Calculate Your Paycheck Salary with Ease and Accuracy

Understanding Your Paycheck Salary

Calculating your paycheck salary can be a daunting task, especially with the various deductions and taxes that come into play. However, having a clear understanding of your take-home pay is essential for budgeting, saving, and making informed financial decisions. In this article, we will guide you through the process of calculating your paycheck salary with ease and accuracy.

Gross Income vs. Net Income

Before we dive into the calculation process, it’s essential to understand the difference between gross income and net income.

- Gross Income: This is the total amount of money you earn from your employer before any deductions or taxes are taken out.

- Net Income: This is the amount of money you take home after all deductions and taxes have been applied.

Calculating Your Paycheck Salary

To calculate your paycheck salary, you will need to consider the following factors:

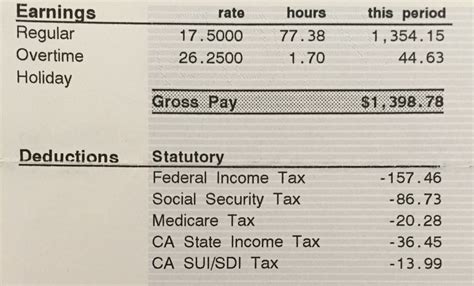

- Gross Income: Start with your gross income, which can be found on your pay stub or by contacting your HR department.

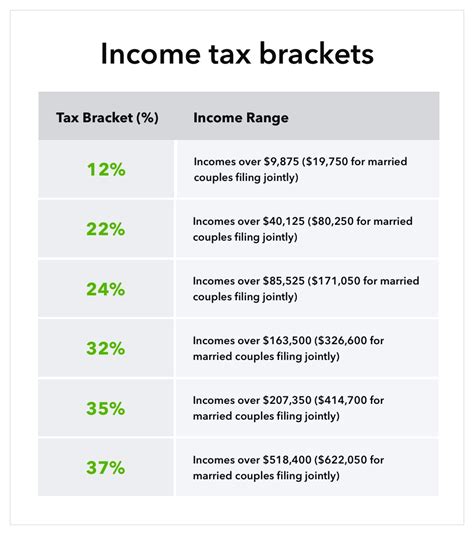

- Federal Income Tax: This is the amount of money withheld from your paycheck for federal income taxes. The amount will depend on your tax filing status, number of dependents, and tax bracket.

- State and Local Taxes: Some states and local governments also withhold taxes from your paycheck. The amount will vary depending on where you live.

- Social Security Tax: This is a 6.2% tax on your gross income, which is used to fund Social Security.

- Medicare Tax: This is a 1.45% tax on your gross income, which is used to fund Medicare.

- Other Deductions: You may also have other deductions taken out of your paycheck, such as health insurance premiums, retirement contributions, or garnishments.

Here is a step-by-step guide to calculating your paycheck salary:

- Start with your gross income.

- Calculate your federal income tax using the IRS tax tables or a tax calculator.

- Calculate your state and local taxes, if applicable.

- Calculate your Social Security tax (6.2% of gross income).

- Calculate your Medicare tax (1.45% of gross income).

- Add up all other deductions, such as health insurance premiums or retirement contributions.

- Subtract all deductions from your gross income to get your net income.

📝 Note: You can use a paycheck calculator or a spreadsheet to make the calculation process easier and more accurate.

Example Calculation

Let’s say your gross income is $4,000 per month. Here is an example calculation:

- Gross Income: $4,000

- Federal Income Tax: $800 (20% of gross income)

- State Tax: $100 (2.5% of gross income)

- Social Security Tax: $248 (6.2% of gross income)

- Medicare Tax: $58 (1.45% of gross income)

- Health Insurance Premium: $100

- Retirement Contribution: $200

Net Income: 4,000 - 800 - 100 - 248 - 58 - 100 - 200 = 2,494

Paycheck Frequency and Calculation

Paycheck frequency can affect your take-home pay. Here are some common paycheck frequencies and how they impact your calculation:

- Bi-Weekly: If you are paid every two weeks, you will receive 26 paychecks per year. To calculate your monthly take-home pay, multiply your bi-weekly paycheck by 2.

- Weekly: If you are paid every week, you will receive 52 paychecks per year. To calculate your monthly take-home pay, multiply your weekly paycheck by 4.

- Monthly: If you are paid once a month, your calculation is straightforward.

Conclusion

Calculating your paycheck salary requires considering various factors, including gross income, federal income tax, state and local taxes, Social Security tax, Medicare tax, and other deductions. By following the step-by-step guide and example calculation, you can easily and accurately determine your take-home pay. Remember to consider your paycheck frequency and adjust your calculation accordingly.

What is the difference between gross income and net income?

+

Gross income is the total amount of money you earn from your employer before any deductions or taxes are taken out. Net income, on the other hand, is the amount of money you take home after all deductions and taxes have been applied.

How do I calculate my Social Security tax?

+

Social Security tax is 6.2% of your gross income. You can calculate it by multiplying your gross income by 0.062.

Can I use a paycheck calculator to simplify the calculation process?

+

Yes, you can use a paycheck calculator or a spreadsheet to make the calculation process easier and more accurate.

Related Terms:

- Calculator

- how to calculate a paycheck

- paycheck stub examples