5 Ways To Spot

Introduction to Identifying Scams

In today’s digital age, scams and frauds are becoming increasingly sophisticated, making it harder for individuals to distinguish between legitimate opportunities and deceptive schemes. Whether it’s an investment scam, a phishing email, or a fake online store, the consequences of falling victim can be severe, ranging from financial loss to identity theft. Therefore, it’s crucial to be equipped with the knowledge and skills necessary to spot these scams before they cause harm. This article will explore five key ways to identify scams, helping you navigate the complex online landscape with greater confidence and security.

Understanding the Anatomy of a Scam

Before diving into the methods for spotting scams, it’s essential to understand the basic components and tactics used by scammers. Scams often rely on psychological manipulation, urgency, and misinformation to convince victims to take the desired action. Scammers may use fake websites, spoofed emails, or social media profiles that mimic those of legitimate companies or individuals to build trust. Recognizing these tactics is the first step in protecting yourself.

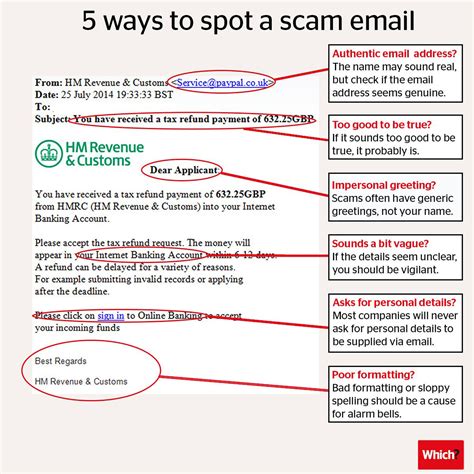

1. Verify the Source

The first and perhaps most critical step in identifying a scam is to verify the source. Scammers often pretend to be from reputable companies or government agencies. To verify, look for official contact information and reach out to the company directly using a phone number or email address you know is legitimate. Be wary of unsolicited contacts, especially if they request personal or financial information.

2. Be Cautious of Urgency

Scams often create a sense of urgency to prompt victims into acting quickly without thinking. Phrases like “limited time offer” or “your account will be closed” are designed to panic you into making a decision. Legitimate companies will not pressure you in this way. Always take a step back and assess the situation calmly.

3. Check for Grammar and Spelling Mistakes

While not foolproof, poor grammar and spelling can be indicative of a scam. Legitimate companies typically have professional communications without such errors. However, some scams are becoming more sophisticated, so this alone should not be relied upon as a definitive indicator.

4. Look for Secure Connections

When dealing with websites, especially those asking for personal or financial information, ensure the connection is secure. Look for “https” at the start of the URL and a “lock icon” in the address bar. A secure connection does not guarantee legitimacy but is a necessary aspect of any legitimate transaction.

5. Research and Reviews

Finally, research the opportunity thoroughly. Look for reviews from multiple sources, and be wary of overly positive reviews that seem fake. Check if the company or individual is registered with relevant regulatory bodies. The absence of verifiable information or the presence of numerous complaints can be a strong indicator of a scam.

🚨 Note: Staying informed and up-to-date with the latest scam tactics is crucial. Regularly visit reputable sources for information on current scams and best practices for online safety.

In the quest for online safety, vigilance and knowledge are your best defenses. By understanding how scams operate and applying the methods outlined above, you can significantly reduce your risk of falling victim. In a world where digital interactions are increasingly common, being proactive about your online security is not just beneficial, it’s essential.

What are some common tactics used by scammers?

+

Scammers often use psychological manipulation, urgency, and misinformation. They may also use fake websites, spoofed emails, or social media profiles to appear legitimate.

How can I verify the legitimacy of a company or individual online?

+

Verify by looking for official contact information and reaching out directly. Also, check for reviews from multiple sources and ensure they are registered with relevant regulatory bodies.

What should I do if I suspect I’ve fallen victim to a scam?

+

If you suspect you’ve fallen victim to a scam, act quickly. Contact your bank or credit card company to freeze your accounts, change your passwords, and report the incident to the relevant authorities.