Unlock Your Paycheck: Easy Worksheet Answer Key

Paychecks can be a source of confusion for many employees, especially when you factor in withholdings, deductions, and various contributions. This blog post is dedicated to demystifying the information on your paycheck with an Unlock Your Paycheck Worksheet and its Answer Key. By understanding each line item on your pay stub, you can better manage your finances, ensure you're being paid correctly, and make informed decisions about retirement savings and other benefits.

Understanding Your Pay Stub

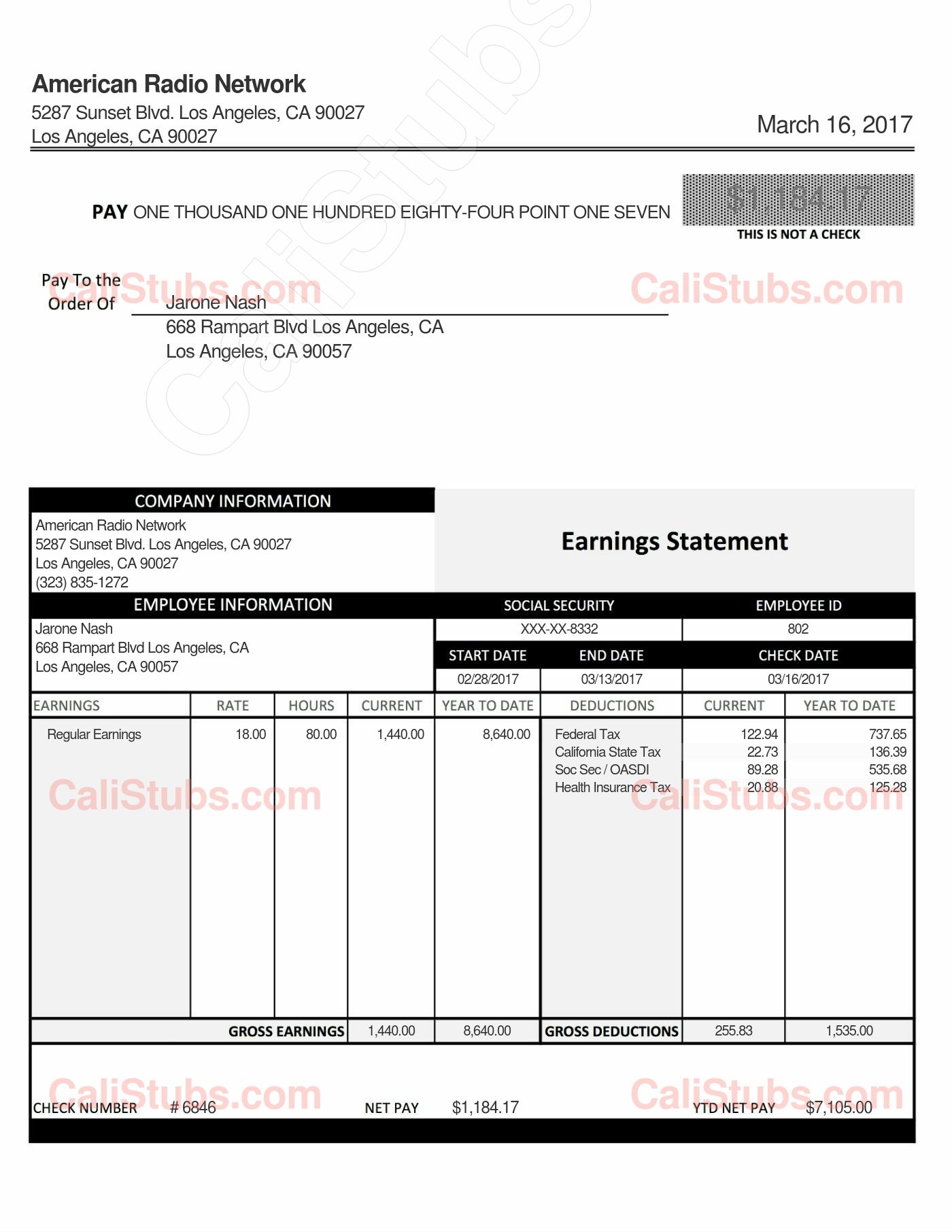

Before we delve into the worksheet, let's understand what's typically on a pay stub:

- Gross Earnings: Your total earnings before deductions.

- Withholdings: Federal and state taxes, Social Security, and Medicare.

- Deductions: These can include health insurance, retirement contributions, union dues, etc.

- Net Pay: The actual amount you take home.

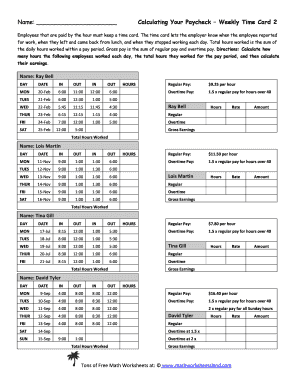

The "Unlock Your Paycheck Worksheet" Explained

The worksheet we're discussing today is designed to help you decode your paycheck by breaking down each section into simpler terms:

| Section | What It Is |

|---|---|

| Gross Pay | The total amount of money you earn before any deductions. |

| Federal Income Tax | Withholding for federal taxes based on your income, filing status, and allowances. |

| State and Local Taxes | Tax withheld for state or local governments; varies by location. |

| Social Security Tax | Mandatory contribution to the Social Security system. |

| Medicare Tax | Mandatory contribution for Medicare insurance. |

| Other Deductions | This can include health insurance premiums, retirement plans, etc. |

| Net Pay | What's left after all deductions. |

💡 Note: Always cross-check the figures on your worksheet with your actual pay stub.

Using the Worksheet to Understand Your Paycheck

Here's a step-by-step guide on how to use the Unlock Your Paycheck Worksheet to demystify your paycheck:

- Fill in Gross Pay: Start by entering the total amount of money you earn in a pay period.

- Enter Federal Income Tax: Calculate or use the provided tax tables to fill this in.

- Add State and Local Taxes: Check your pay stub or use state-specific tax calculators.

- Include Social Security and Medicare Taxes: These are usually fixed percentages of your gross income.

- Deductions: List all other deductions like health insurance, 401(k), etc.

- Calculate Net Pay: Subtract all withholdings and deductions from your gross pay.

Key Takeaways

- Understanding gross vs. net pay is crucial for budgeting.

- Your contributions to retirement accounts directly impact your tax liability.

- Check for errors or discrepancies on your pay stub regularly.

To help you get started with the worksheet, here are some key points for each section:

Gross Pay: This is your earnings before anything is taken out. Make sure it matches your agreed salary or hourly rate multiplied by hours worked.

Federal and State Income Tax: These amounts are determined by IRS tables and your state's tax laws. You might want to use an online tax calculator or consult your HR department for exact figures.

Social Security and Medicare: These taxes fund your future Social Security benefits and Medicare. They're a percentage of your gross income up to a certain limit (for Social Security).

Other Deductions: Each paycheck might contain different deductions. Common ones include:

- Health Insurance Premiums

- Retirement Plan Contributions (like 401(k))

- Life Insurance

- Union or Association Dues

After filling in the worksheet, you’ll have a clear view of how your paycheck breaks down. This knowledge can help you make better financial decisions:

- Evaluate the cost of your benefits to see if you’re getting good value.

- Adjust your withholdings to prevent over or underpaying taxes.

- Plan for retirement by contributing appropriately to your retirement account.

To wrap up our journey through the paycheck maze, understanding how your earnings are split is not just about numbers on a slip of paper; it’s about control over your financial health. The Unlock Your Paycheck Worksheet is your tool for empowerment. Here are some final thoughts:

- Remember to regularly review your paycheck for any discrepancies. Mistakes can happen, and catching them early saves you money and stress.

- Having a clear understanding of your pay stub empowers you to make informed decisions about benefits, retirement planning, and tax withholdings.

- If something seems off, don’t hesitate to contact your HR department or use this worksheet as a guide to understand where the discrepancy might lie.

Why is it important to understand my paycheck?

+

Understanding your paycheck helps you manage your finances better, ensures you are being paid correctly, and allows you to plan for taxes, benefits, and retirement.

What should I do if I find a mistake on my pay stub?

+

If you find a mistake, contact your HR department immediately with details of the error. Use your worksheet as a guide to clarify where the discrepancy might be.

How can I change my tax withholdings?

+

You can usually change your tax withholdings by submitting a new W-4 form to your HR department or by using their online portal if available.