Colorado Salary Calculator Guide

Introduction to Colorado Salary Calculator

When it comes to understanding and managing personal finances, having the right tools can make a significant difference. For individuals living in Colorado, a Colorado salary calculator can be an invaluable resource. This tool helps users calculate their net salary, taking into account various factors such as gross income, deductions, and taxes. In this guide, we will delve into the world of Colorado salary calculators, exploring their benefits, how they work, and what to consider when using them.

Benefits of Using a Colorado Salary Calculator

Using a Colorado salary calculator offers several benefits, including: * Accurate Financial Planning: By providing a clear picture of your take-home pay, these calculators enable you to plan your finances more effectively. * Tax Efficiency: Understanding how taxes impact your salary can help you make informed decisions about deductions and exemptions. * Budgeting: Knowing your net income allows you to create a realistic budget that accounts for all your expenses and savings goals. * Career Decisions: When considering job offers or promotions, a salary calculator can help you evaluate the true financial implications of your choices.

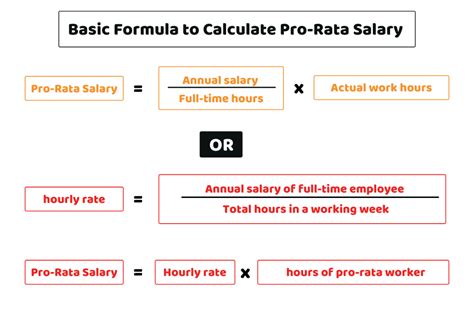

How Colorado Salary Calculators Work

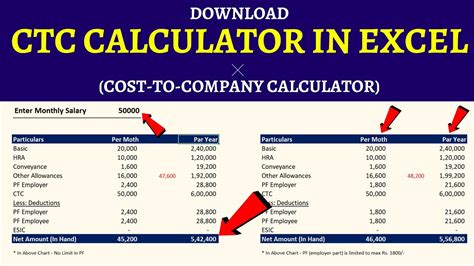

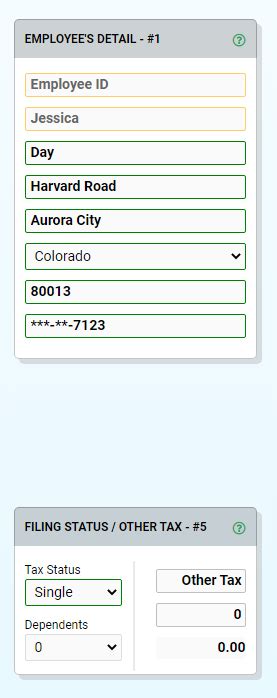

Colorado salary calculators are designed to be user-friendly, requiring you to input a few key pieces of information: * Gross Income: Your total salary before any deductions. * Filing Status: Your marital status, which affects tax rates. * Number of Dependents: The number of individuals you claim as dependents on your tax return. * Deductions and Exemptions: Any pre-tax deductions, such as 401(k) contributions, and exemptions you’re eligible for.

Once you’ve entered this information, the calculator applies the relevant tax rates and deductions to estimate your net income. This process involves considering both federal and state income taxes, as well as any local taxes that may apply.

Colorado State Income Tax

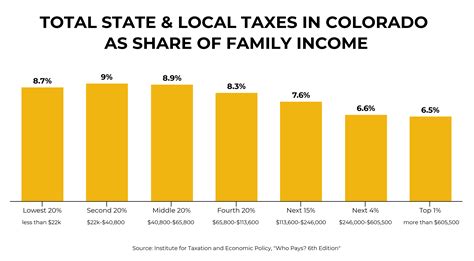

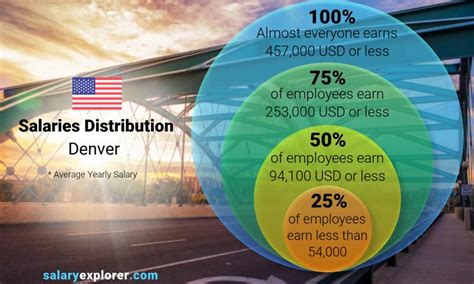

Colorado has a flat state income tax rate of 5%, which is relatively low compared to other states. However, this rate is applied to your taxable income, which is your gross income minus any deductions and exemptions. Understanding how this tax rate affects your net income is crucial for accurate financial planning.

Factors to Consider When Using a Colorado Salary Calculator

While salary calculators are highly useful, there are several factors to consider to ensure you’re getting an accurate picture of your financial situation: * Local Taxes: Some cities and counties in Colorado may have additional income taxes, which can impact your net income. * Other Income Sources: If you have income from sources other than your salary, such as investments or a side business, you’ll need to account for these separately. * Changes in Tax Law: Tax laws and rates can change, so it’s essential to use a calculator that is updated with the latest information.

💡 Note: Always verify the calculator you're using is based on the most current tax laws and rates to ensure the accuracy of your calculations.

Using a Colorado Salary Calculator for Financial Planning

A Colorado salary calculator is not just a tool for calculating your net income; it’s also a powerful resource for financial planning. By understanding your true take-home pay, you can make more informed decisions about: * Savings: How much you can afford to save each month. * Debt Repayment: How to allocate your income to pay off debts efficiently. * Investments: How to invest your money wisely, considering your financial goals and risk tolerance.

Conclusion

In conclusion, a Colorado salary calculator is a vital tool for anyone looking to understand their financial situation better and make informed decisions about their money. By considering the factors that affect your net income and using a reliable calculator, you can take control of your finances and work towards achieving your long-term goals. Whether you’re a resident of Colorado or considering moving there, understanding how to use these calculators effectively can make a significant difference in your financial well-being.

What is the Colorado state income tax rate?

+

The Colorado state income tax rate is a flat 5% of your taxable income.

How do I use a Colorado salary calculator?

+

To use a Colorado salary calculator, you’ll need to input your gross income, filing status, number of dependents, and any deductions or exemptions you’re eligible for. The calculator will then estimate your net income based on these factors.

What factors can affect my net income in Colorado?

+

Several factors can affect your net income in Colorado, including federal and state income taxes, local taxes, deductions, exemptions, and other income sources. It’s essential to consider these factors when using a salary calculator to ensure an accurate estimate of your net income.