5 CT Payroll Tips

Introduction to Payroll Management in Connecticut

Payroll management is a critical aspect of any business, ensuring that employees are paid accurately and on time. In Connecticut, there are specific regulations and laws that employers must comply with when managing their payroll. In this article, we will provide 5 key payroll tips for businesses operating in Connecticut, covering topics such as tax withholding, worker classification, and record-keeping.

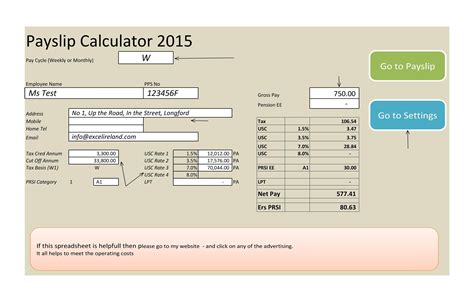

Tip 1: Understand Connecticut Tax Withholding Requirements

Connecticut has its own set of tax withholding requirements that employers must follow. The state requires employers to withhold state income tax from employee wages, with the tax rate ranging from 3% to 7%. Employers must also withhold federal income tax, Social Security tax, and Medicare tax. It is essential to understand these requirements to avoid any penalties or fines. Employers can use the Connecticut Tax Withholding Tables to determine the correct amount of state income tax to withhold from employee wages.

Tip 2: Properly Classify Workers as Employees or Independent Contractors

Correctly classifying workers as employees or independent contractors is crucial for payroll management. Misclassification can lead to penalties, fines, and even lawsuits. In Connecticut, the ABC Test is used to determine whether a worker is an employee or an independent contractor. The test considers factors such as control over the worker’s schedule, payment, and work environment. Employers must ensure that they are complying with the ABC Test to avoid any potential issues.

Tip 3: Maintain Accurate and Detailed Payroll Records

Maintaining accurate and detailed payroll records is essential for complying with Connecticut payroll regulations. Employers must keep records of employee wages, hours worked, tax withholdings, and other payroll-related information. These records must be kept for a minimum of three years and must be easily accessible in case of an audit. Employers can use payroll software or outsource their payroll management to ensure that their records are accurate and up-to-date.

Tip 4: Comply with Connecticut’s Wage and Hour Laws

Connecticut has specific wage and hour laws that employers must comply with. These laws cover topics such as minimum wage, overtime pay, and meal breaks. Employers must ensure that they are paying their employees at least the minimum wage, which is currently $12 per hour. Employers must also provide overtime pay to employees who work more than 40 hours in a workweek. Failure to comply with these laws can result in penalties and fines.

Tip 5: Stay Up-to-Date with Changes in Connecticut Payroll Regulations

Payroll regulations in Connecticut are subject to change, and employers must stay up-to-date with these changes to avoid any potential issues. Employers can subscribe to newsletters or follow payroll blogs to stay informed about changes in payroll regulations. Employers can also consult with payroll professionals to ensure that they are complying with all applicable laws and regulations.

📝 Note: Employers must also comply with federal payroll regulations, such as the Fair Labor Standards Act (FLSA), in addition to Connecticut state regulations.

| Topic | Requirement |

|---|---|

| Tax Withholding | Withhold state income tax, federal income tax, Social Security tax, and Medicare tax |

| Worker Classification | Use the ABC Test to determine whether a worker is an employee or an independent contractor |

| Record-Keeping | Keep records of employee wages, hours worked, tax withholdings, and other payroll-related information for at least three years |

| Wage and Hour Laws | Comply with minimum wage, overtime pay, and meal break laws |

| Regulation Updates | Stay up-to-date with changes in Connecticut payroll regulations |

In summary, managing payroll in Connecticut requires careful attention to detail and compliance with various state and federal regulations. By following these 5 key payroll tips, employers can ensure that they are managing their payroll accurately and efficiently, avoiding any potential penalties or fines. Whether it’s understanding tax withholding requirements, properly classifying workers, or maintaining accurate records, employers must prioritize payroll management to ensure the success of their business. As the payroll landscape continues to evolve, employers must stay informed and adapt to changes in regulations to remain compliant and avoid any potential issues.

What is the minimum wage in Connecticut?

+

The minimum wage in Connecticut is currently $12 per hour.

How long must employers keep payroll records in Connecticut?

+

Employers must keep payroll records for at least three years in Connecticut.

What is the ABC Test used for in Connecticut payroll?

+

The ABC Test is used to determine whether a worker is an employee or an independent contractor in Connecticut.