5 Essential Tips for Completing Colorado Child Support Worksheet B

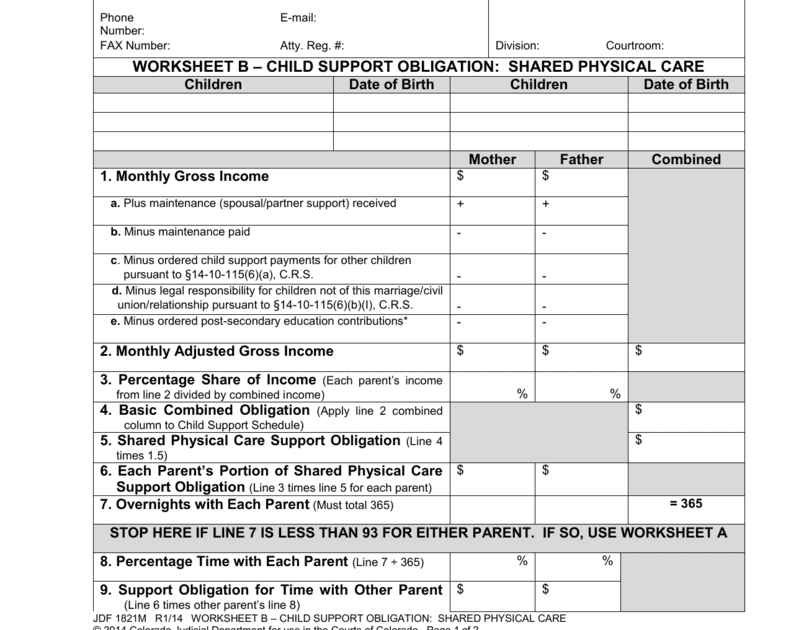

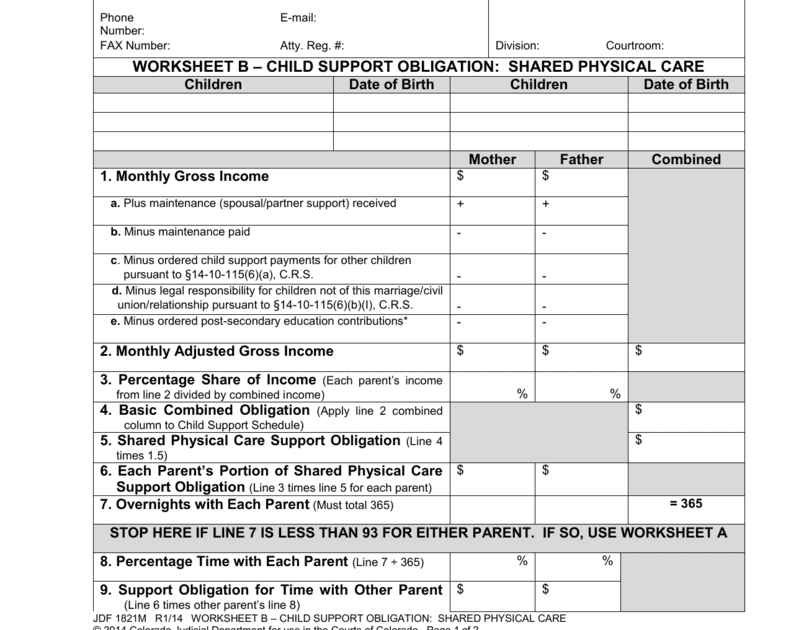

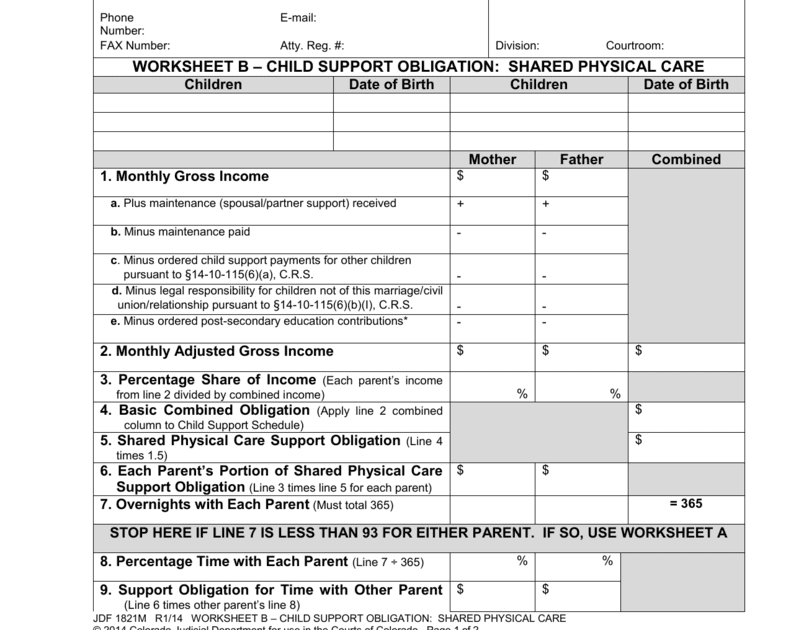

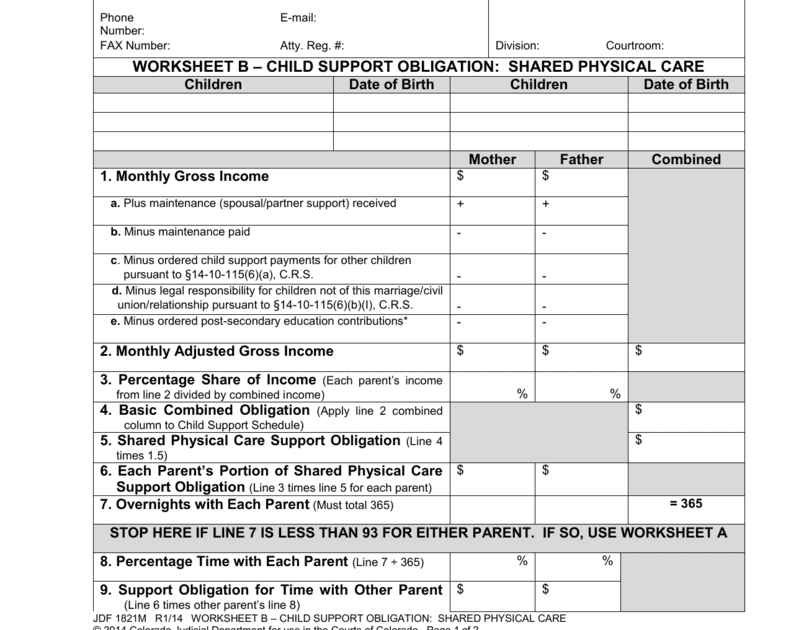

In Colorado, parents going through a divorce or separation often need to navigate the complexities of child support. The Colorado Child Support Worksheet B is an essential document that helps determine the appropriate amount of child support payments. Whether you're a parent or a guardian involved in a child support case, understanding how to complete this worksheet accurately is crucial. Here, we delve into five vital tips that will guide you through the process, ensuring your child support calculations are both fair and in compliance with Colorado's legal standards.

1. Understand the Purpose of Worksheet B

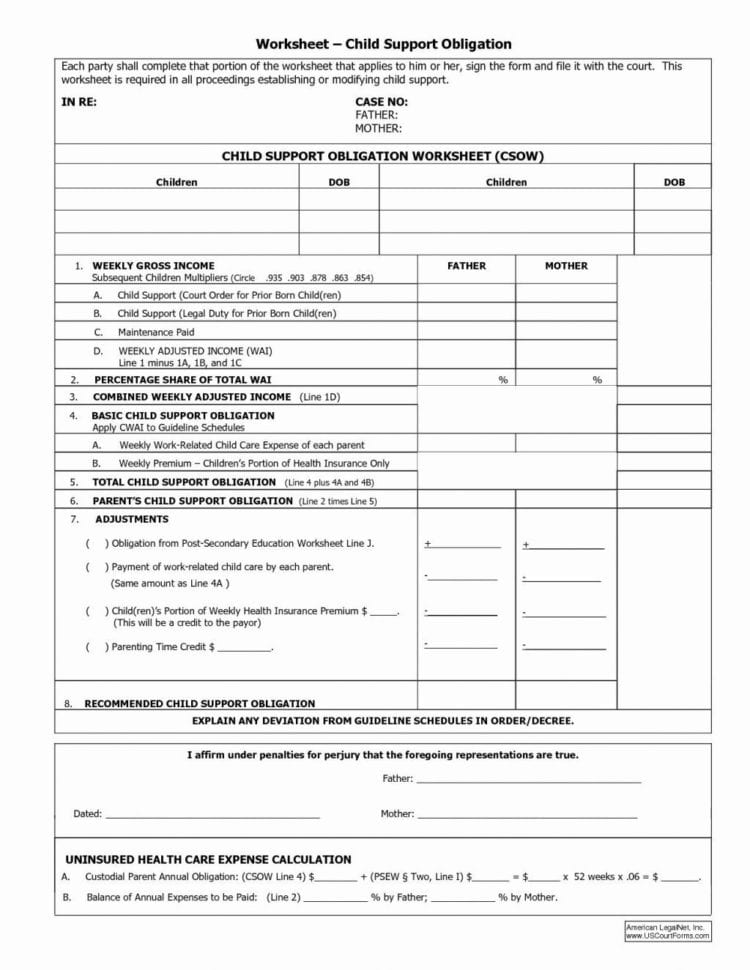

Before filling out the worksheet, it’s important to understand why Worksheet B is used. Unlike Worksheet A, which is for basic calculations, Worksheet B is specifically for situations where one or both parents have children from another relationship. This worksheet ensures that child support payments are adjusted appropriately to reflect these additional financial responsibilities.

- It accounts for shared parenting schedules, health insurance premiums, work-related child care costs, and extraordinary adjustments.

- It’s used to distribute child support obligations fairly when more than one child is involved with different parents.

2. Gather All Necessary Documentation

To complete Worksheet B, you’ll need:

- Income verification for both parents, including pay stubs, tax returns, and any other sources of income.

- Expenses related to the children, like child care costs or medical insurance.

- Documentation on the child custody schedule, as this directly impacts child support calculations.

- Any court orders or agreements from other child support cases.

Having all these documents at hand will streamline the process and ensure accuracy in your calculations.

3. Use the Correct Calculation Method

Here are the steps to correctly calculate child support with Worksheet B:

| Step | Description |

|---|---|

| 1. Determine Each Parent’s Gross Income | Calculate the total income for each parent before deductions. |

| 2. Subtract Prior Child Support or Maintenance | Deduct any child support or maintenance payments from prior relationships. |

| 3. Calculate Adjusted Gross Income | Subtract adjustments for health insurance and other allowable deductions. |

| 4. Pro Rata Shares | Determine each parent’s proportional share of the total adjusted gross income. |

| 5. Basic Child Support Obligation | Use the guideline schedule to find the basic child support amount. |

| 6. Extraordinary Adjustments | Adjust for any extraordinary circumstances affecting the child’s needs or costs. |

| 7. Child Support Payments | Calculate the final child support payment using each parent’s pro rata share and the adjusted obligation. |

4. Pay Attention to Time Allocation

Child support in Colorado is influenced by the amount of time each parent spends with the child. Here’s how:

- Calculate the percentage of overnight time each parent has with the child.

- Adjust the child support amount based on this time. If parents share equal time, adjustments might be made to offset payments.

⏳ Note: Document the exact overnight schedule to ensure all calculations are based on accurate information.

5. Review and Consult if Necessary

Filling out the Colorado Child Support Worksheet B can be intricate:

- Ensure all calculations are correct and align with current state guidelines.

- Consider consulting with a family law attorney or a mediator familiar with child support laws in Colorado.

In summary, completing the Colorado Child Support Worksheet B involves understanding its purpose, gathering all relevant financial documentation, following the correct calculation method, accurately accounting for time allocation, and reviewing your work for accuracy. By following these steps, parents can work towards a child support agreement that is fair, legally compliant, and in the best interests of their child. This process, while detailed, ensures that the financial support provided for the child is equitable and reflective of both parents' responsibilities and capabilities.

What is the difference between Worksheet A and Worksheet B?

+

Worksheet A is used for simple child support calculations in Colorado. However, Worksheet B is specifically designed for more complex cases where one or both parents have children from previous relationships. It accounts for shared parenting, multiple children, and adjusts for financial responsibilities from other child support or maintenance obligations.

Can adjustments be made after the child support is set?

+

Yes, child support orders can be modified. Changes might be considered due to a significant change in circumstances, such as changes in income, the cost of living, custody arrangements, or health insurance costs. However, both parties usually need to agree, or a formal review must be requested.

How is income calculated for child support in Colorado?

+

Income for child support calculations includes gross income from all sources before deductions, such as employment, overtime, commissions, bonuses, business income, severance pay, pensions, and social security benefits. However, certain income like public assistance isn’t considered.