5 Ways Pension Inflates

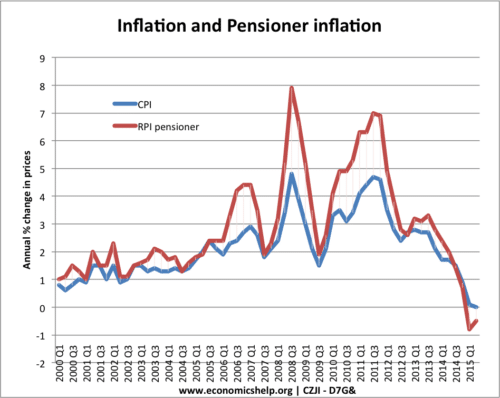

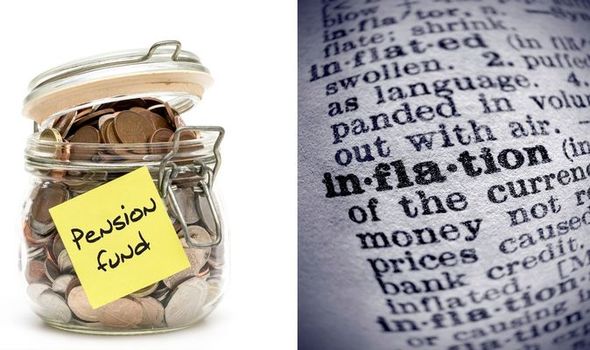

Introduction to Pension Inflation

Pension inflation refers to the increase in the cost of living that affects the purchasing power of pensioners. It is a critical factor in ensuring that retirees can maintain their standard of living throughout their retirement. There are several ways in which pension inflation can impact retirees, and understanding these factors is essential for effective retirement planning. In this article, we will explore five ways in which pension inflation can affect retirees and discuss strategies for mitigating its impact.

1. Reduction in Purchasing Power

One of the primary ways in which pension inflation affects retirees is by reducing their purchasing power. As prices rise, the same amount of money can buy fewer goods and services, effectively reducing the retiree’s standard of living. This can be particularly challenging for retirees who are living on a fixed income, as they may not have the ability to increase their earnings to keep pace with inflation. For example, if a retiree is receiving a pension of 50,000 per year, and inflation is running at 3%, their purchasing power will be reduced by 1,500 per year.

2. Increased Cost of Living

Pension inflation can also lead to an increased cost of living for retirees. As prices rise, retirees may need to pay more for essential goods and services, such as housing, food, and healthcare. This can be particularly challenging for retirees who are living on a fixed income, as they may not have the ability to increase their earnings to keep pace with inflation. For instance, if a retiree is paying 1,000 per month for rent, and their landlord increases the rent by 5% due to inflation, the retiree will need to pay an additional 50 per month.

3. Impact on Retirement Savings

Pension inflation can also impact retirement savings. If inflation is high, the value of retirement savings may be reduced over time, as the purchasing power of the savings is eroded. This can be particularly challenging for retirees who are relying on their retirement savings to support them throughout their retirement. For example, if a retiree has saved 500,000 for retirement, and inflation is running at 4%, the purchasing power of their savings will be reduced by 20,000 per year.

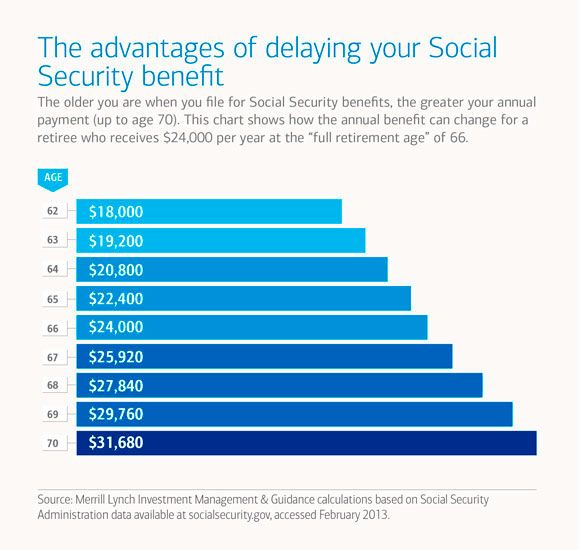

4. Effect on Annuities and Other Retirement Income

Pension inflation can also affect annuities and other retirement income. If inflation is high, the value of annuity payments may be reduced over time, as the purchasing power of the payments is eroded. This can be particularly challenging for retirees who are relying on annuities to provide a guaranteed income stream throughout their retirement. For instance, if a retiree is receiving an annuity payment of 2,000 per month, and inflation is running at 3%, the purchasing power of their annuity payment will be reduced by 60 per month.

5. Impact on Healthcare Costs

Finally, pension inflation can also impact healthcare costs. As prices rise, the cost of healthcare services may increase, making it more challenging for retirees to access the care they need. This can be particularly challenging for retirees who are living on a fixed income, as they may not have the ability to increase their earnings to keep pace with inflation. For example, if a retiree is paying 500 per month for health insurance, and the cost of healthcare services increases by 5% due to inflation, the retiree will need to pay an additional 25 per month.

| Year | Inflation Rate | Purchasing Power |

|---|---|---|

| 2020 | 2% | $50,000 |

| 2021 | 3% | $48,500 |

| 2022 | 4% | $46,800 |

💡 Note: The table above illustrates the impact of inflation on purchasing power over time. As inflation increases, the purchasing power of the retiree's income is reduced.

In terms of strategies for mitigating the impact of pension inflation, there are several options available. One approach is to invest in assets that historically perform well during periods of high inflation, such as precious metals or real estate. Another approach is to consider purchasing an inflation-indexed annuity, which can provide a guaranteed income stream that increases over time to keep pace with inflation. Retirees can also consider working with a financial advisor to develop a comprehensive retirement plan that takes into account the potential impact of inflation.

In final consideration, pension inflation is a critical factor that can impact the standard of living of retirees. Understanding the ways in which pension inflation can affect retirees is essential for effective retirement planning. By developing strategies to mitigate the impact of inflation, retirees can help ensure that they are able to maintain their standard of living throughout their retirement.

What is pension inflation?

+

Pension inflation refers to the increase in the cost of living that affects the purchasing power of pensioners.

How can pension inflation impact retirees?

+

Pension inflation can impact retirees by reducing their purchasing power, increasing the cost of living, impacting retirement savings, affecting annuities and other retirement income, and increasing healthcare costs.

What are some strategies for mitigating the impact of pension inflation?

+

Some strategies for mitigating the impact of pension inflation include investing in assets that historically perform well during periods of high inflation, considering purchasing an inflation-indexed annuity, and working with a financial advisor to develop a comprehensive retirement plan.