Budgeting for Dummies: Simple Worksheet Guide

Managing personal finances effectively is an essential skill for long-term financial stability and achieving personal goals. Whether you're saving for a big vacation, planning to buy a home, or simply aiming to get out of debt, budgeting is the cornerstone of financial planning. For beginners, however, the process can seem daunting. Here’s your comprehensive guide to creating a simple, effective budget worksheet that will help you take control of your finances.

Why Budgeting Matters

Before diving into how to create a budget, let’s understand why it’s crucial:

- Clarity: Provides a clear picture of your financial health.

- Control: Gives you control over where your money goes each month.

- Goal Setting: Helps in setting and achieving financial goals.

- Savings: Encourages saving by earmarking money before it gets spent.

Starting With the Basics

The first step in budgeting is gathering all necessary financial data:

- Your total monthly income from all sources.

- Fixed expenses like rent or mortgage, utilities, insurance, etc.

- Variable expenses which include groceries, entertainment, and miscellaneous purchases.

Monthly Income Calculation

Here’s how to calculate your monthly income:

- List all income sources: salary, freelance work, investments, etc.

- Add these amounts to get your total monthly income.

- If your income varies, use an average monthly figure.

Fixed vs. Variable Expenses

Fixed expenses are predictable, whereas variable expenses fluctuate:

- Fixed: Rent/Mortgage, Car Payments, Insurance Premiums

- Variable: Groceries, Dining Out, Entertainment

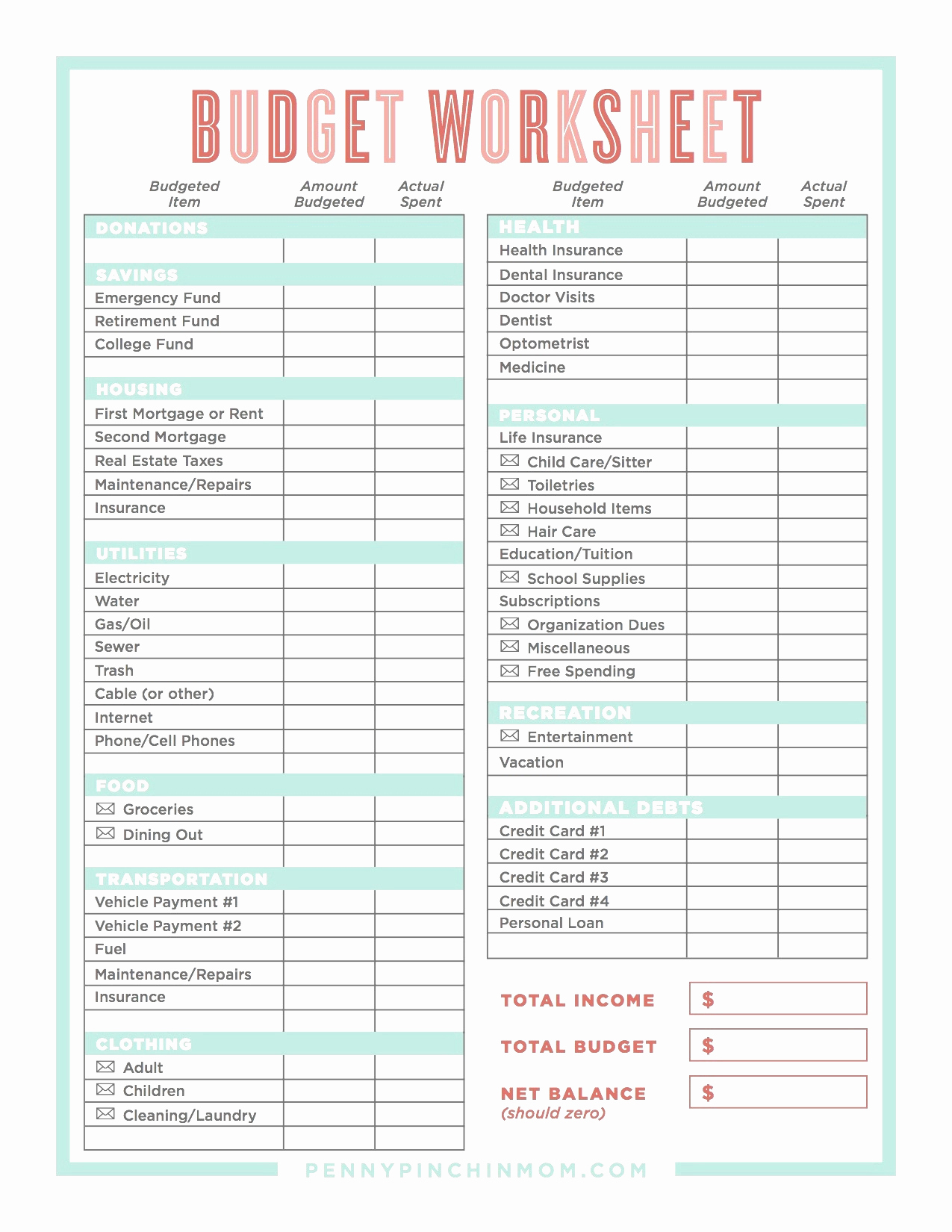

Setting Up Your Budget Worksheet

Now, let’s create a straightforward worksheet using the following structure:

| Category | Amount | Notes |

|---|---|---|

| Income | $X,XXX.XX | Total Monthly Income |

| Housing | $X,XXX.XX | |

| Utilities | $X,XX.XX | |

| Transportation | $XX.XX | |

| Food | $XX.XX | |

| Entertainment | $XX.XX | |

| Savings | $X,XX.XX | At least 10% recommended |

| Total Expenses | $X,XXX.XX | |

| Balance | $XXX.XX | Income minus Total Expenses |

💡 Note: Always allocate a portion of your income to savings, even if it's a small amount to start with.

Filling in Your Budget

Follow these steps to complete your budget:

- Enter your total monthly income in the “Income” category.

- Fill in the expenses for each category, estimating where necessary.

- Calculate the total expenses.

- Subtract total expenses from total income to find your balance.

Tracking and Adjusting Your Budget

A budget isn’t static; it requires regular review and adjustments:

- Track: Keep receipts or use a budgeting app to track actual spending.

- Adjust: If you find discrepancies, adjust future budgets accordingly.

- Plan: Use unexpected income or savings to bolster your emergency fund or invest.

Budgeting Tools and Apps

Consider these tools to make budgeting easier:

- Microsoft Excel or Google Sheets for custom spreadsheets.

- Mint or You Need A Budget (YNAB) for automated tracking and insights.

🌟 Note: Regularly updating your budget will keep it relevant and effective. Budgeting software can make this process much more manageable.

Overcoming Common Budgeting Challenges

Here are strategies to deal with common budgeting hurdles:

- Overspending: Set strict limits per category and use cash envelopes for discretionary spending.

- Fluctuating Income: Create a buffer with emergency savings and budget for the lowest expected income.

- Unexpected Expenses: Allocate a portion of your budget to an “emergency” category.

Summary of Key Points

In this comprehensive guide, we’ve explored the importance of budgeting, outlined steps to set up a personal budget worksheet, and discussed the tools and strategies to keep your budget on track. Budgeting is not just about controlling expenses but also about understanding your financial habits and making informed decisions. With this knowledge, you can better manage your money, save for the future, and achieve your financial goals.

What if my expenses exceed my income?

+

Adjust your budget to reduce discretionary spending or consider increasing your income through side gigs or better-paying jobs.

How do I handle irregular income in my budget?

+

Use an average monthly income estimate, and allocate a portion to savings during high-income months to cover low-income periods.

Can I still save if I have debts?

+

Yes, prioritize high-interest debt payment but don’t neglect your savings. Even small regular contributions to an emergency fund are beneficial.

What should I do if I have a zero balance after budgeting?

+

Look for ways to cut back on variable expenses, or find a new income stream. Also, ensure you are accounting for savings to prevent living paycheck to paycheck.