Master Your Finances: Dave Ramsey Budget Worksheet Guide

When it comes to managing personal finances, there's a name that often comes up as a beacon of guidance: Dave Ramsey. His budgeting strategies have empowered millions to take control of their money, eliminate debt, and live a financially secure life. In this comprehensive guide, we'll delve into Dave Ramsey's Budget Worksheet, providing a step-by-step walkthrough on how to utilize this invaluable tool to streamline your financial journey.

Understanding the Philosophy Behind Dave Ramsey’s Budget

Before jumping into the practicalities, it’s crucial to understand the philosophy behind Ramsey’s budgeting approach:

- Zero-Based Budgeting: Every dollar has a purpose. You allocate every cent you earn before the month begins.

- Cash-Flow Focus: Emphasizing on managing cash flow rather than simply saving or investing.

- Debt Snowball Method: A motivational debt reduction strategy where you pay off your debts in order from smallest to largest, regardless of interest rate.

Getting Started with Dave Ramsey’s Budget Worksheet

To begin mastering your finances with Dave Ramsey’s Budget Worksheet:

- Download the Worksheet: You can find printable versions of Dave Ramsey’s Budget Forms on various financial education websites or purchase his budgeting software.

- Set Your Financial Goals: Define your short-term and long-term financial objectives. What do you want to achieve with your money?

- Calculate Your Income: Sum up all your income sources, including salaries, side hustles, and any passive income.

Breaking Down the Dave Ramsey Budget Worksheet

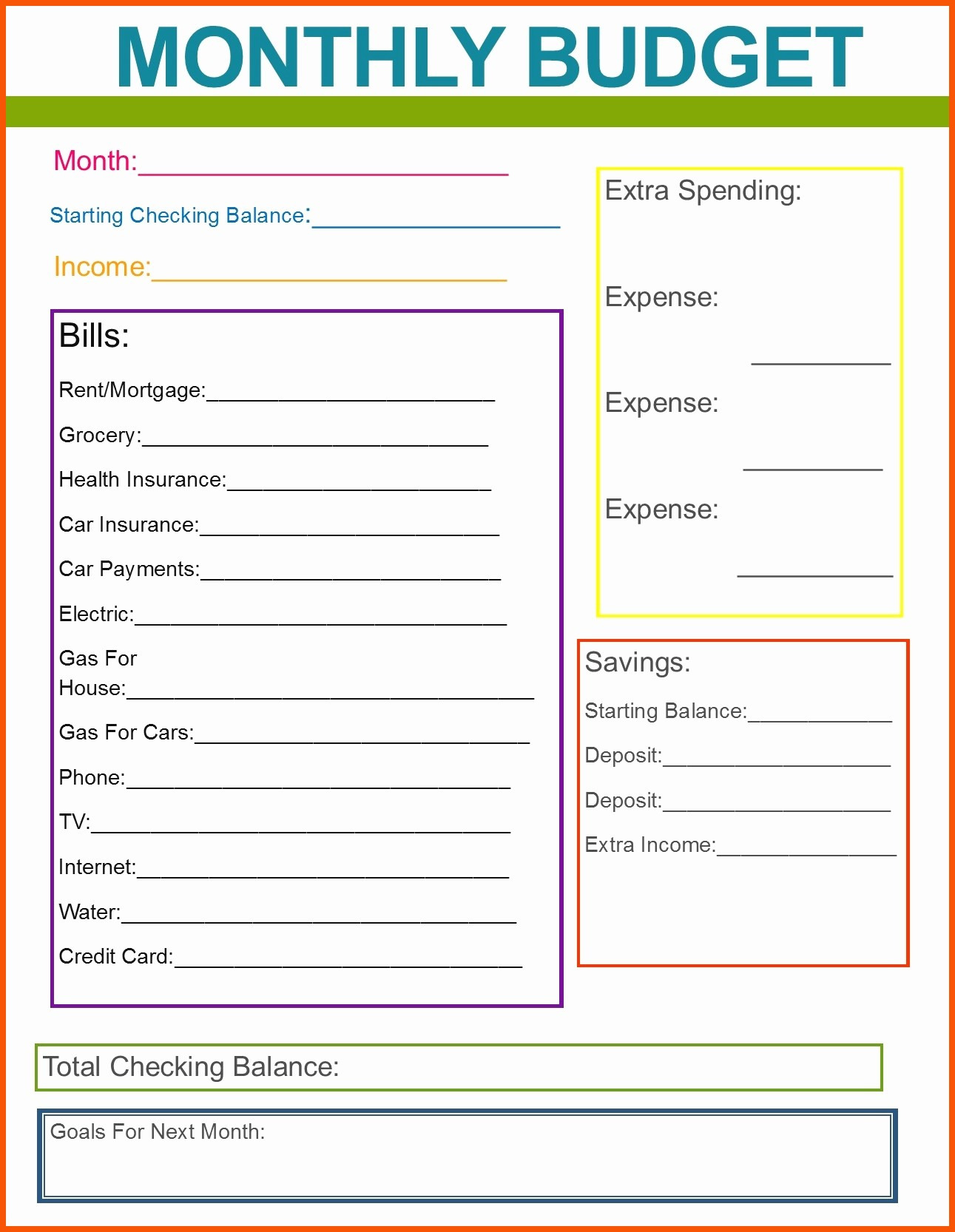

The Dave Ramsey Budget Worksheet can be divided into several key areas:

- Income: Where you record all income streams.

- Outgo: Here’s where you list all your expenses.

- Charity/Giving: Ramsey promotes tithing, though this can also be a percentage of your income for donations or causes.

- Savings: Emergency fund, retirement, and other savings goals.

- Housing: Mortgage or rent, utilities, maintenance, etc.

- Transportation: Car payments, insurance, fuel, maintenance.

- Food: Groceries, eating out, etc.

- Personal: Clothing, gifts, entertainment.

- Healthcare: Insurance, medications, and out-of-pocket expenses.

- Insurance: Home, auto, life insurance, etc.

- Debts: Minimum payments for credit cards, student loans, and other debts.

- Investments: Retirement accounts, stocks, real estate, etc.

Implementing the Budget Worksheet

Here’s how to effectively use the worksheet:

- List All Expenses: Ensure you capture both fixed and variable expenses, including those small purchases that often slip through.

- Allocate Income: Assign every dollar of your income. This might mean adjusting your lifestyle if your expenses exceed your income.

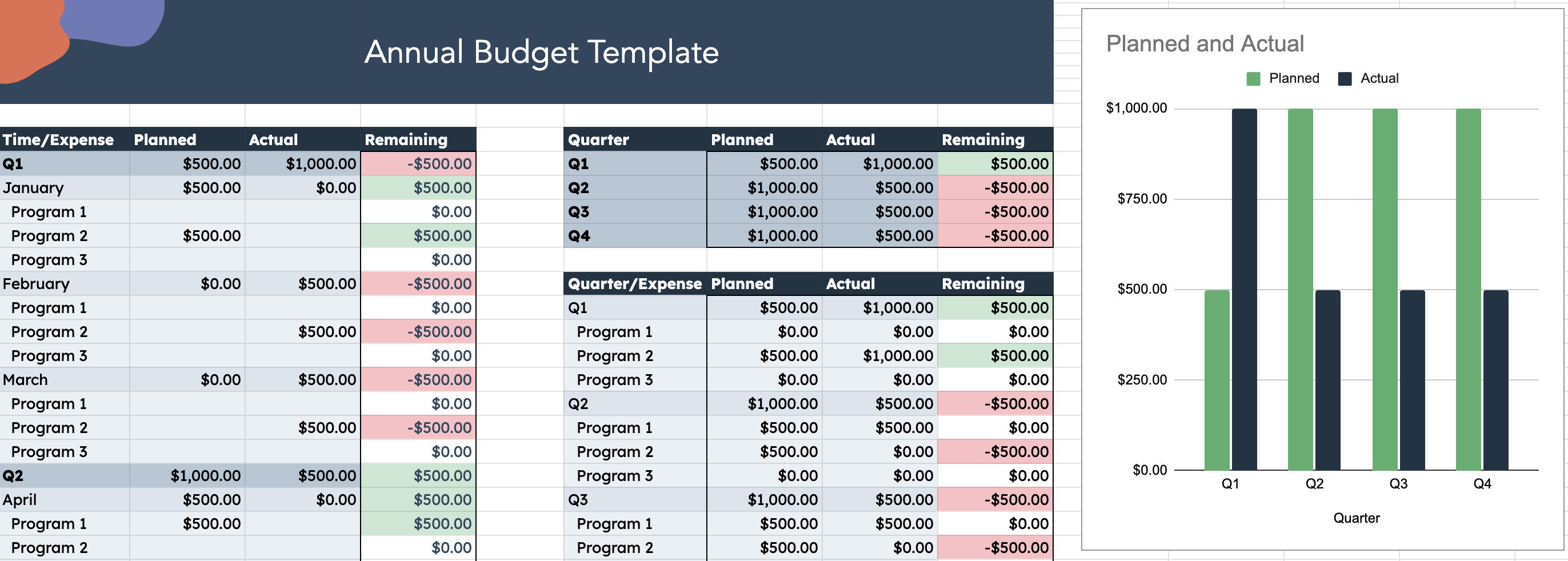

- Use Budgeting Software: While pen and paper work, digital tools can make tracking and adjusting easier.

- Follow the Plan: Stick to your allocations, adjusting where necessary throughout the month.

- Review Monthly: At the end of the month, evaluate how well you adhered to your budget and where you need to make changes.

💡 Note: Consistency is key when using any budgeting system. It takes time to adjust your financial habits.

Advanced Budgeting Tips

To get the most out of Dave Ramsey’s approach:

- Zero-based budgeting for every pay period: This ensures that every dollar from each paycheck has a purpose before it’s spent.

- Envelopes and Cash: Use the envelope system for discretionary categories like food, entertainment, and clothing.

- The Debt Snowball: Focus on paying off the smallest debt first while maintaining minimum payments on others.

- Automate Savings: Set up automatic transfers for savings to ensure you’re always contributing to your financial future.

- Track Everything: Use budgeting apps or spreadsheets to track every expense meticulously.

Customizing Your Worksheet

Every individual’s financial situation is unique. Here’s how you can personalize the budget worksheet:

- Add or remove categories based on your income streams or spending habits.

- Incorporate long-term goals like saving for a down payment on a house or funding education.

- Consider a separate “miscellaneous” category for unexpected or small expenses.

Now that we've covered the essentials of using the Dave Ramsey Budget Worksheet, let's summarize the key points you need to keep in mind:

Budgeting, when done correctly, isn't just about restriction but about empowerment. It's about understanding where your money goes, optimizing its use, and setting yourself up for a financially free life. Dave Ramsey's approach has proven effective for countless individuals, and with dedication, it can work for you too. Every step towards financial mastery begins with a well-thought-out budget, and now you have the tools to make that happen.

Can I use the Dave Ramsey Budget Worksheet if I earn irregular income?

+

Yes, you can adapt the worksheet for irregular income. During high income periods, allocate more to savings or debt reduction, and during low periods, adjust your budget to cover essentials only.

Is it necessary to use cash for the envelope system?

+

While cash is traditionally used for the envelope system, you can also allocate money in a digital account dedicated to specific categories, ensuring you don’t spend beyond your budget for each category.

How do I handle extra income or windfalls with this budgeting method?

+

According to Dave Ramsey, any extra income should first go towards paying off debts or bolstering your emergency fund, in line with your current financial priorities.