Maximize Profits with Chubb Business Income Worksheet

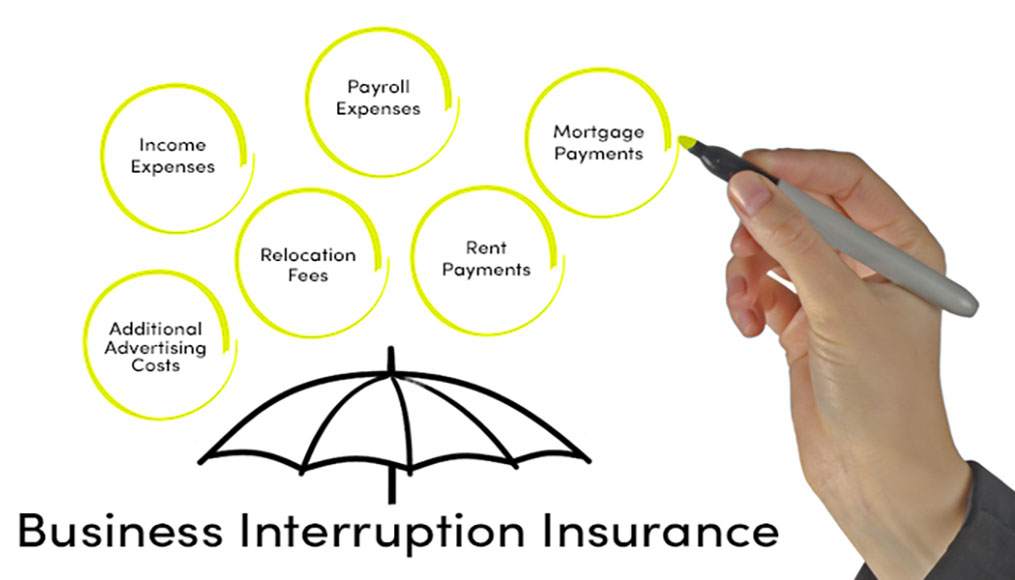

Unlock the potential of your business with Chubb's Business Income Worksheet, a comprehensive tool that helps you estimate the potential financial loss due to a business interruption. With rising uncertainties and the ever-present risk of disruptions, every business, regardless of size or industry, needs to have a clear picture of its vulnerability to income loss. This worksheet not only aids in quantifying potential losses but also guides businesses in securing appropriate insurance coverage to protect their financial health. Here's how you can leverage this worksheet to safeguard your revenue streams and maximize your profits.

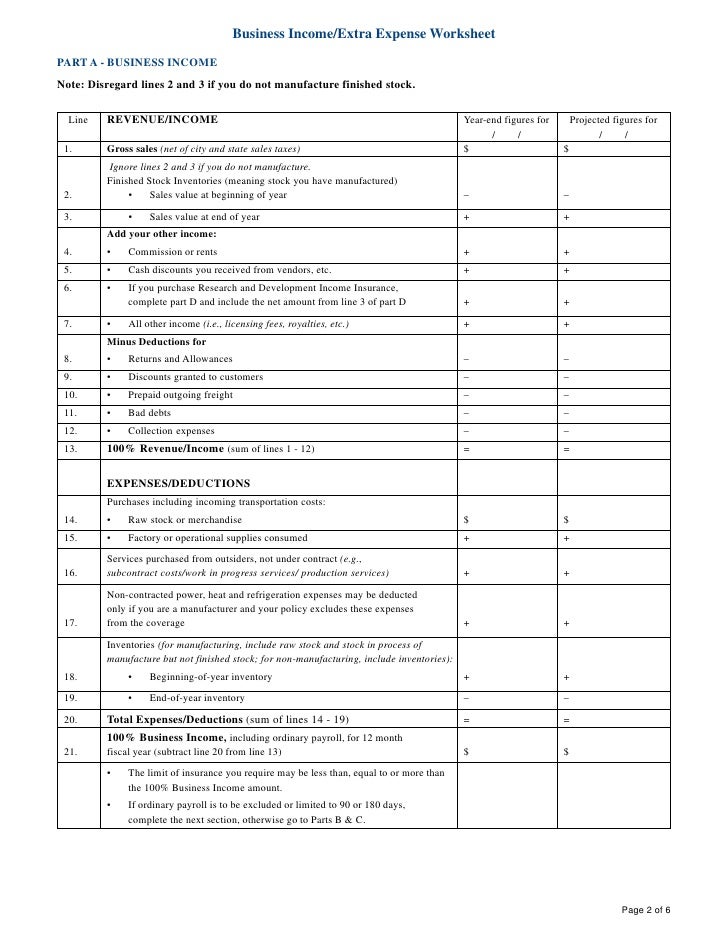

Understanding the Business Income Worksheet

The Chubb Business Income Worksheet is designed to be user-friendly, yet it requires a good understanding of your business's financial operations. Here are the key components you'll need to address:

- Net Income: This represents the profit or loss before taxes, crucial as a starting point to understand your baseline financial health.

- Operating Expenses: Include costs like rent, salaries, utilities, and ongoing costs that would continue during an interruption.

- Extraordinary Expenses: Expenses you might incur due to a business interruption, like costs for temporary operations.

- Ordinary Payroll: Costs related to salaries for non-essential staff you might decide to retain during an interruption.

- Non-Operating Expenses: Expenses that would not continue during an interruption, such as sales and marketing costs.

- Coinsurance: This refers to the percentage of coverage you are responsible for if your business suffers a loss.

Calculating Potential Income Loss

Estimating potential income loss involves analyzing historical financial data, understanding your business cycle, and anticipating market conditions. Here's how you can approach this:

- Historical Analysis: Review at least three years of past income statements to identify trends and seasonal fluctuations.

- Projections: Use your business plan and market research to project future revenue. Consider economic forecasts, industry growth rates, and any planned business expansions.

- Seasonality: Recognize peak and off-peak periods which might affect your income during disruptions.

- Future Commitments: Factor in any upcoming contracts or obligations that might increase income loss if delayed or canceled due to a business interruption.

⚠️ Note: Be conservative with projections as insurance companies will scrutinize your numbers for accuracy and reasonableness.

Determining Coverage Limits

Once you have an estimate of potential income loss, the next step is to set the coverage limit on your business income insurance policy:

- Coinsurance: This can affect your coverage amount, so determine the appropriate coinsurance percentage with your agent or broker.

- Business Interruption Limit: This is the maximum amount your insurance will pay for lost income, which should cover the period of restoration plus the period of indemnity.

- Extra Expense Coverage: Include any additional costs you'd incur to resume operations, like renting temporary premises or overtime pay.

| Expense Type | Coverage Options |

|---|---|

| Ordinary Payroll | 100% or Percentage of Payroll |

| Extraordinary Expenses | Actual or Time-Related Costs |

| Contingent Business Interruption | Specific Suppliers or Key Customers |

Maximizing Profits Post-Interruption

Once you've used the worksheet to calculate potential losses and set coverage limits, you can take steps to minimize income loss and maximize profits:

- Continuity Planning: Develop or update your business continuity plan to speed up recovery after an interruption.

- Financial Buffer: Maintain a cash reserve or secure a line of credit to cover expenses during the period of indemnity.

- Communication Strategy: Keep stakeholders informed to maintain trust and loyalty, potentially reducing revenue losses.

- Adaptability: Implement flexible work policies or alternative operational strategies to keep the business running.

- Insurance Claims: File insurance claims promptly and accurately, ensuring all relevant information is provided to expedite the claim process.

Chubb's Business Income Worksheet is not just about calculating potential losses; it's a strategic tool to plan for the unexpected, ensuring that your business can withstand and recover from any interruption with minimal financial impact. By understanding your vulnerabilities, securing appropriate coverage, and preparing for quick recovery, you can protect your business's income stream and enhance its long-term financial resilience.

🔑 Note: Regularly updating the worksheet is essential as your business grows or changes direction to ensure it accurately reflects your current financial risk profile.

Utilizing the Chubb Business Income Worksheet to its full potential requires a proactive approach to understanding and preparing for the financial risks associated with business interruptions. By accurately forecasting potential income loss, setting appropriate coverage limits, and employing smart recovery strategies, businesses can safeguard against income loss, protect profits, and thrive in the face of adversity.

What does the “period of restoration” mean in the context of business income insurance?

+

The period of restoration is the time it takes to repair or rebuild your business after a loss, during which insurance coverage helps replace lost income. It begins when the physical damage occurs and ends when the property should be repaired or replaced, typically with reasonable speed and due diligence.

How often should I update my business income worksheet?

+

It’s advisable to update your worksheet annually or whenever significant changes in your business operations, revenue forecasts, or risk profile occur to ensure your insurance coverage remains accurate and effective.

Can I get insurance for extraordinary expenses during a business interruption?

+

Yes, many business income policies include coverage for extraordinary expenses, which are costs beyond normal operating expenses incurred to mitigate or reduce the length of the interruption.

Related Terms:

- Chubb business income worksheet pdf

- Manufacturing Business Income Worksheet

- Business income insurance coverage calculator

- Chubb small business

- Chubb Business Services

- Business interruption examples