Maximize Savings with California Itemized Deductions Worksheet

Maximizing your savings through tax deductions is crucial for residents of California, where the cost of living can significantly impact your finances. Navigating the state's tax code can be challenging, but understanding how to utilize the California Itemized Deductions Worksheet can lead to substantial tax savings. This comprehensive guide will walk you through the process of itemizing your deductions to reduce your taxable income effectively.

What are Itemized Deductions?

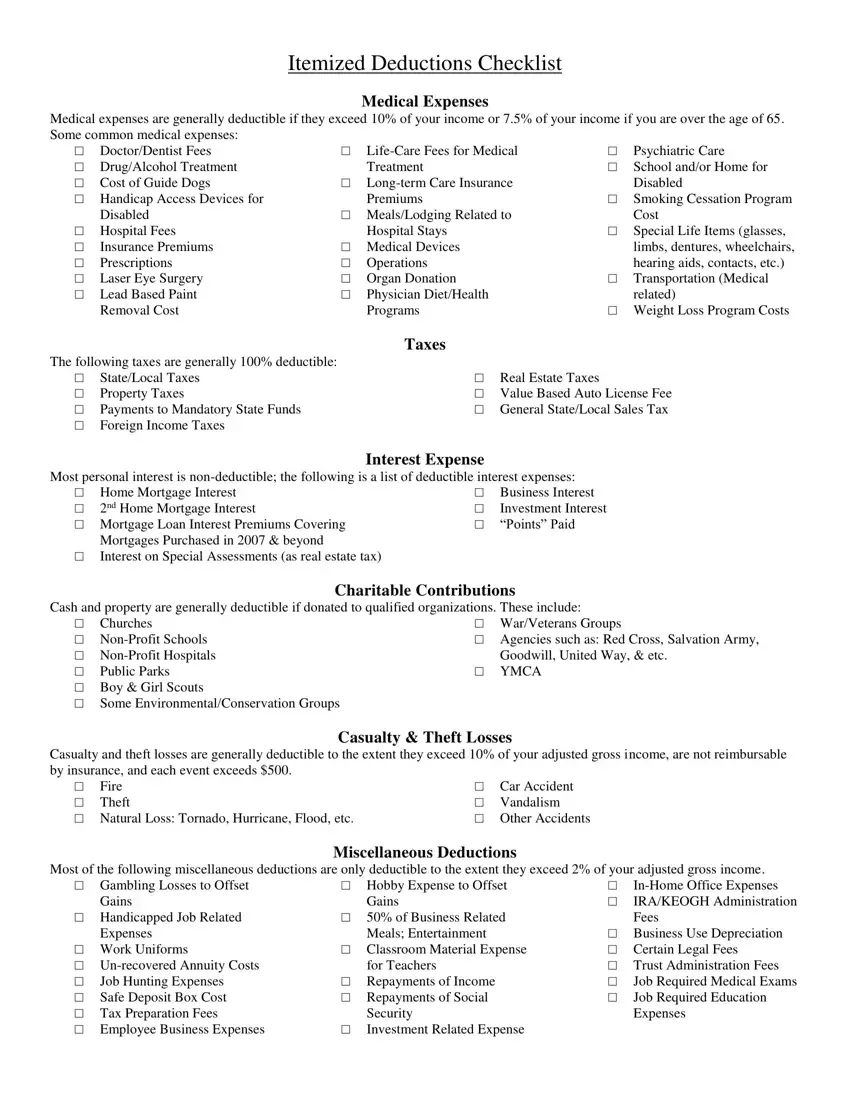

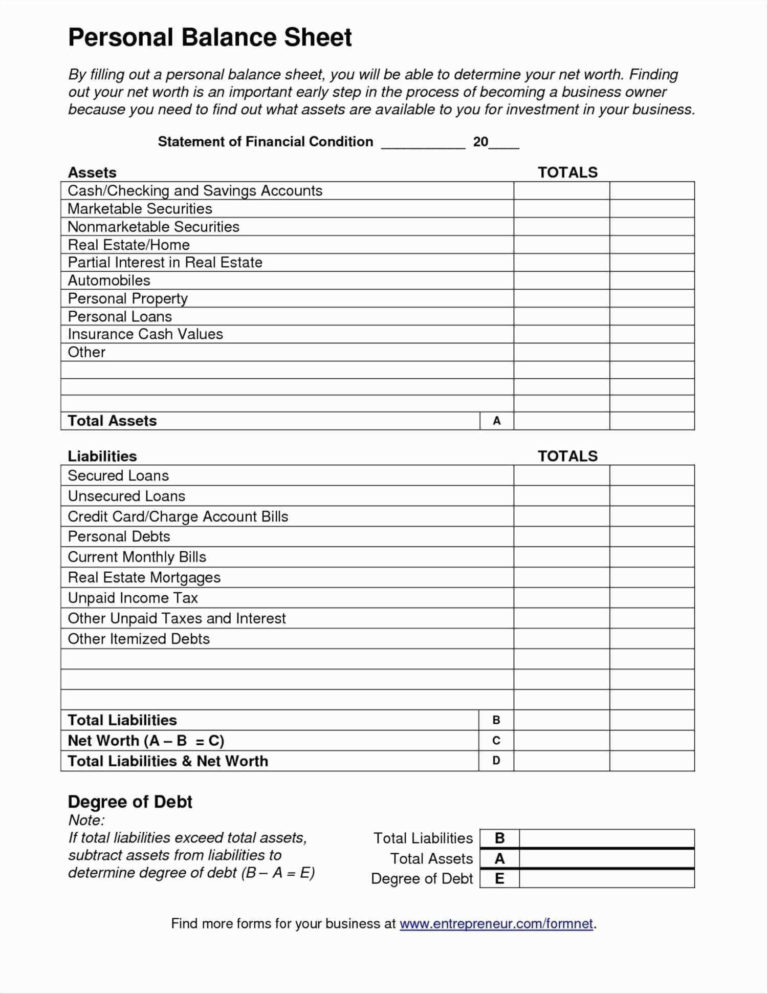

Itemized deductions allow you to reduce your taxable income by subtracting certain expenses from your adjusted gross income (AGI). While taking the standard deduction is simpler, itemizing can yield greater benefits if your expenses exceed the standard amount. Here are the primary types of itemized deductions:

- Medical and dental expenses

- Taxes paid (state, local, property)

- Home mortgage interest

- Charitable contributions

- Casualty and theft losses

- Miscellaneous deductions

Who Should Itemize?

Itemizing deductions might be beneficial if:

- You own a home with a substantial mortgage.

- You have significant medical expenses.

- You've made large charitable contributions.

- Your state or local taxes are unusually high.

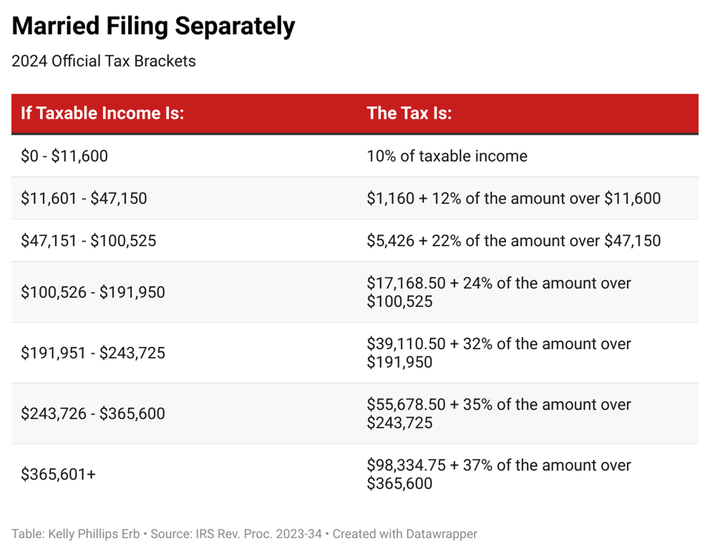

Consider comparing the total of your itemized deductions against the standard deduction to make an informed decision. For the tax year 2023, the standard deduction amounts are:

| Filing Status | Standard Deduction |

|---|---|

| Single or Married Filing Separately | $12,950 |

| Married Filing Jointly or Qualifying Widow(er) | $25,900 |

| Head of Household | $19,400 |

How to Use the California Itemized Deductions Worksheet

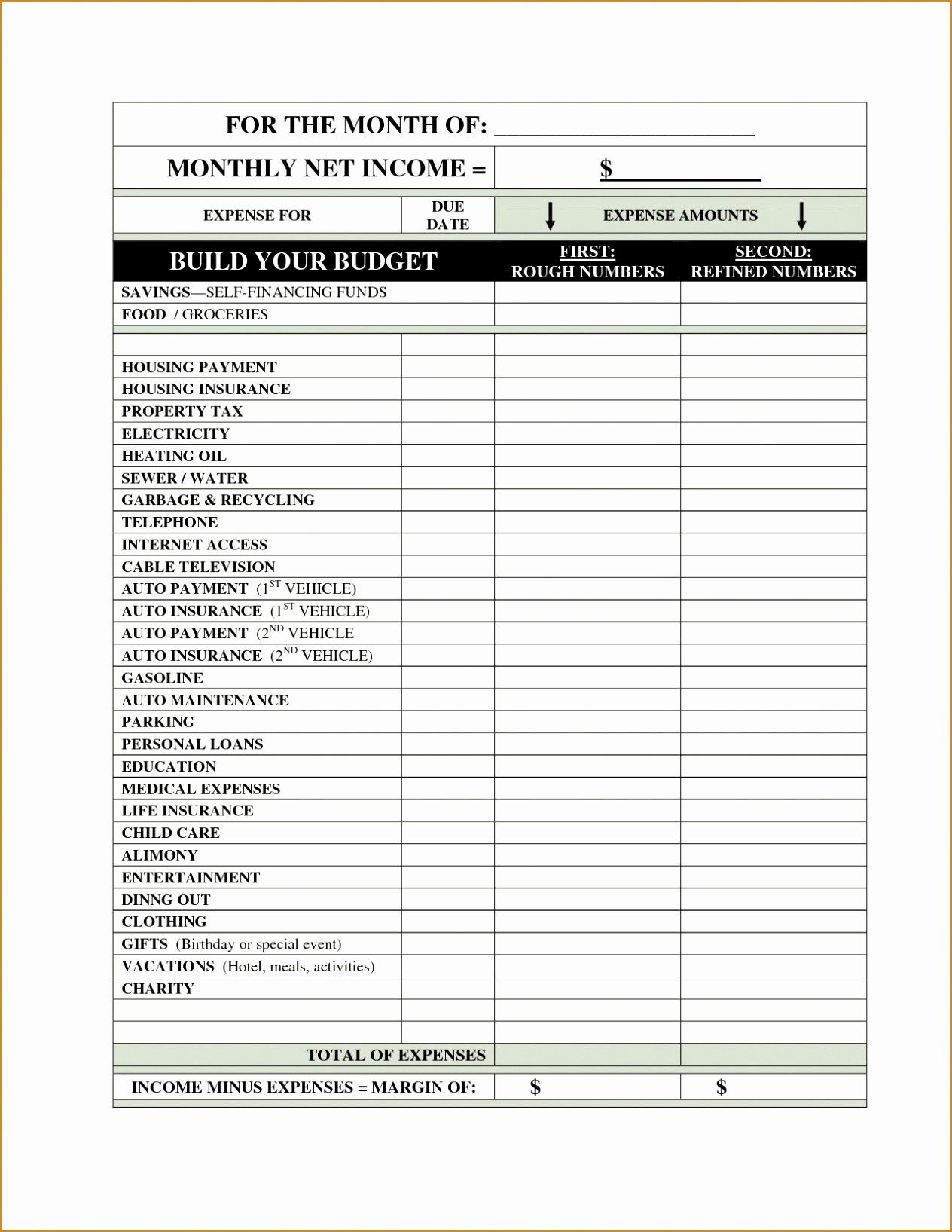

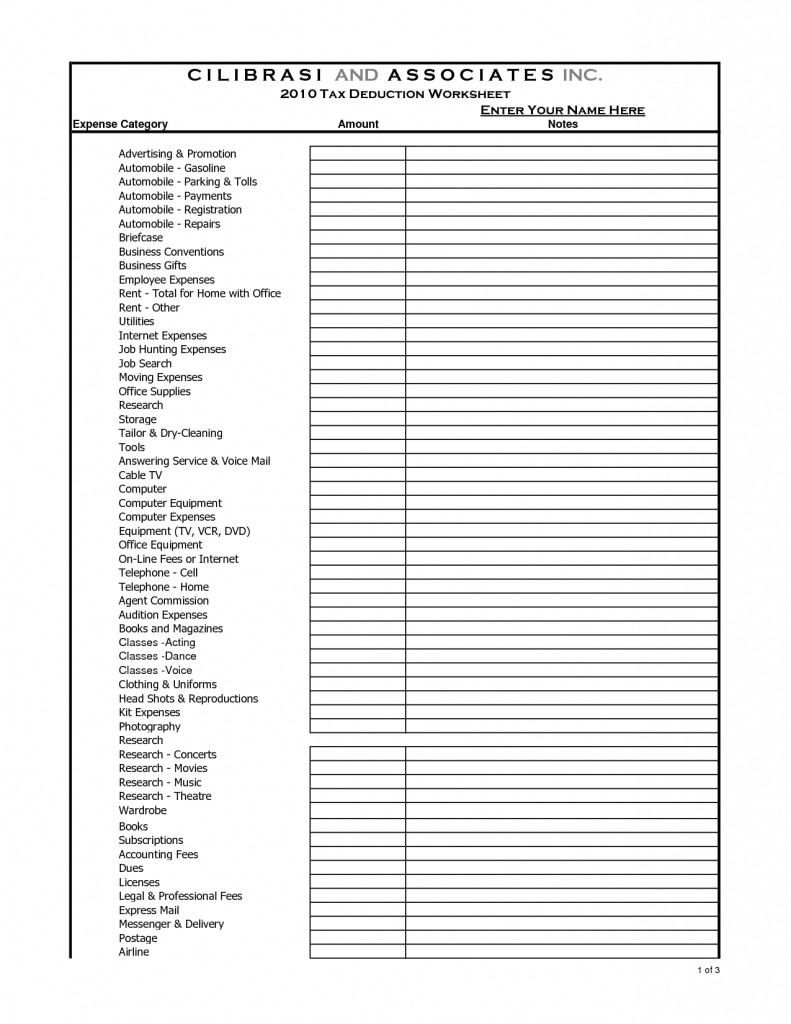

Here's a step-by-step guide on how to use the California Itemized Deductions Worksheet:

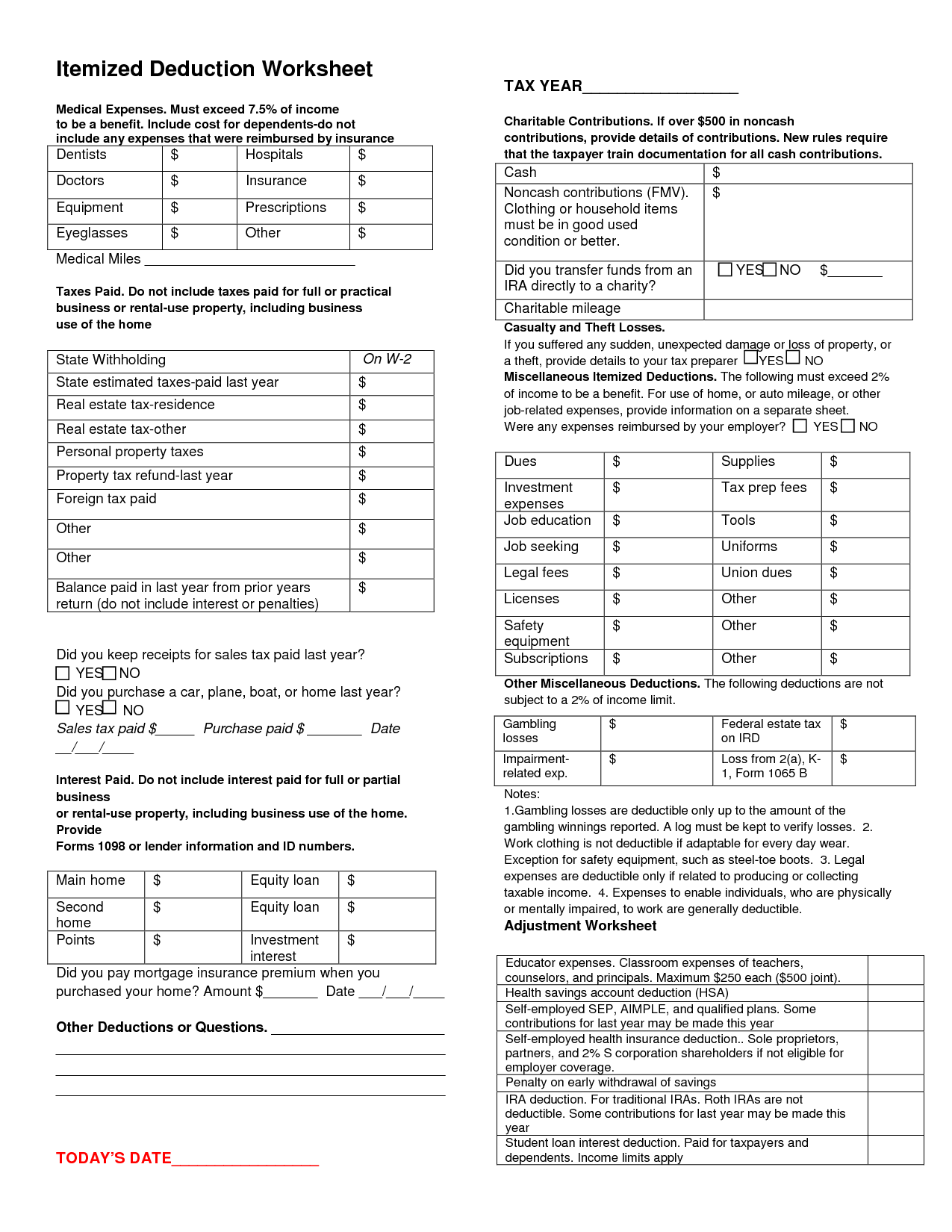

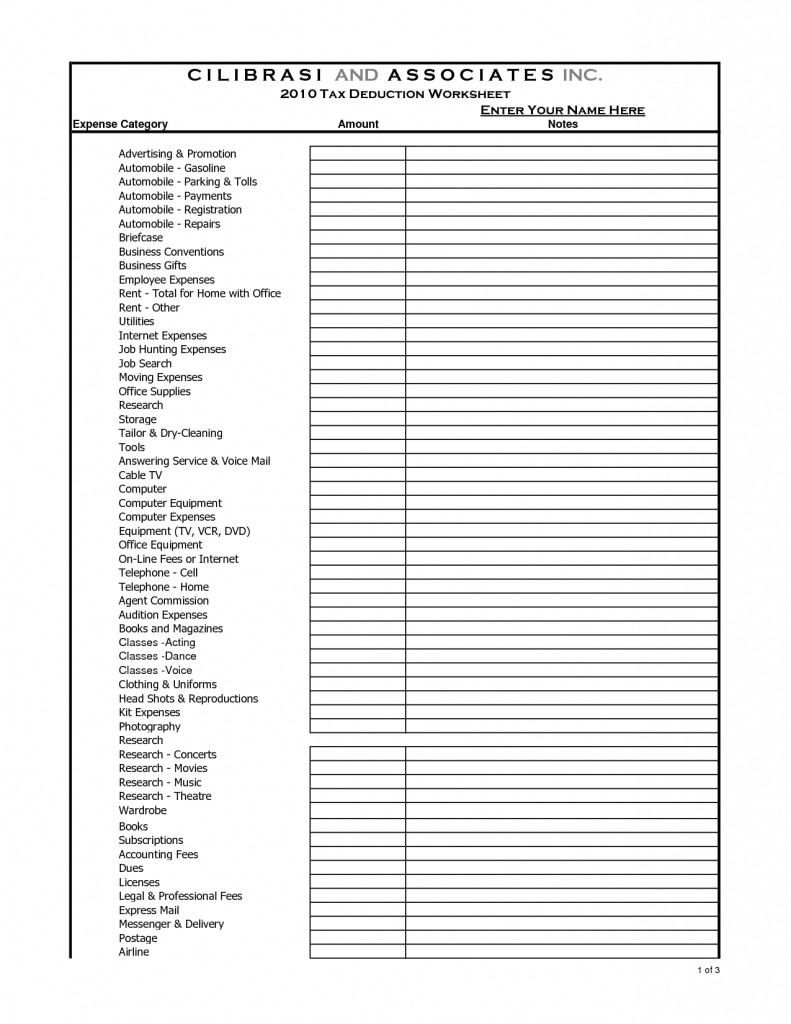

1. Gather Your Documentation

- Medical Expenses: Collect receipts or statements showing expenses like surgeries, dental treatments, and out-of-pocket medical costs.

- Taxes Paid: Real estate tax statements, state and local income tax forms, and any other tax-related documents.

- Mortgage Interest: Mortgage statements detailing interest paid.

- Charitable Contributions: Donation receipts or acknowledgements from charitable organizations.

- Miscellaneous: Include expenses like casualty losses, gambling losses (up to the amount of gambling winnings), and other IRS-approved miscellaneous expenses.

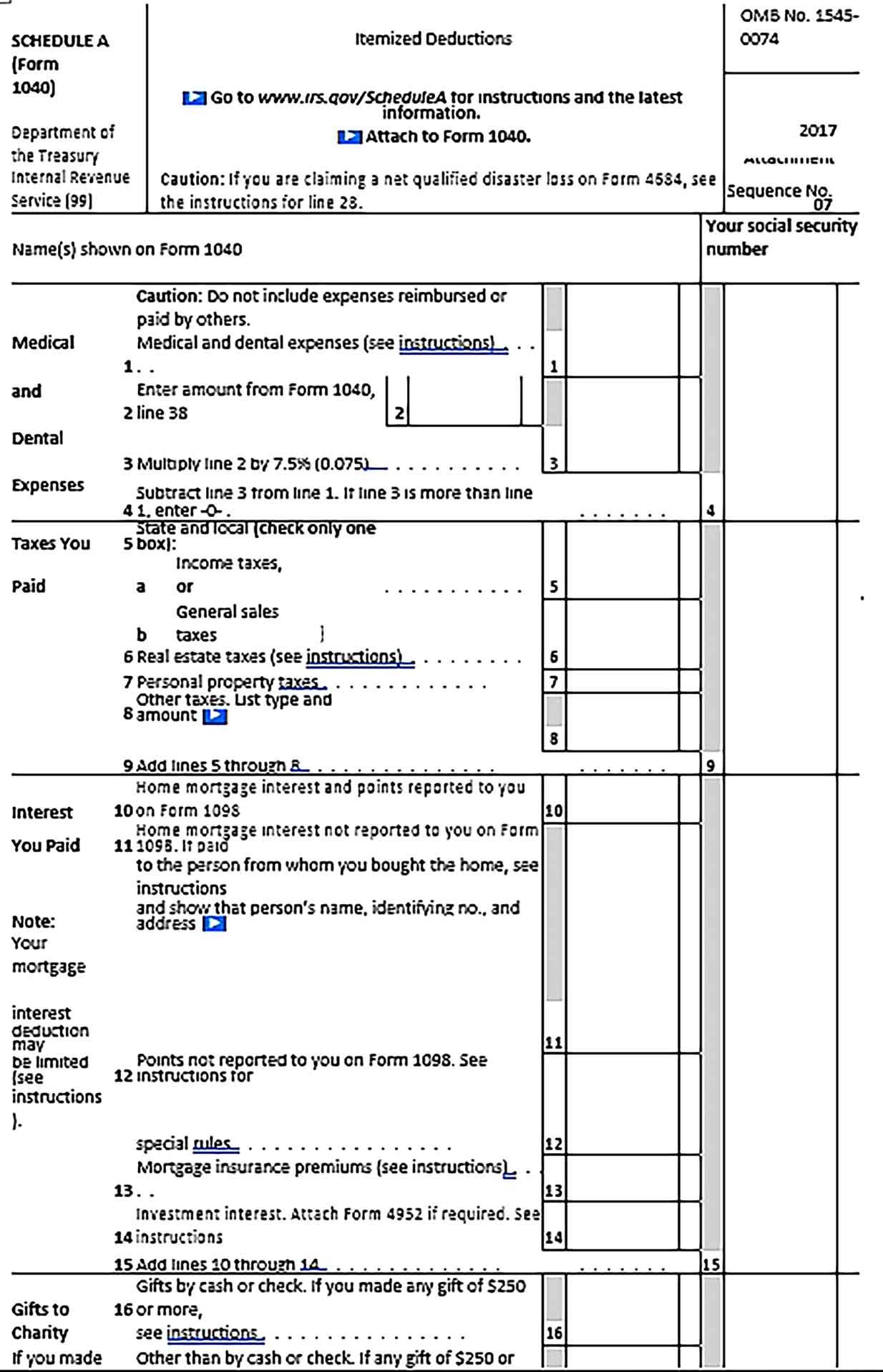

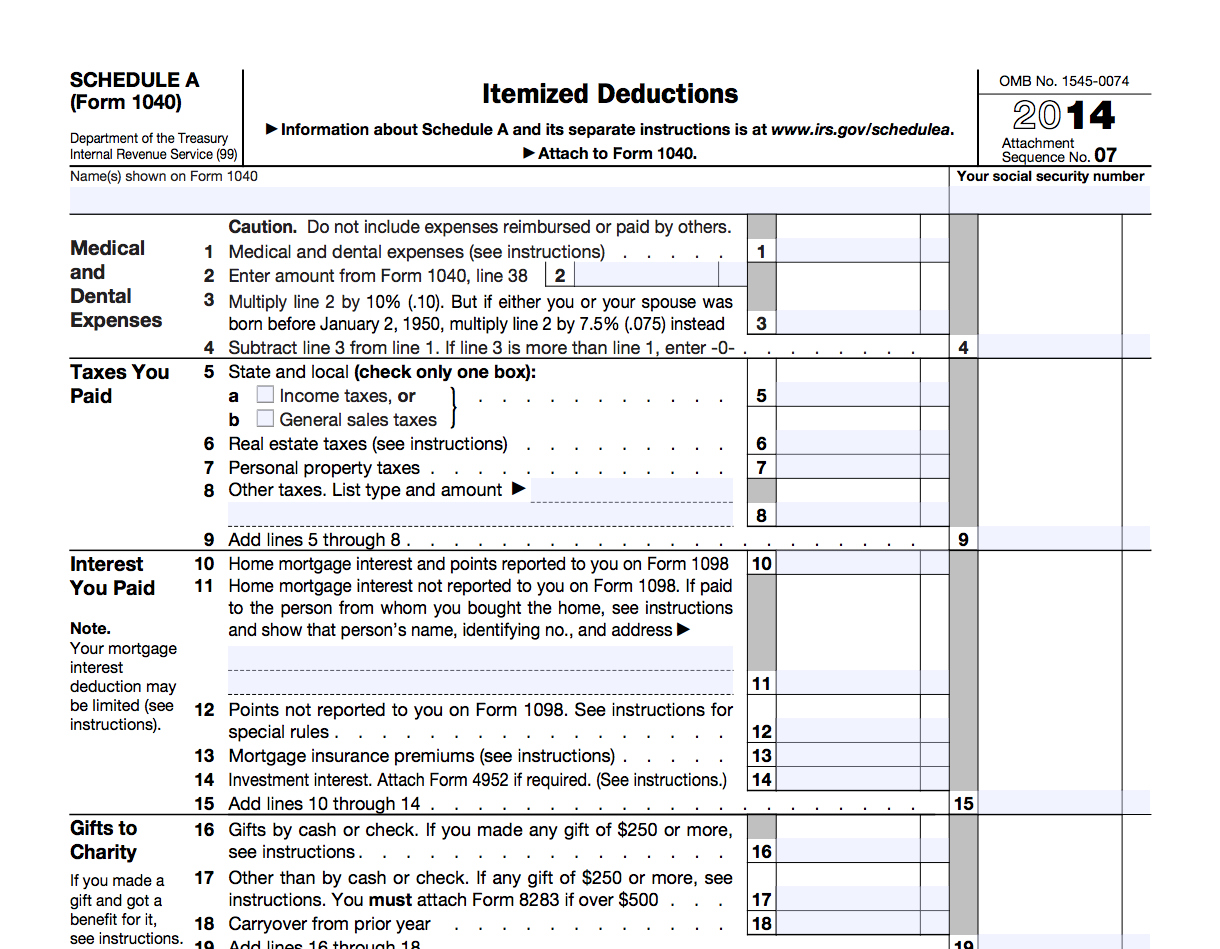

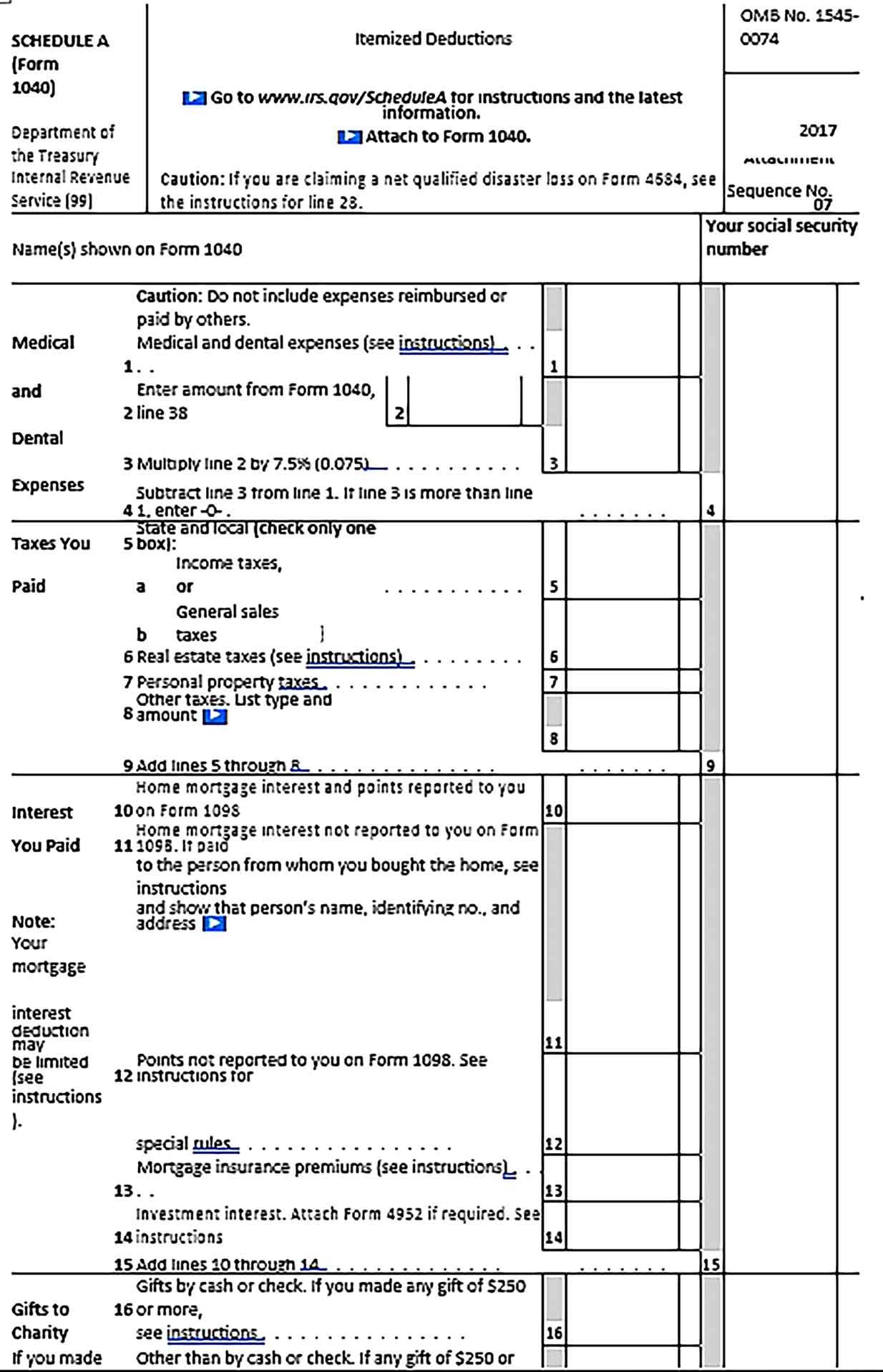

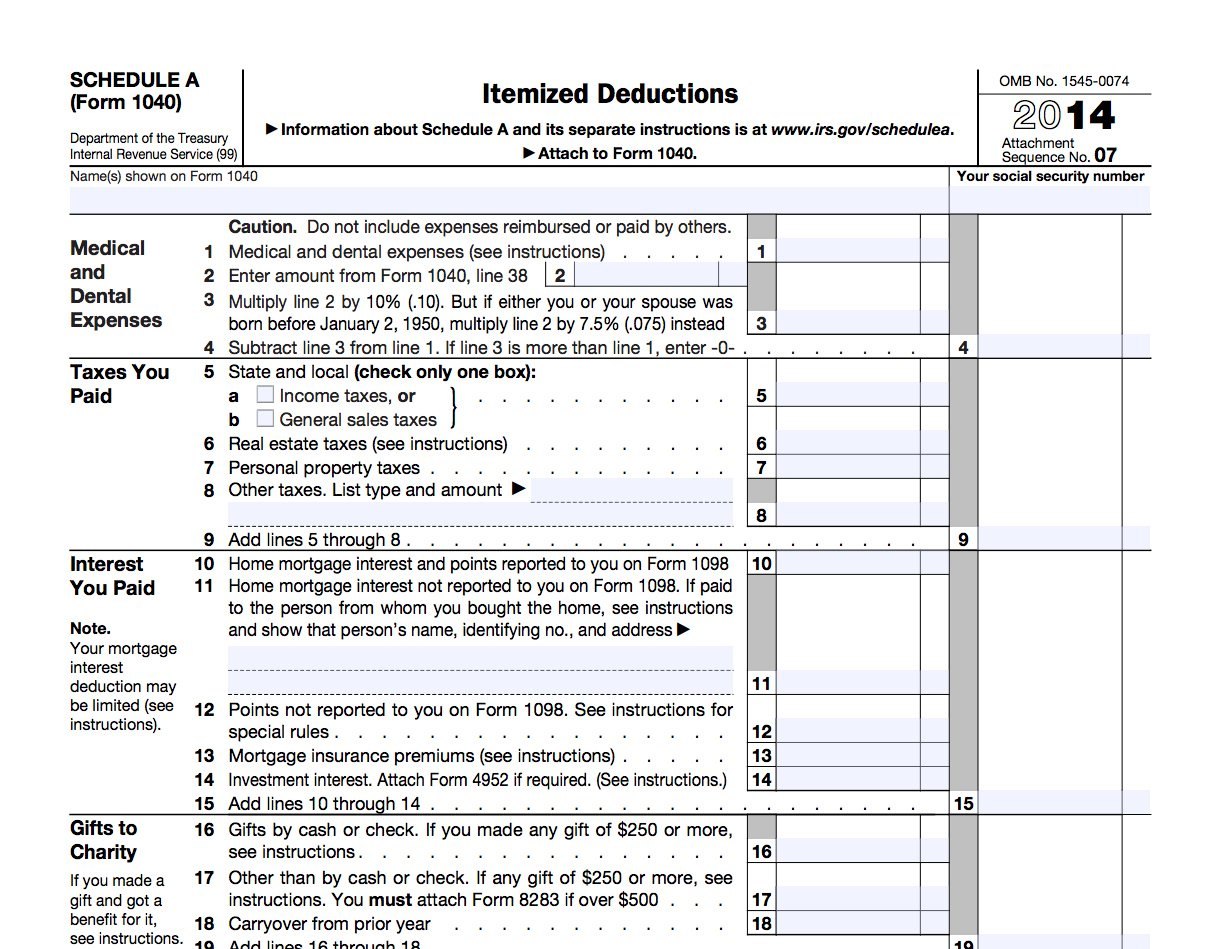

2. Complete Federal Form Schedule A

Start by filling out the Federal Schedule A to itemize deductions. This form will also help you identify which deductions are applicable to California's worksheet.

3. Access and Use the California Itemized Deductions Worksheet

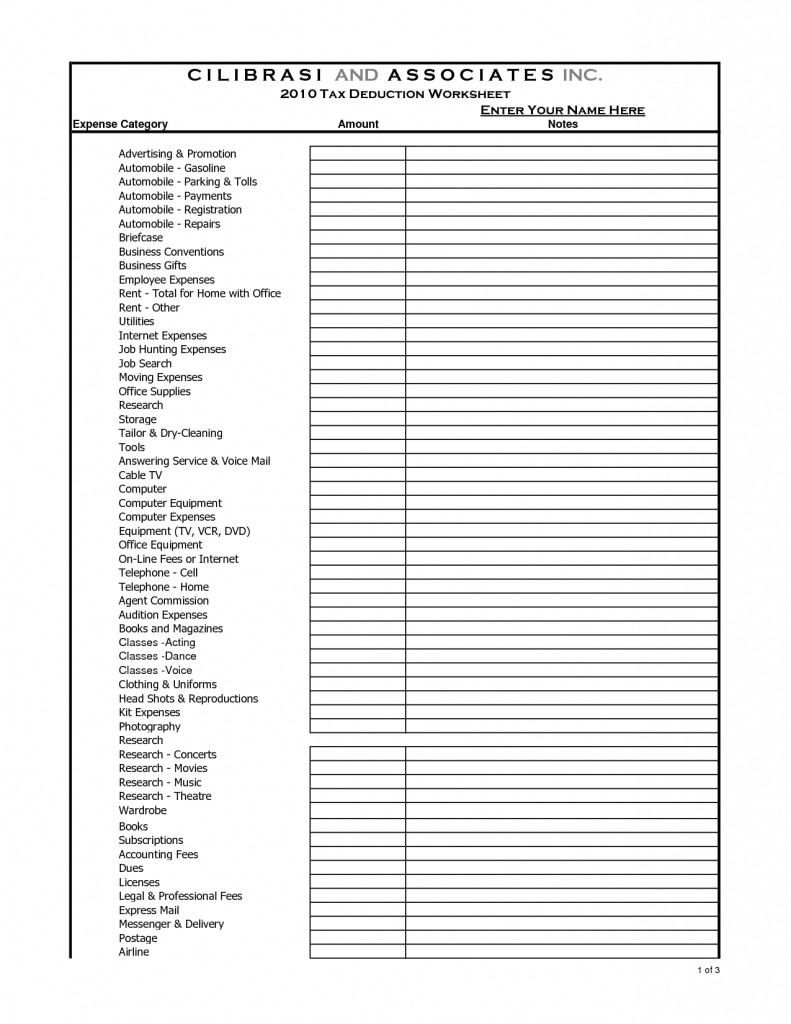

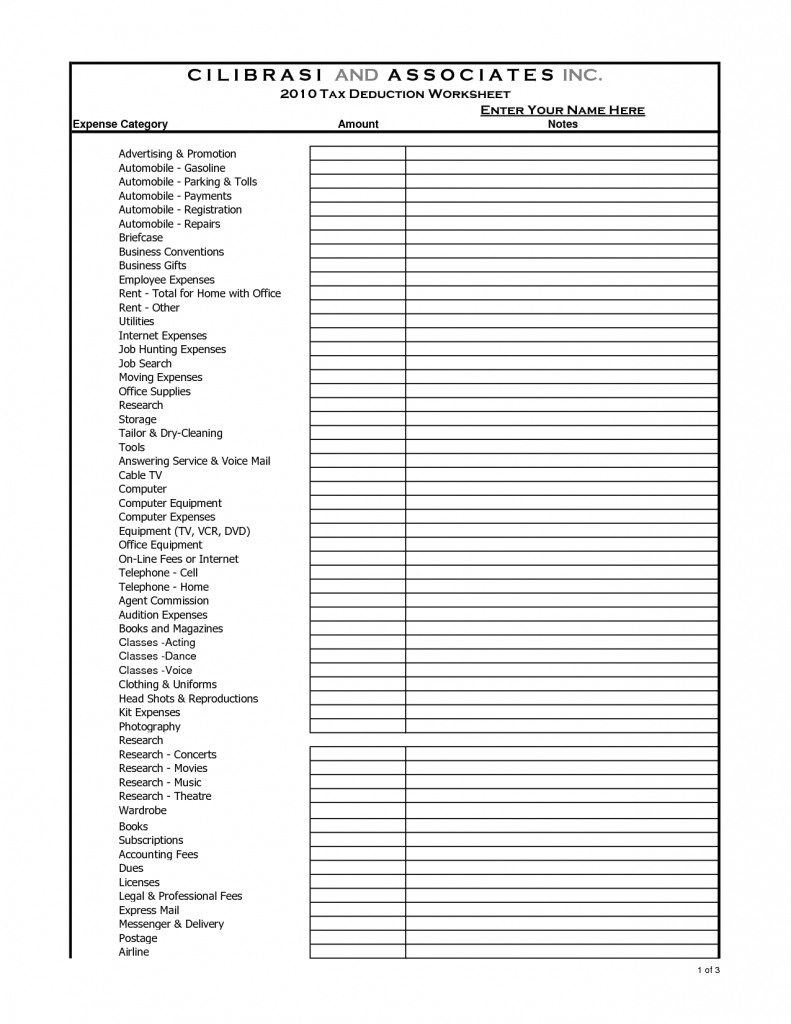

The worksheet for California can be found within the state's tax return forms or accessed online. Here are the steps to follow:

- Download or Obtain the Worksheet: Ensure you have the most up-to-date version.

- List Deductions: Enter each applicable deduction in the respective category on the worksheet.

- Adjust for AGI: California has specific rules about AGI limits for some deductions, especially medical expenses and casualty losses. Only list the amount that exceeds the AGI threshold.

- Check for Itemized Deduction Limits: California might limit or cap certain deductions. For instance, there's a cap on state and local tax (SALT) deductions.

- Calculate Total: Sum up all allowable deductions to compare against the standard deduction.

🔔 Note: Ensure all deductions claimed are well-documented as the Franchise Tax Board (FTB) might request proof during an audit.

Strategies to Maximize Your Deductions

To leverage the California Itemized Deductions Worksheet for maximum savings, consider these strategies:

1. Timing Your Expenses

If possible, time your deductible expenses to maximize their tax benefit. For example, scheduling a large medical procedure at the end of the year or prepaying mortgage interest.

2. Charitable Planning

Bundle your charitable contributions in a single year to exceed the standard deduction. For instance, if you usually give $5,000 annually, donating $10,000 in one year could push your itemized deductions over the standard deduction, reducing your taxable income more significantly in that year.

3. Use Deduction Groups

Combine or "bundle" expenses in groups to push you over the standard deduction threshold. This includes expenses like medical, taxes, and charitable contributions.

4. Keep Detailed Records

Track every deduction-eligible expense. Having a well-organized system can make the itemization process much more manageable.

5. Consult a Tax Professional

If you're unsure about the nuances of California tax laws, a tax advisor can provide guidance to maximize your deductions legally and efficiently.

In summary, effectively utilizing the California Itemized Deductions Worksheet involves understanding what expenses qualify, tracking them meticulously, and comparing them to the standard deduction to ensure you're choosing the best route for tax savings. By timing your deductions, planning charitable contributions, and grouping expenses, you can reduce your taxable income significantly. This guide aims to provide a clear path through the complex landscape of California tax deductions, enabling you to make informed financial decisions that could lead to substantial savings come tax season.

When is the best time to itemize my deductions?

+

The end of the tax year is often the best time to itemize deductions as you can evaluate all your eligible expenses together, potentially maximizing your tax savings.

Can I itemize in California if I take the standard deduction on my federal return?

+

Yes, you can itemize for state taxes in California even if you opt for the standard deduction on your federal return, provided your itemized deductions exceed California’s standard deduction.

What if I miss a deduction on my California tax return?

+If you’ve missed a deduction, you can file an amended return using Form FTB 540X within the allowable time frame to claim it.