Simplify Your Taxes: Free Dad's Worksheets

As tax season rolls around, the thought of navigating the labyrinth of tax forms and regulations can be daunting for many. Whether you're a student filing for the first time or a seasoned business owner, simplifying your tax preparation can save you both time and money. Thankfully, "Free Dad's Worksheets" are here to help guide you through this process with ease.

The Importance of Simplifying Tax Filing

Taxes are an inescapable part of financial life, but they don't have to be an overwhelming burden. Simplifying your tax filing process:

- Reduces Stress: Less complexity means less time spent worrying about whether you've done everything correctly.

- Minimizes Errors: A clear, straightforward approach helps avoid mistakes that could lead to audits or penalties.

- Saves Time: Streamlining your tax preparation can significantly reduce the hours spent on this annual chore.

- Maximizes Returns: With a better understanding of your tax situation, you might find overlooked deductions or credits, increasing your refund.

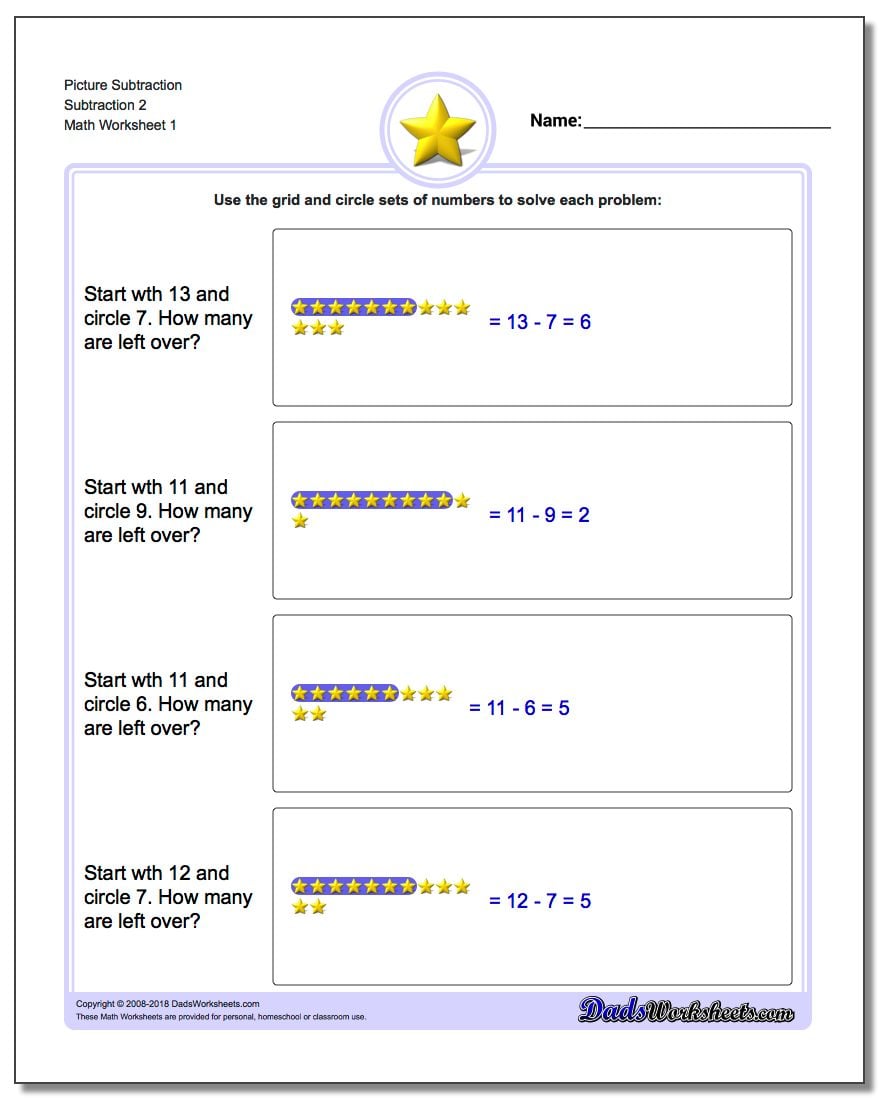

Introducing Free Dad's Worksheets

"Free Dad's Worksheets" is a set of tools designed by tax experts to simplify your tax filing. These worksheets cover:

- Income Calculation: Track all sources of income from employment, investments, and other sources.

- Deductions: Identify and organize deductible expenses, both standard and itemized.

- Credits: Worksheet for various tax credits that you might qualify for.

- Record Keeping: Forms to keep track of important tax-related documents throughout the year.

- Self-Employment: Special worksheets for those running their own business or freelancing.

🚀 Note: These worksheets are not just for the mathematically inclined; they are crafted to be user-friendly, making tax preparation accessible to everyone.

How to Use Free Dad's Worksheets

Here's how you can make the most of "Free Dad's Worksheets":

1. Start Early

- Begin your tax preparation as soon as you have all your documents at hand. This gives you time to go through the worksheets thoroughly.

2. Organize Your Documents

| Document Type | Purpose |

|---|---|

| W-2s | Provides wage and salary income details. |

| 1099 Forms | Income from non-employee compensation, interest, dividends, etc. |

| Receipts | Records of deductible expenses. |

| Financial Statements | Details on mortgages, student loans, and more. |

3. Fill Out the Worksheets Step by Step

- Follow the sequence suggested in the worksheets, ensuring you cover all income, deductions, credits, and self-employment aspects if applicable.

4. Double-Check Everything

- Verify numbers, especially on documents like W-2s and 1099 forms, to ensure accuracy.

5. Use Online Tools if Needed

- If some calculations seem complex, consider using free online tax calculators or consult IRS publications.

Maximizing Deductions and Credits

While the worksheets guide you through the process, here are a few tips to ensure you're maximizing your tax benefits:

- Keep Detailed Records: Not just receipts, but track any potential tax benefits like energy-efficient home improvements or education-related expenses.

- Understand Itemized Deductions: Use the worksheets to compare standard and itemized deductions and choose what's best for your situation.

- Explore Tax Credits: Don't overlook credits like the Earned Income Tax Credit, Child Tax Credit, or American Opportunity Tax Credit.

- Stay Updated: Tax laws change; the worksheets should help you stay on top of recent changes affecting your taxes.

🔍 Note: Ensure that all deductions and credits claimed are supported by documentation. The IRS can audit returns, and having the proper paperwork can make the process much smoother.

By now, you should have a good grasp on how "Free Dad's Worksheets" can simplify your tax filing. These tools are designed to take the complexity out of tax season, allowing you to focus on what matters most – your financial well-being. Remember, the key to an easier tax season is organization, knowledge, and a proactive approach to tax preparation. With these worksheets in hand, you'll be equipped to handle your taxes with confidence, potentially increasing your refund and reducing the time and stress associated with tax filing.

Frequently Asked Questions

Where can I get Free Dad’s Worksheets?

+

“Free Dad’s Worksheets” can be found in local libraries, on community websites, or sometimes directly from tax professionals offering these resources for public use.

Can I use these worksheets if I have a complex tax situation?

+

Yes, while designed to simplify, “Free Dad’s Worksheets” are comprehensive enough to handle complex tax scenarios, including self-employment income and multiple income streams.

Do I still need to file taxes if I use these worksheets?

+

Yes, these worksheets are tools to help with preparation, but you’ll still need to file your tax return. They assist in organizing your tax documents and calculations, making the actual filing process smoother.