Max Out TSP Contributions

Introduction to TSP Contributions

The Thrift Savings Plan (TSP) is a retirement savings plan for federal employees and members of the uniformed services. It offers a range of investment options and provides a way for participants to save for their retirement on a tax-deferred basis. One of the key benefits of the TSP is the ability to make contributions, which can help participants maximize their retirement savings. In this article, we will explore the importance of maxing out TSP contributions and provide guidance on how to do so.

Benefits of Maxing Out TSP Contributions

Maxing out TSP contributions can have a significant impact on a participant’s retirement savings. Some of the benefits of maxing out TSP contributions include: * Increased retirement savings: Contributing the maximum amount to the TSP can help participants build a larger retirement nest egg. * Tax benefits: TSP contributions are made on a tax-deferred basis, which means that participants do not have to pay taxes on the contributions until they withdraw the funds in retirement. * Compound interest: The earlier participants start contributing to the TSP, the more time their money has to grow through compound interest. * Employer matching contributions: Many federal agencies and uniformed services offer employer matching contributions to the TSP, which can help participants boost their retirement savings.

How to Max Out TSP Contributions

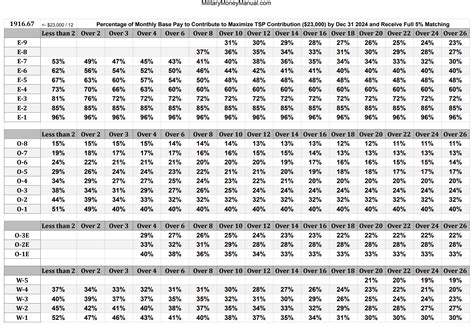

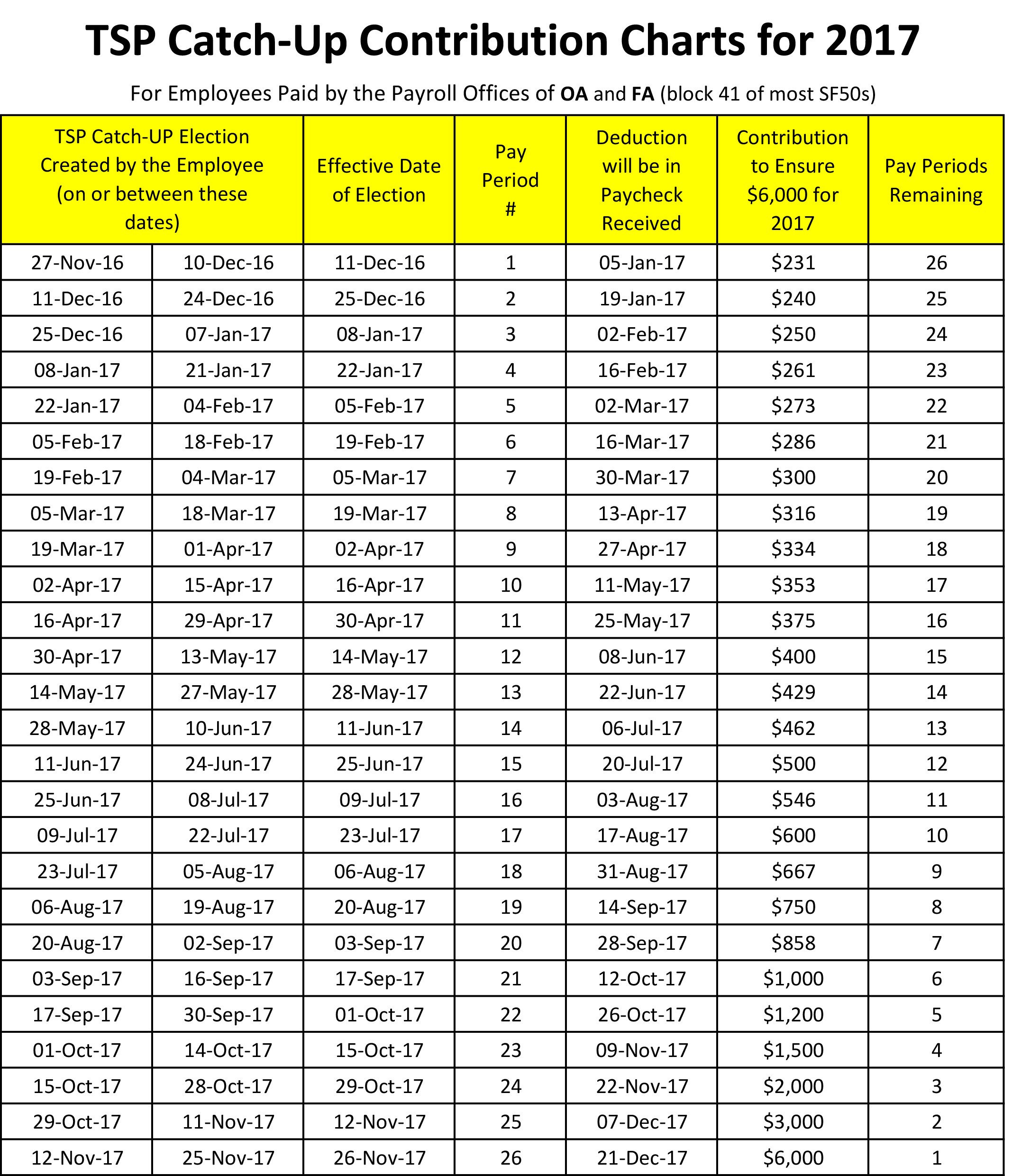

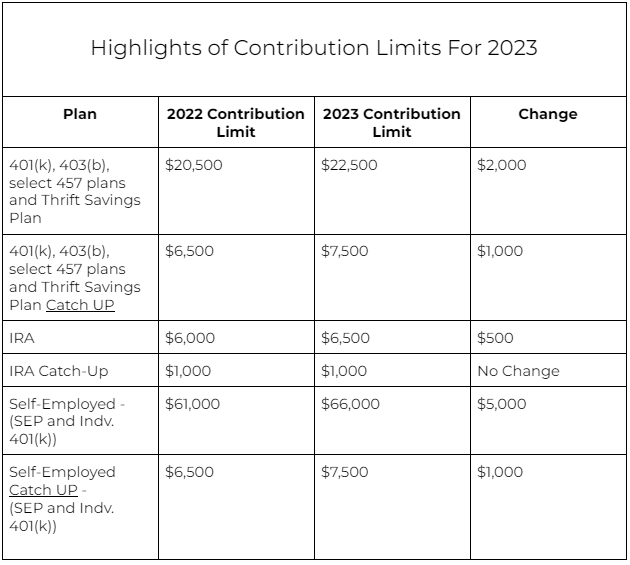

To max out TSP contributions, participants need to contribute the maximum amount allowed by the IRS each year. The maximum contribution limit for the TSP is 19,500 in 2022, and participants who are 50 or older can contribute an additional 6,500 in catch-up contributions. Here are the steps to max out TSP contributions: * Determine the maximum contribution limit: Check the IRS website to determine the maximum contribution limit for the current year. * Calculate the monthly contribution amount: Divide the maximum contribution limit by 12 to determine the monthly contribution amount. * Set up automatic contributions: Set up automatic contributions from your paycheck to ensure that you contribute the maximum amount each month. * Monitor and adjust contributions: Monitor your contributions throughout the year and adjust as needed to ensure that you max out your contributions.

TSP Contribution Limits

The TSP contribution limits are as follows:

| Year | Maximum Contribution Limit | Catch-up Contribution Limit |

|---|---|---|

| 2022 | 19,500</td> <td>6,500 | |

| 2021 | 19,500</td> <td>6,500 | |

| 2020 | 19,500</td> <td>6,500 |

💡 Note: The TSP contribution limits are subject to change each year, so it's essential to check the IRS website for the latest information.

Common Mistakes to Avoid

When maxing out TSP contributions, there are some common mistakes to avoid: * Not starting early enough: The earlier you start contributing to the TSP, the more time your money has to grow. * Not contributing enough: Contributing too little to the TSP can limit the growth of your retirement savings. * Not taking advantage of employer matching contributions: Failing to contribute enough to the TSP to maximize employer matching contributions can result in missed opportunities for retirement savings.

To sum it all up, maxing out TSP contributions is a great way to build a secure retirement nest egg. By understanding the benefits of maxing out TSP contributions, following the steps to max out contributions, and avoiding common mistakes, participants can make the most of their TSP and achieve their retirement goals.

What is the maximum contribution limit for the TSP in 2022?

+

The maximum contribution limit for the TSP in 2022 is 19,500, and participants who are 50 or older can contribute an additional 6,500 in catch-up contributions.

How do I set up automatic contributions to the TSP?

+

To set up automatic contributions to the TSP, log in to your TSP account and follow the prompts to set up automatic contributions from your paycheck.

What are the benefits of maxing out TSP contributions?

+

The benefits of maxing out TSP contributions include increased retirement savings, tax benefits, compound interest, and employer matching contributions.