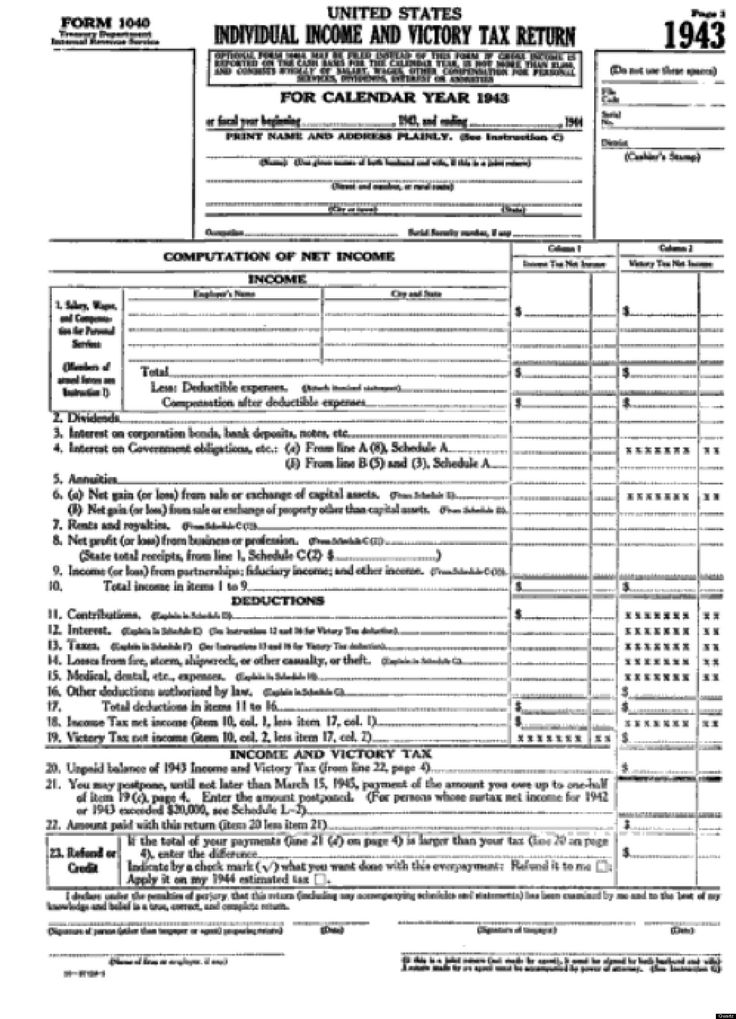

TurboTax Carryover Worksheet: Maximize Your Tax Refund Easily

In the intricate labyrinth of tax preparation, the TurboTax Carryover Worksheet serves as a beacon of simplification. For individuals and businesses navigating the complex tax terrain, this tool can be invaluable in optimizing refunds and easing the filing process. Here, we delve into what the carryover worksheet is, how it works, and how you can use it to maximize your tax benefits with TurboTax.

Understanding the TurboTax Carryover Worksheet

The TurboTax carryover worksheet isn’t just another piece of paper or digital tool; it's your roadmap to smarter tax planning. This worksheet:

- Tracks deductions, credits, and losses that can be carried forward to future tax years.

- Helps in minimizing taxable income by carrying over unused portions to subsequent years.

- Ensures you're not missing out on tax benefits that you’re eligible for, even if they couldn’t be fully utilized in the current year.

💡 Note: The carryover worksheet is especially important for those with investment losses, business losses, or charitable contributions that exceed the IRS limits for the current year.

Why Use the Carryover Worksheet?

Here are compelling reasons to leverage this worksheet:

- Maximize Tax Deductions: Carryover items like capital loss deductions, which have an annual limit of $3,000, can accumulate and be used in future years.

- Optimize Tax Credits: Certain tax credits like the Child Tax Credit or Education Credits have carryover provisions.

- Accurate Filing: Prevent errors and potential audits by keeping an accurate record of carryover items.

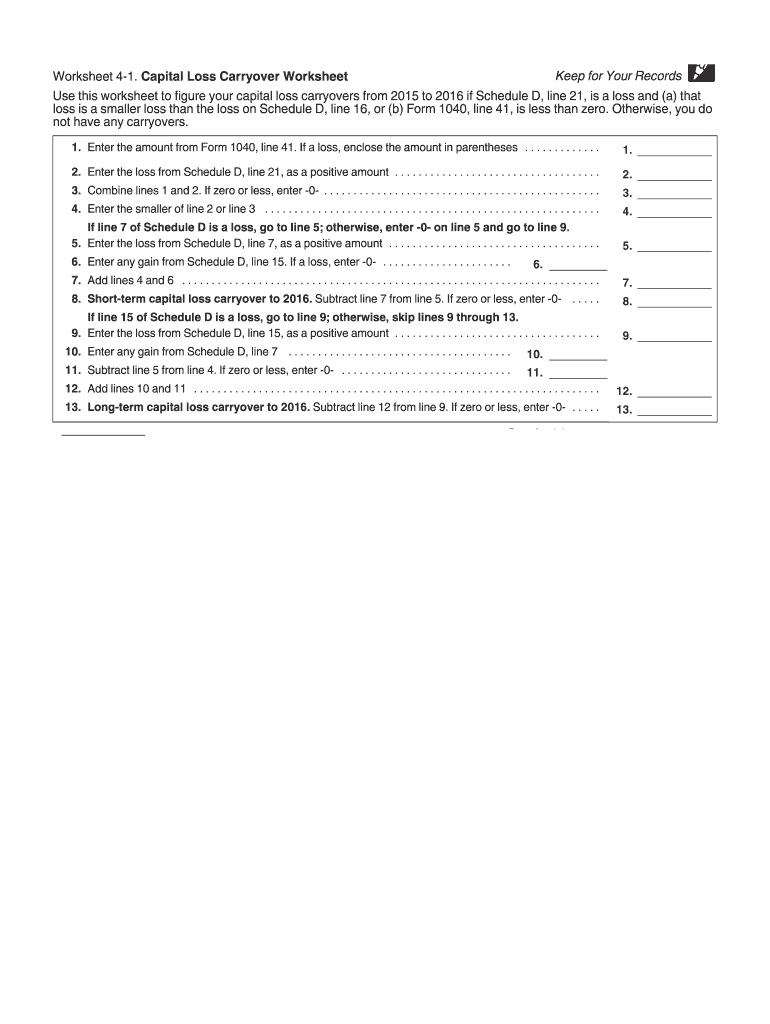

How to Use the TurboTax Carryover Worksheet

Identify Carryover Items

The first step in utilizing the carryover worksheet is to identify the items that qualify for carryover:

- Capital Losses:

- Net capital losses over the $3,000 limit.

- Charitable Contributions:

- Any contributions over the annual limit (up to 60% of AGI).

- Business Losses:

- Net operating losses (NOLs) from business activities.

- Tax Credits:

- Carryover of credits like the Home Energy Improvement Credit or Adoption Credit.

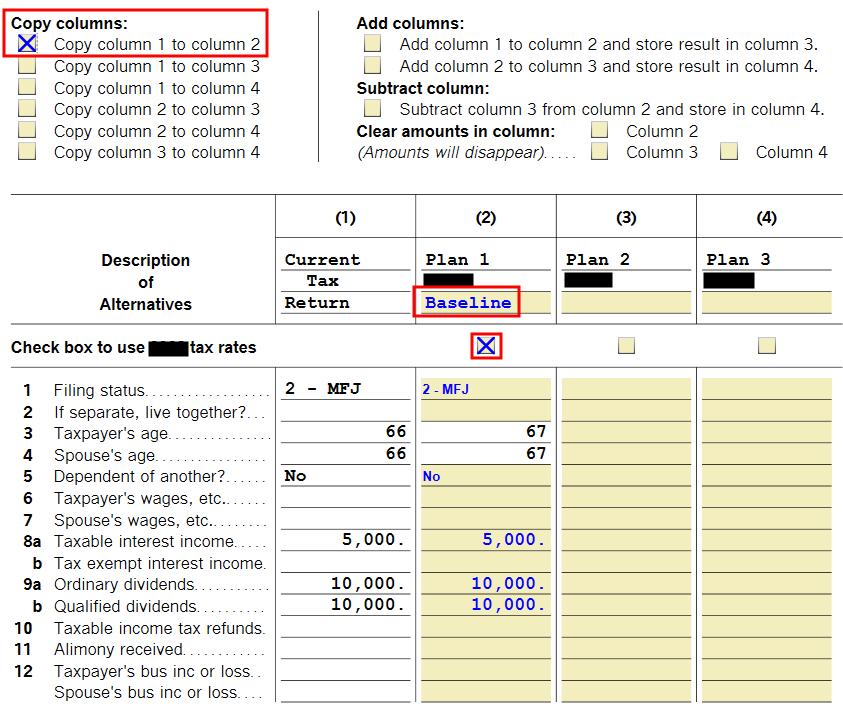

Entering Data into TurboTax

With TurboTax, the process of entering carryover data is straightforward:

- Select the Relevant Tax Forms: TurboTax will guide you to the appropriate forms like Schedule D for capital losses or Form 8582 for passive activity losses.

- Enter Previous Year’s Data: If this is not your first year using the carryover feature, TurboTax will help you import last year's data automatically.

- Input Current Year’s Carryover Amounts: TurboTax prompts you to enter any new carryover amounts not already in your tax history.

📝 Note: Ensure all details are entered correctly as any mistake could result in missing out on potential tax savings.

Carrying Over

Once you’ve entered your carryover data, TurboTax:

- Calculates the amount that can be carried over for future years.

- Keeps track of the carryover limits and periods for each item.

- Automatically carries forward the unused portions to your next tax year.

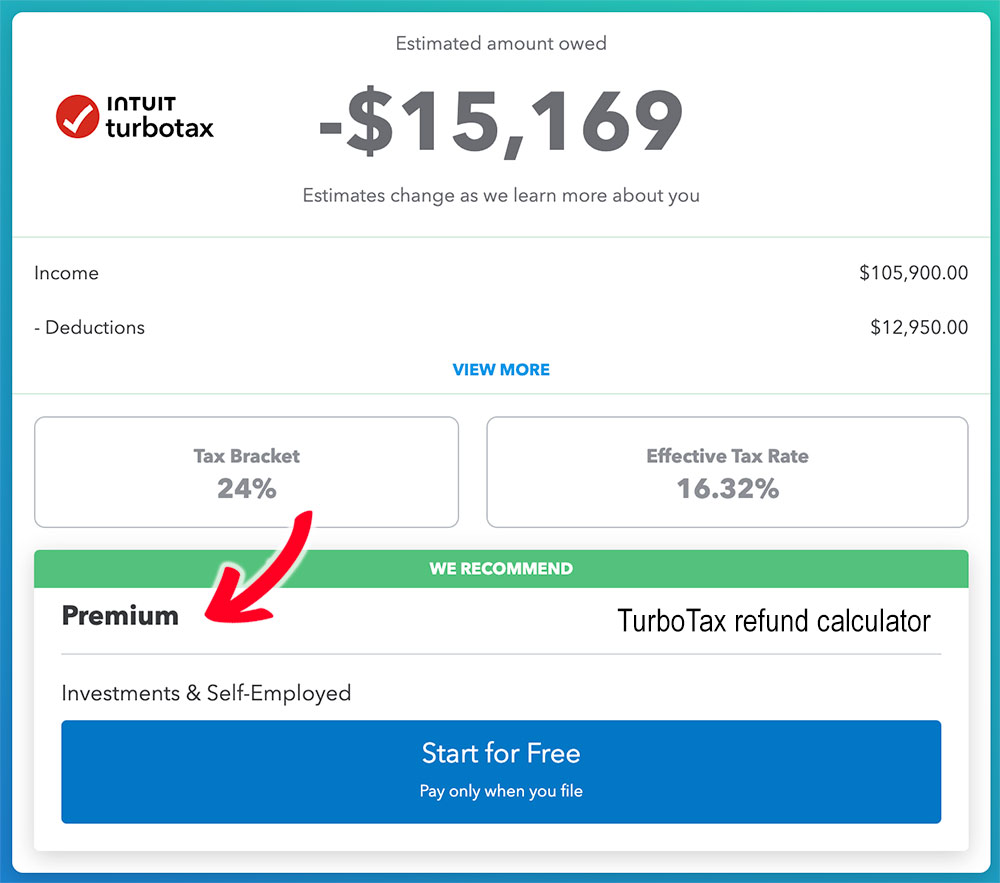

Maximizing Your Tax Refund with Carryovers

Here's how you can make the most out of the carryover provisions:

Strategic Timing

- Harvest losses in a year where you anticipate a higher income.

- Bundle charitable contributions or carry over business losses strategically to offset future gains.

Monitor Carryover Limits

Keep an eye on IRS limitations for carryover items:

| Item | Carryover Limit |

|---|---|

| Capital Losses | $3,000 per year |

| Charitable Contributions | 60% of AGI |

| Net Operating Losses | No limit, but time restrictions apply |

Plan for Future Tax Years

- Factor in expected income changes to use carryovers effectively.

- Consider future tax law changes that might impact carryover rules.

Wrapping Up

Using the TurboTax Carryover Worksheet transforms what could be a complex, daunting task into a manageable, strategic one. It allows taxpayers to maximize deductions and credits, ensuring they don’t miss out on potential refunds. By following these steps, entering data accurately, and understanding how to carry over tax benefits strategically, you'll find that tax preparation can be less stressful and more financially rewarding.

How do I find the carryover worksheet in TurboTax?

+

When you’re filling out your tax forms, TurboTax will automatically guide you to relevant carryover sections where you can input or review data. It’s usually part of the form review process or when dealing with specific schedules like Schedule D or Form 8582.

Can I carry over losses indefinitely?

+

It depends on the type of loss. For example, capital losses can be carried over indefinitely, while net operating losses (NOLs) have a specific time limit after which they must be used or lost.

What happens if I forget to enter carryover data?

+

Omitting carryover data might result in a lower tax refund or higher tax liability for the current year. TurboTax typically prompts users to enter or review this information, but always double-check your tax history or consult previous filings to ensure accuracy.