5 Ways Ohio Pay Works

Introduction to Ohio Pay

Ohio Pay is a comprehensive system designed to manage and process payroll for businesses and organizations operating within the state of Ohio. Understanding how Ohio Pay works is crucial for both employers and employees to ensure seamless and accurate payroll processing. This system integrates various aspects of payroll management, including wage calculation, tax deductions, and benefits administration. In this article, we will delve into the five key ways Ohio Pay works, exploring its features, benefits, and the impact it has on payroll processing.

1. Registration and Setup

The first step in utilizing Ohio Pay involves registration and setup. Employers must register their business with the appropriate state and federal agencies to obtain necessary identification numbers, such as the Employer Identification Number (EIN). Once registered, employers can set up their payroll system, which includes configuring payroll schedules, defining pay rates, and establishing tax withholding rates. This initial setup is critical as it lays the foundation for all subsequent payroll processing activities.

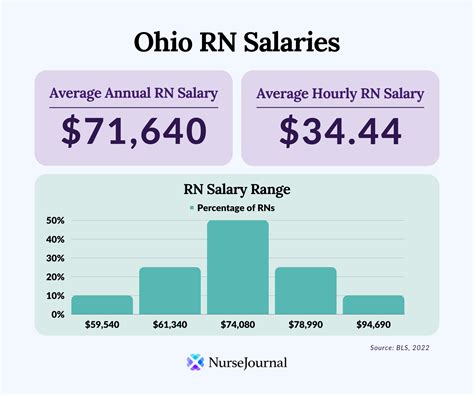

2. Payroll Calculation and Processing

Ohio Pay simplifies the payroll calculation and processing phase by automating the computation of gross pay, deductions, and net pay for each employee. The system takes into account various factors, including hourly rates, salaried amounts, overtime pay, and benefits, to accurately calculate payroll. Additionally, it deducts the appropriate state and federal taxes, ensuring compliance with tax regulations. This automated process reduces the likelihood of human error, making payroll management more efficient and reliable.

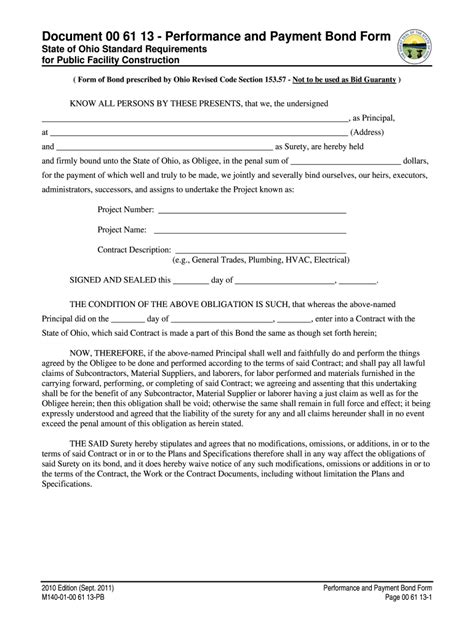

3. Tax Compliance and Reporting

One of the critical aspects of Ohio Pay is its ability to handle tax compliance and reporting. The system ensures that all necessary tax deductions are made and that tax returns are filed on time. This includes processing forms such as the W-2 for employees and the W-3 for the employer, as well as quarterly and annual tax returns. Ohio Pay’s tax compliance feature helps businesses avoid penalties associated with late or incorrect tax filings, ensuring they remain in good standing with state and federal tax authorities.

4. Benefits Administration

Ohio Pay also facilitates the administration of employee benefits, such as health insurance, retirement plans, and other fringe benefits. The system allows employers to easily manage benefit enrollments, deductions, and payments. By integrating benefits administration into the payroll process, Ohio Pay streamlines the management of employee compensation packages, making it easier for employers to attract and retain talent.

5. Reporting and Analytics

The final key aspect of Ohio Pay is its reporting and analytics capability. The system provides employers with access to detailed payroll reports and analytics, enabling them to track payroll expenses, identify trends, and make informed business decisions. These reports can include summaries of payroll costs, benefit utilization, and tax liabilities, among others. By leveraging these insights, businesses can optimize their payroll processes, reduce costs, and improve overall financial management.

📝 Note: It's essential for employers to regularly review and update their payroll settings within Ohio Pay to ensure accuracy and compliance with changing tax laws and regulations.

In summary, Ohio Pay is a multifaceted system that simplifies payroll management for businesses in Ohio. By understanding the five key ways Ohio Pay works, employers can better navigate the complexities of payroll processing, ensuring compliance, efficiency, and accuracy in their payroll operations. Whether it’s the initial setup, payroll calculation, tax compliance, benefits administration, or reporting and analytics, Ohio Pay offers a comprehensive solution that supports the payroll needs of businesses across the state.

What is the primary purpose of Ohio Pay?

+

The primary purpose of Ohio Pay is to provide a comprehensive system for managing and processing payroll for businesses operating in Ohio, ensuring accuracy, compliance, and efficiency in payroll operations.

How does Ohio Pay handle tax compliance?

+

Ohio Pay ensures tax compliance by deducting the appropriate state and federal taxes and filing necessary tax returns, including forms W-2 and W-3, and quarterly and annual tax returns, to avoid penalties associated with late or incorrect filings.

What benefits does Ohio Pay offer for employee benefits administration?

+

Ohio Pay streamlines the administration of employee benefits by allowing employers to easily manage benefit enrollments, deductions, and payments, integrating benefits administration into the payroll process for a comprehensive compensation package management.