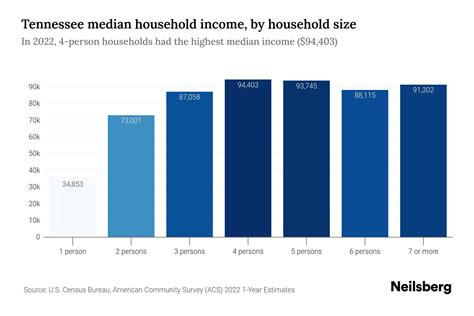

5 Ways Tennessee Income Works

Introduction to Tennessee Income

Tennessee, known as the Volunteer State, is a place where the economy is diverse and the people are friendly. When it comes to Tennessee income, there are several ways it works, affecting the lives of its residents and the overall economic landscape. Understanding these aspects can provide valuable insights into how the state’s economy functions and how its residents manage their finances. In this article, we will delve into five key ways Tennessee income works, covering topics from taxation to employment opportunities.

Taxation in Tennessee

Tennessee has a unique approach to taxation, which directly impacts the income of its residents. The state does not have a state income tax, which means that individuals do not have to pay taxes on their earned income. However, there are other forms of taxation, such as the Hall Income Tax, which applies to certain types of investment income, including dividends and interest. This tax system is designed to encourage economic growth by reducing the burden on workers and businesses.

Employment Opportunities

The employment landscape in Tennessee is diverse, with major industries including healthcare, manufacturing, tourism, and music and entertainment. These sectors provide a wide range of job opportunities for residents, contributing to the state’s overall income. Major cities like Nashville and Memphis are hubs for employment, with companies ranging from small startups to large corporations. The job market in Tennessee is relatively strong, with a mix of blue-collar and white-collar jobs available.

Cost of Living

The cost of living in Tennessee is generally lower compared to other states in the U.S. This aspect of Tennessee income is crucial because it affects how far one’s income can stretch. With lower costs for housing, food, and transportation, residents can enjoy a higher standard of living without needing exceptionally high incomes. This makes Tennessee an attractive location for individuals and families looking to relocate for better economic opportunities.

Economic Growth Initiatives

Tennessee has implemented various initiatives to boost economic growth and increase income opportunities for its residents. These include business incentives, education and training programs, and infrastructure development. By attracting new businesses and supporting the growth of existing ones, the state aims to create more jobs and increase average incomes. Furthermore, investments in education and infrastructure are designed to enhance the state’s competitiveness and appeal to both businesses and individuals.

Agriculture and Rural Income

A significant portion of Tennessee’s economy is based on agriculture, with the state being a major producer of crops like tobacco, cotton, and soybeans, as well as livestock. For residents in rural areas, agriculture is a primary source of income. The state also supports rural development initiatives to help communities thrive, including programs for farm assistance, rural business development, and community facilities improvement. These efforts are vital for maintaining the economic viability of rural areas and ensuring that all residents have access to opportunities for income growth.

🌟 Note: Understanding the local economy and income sources is essential for making informed decisions about living, working, or investing in Tennessee.

In summary, Tennessee’s income landscape is shaped by a combination of its tax policies, employment opportunities, cost of living, economic growth initiatives, and agricultural sector. Each of these factors plays a critical role in determining the overall economic health of the state and the financial well-being of its residents. By grasping these concepts, individuals can better navigate the economic environment in Tennessee and make the most of the opportunities available.

What is the Hall Income Tax in Tennessee?

+

The Hall Income Tax is a tax on certain types of investment income, including dividends and interest, applicable to residents of Tennessee.

Does Tennessee have a state income tax?

+

No, Tennessee does not have a state income tax on earned income, making it an attractive location for individuals and businesses.

What are the main industries in Tennessee?

+

The main industries in Tennessee include healthcare, manufacturing, tourism, and music and entertainment, providing a diverse range of employment opportunities.

Related Terms:

- Omarr Norman Lott

- Andrej Karic

- Will Brooks

- Omari Thomas

- Gaston Moore

- Christian Charles