5 Free Dave Ramsey Worksheets for Financial Success

Embarking on the journey towards financial freedom is both exhilarating and intimidating. It's a path that requires knowledge, discipline, and the right tools to succeed. Dave Ramsey, a household name in personal finance, has crafted an array of worksheets designed to streamline your budgeting, debt management, and more. Here are five free Dave Ramsey worksheets that can serve as your roadmap to financial success.

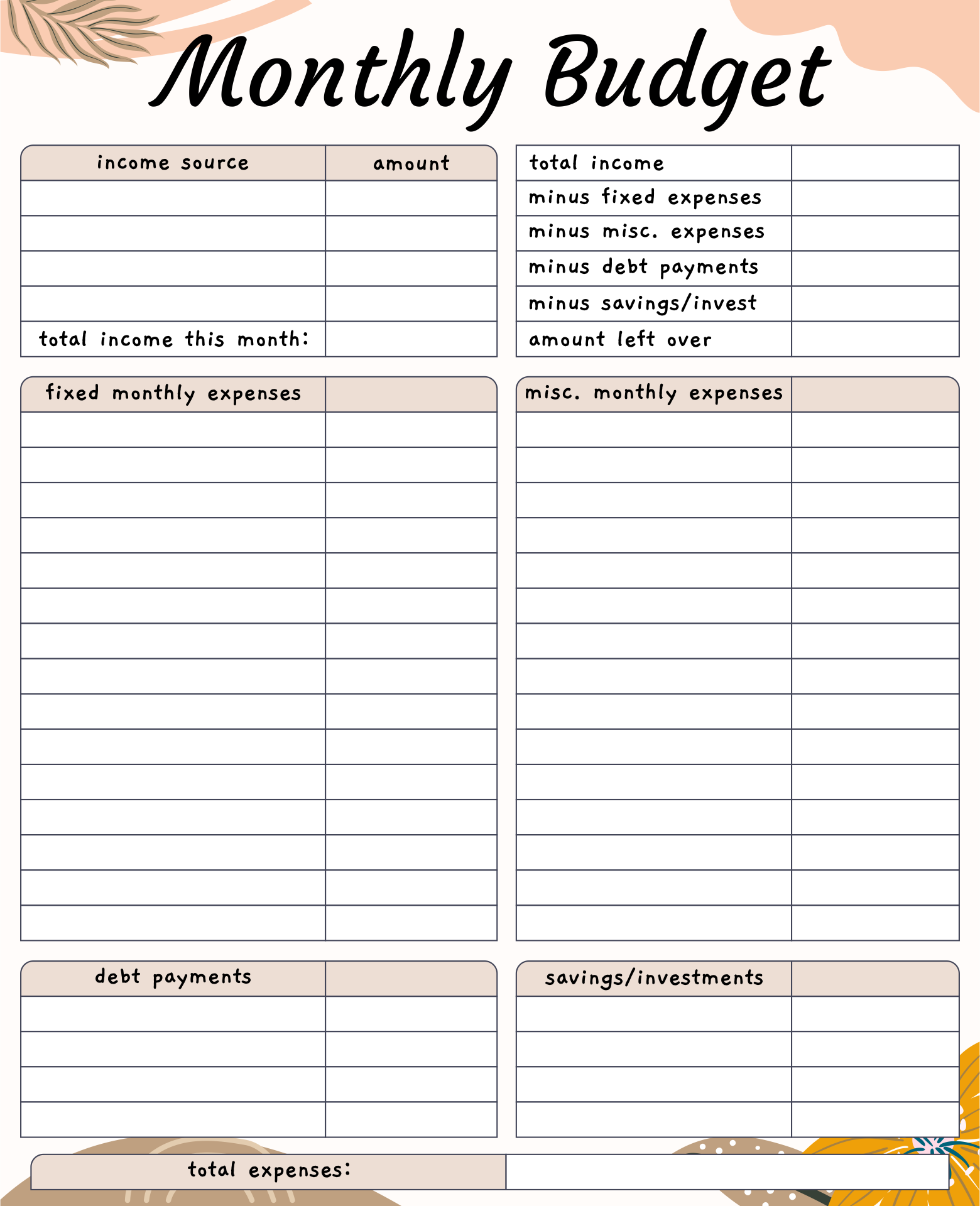

The Budget Worksheet

Starting with the cornerstone of financial success—budgeting—Dave Ramsey's Budget Worksheet simplifies what many find to be an overwhelming process. Here's how to use it effectively:

- Income: List all sources of income after taxes. If you're uncertain about which expenses to prioritize, Ramsey suggests applying the "Four Walls" principle (food, utilities, shelter, transportation).

- Expenses: Divide your expenses into categories such as housing, food, transportation, and entertainment. Use bullet points to keep things organized.

- Savings Goals: Set specific, measurable savings goals to keep your motivation high.

💡 Note: If you're employing software or an app, ensure it allows you to input custom categories as the Dave Ramsey Budget Worksheet does.

Debt Snowball Worksheet

If debt is your biggest hurdle, the Debt Snowball Worksheet is your ally. Here's how to follow Dave Ramsey's debt elimination strategy:

- List all your debts from the smallest to the largest balance, regardless of interest rates.

- Make minimum payments on all but the smallest debt, putting every extra cent into paying off the smallest debt first.

- Once the smallest debt is paid off, use the money you were paying on it to snowball into the next smallest debt.

This approach provides a psychological boost as you see debts being knocked off quickly, encouraging you to stay on track.

Retirement Planning Worksheet

Planning for retirement is crucial, and Dave Ramsey's worksheet assists in understanding where you stand and what you need to do to reach your retirement goals:

- Assess your current financial situation.

- Set retirement income goals and calculate how much you need to save monthly to achieve these.

- Estimate potential retirement income sources like Social Security, pensions, or investments.

| Age | Retirement Age | Annual Retirement Goal | Monthly Savings |

|---|---|---|---|

| 30 | 67 | $60,000 | $500 |

| 40 | 67 | $60,000 | $1,000 |

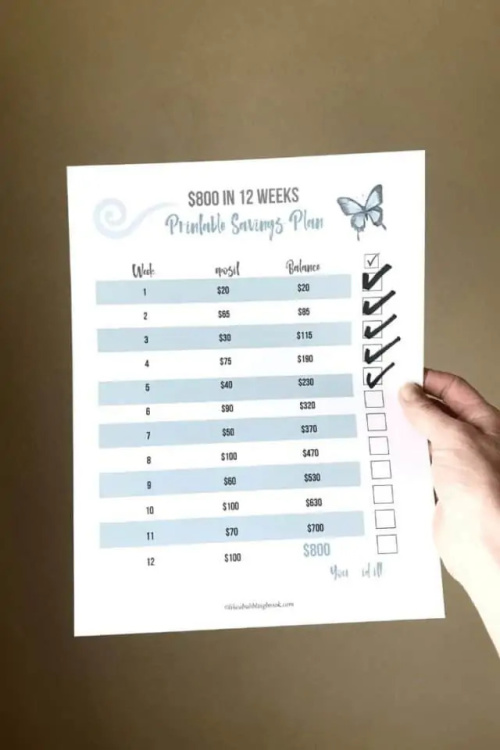

The Allocated Spending Plan

This worksheet guides you in the Zero-Based Budget approach, where every dollar has a purpose:

- List your income at the top.

- List your expenses in categories. Allocate funds from your income until you reach zero.

- Track spending for each category to ensure you stick to your plan.

📌 Note: Remember that this method requires meticulous tracking and adjustments to your plan as your expenses change.

The Pro Rata Plan Worksheet

If you're behind on several bills, this worksheet can help prioritize which bills to pay with limited funds:

- List: Write down all bills with their amounts due and past due dates.

- Amount Paid: Allocate funds proportionally based on the percentage of each debt's total amount to your total debt.

- Update: Reevaluate your financial situation monthly to adjust payments if necessary.

By summarizing the key elements of Dave Ramsey’s financial strategies, these free worksheets become invaluable tools for achieving financial independence. Whether you're just starting your financial journey or looking to refine your approach, these resources provide a clear path to follow.

What if I miss payments while using the Debt Snowball method?

+

If you miss payments, do not despair. It’s common to face setbacks. Adjust your budget to include the missed payment, and continue the snowball process. The key is to maintain momentum and not stop making payments altogether.

Can I use the Allocated Spending Plan without a strict budget?

+

Yes, but the plan works best with some level of budgeting discipline. While it allows for discretionary spending, ensuring you’re allocating every dollar effectively is crucial for success.

What are some tips for effective retirement planning?

+

Start early, save consistently, diversify your investments, and consider your retirement lifestyle when setting savings goals. Also, remember to adjust your plan as life circumstances change.