Food Stamps

Foster Care Payments Count as Income

Introduction to Foster Care Payments

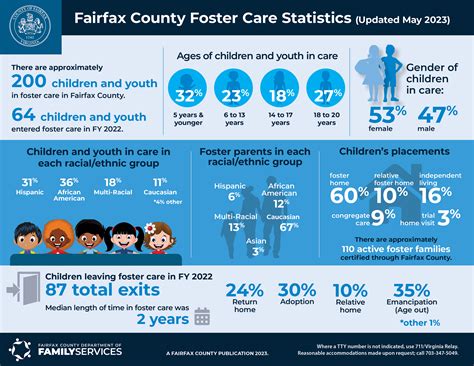

Foster care payments are a type of financial support provided to individuals or families who take in and care for children who are unable to live with their biological parents. These payments are designed to help cover the costs of caring for the child, including food, clothing, shelter, and other necessities. However, the question of whether foster care payments count as income is a complex one, and the answer can vary depending on the context and the specific laws and regulations in place.

Understanding Foster Care Payments

Foster care payments are typically made by the government or a private agency to the foster care provider, who is responsible for the daily care and well-being of the child. These payments can be made on a monthly or weekly basis, and the amount of the payment can vary depending on the age and needs of the child, as well as the location and cost of living in the area. In general, foster care payments are intended to help offset the costs of caring for the child, but they may not be enough to cover all of the expenses associated with providing care.

Tax Implications of Foster Care Payments

When it comes to taxes, foster care payments are generally not considered to be taxable income. This means that the foster care provider does not have to report the payments as income on their tax return, and they are not subject to income tax on the payments. However, there may be some exceptions to this rule, and it’s always a good idea to consult with a tax professional to determine how foster care payments will be treated for tax purposes.

Impact on Government Benefits

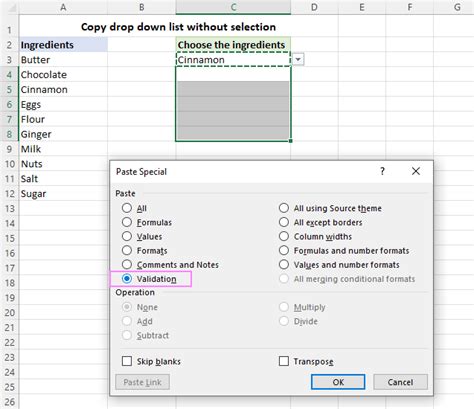

Foster care payments can also have an impact on government benefits, such as food stamps or Medicaid. In some cases, foster care payments may be considered to be income for the purposes of determining eligibility for these benefits. This means that the foster care provider may be required to report the payments as income when applying for or recertifying for government benefits. However, the specific rules and regulations regarding foster care payments and government benefits can vary depending on the state and the specific benefit program.

Examples of How Foster Care Payments Can Affect Income

Here are a few examples of how foster care payments can affect income: * Foster care payments may be considered income for the purposes of determining eligibility for government benefits, such as food stamps or Medicaid. * Foster care payments may not be considered income for tax purposes, but they may still be subject to reporting requirements. * Foster care payments can impact the amount of child support that is owed or received. * Foster care payments can also impact the amount of alimony that is owed or received.

📝 Note: It's always a good idea to consult with a financial advisor or tax professional to determine how foster care payments will affect your specific situation.

Table of Foster Care Payment Examples

| Example | Payment Amount | Tax Implications | Impact on Government Benefits |

|---|---|---|---|

| Monthly foster care payment for one child | 900</td> <td>Not taxable</td> <td>May be considered income for government benefits</td> </tr> <tr> <td>Weekly foster care payment for two children</td> <td>200 | Not taxable | May be considered income for government benefits |

| Annual foster care payment for three children | $10,000 | Not taxable | May be considered income for government benefits |

Conclusion and Final Thoughts

In conclusion, foster care payments can have a significant impact on the financial situation of the foster care provider, and it’s essential to understand how these payments will be treated for tax purposes and how they may affect government benefits. By consulting with a financial advisor or tax professional, foster care providers can ensure that they are in compliance with all applicable laws and regulations and that they are taking advantage of all available tax benefits. Ultimately, the goal of foster care payments is to provide support to individuals and families who are caring for children in need, and by understanding the intricacies of these payments, we can work to create a more supportive and sustainable system for all.

Are foster care payments considered taxable income?

+

No, foster care payments are generally not considered to be taxable income.

Can foster care payments affect government benefits?

+

Yes, foster care payments may be considered income for the purposes of determining eligibility for government benefits, such as food stamps or Medicaid.

How do foster care payments impact child support or alimony?

+

Foster care payments can impact the amount of child support or alimony that is owed or received, and it’s essential to consult with a financial advisor or attorney to determine the specific impact in your situation.