SNAP eligibility purposes. Understanding how these benefits affect gross income, eligibility, and benefit amounts is essential for households relying on both workers’ compensation and SNAP. Key points to remember include the importance of reporting changes in income, the potential impact of workers’ compensation on SNAP eligibility, and the role of deductions in calculating net income for benefit purposes.

How does workers’ compensation affect food stamps eligibility?

+

Workers’ compensation benefits are considered income for SNAP purposes and can affect eligibility and benefit amounts by potentially increasing the household’s gross income above the eligibility threshold.

What deductions can be made from income when calculating SNAP benefits?

+

Examples of deductions include a standard deduction, dependent care costs, shelter costs (such as rent or mortgage and utilities), and in some cases, medical expenses for disabled household members.

Why is it important to report changes in income to the SNAP office?

+

Reporting changes, such as the start or stop of workers’ compensation benefits, is crucial to ensure correct benefit amounts and to avoid potential overpayment or disqualification from the program.