5 Compound Interest Tips

Understanding Compound Interest

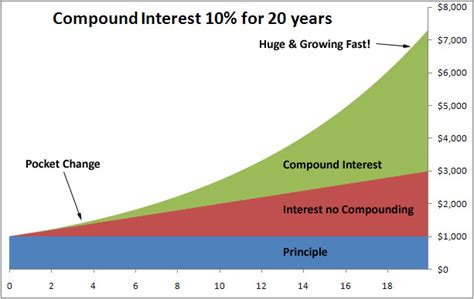

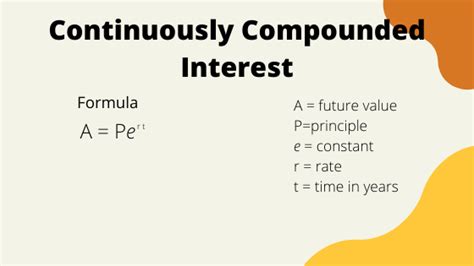

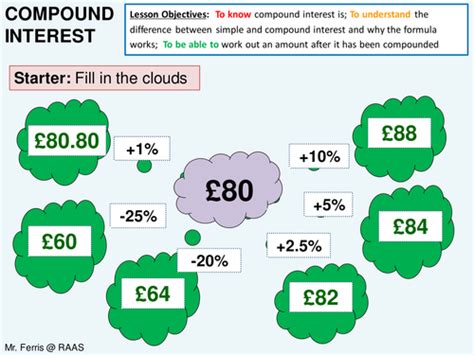

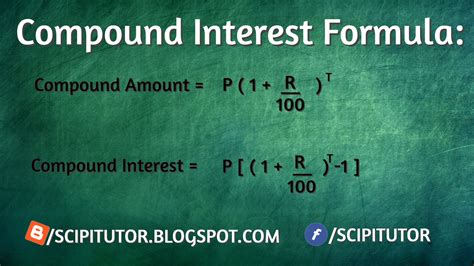

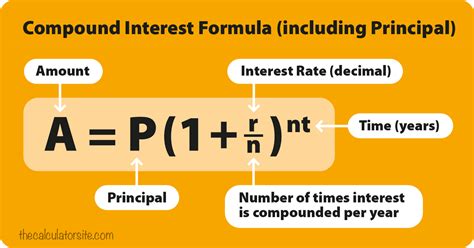

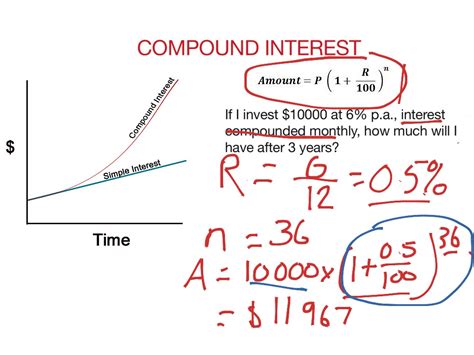

Compound interest is a powerful financial concept that can help you grow your wealth over time. It’s a type of interest that’s calculated on both the initial principal amount and any accrued interest over time. This means that your savings or investment can earn interest on top of interest, resulting in exponential growth. To make the most of compound interest, it’s essential to understand how it works and how to maximize its benefits. In this article, we’ll explore five compound interest tips to help you get started.

Tip 1: Start Early

The sooner you start saving or investing, the more time your money has to grow. Compound interest can work in your favor when you give it enough time to accumulate. Even small, consistent investments can add up over the years, resulting in a substantial amount of money. For example, if you invest 100 per month for 30 years, earning an average annual return of 7%, you'll end up with over 100,000. However, if you wait 10 years to start investing, you’ll end up with around $50,000, assuming the same interest rate and monthly investment. As you can see, starting early can make a significant difference in the long run.

Tip 2: Be Consistent

Consistency is key when it comes to compound interest. Regular investments, even if they’re small, can help you build wealth over time. Try to set aside a fixed amount of money each month or quarter, and invest it in a high-yield savings account or a diversified investment portfolio. Avoid withdrawing money from your savings or investment account, as this can reduce the compounding effect. Instead, let your money grow and watch it snowball into a substantial amount over time. Some popular investment options for consistent investing include index funds, dividend-paying stocks, and real estate investment trusts (REITs).

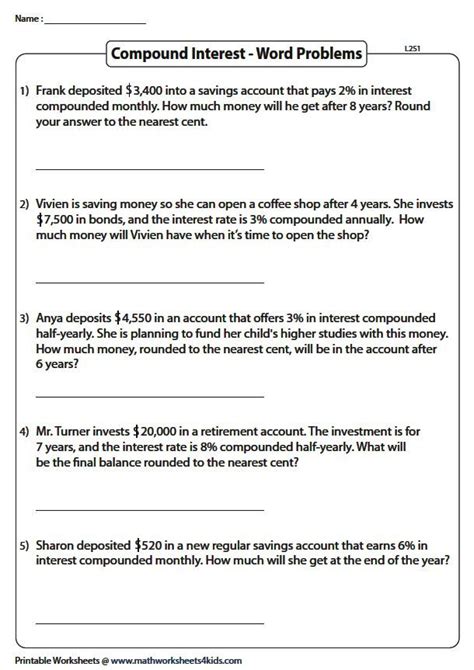

Tip 3: Choose High-Yield Options

Not all savings or investment accounts are created equal. Some accounts offer higher interest rates or returns than others, which can significantly impact the compounding effect. For example, a high-yield savings account may offer an interest rate of 2.0% APY, while a traditional savings account may offer only 0.1% APY. Over time, the difference in interest rates can add up, resulting in a substantial difference in your savings. When choosing a savings or investment account, look for options with high-yield interest rates or returns, such as certificates of deposit (CDs), money market funds, or peer-to-peer lending platforms.

Tip 4: Avoid Fees and Taxes

Fees and taxes can eat into your savings or investment returns, reducing the compounding effect. Try to minimize fees by choosing low-cost investment options, such as index funds or ETFs. You can also consider tax-advantaged accounts, such as 401(k) or IRA accounts, which can help reduce your tax liability. Additionally, be mindful of inflation, which can erode the purchasing power of your money over time. Consider investing in assets that historically perform well during periods of inflation, such as real estate or commodities.

Tip 5: Monitor and Adjust

Finally, it’s essential to monitor your savings or investment portfolio regularly and adjust as needed. This can help you ensure that your money is working efficiently and effectively. Consider rebalancing your portfolio periodically to maintain an optimal asset allocation. You can also take advantage of dollar-cost averaging, which involves investing a fixed amount of money at regular intervals, regardless of the market’s performance. This can help reduce the impact of market volatility and timing risks.

| Investment Option | Interest Rate/Return | Fees | Tax Advantages |

|---|---|---|---|

| High-Yield Savings Account | 2.0% APY | Low | |

| Index Fund | 7% average annual return | Low | Tax-efficient |

| Real Estate Investment Trust (REIT) | 8% average annual return | Moderate | Tax advantages for income |

💡 Note: The interest rates and returns listed in the table are examples and may not reflect current market rates or performance.

As you can see, compound interest can be a powerful tool for building wealth over time. By starting early, being consistent, choosing high-yield options, avoiding fees and taxes, and monitoring and adjusting your portfolio, you can maximize the compounding effect and achieve your long-term financial goals.

In the end, it’s all about making informed decisions and taking a proactive approach to your finances. By following these compound interest tips and staying committed to your goals, you can unlock the full potential of your savings and investments and enjoy a more secure financial future.

What is compound interest?

+

Compound interest is a type of interest that’s calculated on both the initial principal amount and any accrued interest over time.

How can I maximize compound interest?

+

To maximize compound interest, start early, be consistent, choose high-yield options, avoid fees and taxes, and monitor and adjust your portfolio regularly.

What are some high-yield investment options?

+

Some high-yield investment options include index funds, dividend-paying stocks, real estate investment trusts (REITs), and peer-to-peer lending platforms.