5 Delaware Paycheck Tips

Understanding Delaware Paycheck Laws

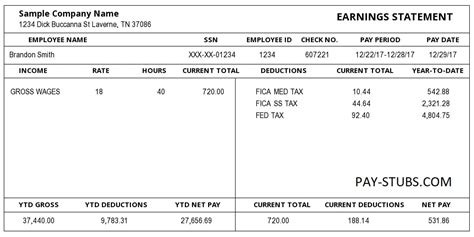

Delaware paycheck laws are designed to protect employees from unfair labor practices, ensuring they receive their rightful earnings. To navigate the complexities of Delaware payroll, it’s essential to understand the state’s specific regulations. Gross income, deductions, and tax withholdings are critical components of payroll processing. Delaware employers must adhere to these laws to avoid penalties and maintain a positive working relationship with their employees.

Delaware Paycheck Tips

Here are five crucial tips to consider when dealing with paychecks in Delaware: * Tip 1: Verify Pay Frequency - Delaware law requires employers to pay employees at least once a month, but the pay frequency may vary depending on the employment contract or company policy. It’s essential to confirm the pay schedule to avoid misunderstandings. * Tip 2: Calculate Gross Income - Gross income includes all earnings before deductions, such as salaries, wages, bonuses, and commissions. Accurate calculation of gross income is vital to determine the correct amount of tax withholdings and deductions. * Tip 3: Understand Deductions - Delaware law allows for various deductions, including tax withholdings, health insurance premiums, and retirement plan contributions. Employers must ensure that deductions are lawful and authorized by the employee. * Tip 4: Familiarize Yourself with Tax Withholdings - Delaware has a progressive tax system, with tax rates ranging from 0% to 5.95%. Employers must withhold the correct amount of state and federal taxes from employee wages, taking into account exemptions and tax credits. * Tip 5: Maintain Accurate Payroll Records - Delaware employers are required to maintain accurate and detailed payroll records, including employee information, pay rates, hours worked, and deductions. These records must be kept for a minimum of three years and be readily available for inspection by state authorities.

Delaware Paycheck Laws and Regulations

Delaware has specific laws and regulations governing paychecks, including:

| Law/Regulation | Description |

|---|---|

| Delaware Minimum Wage Law | Requires employers to pay employees a minimum wage of $9.25 per hour |

| Delaware Wage Payment Law | Regulates the payment of wages, including the frequency and method of payment |

| Delaware Tax Withholding Law | Requires employers to withhold state and federal taxes from employee wages |

📝 Note: Employers must comply with all applicable laws and regulations to avoid penalties and fines.

Importance of Compliance

Compliance with Delaware paycheck laws is crucial to avoid penalties, fines, and lawsuits. Employers must ensure that they are adhering to all relevant laws and regulations, including those related to minimum wage, overtime pay, and tax withholdings. Failure to comply can result in severe consequences, including damage to the company’s reputation and financial stability.

In summary, understanding Delaware paycheck laws and regulations is essential for employers to ensure compliance and avoid potential issues. By following the five tips outlined above and maintaining accurate payroll records, employers can protect themselves and their employees from unfair labor practices and ensure a positive working relationship.

What is the minimum wage in Delaware?

+

The minimum wage in Delaware is $9.25 per hour.

How often must employers pay employees in Delaware?

+

Delaware law requires employers to pay employees at least once a month.

What is the purpose of maintaining accurate payroll records in Delaware?

+

Maintaining accurate payroll records is essential to ensure compliance with Delaware laws and regulations, as well as to protect employers and employees from potential disputes and lawsuits.