Colorado Paycheck Calculator Tool

Introduction to Colorado Paycheck Calculator Tool

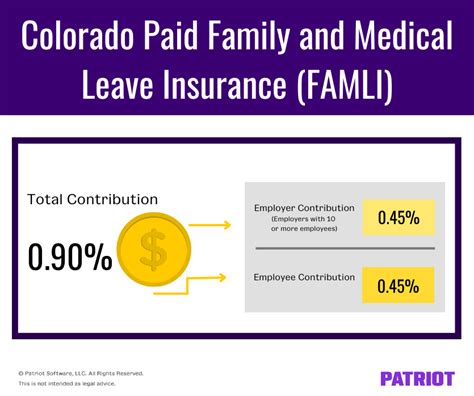

The Colorado Paycheck Calculator Tool is a valuable resource for both employees and employers in the state of Colorado. This tool allows users to calculate the amount of taxes withheld from their paychecks, ensuring that they are taking home the correct amount of money. With the ever-changing tax laws and regulations, it’s essential to have a reliable and accurate way to calculate paycheck taxes. In this article, we will delve into the features and benefits of the Colorado Paycheck Calculator Tool, as well as provide guidance on how to use it effectively.

Features of the Colorado Paycheck Calculator Tool

The Colorado Paycheck Calculator Tool is designed to be user-friendly and provide accurate calculations. Some of the key features of this tool include: * Easy input fields for entering salary, tax filing status, and number of allowances * Automatic calculations for federal, state, and local taxes * Customizable options for adjusting tax withholding and deductions * Comprehensive results that include gross pay, net pay, and tax withholding amounts * Regular updates to reflect changes in tax laws and regulations

Benefits of Using the Colorado Paycheck Calculator Tool

Using the Colorado Paycheck Calculator Tool can provide numerous benefits for both employees and employers. Some of the advantages of using this tool include: * Accurate calculations: The tool ensures that taxes are withheld correctly, reducing the risk of errors and potential penalties * Increased transparency: Users can see exactly how much is being withheld from their paychecks and why * Improved budgeting: With accurate calculations, users can better plan their finances and make informed decisions about their money * Reduced stress: The tool eliminates the need for manual calculations, saving time and reducing stress

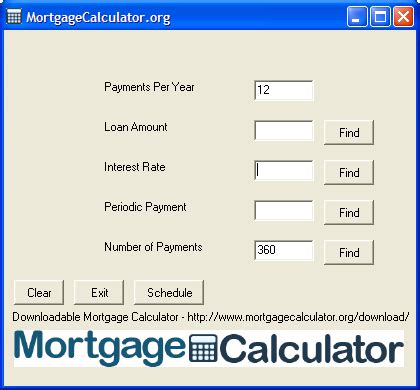

How to Use the Colorado Paycheck Calculator Tool

Using the Colorado Paycheck Calculator Tool is straightforward and easy to follow. Here are the steps to get started: * Enter your salary or hourly wage and the number of pay periods per year * Select your tax filing status and number of allowances * Choose any additional tax withholding options or deductions you may have * Click the calculate button to see your results

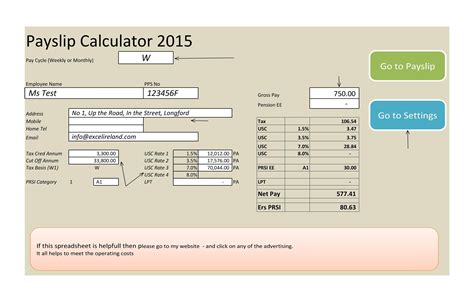

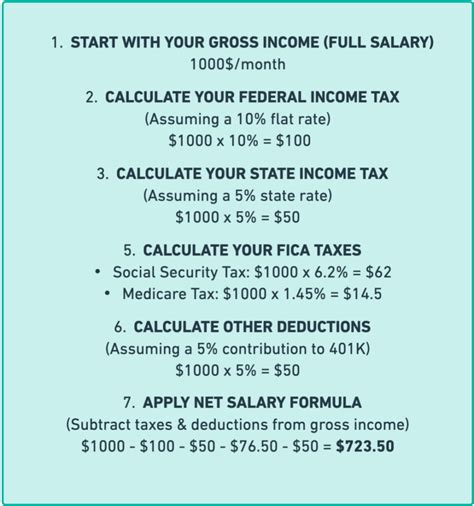

Understanding Your Results

Once you’ve entered your information and clicked the calculate button, you’ll see a comprehensive breakdown of your paycheck taxes. This will include: * Gross pay: Your total salary or hourly wage before taxes * Net pay: Your take-home pay after taxes have been withheld * Tax withholding: The amount of taxes withheld from your paycheck * Other deductions: Any additional deductions or withholdings, such as health insurance or retirement contributions

💡 Note: It's essential to review your results carefully and ensure that all information is accurate and up-to-date.

Tips for Getting the Most Out of the Colorado Paycheck Calculator Tool

To get the most out of the Colorado Paycheck Calculator Tool, follow these tips: * Keep your information up-to-date: Make sure to update your information whenever your salary, tax filing status, or number of allowances changes * Use the tool regularly: Regularly check your paycheck taxes to ensure that you’re taking home the correct amount of money * Explore additional features: Take advantage of any additional features or resources offered by the tool, such as tax planning guides or budgeting tips

| Feature | Benefit |

|---|---|

| Easy input fields | Quick and easy to use |

| Automatic calculations | Accurate and reliable results |

| Customizable options | Tailored to individual needs |

In the end, the Colorado Paycheck Calculator Tool is a valuable resource for anyone looking to simplify their paycheck taxes and ensure accuracy. By following the steps outlined in this article and taking advantage of the tool’s features and benefits, users can enjoy increased transparency, improved budgeting, and reduced stress. With its user-friendly interface and comprehensive results, the Colorado Paycheck Calculator Tool is an essential tool for anyone living or working in Colorado.

What is the Colorado Paycheck Calculator Tool?

+

The Colorado Paycheck Calculator Tool is a online resource that helps users calculate the amount of taxes withheld from their paychecks.

How do I use the Colorado Paycheck Calculator Tool?

+

To use the tool, simply enter your salary or hourly wage, tax filing status, and number of allowances, and click the calculate button to see your results.

What are the benefits of using the Colorado Paycheck Calculator Tool?

+

The benefits of using the tool include accurate calculations, increased transparency, improved budgeting, and reduced stress.