Master Debt with Our Stacking Worksheet Guide

Are you tired of living paycheck to paycheck, with credit card bills, student loans, and other personal debts piling up? Understanding how to manage your debt effectively can feel like a mountain to climb, but with our stacking worksheet guide, you can master this art one step at a time. Let's dive into a comprehensive debt management strategy that will not only help you regain control but also pave the way towards financial freedom.

The Importance of Debt Management

Managing your debt is crucial not just for your peace of mind but also for your overall financial health. Here’s why:

- Reduces stress: Knowing how and when you’ll pay off your debts can significantly reduce financial stress.

- Improves credit score: Timely payments and managing debts positively impact your credit score.

- Saves money: Paying off debts faster can save you from paying high interest rates over time.

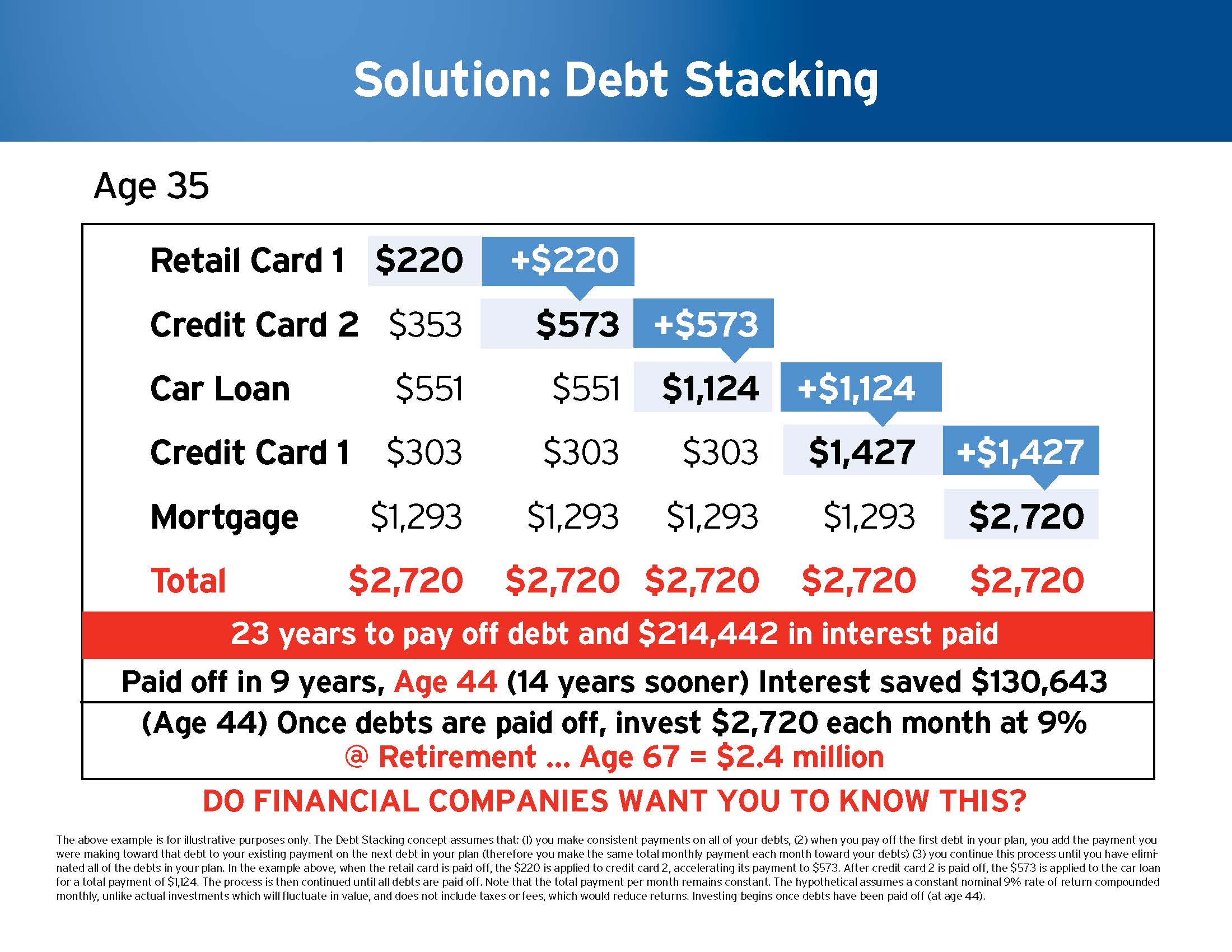

What is Debt Stacking?

Debt stacking, sometimes called the debt snowball or debt avalanche method, involves paying off debts in a specific order:

- By Balance (Debt Snowball): Start with the smallest debt to the largest.

- By Interest Rate (Debt Avalanche): Focus on the highest interest rate debt first.

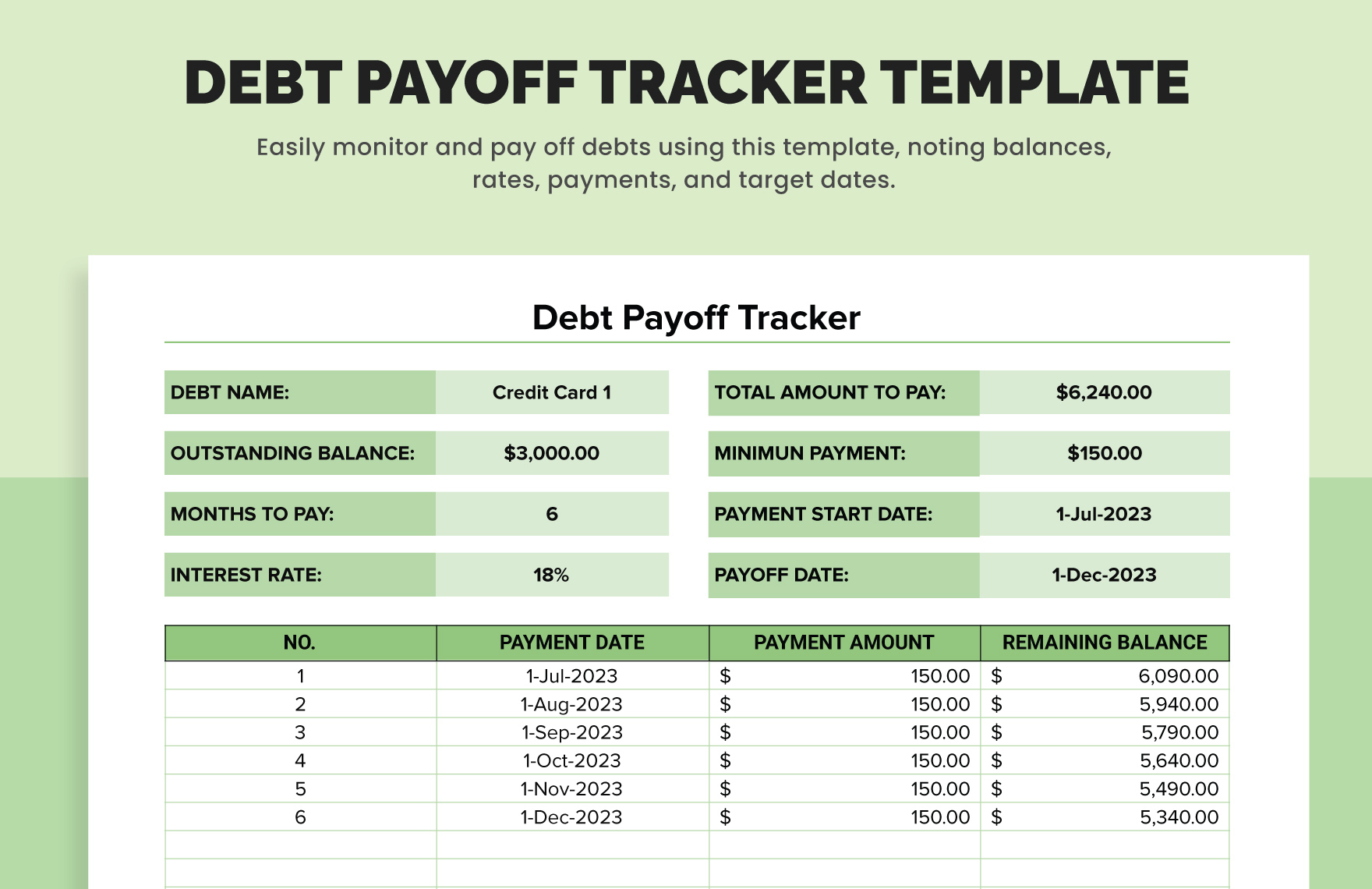

How to Use Our Debt Stacking Worksheet

Our debt stacking worksheet is designed to simplify your journey toward debt-free living. Here’s how you can leverage it:

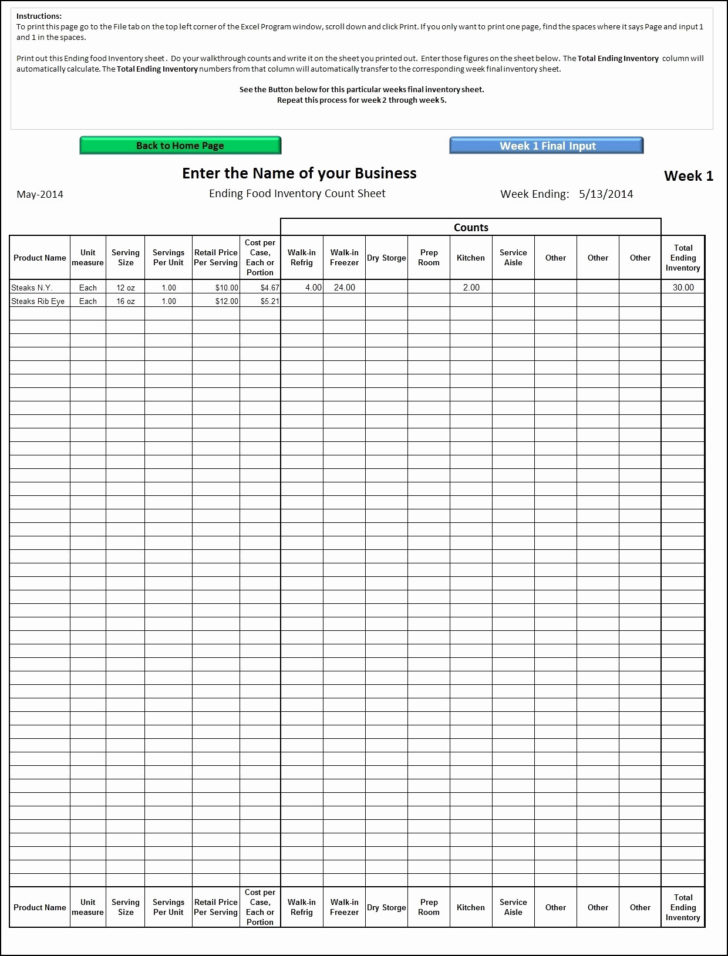

Step 1: Compile Your Debt List

Begin by listing all your debts:

| Debt Type | Balance | Interest Rate | Minimum Payment |

|---|---|---|---|

| Credit Card | 5,000</td> <td>18%</td> <td>100 | ||

| Student Loan | 30,000</td> <td>6%</td> <td>350 | ||

| Car Loan | 10,000</td> <td>5%</td> <td>250 |

🔹 Note: Only include secured loans like mortgages if you feel comfortable paying them off early, considering potential penalties or changes in cash flow.

Step 2: Choose Your Strategy

Decide whether you’ll go with the snowball or avalanche method. Here’s a quick comparison:

- Snowball: More motivational as you see results quickly.

- Avalanche: Mathematically optimal for saving on interest.

Step 3: Set Your Budget

Create a budget that includes:

- The minimum payment for all debts.

- An extra amount to pay on your priority debt (the highest interest or smallest balance, depending on your strategy).

Step 4: Apply the Stacking Method

Here’s how to stack your debt payments:

- Pay the minimum on all other debts.

- Apply all extra funds to the debt you’re focusing on.

- Once a debt is paid off, add that payment to the next debt on your list.

- Repeat until all debts are cleared.

🔹 Note: Keep a small emergency fund to avoid backsliding into debt due to unexpected expenses.

Step 5: Track Your Progress

Regularly update your worksheet to track progress:

- Balances paid off

- Interest saved

- Total debt reduction

Step 6: Celebrate Milestones

As you pay off each debt, celebrate this victory. It not only boosts morale but also reinforces your financial discipline.

Final Thoughts

By meticulously following this guide, you’re not just managing your debt; you’re mastering it. Each step you take towards reducing your debt empowers you financially and emotionally. Remember, the journey to being debt-free is not just about paying off what you owe; it’s about developing habits that will keep you financially sound for life. Use our worksheet, adjust your strategy as you see fit, and keep moving forward with the confidence that comes from being in control of your financial destiny.

What if I miss a payment?

+

If you miss a payment, catch up as soon as possible to avoid penalties and credit score impact. Consider contacting your creditor to discuss payment options.

Should I focus on one debt at a time?

+

Yes, for the stacking method, focusing on one debt at a time (either by balance or by interest rate) is typically more effective. However, always pay the minimums on all your debts to avoid issues.

How often should I update my debt stacking worksheet?

+

Monthly updates are often sufficient, but if you’ve made significant payments or your financial situation changes, update it accordingly.