Section 8 Counts Food Stamps As Income

Understanding the Implications of Section 8 on Food Stamps

When it comes to government assistance programs, there are numerous factors to consider, especially regarding how different forms of aid interact with one another. For individuals and families relying on these programs, understanding the rules and regulations is crucial for managing their benefits effectively. One critical area of consideration is how Section 8 housing assistance affects eligibility for food stamps, now known under the Supplemental Nutrition Assistance Program (SNAP).

What is Section 8?

Section 8, also known as the Housing Choice Voucher (HCV) program, is a federal program designed to help low-income families, the elderly, and the disabled afford decent, safe, and sanitary housing in the private market. It operates under the U.S. Department of Housing and Urban Development (HUD) and provides rental assistance to qualified applicants. This assistance allows participants to choose from a variety of housing options, including single-family homes, townhouses, and apartments, as long as the housing meets the program’s requirements.

What are Food Stamps (SNAP)?

The Supplemental Nutrition Assistance Program (SNAP), formerly known as the Food Stamp Program, is a U.S. government initiative that provides food assistance to eligible, low-income individuals and families. SNAP is administered by the U.S. Department of Agriculture (USDA) and operates through state and local agencies. The program aims to provide nutrition assistance to those most in need, helping to ensure they have access to a healthy diet.

How Does Section 8 Affect Food Stamps (SNAP) Eligibility?

The primary concern for those receiving Section 8 housing assistance is how this benefit impacts their eligibility for SNAP. Generally, when calculating income for SNAP eligibility, certain types of income are excluded. However, the rules can be complex, and the impact of Section 8 benefits on SNAP eligibility depends on several factors, including the specific regulations of the state in which the individual or family resides.

In most cases, the rental assistance received through Section 8 is not considered income for the purpose of determining SNAP eligibility. This is because the benefit is specifically designated for housing costs and does not directly increase the monetary income available for food or other expenses. Nonetheless, the calculation of income for SNAP purposes can be intricate, involving considerations of gross income, deductions, and exclusions.

Key Factors to Consider

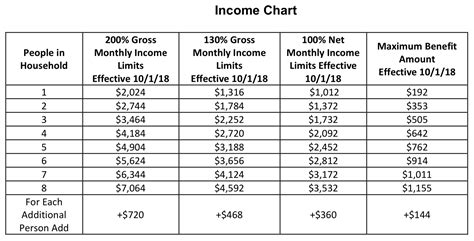

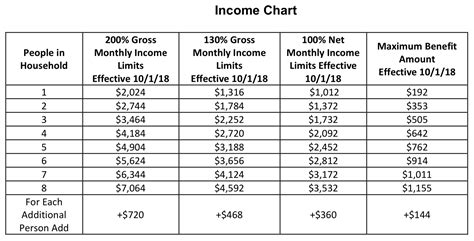

When assessing how Section 8 affects SNAP eligibility, the following points are crucial: - Income Calculation: For SNAP, income includes both earned income (from jobs) and unearned income (from sources like Social Security or cash assistance). Section 8 benefits, being a form of rental assistance, typically fall outside these categories. - Deductions and Exclusions: Certain deductions, such as a standard deduction for all households and deductions for specific expenses like childcare costs or medical expenses for the elderly or disabled, can reduce the countable income for SNAP eligibility. The treatment of Section 8 benefits in this context is primarily as an exclusion, not directly impacting the income used for SNAP calculations. - State Variations: While federal guidelines provide a framework, states have some flexibility in implementing SNAP. This means that the exact impact of Section 8 on SNAP eligibility can vary by state, with different states potentially handling the interaction between these programs slightly differently.

Steps to Determine SNAP Eligibility with Section 8

For individuals or families receiving Section 8 who are interested in applying for SNAP, the following steps can help guide the process: - Gather Necessary Documents: This includes proof of identity, residency, income, and expenses. Since Section 8 benefits are not considered income, documentation related to these benefits will be more about verifying housing costs. - Calculate Gross Income: Add up all income from jobs and other sources. Remember, Section 8 is not included in this calculation. - Apply Deductions: Subtract applicable deductions from gross income to arrive at net income, which is used for SNAP eligibility determination. - Check State-Specific Rules: Understand how your state handles the interaction between Section 8 and SNAP, as there may be specific guidelines or considerations.

📝 Note: The interaction between government assistance programs can be complex. It's always a good idea to consult directly with local SNAP or Section 8 offices for personalized guidance, as individual circumstances can affect eligibility and benefit amounts.

Importance of Accurate Information

Given the complexity of these programs and their interactions, it’s vital to seek accurate and up-to-date information. Both SNAP and Section 8 are designed to provide critical support to those in need, and understanding how they work together can help individuals and families access the assistance they require.

In essence, while Section 8 housing assistance can impact the overall financial situation of recipients, it does not directly count as income for SNAP purposes. By grasping the nuances of how these programs interact, individuals can better navigate the system and ensure they are receiving all the assistance for which they are eligible.

To summarize the key points, understanding the implications of Section 8 on food stamps involves recognizing that Section 8 benefits are generally not considered income for SNAP eligibility purposes, the importance of accurately calculating income and deductions, and the potential for state-specific variations in how these programs interact. By following the steps outlined and seeking personalized guidance, individuals can effectively manage their benefits and access the support they need.

Do Section 8 benefits count as income for SNAP eligibility?

+

Generally, no. Section 8 benefits are not considered income for the purpose of determining SNAP eligibility because they are specifically designated for housing costs.

How do I apply for SNAP if I am receiving Section 8 assistance?

+

To apply for SNAP, gather necessary documents, calculate your gross income excluding Section 8 benefits, apply deductions, and check state-specific rules. It’s recommended to consult with local SNAP or Section 8 offices for personalized guidance.

Can I receive both Section 8 and SNAP benefits simultaneously?

+

Yes, it is possible to receive both Section 8 and SNAP benefits at the same time, as they serve different needs—housing and nutrition assistance, respectively. Eligibility for one program does not automatically affect eligibility for the other, though overall income and family size are considerations for both.