Military

Assumable VA Loan Benefits

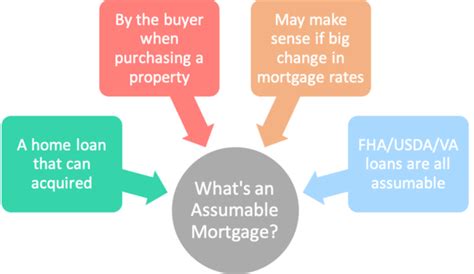

Introduction to Assumable VA Loans

An Assumable VA loan is a type of mortgage that allows a buyer to take over the seller’s existing VA loan when purchasing a home. This can be a highly beneficial option for both the buyer and the seller, as it provides a unique opportunity to save money on interest rates and closing costs. In this article, we will explore the benefits of assumable VA loans and how they can be a game-changer for those looking to purchase or sell a home.

Benefits for the Buyer

There are several benefits for the buyer when assuming a VA loan. Some of the most significant advantages include: * Lower Interest Rates: VA loans often have lower interest rates compared to other types of mortgages. By assuming a VA loan, the buyer can take advantage of these lower rates, which can result in significant savings over the life of the loan. * Reduced Closing Costs: When assuming a VA loan, the buyer may not have to pay all of the typical closing costs associated with purchasing a home. This can help reduce the upfront costs of buying a home and make it more affordable. * No Need for a New Appraisal: In many cases, the buyer may not need to get a new appraisal of the property, which can save time and money. * Faster Closing Process: The assumption process can be faster than applying for a new mortgage, as the buyer is essentially taking over the existing loan.

Benefits for the Seller

Assumable VA loans can also be beneficial for the seller. Some of the advantages include: * Attracting More Buyers: By offering an assumable VA loan, the seller may be able to attract more buyers who are interested in taking advantage of the benefits of a VA loan. * Reduced Risk of Default: When a buyer assumes a VA loan, the seller is no longer responsible for the loan. This can reduce the risk of default and provide peace of mind for the seller. * Potential for a Faster Sale: The assumption process can be faster than the traditional mortgage process, which can result in a quicker sale for the seller. * More Competitive Market: Offering an assumable VA loan can make the seller’s property more competitive in the market, as it provides a unique benefit that other sellers may not be able to offer.

How to Assume a VA Loan

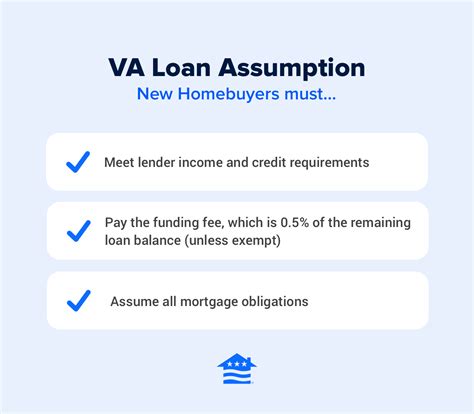

Assuming a VA loan is a relatively straightforward process. Here are the general steps involved: * Find a Home with an Assumable VA Loan: The buyer must find a home that has an existing VA loan that can be assumed. * Meet the Eligibility Requirements: The buyer must meet the eligibility requirements for a VA loan, which includes being a veteran, active-duty military, or surviving spouse. * Apply for Assumption: The buyer must apply for assumption of the VA loan, which involves submitting an application and providing financial information. * Undergo a Credit Check: The buyer will undergo a credit check to ensure they are eligible to assume the loan. * Close the Assumption: Once the assumption is approved, the buyer will close the assumption and take over the existing VA loan.

📝 Note: The buyer must also pay a funding fee, which can range from 0.5% to 3.3% of the loan amount, depending on the type of loan and the buyer's eligibility.

Comparison of Assumable VA Loans to Other Mortgage Options

Assumable VA loans can be compared to other mortgage options, such as conventional loans and FHA loans. Here is a table summarizing the key differences:

| Mortgage Type | Interest Rate | Closing Costs | Eligibility Requirements |

|---|---|---|---|

| Assumable VA Loan | Lower interest rates | Reduced closing costs | Must be a veteran, active-duty military, or surviving spouse |

| Conventional Loan | Higher interest rates | Higher closing costs | No eligibility requirements |

| FHA Loan | Lower interest rates | Lower closing costs | Must meet FHA eligibility requirements |

Conclusion and Final Thoughts

Assumable VA loans can be a highly beneficial option for both buyers and sellers. With their lower interest rates, reduced closing costs, and faster closing process, they can provide a unique opportunity to save money and make the home buying process more efficient. Whether you are a buyer looking to take advantage of the benefits of a VA loan or a seller looking to attract more buyers, an assumable VA loan is definitely worth considering. By understanding the benefits and process of assuming a VA loan, you can make an informed decision and take the first step towards achieving your homeownership goals.

What is an assumable VA loan?

+

An assumable VA loan is a type of mortgage that allows a buyer to take over the seller’s existing VA loan when purchasing a home.

What are the benefits of assuming a VA loan?

+

The benefits of assuming a VA loan include lower interest rates, reduced closing costs, and a faster closing process.

Who is eligible to assume a VA loan?

+

To be eligible to assume a VA loan, the buyer must be a veteran, active-duty military, or surviving spouse, and meet the eligibility requirements for a VA loan.