5 Steps to Master Your Money with Ramsey’s Excel Budget

Are you looking to take control of your finances but unsure where to start? You’re not alone. Financial management can be daunting, especially when you’re managing it yourself. However, with the right tools, like Ramsey Solutions’ Excel Budget, you can transform your money management skills significantly. Here, we’ll guide you through five steps to master your money using Ramsey's popular budgeting tool.

Step 1: Understand the Basics

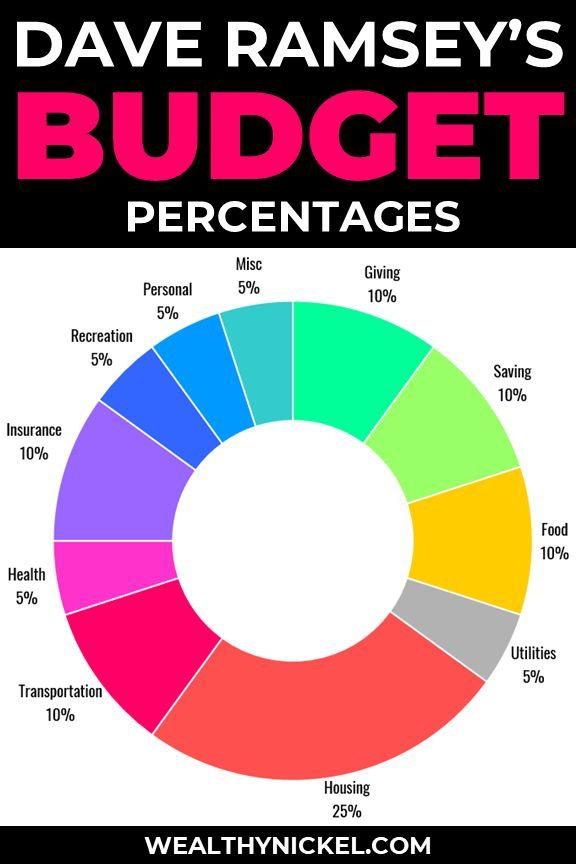

Before diving into complex budgeting, it’s crucial to understand the basics of personal finance:

- Income: This is the money you bring in, including your salary, freelance income, and any other regular earnings.

- Expenses: These are your regular and occasional spending, which include bills, groceries, entertainment, and more.

- Savings: Setting aside money for future needs or emergencies.

- Debt: Money you owe, which could be student loans, credit cards, etc.

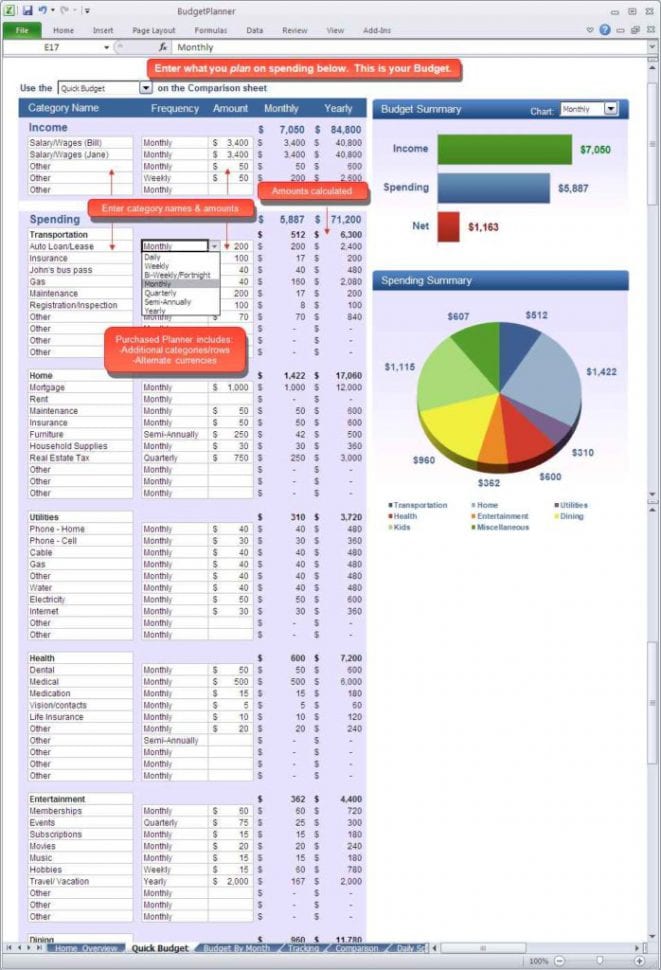

Here’s where Ramsey’s Excel Budget comes in handy. It provides a structured template where you can input your income, expenses, and savings goals all in one place.

Step 2: Set Up Your Budget

Begin with downloading Ramsey’s Excel Budget template:

- Open the template in Microsoft Excel or Google Sheets.

- Enter your monthly income into the designated area.

- Categorize your expenses:

- Fixed expenses (like rent, utilities)

- Variable expenses (like groceries, entertainment)

- Irregular expenses (car maintenance, insurance)

- Don’t forget to allocate funds to savings and debt reduction.

📘 Note: Make sure your expenses do not exceed your income, which is the cornerstone of maintaining a balanced budget.

Step 3: Track Your Spending

With your budget in place, now comes the critical part – tracking your spending:

- Every time you spend money, update the budget immediately or at least daily. This real-time tracking helps prevent overspending.

- Use cash, debit cards, or the envelope system to physically feel when you’re running out of money for specific categories.

- Ramsey’s tool includes features for tracking daily transactions, making this process seamless.

Table Example:

| Category | Planned | Actual |

|---|---|---|

| Rent | $1200 | $1200 |

| Groceries | $400 | $380 |

| Entertainment | $100 | $150 |

🔔 Note: If you overspend in one category, you might need to adjust other categories to keep your budget in check.

Step 4: Review and Adjust

Regularly review your financial health:

- Monthly Review: At the end of each month, look at what categories you've overspent or underspent in, and adjust accordingly for the next month.

- Adjustments:

- Increase the budget for categories where you consistently go over.

- Reduce allocations for items you aren't using as much.

- Consider seasonal or periodic changes in your expenses.

- Set Financial Goals: Ramsey’s Budget can help you track progress towards your financial goals, whether it's paying off debt or saving for a down payment on a house.

Step 5: Embrace the Journey

Budgeting isn’t just about numbers; it's about mindset and habits:

- Patience: Financial stability doesn't happen overnight. It requires consistent effort and adjustment.

- Flexibility: Life changes, and your budget should too. Ramsey’s Excel Budget allows for easy modifications as your life evolves.

- Celebrate Milestones: Each time you reach a savings goal or pay off a piece of debt, celebrate it. Positive reinforcement makes the process enjoyable and sustainable.

In summary, mastering your money with Ramsey's Excel Budget involves understanding the basics, setting up your budget, tracking spending, regular reviews, and embracing the journey. With these steps, you can take control of your finances, reduce stress, and move towards financial freedom.

What if I’m not good with Excel?

+

Don’t worry. Ramsey’s Excel Budget is user-friendly, but if you need help, consider seeking guidance from online tutorials or financial literacy classes focused on Excel. You can also team up with a financially savvy friend or family member for support.

How often should I update my budget?

+

It’s ideal to update your budget daily to track your spending accurately. However, at minimum, weekly reviews can help keep you on track. Monthly reviews are crucial for adjustments and planning.

Can this budget method work if I have irregular income?

+

Absolutely! You might set up your budget based on an average income, then adjust each month. Ramsey’s tool allows for the flexibility needed when dealing with fluctuating incomes.